Prepaying your home loan can be a strategic move to reduce your financial burden and save on interest costs. From the borrower’s perspective, prepayment charges are a significant consideration when planning the early settlement of a housing loan. If you’re considering settling your Axis Bank home loan early, here’s everything you need to know about Axis Bank home loan prepayment policies.

Axis Bank Home Loan Prepayment Charges 2025

| Interest Rate Type | Prepayment Charges |

|---|---|

| Floating Rates | NIL |

| Fixed Rates | 2% on Outstanding Loan Amount/ Amount Pre-paid |

Suggested Read: Will Home Loan Interest Rates Go Down in 2025

How to Make Axis Bank Home Loan Prepayment Online?

- Visit Axis Bank’s official website.

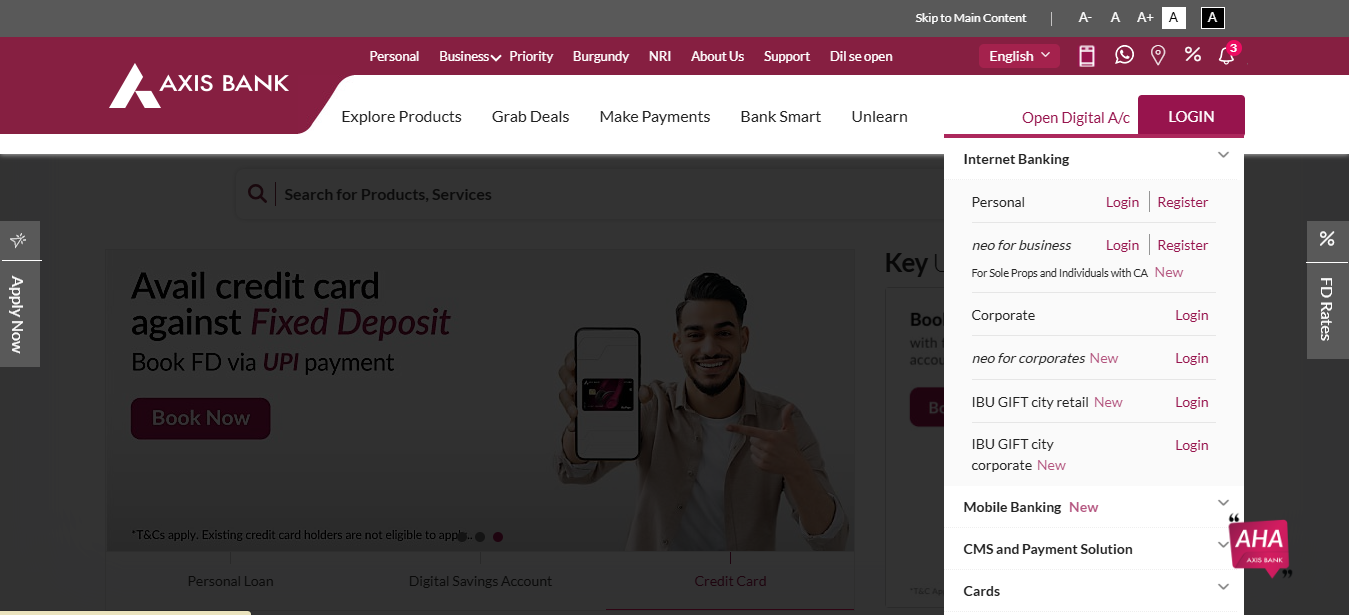

- Login to Axis Bank Personal Internet Banking.

