Axis Bank’s Super Saver Home Loan is a flexible financing solution designed to reduce your interest burden while maintaining liquidity. By depositing surplus funds into your loan account, you can lower the principal balance on which interest is calculated, saving money without locking away your cash. Enjoy zero prepayment charges, and competitive floating interest rates.

Access added convenience with a cheque book, ATM card, and 24/7 digital banking via mobile or internet. Starting from Rs. 10 Lakhs, this loan empowers you to own a home smarter—maximizing savings, minimizing costs, and retaining control over your finances.

Axis Bank Home Loan Overdraft Facility Highlights

Here’s a quick overview of the key features—interest rates, loan amounts, and fees—so you can decide if the home loan is the right choice for you.

| Category | Highlights |

|---|---|

| Interest Rates | 8.75% p.a. onwards |

| Loan Amount | Minimum: ₹10 Lakh |

| Maximum Tenure | 22 years |

| Processing Fees | 1% of the loan amount + GST (minimum: ₹10,000) |

Suggested Read: Axis Bank Home Loan Customer Care

Axis Bank Home Loan Overdraft Facility Interest Rates

Check out the interest rates for home loan in 2025 to get an idea of your potential EMI and costs.

Check out the interest rates for home loan in 2025 to get an idea of your potential EMI and costs.

Axis Bank Home Loan Interest Rates by CIBIL Score

| CIBIL Score | Salaried | Self Employed |

|---|---|---|

| 751 and Above | 8.75% p.a. onwards | 9.10% p.a. onwards |

Axis Bank Standard Home Loan Interest Rates (Vanilla Home Loan)

| CIBIL Score | Salaried |

|---|---|

| No CIBIL Score | 9.30% p.a. onwards |

| 700 and Above | 9.65% p.a. onwards |

| 700 – 750 | 9.50% p.a. onwards |

| 751 and Above | 8.75% p.a. onwards |

Axis Bank Fixed Home Loan Interest Rates

| CIBIL Score | Salaried |

|---|---|

| Fixed Rate Loans | 14.00% p.a. onwards |

Suggested Read: Axis Bank Home Loan Account Login

Axis Bank Home Loan Overdraft Facility Eligibility Criteria

Find out the basic eligibility requirements, such as age, income, and existing home loan status, before applying for a home loan.

| Aspect | Salaried Individuals | Professionals | Self Employed |

|---|---|---|---|

| Age | 21 years – 65 years | 21 years – 65 years | 21 years – 65 years |

| Work Experience | Stable employment history | Consistent income | Consistent income through tax returns. |

| Work History | Government sectors or reputed companies. | Doctors/ Lawyers/ Chartered Accountants/ Management Consultants | Business owners or entrepreneurs |

Suggested Read: Axis Bank Home Loan Balance Transfer

Axis Bank Home Loan Overdraft Facility Processing Fees

Understand the processing fees involved so you can factor them into your overall cost when opting for a home loan.

| Fees | Amount |

|---|---|

| Processing Fees | 1% of the loan amount + GST (Minimum ₹10,000) |

| Upfront Processing Fees | ₹5,000 (collected at the time of application, balance fee will be collected at the time of disbursement) |

Suggested Read: Axis Bank Home Loan Minimum CIBIL Score

Axis Bank Home Loan Overdraft Facility Other Fees and Charges

Be aware of any extra charges, such as prepayment penalties or overdue fees, that may apply to your home loan.

| Charges Category | Fees |

|---|---|

| Repayment Instruction / Instrument Return | ₹339 /- per instance |

| Admin Charges | ₹0 |

| Duplicate Statement Issuance Charges | ₹250 /- per instance |

| Issuance Charges for Photocopy of Title Documents | ₹500 /- per document set |

| Charges of Customer-Initiated Requests for Copies of Documents | ₹500 /- per document set |

| Prepayment Charges for Floating Rate Loan | NIL |

| Equitable Mortgage Creation Charges | As applicable in the state |

| Issuance Charges of Credit Report | ₹50 /- per instance |

| Cheque / Instrument Swap Charges | ₹500 /- per instance |

| Duplicate Amortization Schedule Issuance Charges | ₹250 /- per instance |

| Duplicate Interest Certificate Issuance Charges | ₹50 /- per instance |

| Prepayment Charges for Fixed Rate Loan | 2% of outstanding principal / amount prepaid |

| Duplicate No Dues Certificate / NOC | ₹50 /- per instance |

| CERSAI Charges (Loans up to 5 lakhs) | ₹50 |

| CERSAI Charges (Loans above 5 lakhs) | ₹100 |

| Penal Charges | 8% p.a. above applicable interest rate on overdue amount |

| CERSAI Charges | Loan up to ₹5 Lakh: ₹50Loan Above ₹5 Lakh: ₹100 |

Switching from Higher Floating Rate to Lower Floating Rate

| Principal Outstanding at the Time of ROI Conversion | Charges |

|---|---|

| Up to 10 Lacs | INR 1,000/- |

| 10.01 Lacs to 30 Lacs | INR 2,000/- |

| 30.01 Lacs to 75 Lacs | INR 3,000/- |

| Above 75 Lacs | INR 5,000/- |

Suggested Read: Home Loans for ₹70,000 Salary

Axis Bank Home Loan Overdraft Facility Documents Required

Ensure you have all the necessary documents ready, from identity proof to income statements, to make the home loan application process smooth.

