Are you planning to pay off your Bajaj Housing Finance home loan ahead of schedule? If so, you may be wondering how prepaying your loan affects your finances. With the help of the Bajaj Home Loan Prepayment Calculator, you can easily estimate the impact of extra payments on your loan.

Bajaj Housing Finance Home Loan Prepayment Charges

Looking to close your Bajaj Housing Finance home loan sooner than planned? Whether you want to reduce a few EMIs off your schedule or wipe out the entire balance in one go, the fee you pay depends on two things — your interest‐rate type (floating vs fixed) and the purpose of the loan (personal vs business use). The tables below give you a snapshot of the current* pre‑payment charges for each scenario.

Floating‑Rate Loans (Personal Use – Non‑Business)

| Charge Type | Term Loan | Flexi Term Loan | Flexi Hybrid Loan |

|---|---|---|---|

| Part‑prepayment | Nil | Nil | Nil |

| Full prepayment | Nil | Nil | Nil |

Fixed‑Rate Loans (All Borrowers)

| Charge Type | Term Loan | Flexi Term Loan | Flexi Hybrid Loan |

|---|---|---|---|

| Part‑prepayment | 2 %* on part‑payment amount | Nil | Nil |

| Full prepayment | 4 %* on principal outstanding | 4 %* on available Flexi loan limit | 4 %* on sanctioned amount during the Flexi “interest‑only” period 4 %* on the available Flexi loan limit during the Flexi “term” period |

Suggested Read: Bajaj Housing Finance Repayment Options

Bajaj Housing Finance Home Loan Pre Payment Rules

| Item | Details |

|---|---|

| Issuance of foreclosure letter | Within 21 days of the borrower’s written request |

| Part‑prepayment charges on Flexi Term Loans / Flexi Hybrid Loans | NIL |

Suggested Read: Bajaj Housing Finance Home Loan Customer Care

Bajaj Housing Finance Home Loan Prepayment Eligibility Criteria

If you’re a Bajaj Housing Finance home loan borrower, here’s what you need to know about eligibility for prepayment:

| Eligibility Criteria | Details |

|---|---|

| Primary Borrower | Eligible to make the prepayment. |

| Joint Home Loan | Co-applicants can also make the prepayment if the loan is in their name. |

| Account Status | Account should be free of defaults or overdue payments. Prepayment is allowed only with a consistent repayment track record. |

Suggested Read: Bajaj Housing Finance Home Loan Statement Download

How Does Bajaj Housing Finance Home Loan Prepayment Calculator Work?

To calculate the impact of prepayment on your home loan, the formula involves adjusting the remaining principal and recalculating either the loan tenure or the EMI. The formula is:

Remaining Principal = (Remaining Principal – Prepayment Amount) × (1 + i/n)^(n × t)

Where:

- Remaining Principal: The remaining loan amount after accounting for the prepayment.

- Prepayment Amount: The extra payment made towards the loan over and above the regular EMI.

- i: The annual interest rate on the home loan.

- n: The number of times the interest is compounded per year (usually 12 for monthly compounding).

- t: The remaining term of the loan in years.

Suggested Read: Bajaj Housing Finance Home Loan Tax Certificate

Home Loan Prepayment Case Study

Mr. Ram, a resident of Mumbai, took a home loan from Bajaj Housing Finance to purchase a property. He opted for a loan amount of ₹50,00,000 at an interest rate of 9.75% p.a., with a loan tenure of 30 years.

His monthly EMI was ₹42,958. Over the years, Mr. Ram diligently paid his monthly installments. After 15 years of repayment, he decided to make a prepayment of ₹5,00,000 to reduce his loan burden and save on interest payments. Below is an analysis of how this prepayment impacted his loan status.

| Category | Details |

|---|---|

| Loan Amount | ₹50,00,000 |

| Rate of Interest | 9.75% p.a. |

| Tenure | 30 years |

| EMI | ₹42,958 |

| Total Interest to be Paid in 30 Years | ₹1,04,64,779 |

| Total Amount to be Paid in 30 years | ₹ 1,54,64,779 |

Prepayment Details

Mr. Ram decides to make a prepayment of ₹5,00,000 at the 15-year mark. Let’s analyze the impact of this prepayment.

