Bajaj Housing Finance has made it incredibly convenient for their home loan borrowers to monitor details such as outstanding EMIs, principal repayment, interest paid, prepayments (if any), late payment charges, and the remaining loan balance.

Bajaj offers a seamless online process to download your home loan statement, eliminating the need for visits to the branch. Whether you’re tracking payments or preparing for tax filings, this service makes managing your loan quick and efficient.

Bajaj Housing Finance home loan EMIs weighing you down?

Get a Home Loan Balance Transfer with Credit Dharma!

How to Download Bajaj Housing Finance Home Loan Statement for Income Tax Online?

Checking your Bajaj Housing Finance home loan statement online is quick and convenient. With just a few steps, you can access your statement anytime through Internet Banking.

- Visit the official website of Bajaj Housing Finance.

- Login using your Customer ID, registered e-mail ID, mobile number. Enter the OTP and Login.

- Once logged in, click on ‘Account Summary‘ on the dashboard to access and download your Provisional Home Loan Interest Certificate anytime.

- When the soft copy of your loan statement is downloaded, It is advisable to save it for future reference.

Suggested Read: Home Loan Repayment Strategies

How to Download Bajaj Housing Finance Home Loan Statement for Income Tax Offline?

If you prefer to obtain a physical copy of your home loan statement or don’t have access to online banking, you can visit your nearest Bajaj Housing Finance Branch.

- Visit the Nearest Branch: Use the branch locator tool find the nearest Bajaj Housing Finance branch.

- Request the Form: Ask for the form to obtain your Home Loan Statement, Interest Certificate, or Provisional Interest Statement.

- Complete the Form: Fill in the form with your Home Loan Account Number, Date of Birth, registered email ID, and any other required details.

- Submit Documents: Submit the completed form along with copies of documents such as your Aadhaar Card, PAN Card, Passport, or other identification proofs.

Check Out: A Comprehensive Guide to Home Loan Balance Transfer

How to Download Bajaj Housing Finance Home Loan Statement for Income Tax via Mobile Application?

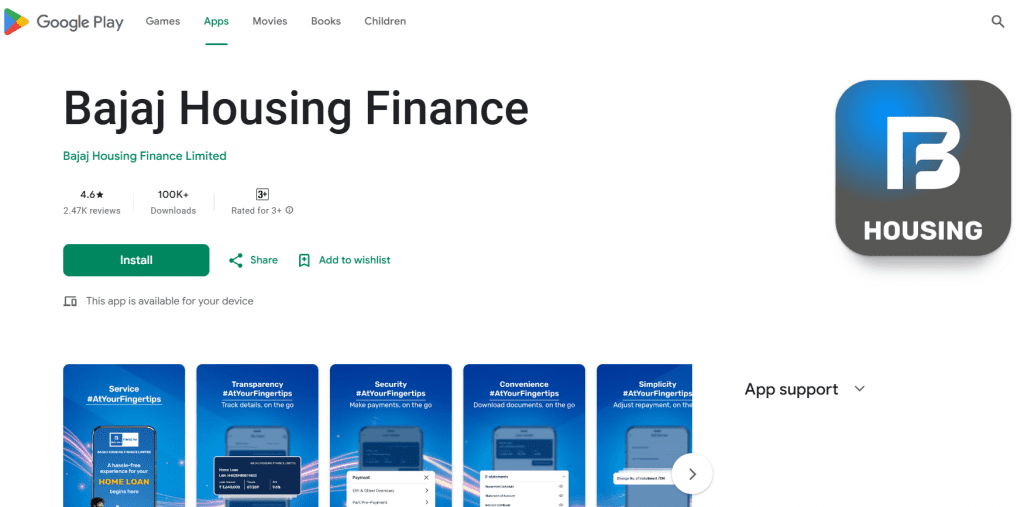

Managing your home loan has never been easier with the Bajaj Housing Finance (BHFL) mobile application. Follow these steps to download your home loan statement directly to your mobile device:

- Download and Install the BHFL App:

- Visit the Google Play Store or Apple App Store on your mobile device.

- Search for “Bajaj Housing Finance” and tap “Install” or “Get” to download the app.

- Log In to Your Account:

- Open the BHFL app.

- Tap “Login.”

- Enter your Customer ID or registered mobile number/email ID.

- Authenticate using your password, OTP, or MPIN, depending on your preference.

- Access Your Loan Account:

- After logging in, you’ll be directed to your dashboard.

- Select the loan account for which you wish to download the statement.

- Navigate to e-Statements:

- Within your loan account details, tap on the “e-Statements” section.

- Here, you can access various documents related to your loan.

- Download the Home Loan Statement:

- Locate the “Statement of Account” document.

- Select the desired financial year.

- Tap “Download” to save the statement to your device.

Key Details Included in Your Bajaj Housing Finance Home Loan Statement

Personal Details:

- Your name, address, and contact information.

- Loan account number for easy reference.

Loan Details:

- Total loan amount sanctioned.

- Interest rate applicable (fixed or floating).

- Loan tenure (duration of the loan).

- Start date of the loan repayment schedule.

Repayment Information:

- Equated Monthly Installment (EMI) amount.

- EMI due dates and payment history.

- Breakdown of each EMI into principal and interest components.

Outstanding Balance:

- Remaining loan balance after each payment.

- Details of any prepayments or part-payments made.