General Documents

| Category | Documents Required |

|---|---|

| Proof of Identity | PAN Card/ Driver’s License / Voter ID / Passport / Aadhar Card |

| Proof of Address | Driver’s License / Ration Card / Voter ID / Passport / Aadhar Card / Registered Rent Agreement |

| Date of Birth Proof | Passport/ Driving Licence/ PAN Card/ Birth Certificate/ 10th Marksheet |

| Signature Proof | Passport/ PAN Card |

Check Out: List of Documents required for Home Loan Disbursement

Proof of Income

| Salaried | NRI Salaried | Self-Employed |

|---|---|---|

| 3 months pay slip | 3 months pay slip | 2 years ITR, Computation of Income, P&L, Balance Sheet with CA seal and sign |

| 6 months pay slip/2 years bonus proof (in case of variable pay) | Appointment letter/contract letter | For Asha HL – 1 year ITR, Computation of Income, P&L, Balance Sheet with CA seal and sign |

| 6 months bank statement showing salary credits | Continuous Discharge Certificate for Shipping cases | Tax Audit Report (if gross turnover exceeds ₹1 crore or gross receipts exceed ₹25 lakh) |

| 2 years Form 16 (or employment continuity proof) | 6 months Domestic NRE/NRO account statement | 6 months bank statements of personal and business accounts |

| 6 months international salary account statement | CPC and tax paid challan | |

| Overseas credit report | Atleast 3 years of business continuity proof | |

| Valid visa copy/OCI card | ||

| Passport copy | ||

| POA details |

Home Loan Balance Transfer

| Category | Details |

|---|---|

| For Balance Transfer / Takeover of Loan from Other Bank / Financial Institution | 12 months loan account statement with latest outstanding letter |

| Existing loan details and 6 months bank statement from where EMI is deducted |

Other Important Documents

| Other Documents |

|---|

| Completely filled and duly signed application form along with all applicants’ latest passport size photo |

| Aadhar card is mandatory for Credit Linked Subsidy Scheme (PMAY) applicants |

| PAN card is mandatory for all financial applicants |

| Processing Fee and CERSAI cheques |

| Self-attestation of borrowers on all documents submitted |

Suggested Read: East House Facing Vastu

How to Apply for Axis Bank Home Loan Overdraft Facility?

The application process is easy—simply fill in your details, upload the required documents, and get started on your loan.

- Visit the Official Website

Go to the Axis Bank home loan page.

- Select Home Loan Option

Choose the type of home loan you want to apply for (e.g., home loan, balance transfer, etc.).