| Prepayment Amount | ₹5,00,000 |

|---|---|

| New Principal After Prepayment | ₹41,69,068 – ₹5,00,000 = ₹36,69,068 |

Loan Status at Year 15

At the 15-year mark, Mr. Ram has already made 180 EMIs and has 180 EMIs remaining. Here’s the status of the loan at that point:

| Category | Amount |

|---|---|

| Opening Balance (Year 15) | ₹41,69,068 |

| EMIs Paid | 180 months (15 years) |

| EMIs Remaining | 180 months |

| Interest Already Paid | ₹1,04,64,779 – Remaining Interest ≈ ₹36,08,226 |

Impact of Prepayment

Below is the detailed impact of the prepayment on Mr. Ram’s home loan:

| Category | Before Prepayment | After Prepayment | Savings |

|---|---|---|---|

| Remaining Principal | ₹41,69,068 | ₹36,69,068 | ₹5,00,000 |

| Remaining Tenure | 15 years (180 months) | 11.5 years (138 months) | 3.5 years (42 months) |

| Monthly EMI | ₹42,958 | ₹42,958 | – |

| Total Future Payments | ₹77,32,440 | ₹59,28,204 | ₹18,04,236 |

| Interest Component | ₹35,63,372 | ₹22,59,136 | ₹13,04,236 |

Financial Benefits:

- Reduction in Loan Tenure: The prepayment of ₹5,00,000 reduces Mr. Ram’s loan tenure by 3.5 years (from 15 years to 11.5 years).

- Interest Savings: Mr. Ram will save approximately ₹13,04,236 in interest payments.

- Total Cash Flow Savings: The total amount of money saved in future payments, including the reduction in principal and interest, is ₹18,04,236.

Documents Required for Bajaj Housing Finance Home Loan Prepayment

- Prepayment Request Form (duly filled and signed).

- Identity & Address Proof : PAN card, Aadhaar, passport, etc.

- Loan Account Details : Loan account number and original loan agreement.

- Payment Instrument : Cheque/DD/online payment proof for prepayment amount.

How to Make Bajaj Housing Finance Home Loan Prepayment Online?

- Visit the official Bajaj Housing Finance website.

- Under ‘Login’ click on ‘Customer Login’

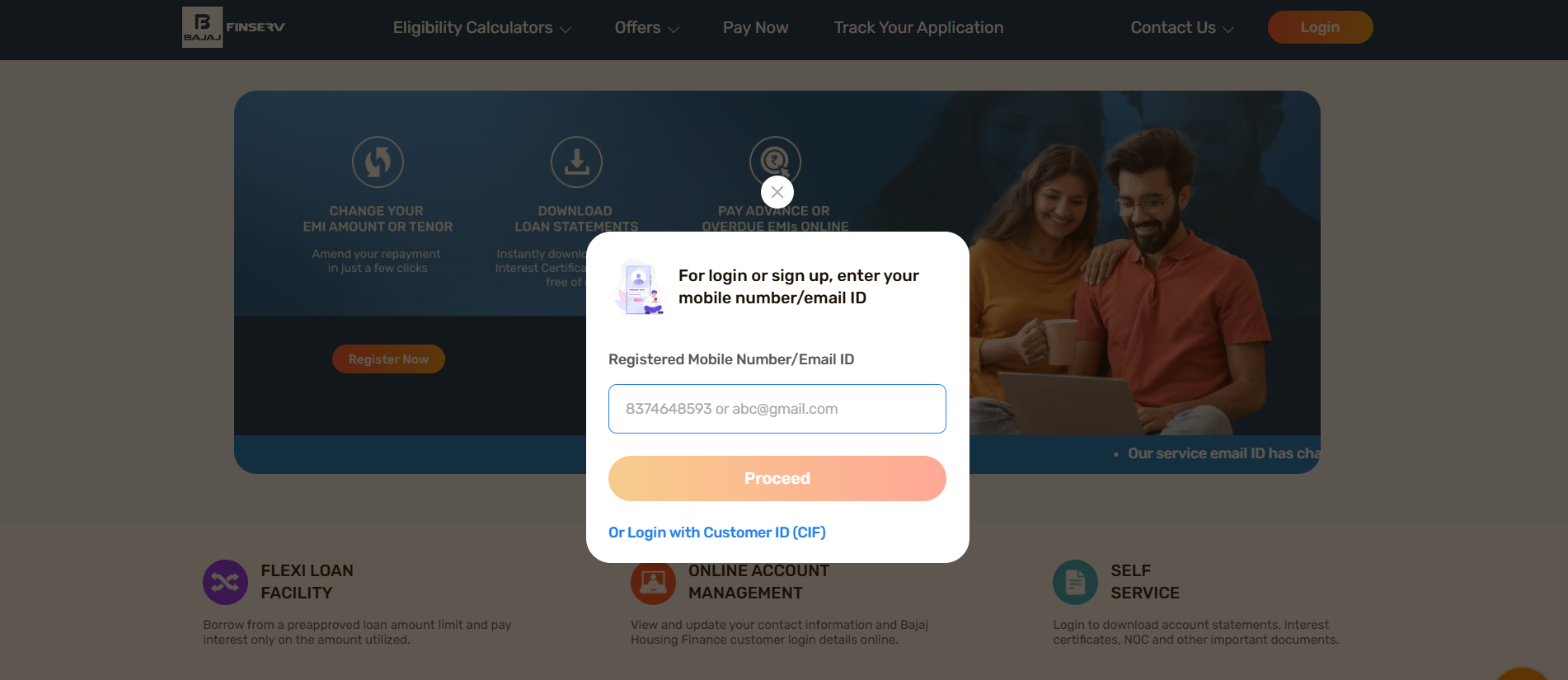

- Login using your registered mobile number and OTP.

