Are you paying high-interest rates on your current home loan? It’s time to make the smart switch with Tata Capital Home Loan Balance Transfer. Transfer your existing home loan to Tata Capital and enjoy lower interest rates, flexible terms, and the convenience of managing everything in one place. Let Credit Dharma help you save more on your EMIs while you continue your journey to homeownership.

Tata Capital Home Loan Balance Transfer Highlights

Take a quick look at the key features like interest rates, loan amounts, and processing fees to see if transferring your home loan with Tata Capital makes sense for you.

| Category | Highlights |

|---|---|

| Interest Rates | 8.75% p.a. onwards |

| Loan Amount | Up to ₹5 Crore |

| Tenure | Up to 30 years |

| Processing Fees | 3% of the Loan Amount + GST |

Suggested Read: Refinancing vs. Home Loan Balance Transfer

Tata Capital Home Loan Balance Transfer Interest Rates 2025

Find out the current interest rates for home loan balance transfers in 2025, so you can understand how much you could save on your EMIs.

| Employment Type | Interest Rates |

|---|---|

| Salaried Individuals | 8.75% p.a. onwards |

| Self Employed Professionals | 8.85% p.a. onwards |

Suggested Read: Role of Credit Score in Home Loan Balance Transfer Approval

Tata Capital Home Loan Balance Transfer Eligibility Criteria

Make sure you meet the basic eligibility criteria to successfully transfer your home loan to Tata Capital.

| Eligibility Criteria | Details |

|---|---|

| Property Status | The property should either be occupied or ready to be occupied. |

| Outstanding Dues | There should be no outstanding dues on your existing home loan. |

Suggested Read: Can Home Loan Balance Transfers Backfire?

Tata Capital Home Loan Balance Transfer Documents Required

Gather all the necessary documents, including identity proof, income details, and current loan statements, to make the transfer process smooth.

| Balance Transfer Documents |

|---|

| KYC Documents |

| Home Loan Statements from Previous Bank |

| Bank Account Statement |

Suggested Read: Should You Opt for Home Loan Balance Transfer After Repo Rate Cut?

Tata Capital Home Loan Balance Transfer Processing Fees

Get a clear understanding of the processing fees involved in transferring your home loan to Tata Capital, so you can budget for them.

| Fees Type | Charges |

|---|---|

| Processing Fees | 3% of the Loan Amount + GST |

Suggested Read: How Home Loan Balance Transfer Reduces EMIs into Half

Tata Capital Home Loan Balance Transfer Other Charges

Be aware of any additional charges, such as prepayment fees or other penalties, that might come up during the balance transfer.

| Categories | Salaried | Self Employed |

|---|---|---|

| Foreclosure Charges | No charges for prepayment with own funds. Nominal charges for prepayment with others’ funds | No charges for prepayment with own funds. Nominal charges for prepayment with others’ funds |

| Delayed EMI Payments | 2.00% P.M. (24.00% P.A.) on the defaulted amount | 2.00% P.M. (24.00% P.A.) on the defaulted amount |

| Cheque Dishonour Charges/ Rejection of NACH/ECS Mandate | Rs 700/- per instrument per process | Rs 700/- per instrument per process |

Suggested Read: Tata Capital Home Loan Customer Care

How to Apply to Tata Capital Home Loan Balance Transfer?

The process is easy—just follow the online steps to apply for the balance transfer, upload the required documents, and start saving on your home loan.

The online application process is simple—fill in your details, upload documents, and wait for your e-sanction.

- Visit the Tata Capital official website.

- Navigate to the “Loans for You” tab. From the dropdown menu, select “Balance Transfer > Apply Now” to begin your application.