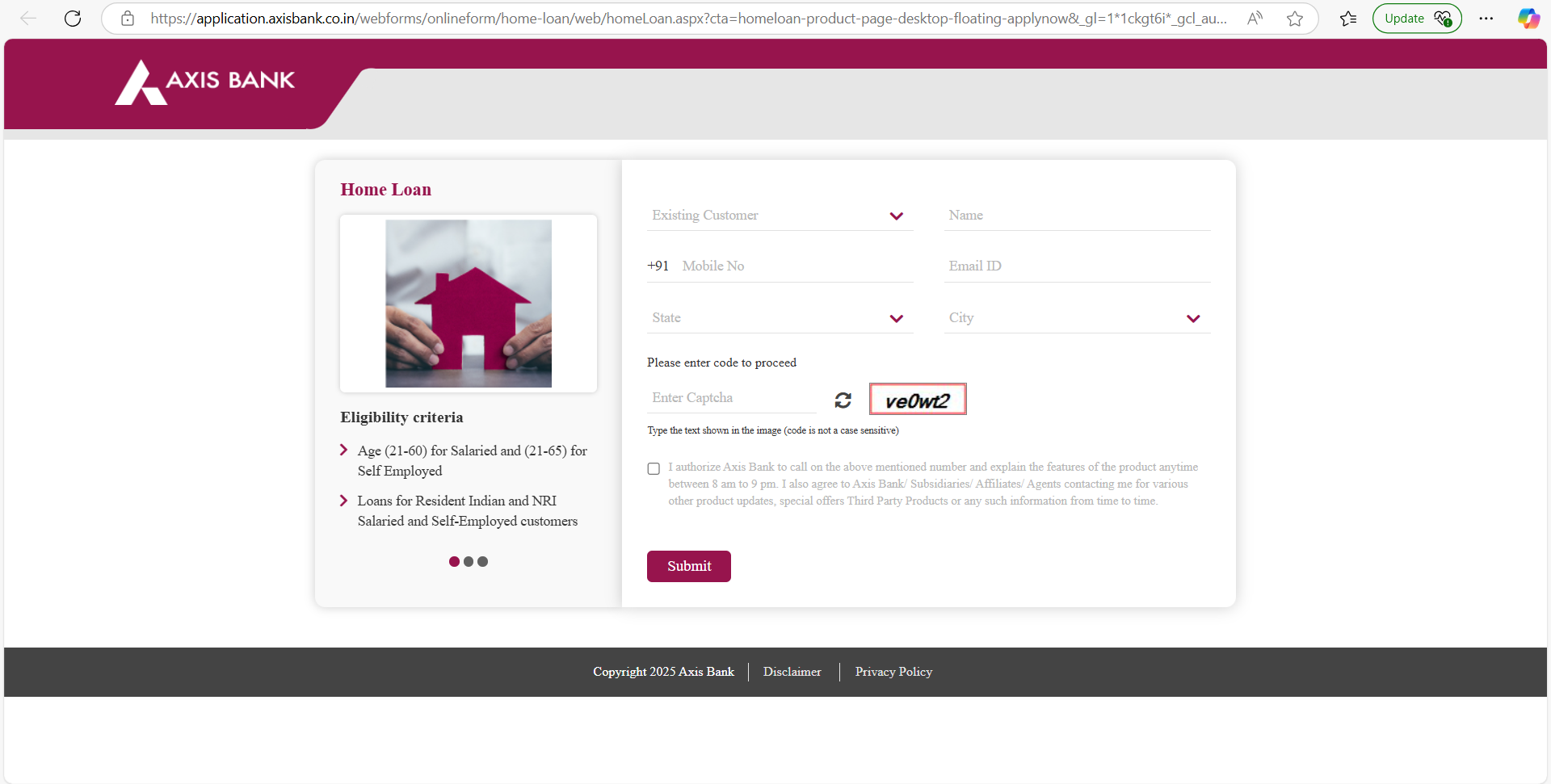

- Fill the Online Application

Enter personal, contact, and financial details in the application form. Make sure to provide accurate information for quick processing.

- Upload Documents

Submit required documents like ID proof, address proof, income proof, and property details online.

- Eligibility Check

Axis Bank will evaluate your eligibility based on the information provided.

- Submit the Application

Review your details and submit the application. You will receive an acknowledgment along with the reference number.

- Approval and Processing

Once your application is reviewed, the bank will process the loan. If approved, they will send you an offer letter and discuss the next steps.

- Sign the Agreement

After receiving the offer, sign the loan agreement electronically or at the bank’s branch.

Suggested Read: Top 5 Banks for Home Loans in Mumbai

Compare Top Banks Home Loan Overdraft Interest Rates

Explore home loan offers from different banks to find the best deal that fits your needs.

| Bank/NBFC | Interest Rates |

|---|---|

| SBI Maxgain | 8.50% p.a. – 9.45% p.a. |

| Axis Bank | 10.50% p.a. onwards |

| ICICI Bank | 9.00% p.a. onwards |

| Bank of India | 8.25% p.a. onwards |

| Bank of Baroda | 8.00% p.a. onwards |

| Central Bank of India | 8.15% p.a. onwards |

Conclusion

Credit Dharma is your trusted partner for securing the best Home Loan offers, with over ₹500 Cr+ loans handled and partnerships with 20+ leading banks. We provide exclusive access to the lowest interest rates and a seamless, digital process with fast approvals in just 1-2 weeks, backed by lifetime support from our home loan experts.

Why choose Credit Dharma? We provide:

- Lowest Interest Rates: Save more with every EMI.

- Maximum Funding: Get up to 100% funding for your dream home.

- Simple & Digital Process: No tedious paperwork or branch visits.

- Expert Guidance: Lifetime support from our team of specialists.

Frequently Asked Questions

A regular home loan has fixed EMIs, and you don’t have the option to deposit or withdraw money as per your needs. But with a home loan overdraft, you can park surplus funds—like your bonuses or savings—and withdraw them later for emergencies. This flexibility can help you save on interest while keeping your money accessible.

Absolutely, yes! The EMI is mandatory as per your loan schedule. But here’s the smart part: when you have extra funds in your overdraft account, the interest portion of your EMI reduces, and more of your payment goes toward the principal.

If you’re someone with irregular income (like a freelancer, business owner, or someone expecting bonuses or windfalls), or if you want to manage liquidity smartly, an overdraft can be super useful. It helps you save on interest while having access to your money when needed.

There’s no specific limit on deposits—you can park any surplus funds. However, withdrawals are limited to the pre-approved overdraft limit (usually up to the sanctioned loan amount). So, you can’t withdraw more than what’s available in your overdraft balance.

Nope! Your EMI stays the same. But when you withdraw money from the overdraft account, your loan balance goes up, so you end up paying more interest compared to when you had extra funds parked. Think of it like a give-and-take relationship—withdrawals give you access to funds, but reduce the interest-saving benefit.

HDFC Home Loan

HDFC Home Loan SBI Home Loan

SBI Home Loan