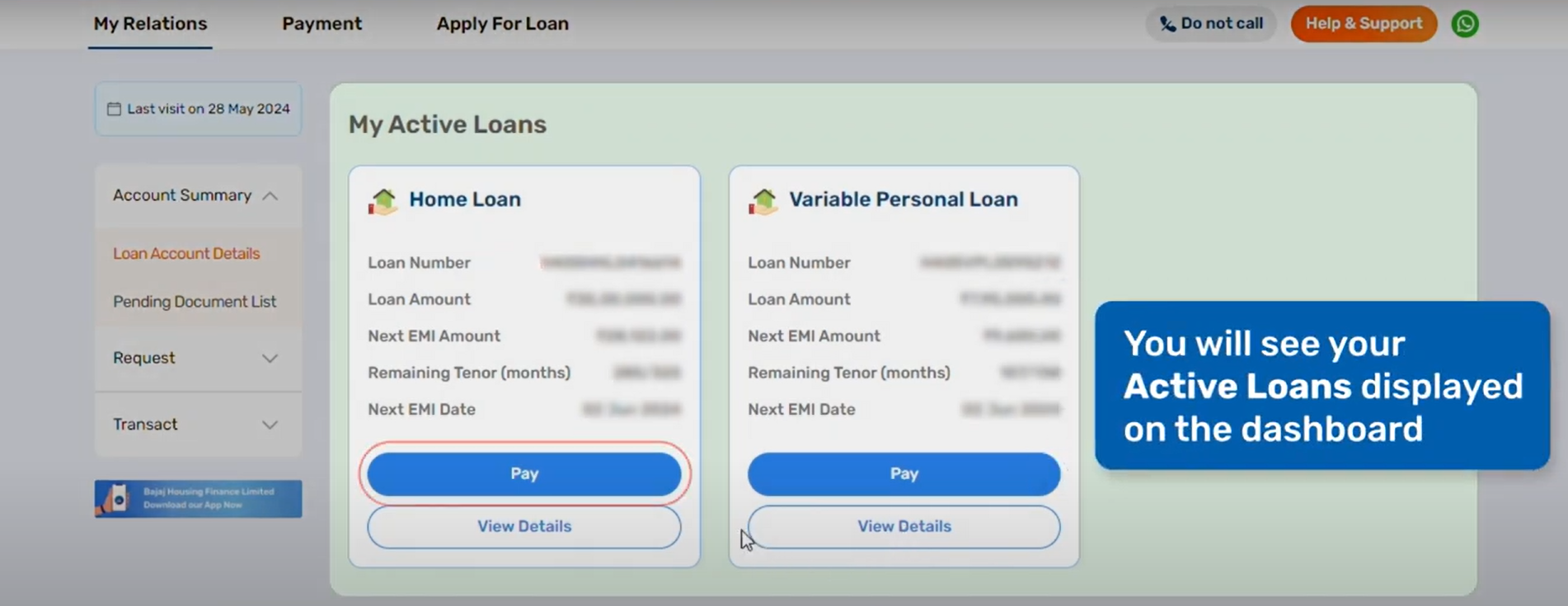

- All your active loan accounts will be displayed on the screen. Click on ‘Pay’