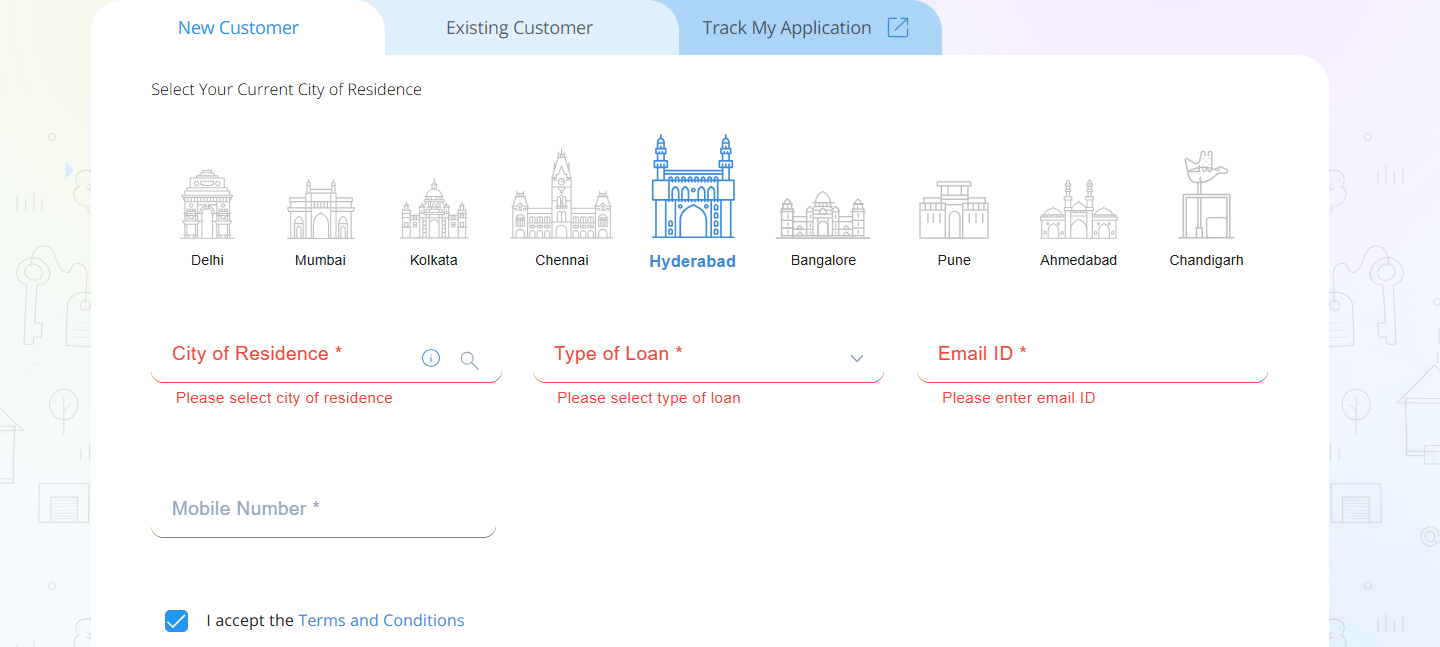

- Fill in the required details in the online home loan application form. Once done, enter the OTP to proceed.