Fees and Charges:

- Any applicable processing fees, late payment charges, or prepayment penalties.

Important Notices:

- Information regarding upcoming EMI adjustments, interest rate changes, or other pertinent updates.

How to Use Your Home Loan Statement for Tax Benefit Claims?

Here’s how you can use your home loan statement for tax benefit claims:

- Claim Tax Deduction on Principal Repayment (Section 80C):

- The principal amount repaid on your home loan qualifies for a deduction under Section 80C, up to ₹1.5 lakh per financial year.

- Your home loan statement will show the principal component of each EMI, which you can use to calculate your total principal repayment for the year.

- Claim Tax Deduction on Interest Repayment (Section 24(b)):

- The interest paid on your home loan can be claimed as a deduction under Section 24(b), up to ₹2 lakh per financial year, for a self-occupied property.

- Your home loan statement includes the breakdown of EMI payments, so you can easily identify the interest component and claim the deduction.

- Tax Benefits for Pre-Construction Period:

- If your property is still under construction, the interest paid during this period can be claimed as a deduction in five equal installments once construction is completed.

- Your statement will include the interest amount paid, which is vital for these claims.

- Verification of Claimable Amounts:

- Ensure that the amounts for both principal and interest repayment are accurately reflected in the statement.

- Use this verified information while filing your taxes to claim the benefits correctly.

Troubleshooting Bajaj Housing Finance Home Loan Statement Issues

Common Problems When Downloading Bajaj Housing Finance Home Loan Statements

- Unable to Login or Access the App/Website:

- Ensure that you are entering the correct credentials, such as your customer ID, registered mobile number, or password.

- If you’ve forgotten your password, use the “Forgot Password” option to reset it.

- Check if the app or website is down for maintenance. Try again after a while.

- Statement Not Available for the Desired Period:

- Statements are usually available for a limited period, so ensure you are checking the correct time frame.

- If your statement for a specific month or year is not available, contact Bajaj Housing Finance customer support for assistance.

- PDF Download Errors:

- If the statement PDF doesn’t download properly, ensure your internet connection is stable.

- Try downloading it from a different browser or app version if the problem persists.

- Inaccurate Details in Statement:

- Double-check the loan account number and EMI breakdown.

- If discrepancies persist, reach out to Bajaj Housing Finance customer service to verify the information or request corrections.

What to Do If Your Tax Certificate Is Incorrect

If you find any inaccuracies in your tax certificate provided by Bajaj Housing Finance, follow these steps:

- Verify the Details:

- Cross-check the details mentioned in the certificate with your loan statement to confirm the error.

- Pay close attention to the principal repayment, interest deduction, and other relevant details.

- Contact Bajaj Housing Finance Customer Support:

- Reach out to Bajaj Housing Finance’s customer service through their helpline or email.

- Provide them with the necessary details, such as your loan account number, tax certificate, and supporting documents.

- Request a corrected tax certificate if needed.

- Re-request the Tax Certificate:

- Once the issue is resolved, you can download the updated tax certificate from the Bajaj Housing Finance website or app.

- File a Complaint if Required:

- If the issue isn’t resolved quickly, you can file a formal complaint with Bajaj Housing Financeor escalate it to higher authorities for prompt resolution.

Get the Best Home Loan Offers with Credit Dharma

Credit Dharma is your trusted partner for securing the best Home Loan offers, with over ₹500 Cr+ loans handled and partnerships with 20+ leading banks. We provide exclusive access to the lowest interest rates and a seamless, digital process with fast approvals in just 1-2 weeks, backed by lifetime support from our home loan experts.

Why choose Credit Dharma? We provide:

- Lowest Interest Rates: Save more with every EMI.

- Maximum Funding: Get up to 100% funding for your dream home.

- Simple & Digital Process: No tedious paperwork or branch visits.

- Expert Guidance: Lifetime support from our team of specialists.

Compare, choose, and secure the best Home Loan offer with Credit Dharma — your home loan journey starts here!

Conclusion

Managing your Bajaj Housing Finance Loan Statement online is simple and highly beneficial. By following the outlined steps, you can easily access your financial details, helping you make well-informed decisions about your home loan.

Take full advantage of the Bajaj Housing Finance online platform to manage your account efficiently. For additional support with your loan payments, loan details, or tracking your loan status, Credit Dharma’s team of experts is here to guide you every step of the way. Trust Credit Dharma as your reliable partner in navigating loans, credit, and financial planning.

Frequently Asked Questions

Log in to the Bajaj Housing Finance portal using your credentials. Access your account dashboard to view or download your loan statement.

You can request your home loan account statement anytime online or at a branch. Availability may vary based on the lender’s policies.

Yes, your home loan account statement typically mentions the type of interest rate, whether it’s fixed or floating.

A home loan statement provides comprehensive details such as:

Total loan amount

Loan start date

Applicable interest rate

Total amount repaid to date

Outstanding loan balance

Details of each EMI payment

To download your loan statement using the Bajaj Finserv App:

1. Log in to the app using your registered mobile number and OTP.

2. Navigate to the ‘Menu’ and select ‘Bank details/Documents’.

3. Tap on ‘Document Centre’ and choose your loan account number.

4. Click on ‘Statement of Account’ to view or download your loan statement.

HDFC Home Loan

HDFC Home Loan SBI Home Loan

SBI Home Loan