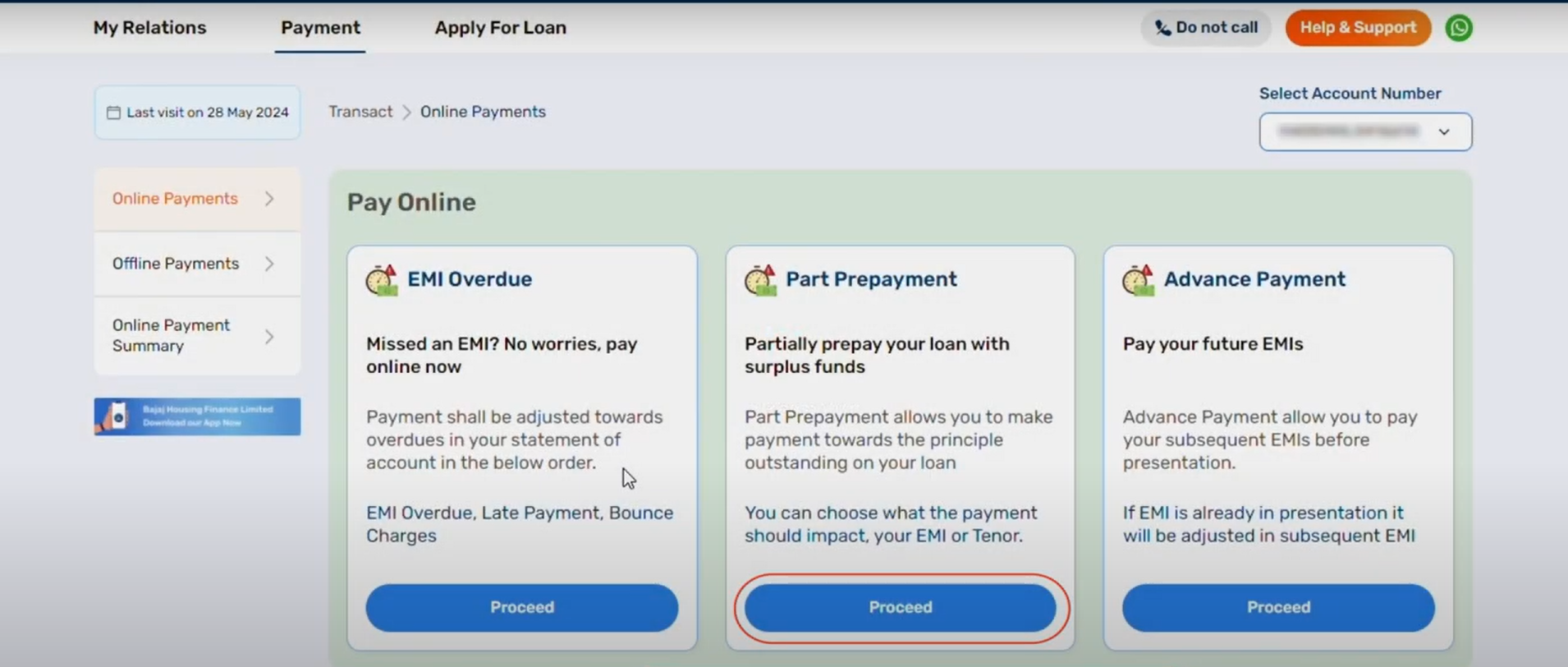

- Choose part prepayment by clicking on “proceed”