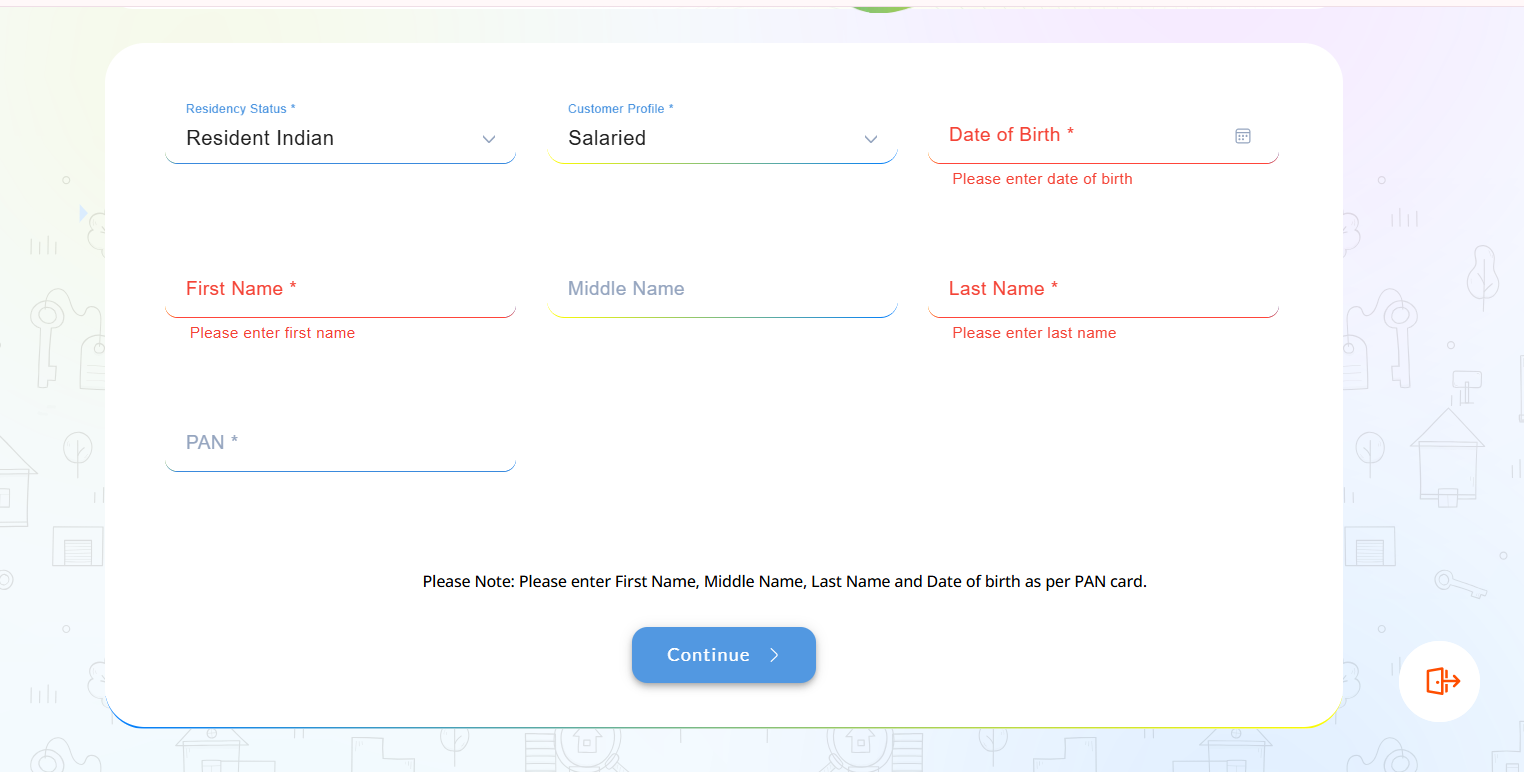

- Provide your basic information and click “Continue” to move to the next step.