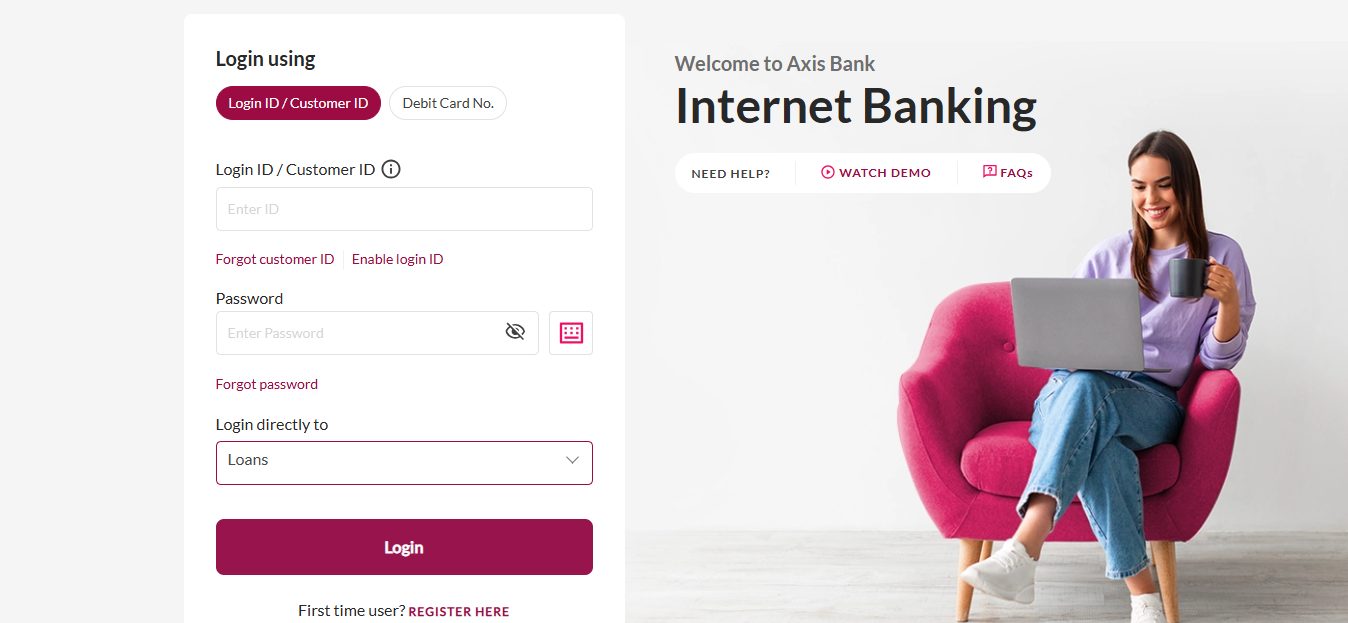

- Enter Customer ID and Password. Under “Login Directly to” select “Loans”

- Once Logged In, under “Services” click on “Part Payment”

- Choose the amount you want to pre-pay. Make the payment using debit card/ credit card/ UPI/ net banking.

Suggested Read: Axis Bank Home Loan Top Up

How to Make Axis Bank Home Loan Prepayment using Mobile App?

You can easily initiate a part payment for your loan using Axis Bank’s Mobile Banking App by following these detailed steps:

Mobile Banking App:

| Step | Action |

|---|---|

| 1. Log in | Open the Axis Bank Mobile App, enter credentials, or use biometric authentication. |

| 2. Navigate to Part Payment | Go to Quick Links > Loans > Make Payment > Part Payment. |

| 3. Select Loan Account | Choose the loan for which you want to make a part payment. |

| 4. Enter Amount | Input the amount, ensuring it meets the bank’s minimum criteria. |

| 5. Choose Payment Mode | Select Axis Bank Account, UPI, Net Banking, Debit Card, or Other Bank (NEFT/IMPS/RTGS). |

| 6. Authenticate Payment | Confirm details and verify using OTP or MPIN. |

| 7. Receive Confirmation | Get SMS/email confirmation and download the receipt if needed. |

Suggested Read: Axis Bank Home Loan Statement Download

Axis Bank Home Loan Prepayment Limits

- Minimum payment: 2% of the outstanding balance

- Maximum payment: 75% of the outstanding balance

Suggested Read: Axis Bank Home Loan CIBIL Score

When is Axis Bank Home Loan Online Part Payment is Not Allowed?