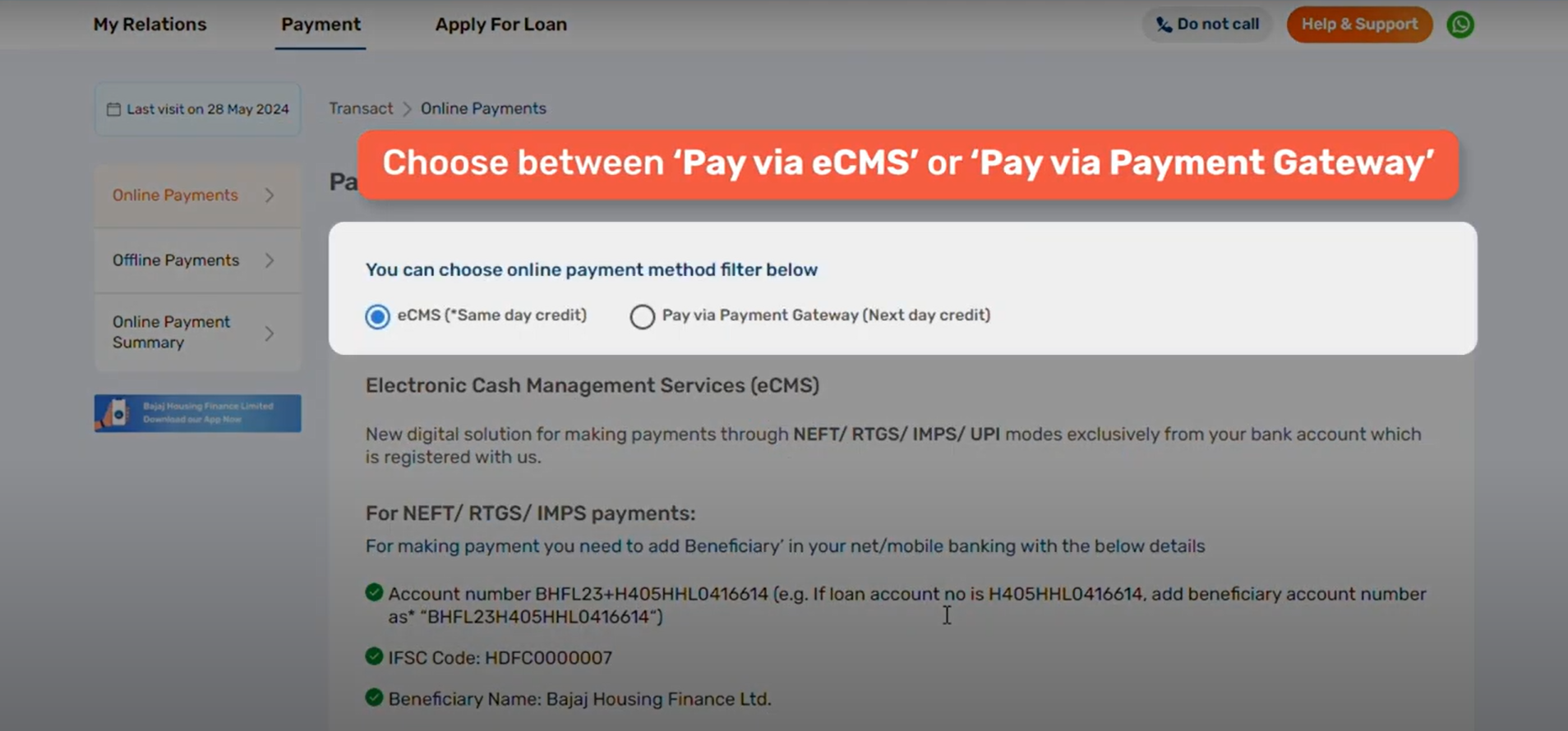

- Choose the payment method and click on ‘Proceed’

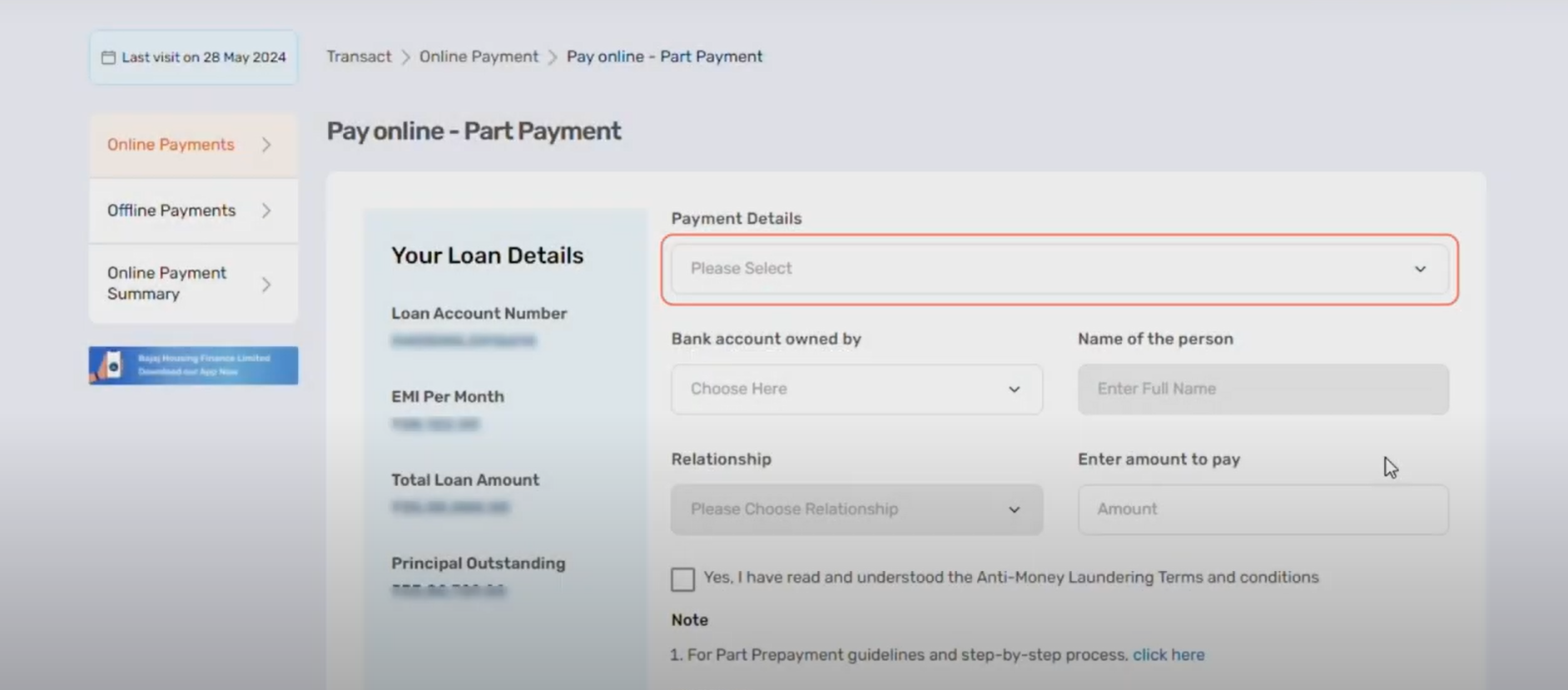

- Fill in the application form and enter the amount you wish to prepay. Click on “Make Payment”