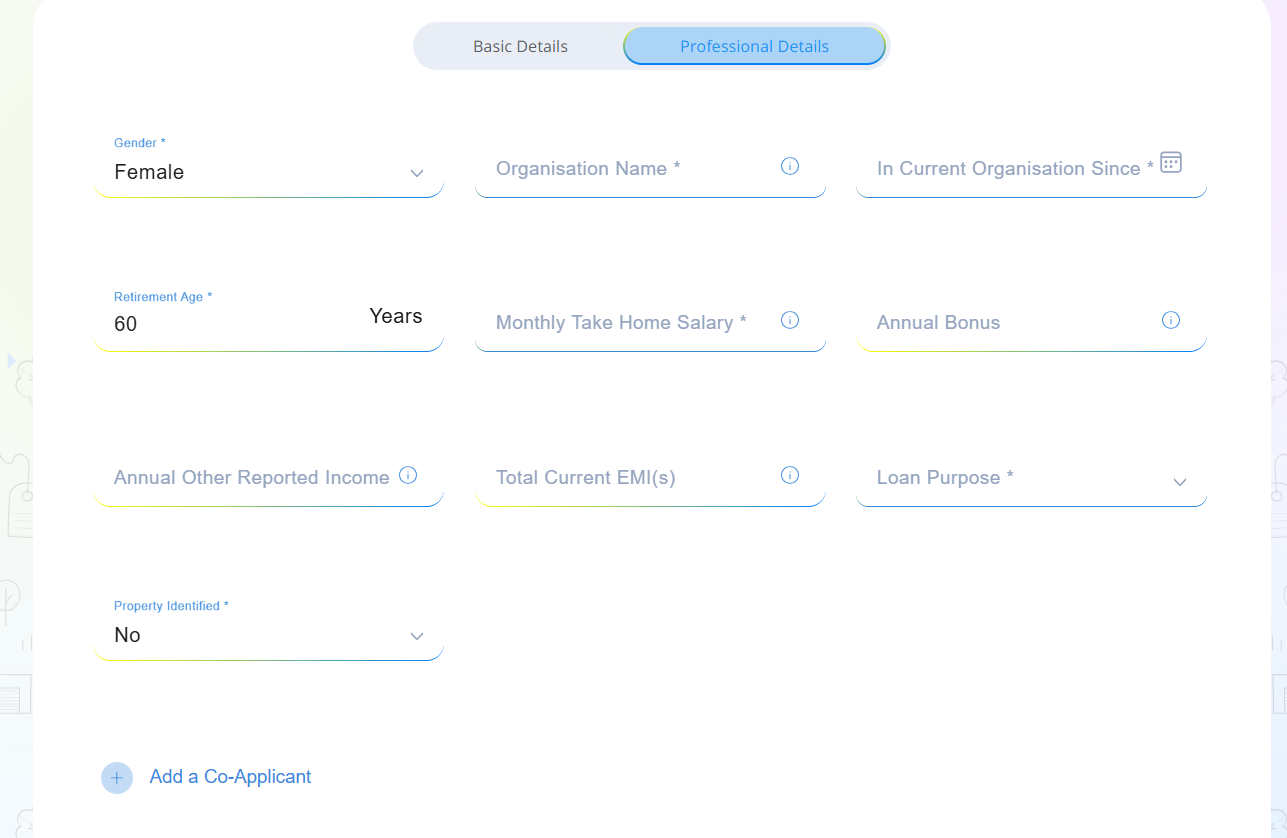

- Fill in your professional details and, if applicable, add your co-applicant information.

- Upload all the necessary financial documents for verification.

- If you qualify, you will receive an e-sanction for your loan.

Suggested Read: How to Check Tata Capital Home Loan Application Status?

Compare Top Banks Home Loan Balance Transfer Interest Rates

Compare home loan balance transfer offers from different banks to find the best rate and deal that suits your needs.

| Bank | Transfer Rate |

|---|---|

| SBI | 8.50% p.a. onwards |

| HDFC Ltd | 8.75% p.a. onwards |

| LIC Housing Finance Ltd | 9.10% p.a. onwards |

| Axis Bank | Contact the bank |

| Bank of Baroda | 8.85% p.a. onwards |

| Canara Bank | 8.80% p.a. onwards |

| Union Bank of India | 9.00% p.a. onwards |

| IDFC First Bank | 8.85% p.a. onwards |

| Federal Bank | 8.80% p.a. onwards |

| Karur Vysya Bank | 9.00% p.a. onwards |

| Tamilnad Mercantile Bank | 9.45% p.a. onwards |

Conclusion

Switching your home loan shouldn’t feel complicated. At Credit Dharma, we understand the value of securing better terms and reducing your financial burden. Our team provides expert guidance and tailored solutions to simplify your balance transfer process, ensuring a seamless transition.

Stay informed with real-time updates on your application status, approval milestones, and disbursement timelines.

From submitting documents to finalizing the transfer, we offer end-to-end support. Experience transparent communication at every step, with no hidden fees or surprises.

Frequently Asked Questions

Most lenders require you to have paid EMIs for at least 12 to 18 months before applying for a balance transfer.

A CIBIL score of 700 or above is generally preferred, though some lenders may consider lower scores on a case-by-case basis.

Common documents include proof of identity, address, income, property documents, and a statement of the existing loan.

The process can take anywhere from 15 to 20 days, depending on the lenders involved and the complexity of the case.

Yes, loans with co-applicants can be transferred, provided both parties meet the eligibility criteria of the new lender.

Yes, but the remaining applicant must meet the eligibility criteria and assume full responsibility for the loan.

Yes, you can switch from a fixed-rate to a floating-rate loan or vice versa, depending on the new lender’s offerings.

Many lenders offer top-up loans during a balance transfer, which can be used for home renovation, education, or other personal needs.

HDFC Home Loan

HDFC Home Loan SBI Home Loan

SBI Home Loan