Customers will be unable to make an online part payment under the following conditions:

- The loan is partially disbursed

- The first EMI has not yet been deducted

- The loan account has overdue payments

- Part payment attempts are made within 5 days before or after the EMI due date

Suggested Read: Axis Bank Home Loan Balance Transfer

Axis Bank Home Loan Prepayment: Rules

- Limited to one online part payment per financial year

- Only one successful transaction per day is allowed

- If you have already made a part payment once in a financial year and need to make another, visit the nearest Axis Bank Loan Centre

- If part payment charges apply, they will be adjusted from the payment amount along with GST (if applicable)

Suggested Read: Home Loan Prepayment vs. Investing

Home Loan Prepayment Case Study

Sanjay, a 40-year-old IT professional, took a home loan of ₹90 lakh from Axis Bank to purchase his dream home in Mumbai.

| Parameter | Value |

|---|---|

| Loan Amount | ₹90,00,000 |

| Interest Rate | 8.75% |

| Loan Tenure | 30 years (360 EMIs) |

| Number of EMIs Paid | 60 |

| EMI Amount | ₹70,803 |

| Total Interest Payable | ₹1,64,89,093 |

After reviewing these numbers, Sanjay realized that he would end up paying nearly ₹1.65 crore in interest alone, which was almost twice the loan amount.

The Solution: Prepayment Strategy

Sanjay decided to prepay ₹8 lakh from his savings and annual bonus. This prepayment directly reduced the outstanding principal amount, leading to major financial benefits.

Loan Details (After Prepayment of ₹8 Lakh)

| Parameter | Before Prepayment | After Prepayment | Impact |

|---|---|---|---|

| Outstanding Principal | ₹86,03,996 | ₹78,03,996 | Reduced |

| Total Interest Payable | ₹1,64,89,093 | ₹1,19,85,541 | Saved ₹45,03,552 |

| Loan Tenure Remaining | 25 years (300 EMIs) | 19 years (225 EMIs) | Reduced by 6 years |

| EMI Amount | ₹70,803 | ₹70,803 | Unchanged |

Key Benefits of Prepayment

- Saved ₹45.03 lakh in total interest payments.

- Loan tenure reduced by 11 years (from 30 years to 19 years).

- The EMI remained unchanged at ₹70,803, but the loan would be closed much earlier.

- Sanjay could now focus on other financial goals such as investments and retirement planning.

Who Should Consider Prepaying their Axis Bank Home Loan?

- Borrowers with a stable surplus who want to cut down on long-term interest costs.

- Individuals receiving windfall gains (bonus, inheritance) looking to close debt faster.

- Those aiming to lower monthly EMIs for better financial flexibility.

- Homeowners seeking to improve overall creditworthiness by reducing liabilities.

- People nearing retirement who prefer a debt-free lifestyle and peace of mind.

Benefits of Axis Bank Home Loan Prepayment

- Reduced Interest Costs: Paying off a portion of the principal early lowers the total interest you pay over the loan’s lifetime.

- Faster Debt Clearance: Prepayment can shorten the loan tenure, helping you become debt-free sooner.

- Lower EMI Burden: If you choose to keep the same tenure, your EMI can be recalculated and reduced, easing monthly outflow.

- Improved Credit Score: Consistent prepayments can reflect positively on your credit history, potentially boosting your credit rating.

- Better Financial Flexibility: Freeing up funds that would otherwise go toward interest allows you to allocate money toward other financial goals.

Conclusion

Prepaying your Axis Bank Home Loan is a smart financial move that can help reduce interest costs, close the loan sooner, and improve overall financial stability. Whether you aim to lower EMIs, shorten the loan tenure, or enhance future loan eligibility, prepayment offers multiple benefits.

Looking to reduce your home loan burden further? Consider a home loan balance transfer for lower interest rates and better repayment terms. Book a FREE consultation call with Credit Dharma to explore your options today!

Frequently Asked Questions

Prepayment lowers total interest outflow and can help shorten the loan tenure or reduce monthly EMIs, providing greater financial flexibility.

For floating-rate home loans, no prepayment penalty is typically charged. However, fixed-rate loans or special schemes may attract fees—verify with Axis Bank.

You can choose to keep the EMI amount the same and reduce your loan tenure, or keep the tenure unchanged and reduce the EMI amount.

Generally, the minimum part-payment is 2% of the outstanding principal, while the maximum can be up to 75%. Confirm limits with the bank’s guidelines.

Consistent or full prepayment can have a positive impact on your credit score, reflecting good financial discipline and reduced debt.

Typically, one online part payment is allowed per financial year. For additional payments, you may need to visit a branch or follow specific bank instructions.

HDFC Home Loan

HDFC Home Loan SBI Home Loan

SBI Home Loan