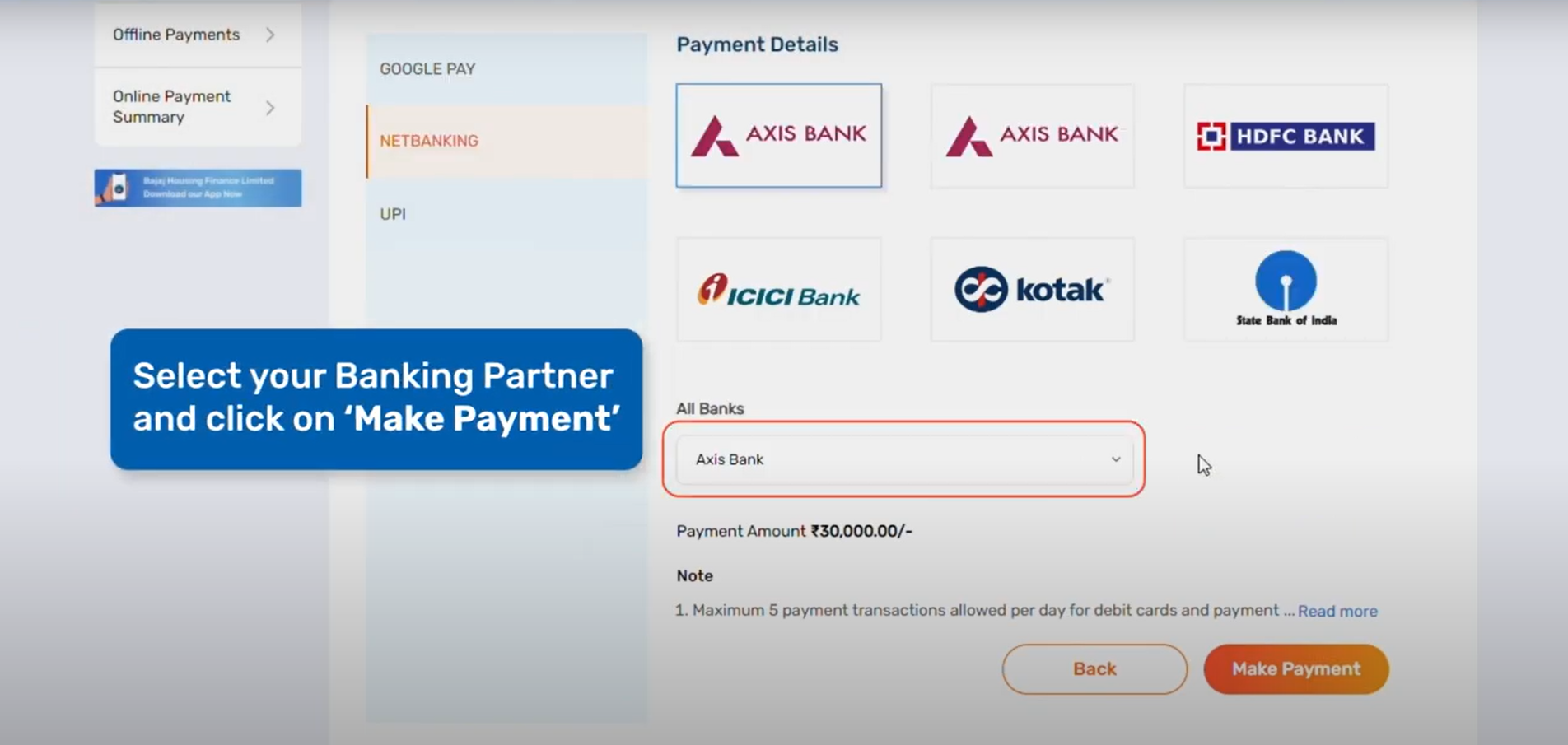

- Select the mode of payment and make the payment.

Source of Images: Bajaj Housing Finance Official Youtube

How to Make Bajaj Housing Finance Home Loan Prepayment Offline?

| Step | Description |

|---|---|

| 1. Visit a Bajaj Housing Finance Branch | Locate and visit the nearest Bajaj Housing Finance branch during working hours. |

| 2. Prepare the Payment | – Cheque Payment: Issue a cheque in favor of “Bajaj Housing Finance”. – Cash Payment: Ensure the exact amount as change may not be available. |

| 3. Submit the Payment | Submit the cheque or cash along with a written application specifying your loan account number, amount being prepaid, and whether it’s a partial or full prepayment. |

| 4. Pay Applicable Charges | – Partial prepayments and full prepayments have charges. Refer to the Schedule of Charges under the “Fair Practice Code” on the Bajaj Housing Finance website. |

| 5. Obtain Acknowledgment | Request an acknowledgment receipt for the payment. |

| Important Notes | – Prepayments are accepted between the 6th and 24th of each month. – It may take up to 7 working days for the prepayment to reflect in your loan account. |

Suggested Read: Impact on Home Loan Insurance During Home Loan Balance Transfer?

Why Does Bajaj Housing Finance Charge You on Making Home Loan Prepayment?

Bajaj Housing Finance, like other housing finance companies (HFCs), charges prepayment fees on home loans primarily for the following reasons:

| Reason | Explanation | Key Points |

|---|---|---|

| Compensation for Lost Interest | Lenders lose future interest income when loans are prepaid. | – Fee offsets financial loss from foregone interest. – Ensures recovery of anticipated revenue. |

| Administrative Costs | Prepayment involves documentation, verification, and record updates. | – Covers operational expenses. – Secondary reason compared to lost interest. |

| Regulatory Framework | HFCs (like PNB Housing) are regulated by NHB, not RBI. | – NHB permits prepayment fees forboth fixed and floating-rate loans. – RBI bans fees for banks’ floating-rate loans. – Borrowers must verify updated regulations. |

| Market Practices & Profit | Prepayment fees act as a revenue stream in competitive markets. | – HFCs may prioritize profitability. – Borrowers can negotiate terms or switch lenders. |

Suggested Read: Top 5 Banks for Home Loan Balance Transfer

When are Banks Not Allowed to Charge Prepayment Fees?

- Floating-Rate Home Loans (Individuals): RBI prohibits prepayment charges on floating-rate loans for individuals, allowing flexibility for partial and full prepayments.

- Government Scheme Loans: Loans under schemes like PMAY cannot have prepayment charges to promote affordable housing.

- Refinancing/Balance Transfer: Banks can’t charge prepayment fees when a loan is refinanced or transferred to another lender, except for standard processing fees.

Suggested Read: Toilet Directions as per Vastu

Things to Consider While Making Bajaj Housing Finance Home Loan Prepayment

- Loan Type: Check if you have a fixed or floating rate loan to determine if prepayment charges apply.

- Prepayment Charges: Fixed-rate loans may attract a 2% charge on the outstanding principal for loan transfer.

- Partial vs. Full Prepayment: Partial prepayment reduces EMI or tenure, full prepayment eliminates the loan entirely.

- Loan Tenure Impact: Prepayment can shorten your tenure or reduce your EMI.

- Prepayment vs. Investing: Consider if investing the prepayment amount gives higher returns than saving on interest.

- Tax Implications: Prepayment may reduce home loan interest deductions under Sections 80C and 24(b).

- CIBIL Score Impact: Prepayment might temporarily affect your credit score.

- Emergency Fund: Ensure sufficient funds remain after prepayment for unforeseen expenses.

- Loan Agreement Terms: Review your agreement for any specific prepayment penalties or conditions.

- Long-Term Financial Goals: Align prepayment with your broader financial strategy and goals.

- EMI and Interest Reduction: Prepayment reduces both your EMI and total interest payable.

- Loan Balance: Ensure the prepayment amount is sufficient to meet your financial objectives.

Suggested Read: Can Home Loan Balance Transfer Backfire?

When is it the Right Time to Make Home Loan Prepayment?

- When interest rates on your loan exceed potential returns from investments (e.g., stock markets, FDs).

- After building an emergency fund (3–6 months of expenses) and clearing high-interest debts.

- When prepayment penalties are low or waived (e.g., RBI prohibits banks from charging fees on floating-rate home loans for individuals).

- To shorten loan tenure significantly (prioritize prepayment if reducing tenure aligns with financial goals like retirement).

- If tax benefits (e.g., Section 24 deductions) are no longer a priority (prepayment reduces interest, lowering tax savings).

Suggested Read: Mutual Funds vs. Rental Income

Home Loan Part Pre Payment vs. Full Pre Payment

Here’s a concise comparison of Home Loan Part Prepayment vs. Home Loan Full Prepayment in a tabular format:

| Criteria | Part Prepayment | Full Prepayment |

|---|---|---|

| Definition | Paying a portion of the outstanding loan amount before tenure ends. | Paying the entireremaining loan balance to close the loan immediately. |

| Impact on Loan | Reduces tenure(if EMI unchanged) or lowers EMI(if tenure unchanged). | Loan is closed permanently; no further EMIs or interest. |

| Key Benefit | Saves interest over the loan term; retains liquidity for other needs. | Eliminates debt entirely; improves cash flow post-closure. |

| Processing Fees | Lower or nil fees (varies by lender). May have annual prepayment limits. | Higher fees (e.g., 1–3% of outstanding amount). Some lenders waive fees. |

| Tax Implications | Tax benefits on interest (if applicable) continue for the reduced tenure. | Tax benefits (e.g., Section 24/80C in India) cease post-closure. |

| Eligibility | Allowed multiple times (subject to lender terms). No lock-in period in most cases. | One-time closure. Requires sufficient funds to settle the entire balance. |

| Example | Loan: ₹50L @ 8% for 20 years. Part-prepay ₹10L → Tenure reduces to ~15 years. | Loan: ₹50L outstanding. Full prepayment closes the loan, saving ₹XXL in future intere |

Suggested Read: Can You Pay Rent to Your Parents and Claim HRA?

Advantages and Disadvantages of Home Loan Prepayment

| Aspect | Advantages | Disadvantages |

|---|---|---|

| Interest Savings | Reduces overall interest paid over the loan tenure. | May not be ideal if the prepayment does not significantly reduce interest. |

| Loan Tenure | Shortens the loan tenure, allowing you to repay the loan faster. | Could lead to a higher monthly EMI if the loan tenure is reduced. |

| Financial Freedom | Provides peace of mind and reduces debt burden. | Might strain finances if the prepayment amount is large. |

| Credit Score Improvement | Can boost credit score by reducing outstanding debt. | Prepayment might temporarily lower liquidity. |

| Flexibility in Loan Terms | Offers the option to re-adjust loan tenure or EMI based on new principal. | Could incur prepayment penalties, especially in fixed-rate loans. |

| Opportunity for Investment | Frees up funds for other investments once the loan is repaid earlier. | Potential opportunity loss if funds used for prepayment could have been invested elsewhere for better returns. |

Suggested Read: Cities for Profitable Airbnb Investment in India

Is it Better to Prepay your Home Loan or Invest in a Mutual Fund?

| Factors | Home Loan Prepayment | SIP Investment |

|---|---|---|

| Interest Rate vs. Returns | Compare your home loan interest rate (post-tax) with SIP returns. – If loan rate > SIP returns (e.g., loan at 12% vs. SIP at 8%), prepay. – If SIP returns > loan rate (e.g., loan at 8% vs. SIP at 10–12% long-term), invest. | Historically, equity SIPs average 10–12% returns over 5+ years. Returns are market-dependent and not guaranteed. |

| Tax Implications | Loss of tax deductions on home loan interest (if applicable). | Tax-efficient if investing in equity (LTCG taxed at 10% post-₹1 lakh exemption). ELSS SIPs offer tax deductions under Section 80C. |

| Risk Tolerance | No risk: Guaranteed savings via reduced interest. | Market risk: Volatile in short-term but potential for higher long-term gains. |

| Financial Goals | Prioritize becoming debt-free (short-term goals). | Build wealth for long-term goals (retirement, education). |

| Job Security/Income | Safer if income is unstable. | Requires stable income to withstand market volatility. |

| Age/Life Stage | Better for those nearing retirement (debt reduction). | Ideal for younger investors (long compounding horizon). |

| Emotional Factor | Peace of mind from reduced debt burden. | Motivation from growing wealth and financial freedom. |

| Loan Tenure Impact | Prepay early to save more interest. Partial payments reduce tenure. | No direct impact on loan; focus on wealth creation. |

| Emergency Fund | Ensure 6–12 months of expenses saved before prepaying. | Ensure emergency funds exist before investing. |

| Future Credit Needs | – Invest in SIPs if the loan rate is 8–10% (equity outperforms long-term). – Compounding in SIPs can yield a higher corpus over 20+ years. | Closing a loan may affect the credit mix/score. |

| Expert Opinion | – Prepay if the loan rate is high (e.g., 12–15%). – Avoid prepayment if leveraging low-interest loans for real estate gains. | – Invest in SIPs if the loan rate is 8–10% (equity outperforms long-term). – Compounding in SIPs can yield higher corpus over 20+ years. |

Key Takeaways

Prepay If :

- Loan interest rate > SIP returns (post-tax).

- You prioritize stability and debt freedom.

- Uncertain income or nearing retirement.

Invest in SIP If :

- SIP returns > loan rate (e.g., equity SIPs over 8–10% loan rates).

- Comfortable with market risk and focused on long-term wealth.

- Younger with stable income and a 5–10+ year horizon.

Example :

- A ₹50 lakh loan at 9% (20 years) costs ₹76 lakh total. Prepaying ₹5 lakh early saves ₹12+ lakh in interest.

- Investing ₹25,000/month via SIP averaging 12% returns yields ₹3.5 crore in 20 years.

Suggested Read: Should you invest that extra cash or prepay

Conclusion

Before considering prepayment, eliminate high-interest debts and secure an emergency fund. Prepaying your home loan can be beneficial if you aim to own your home sooner or decrease interest expenses.

If you’re considering a home loan balance transfer, trust Credit Dharma to find the perfect solution for you.

Frequently Asked Questions

If your loan is on a floating (variable) rate and you are an individual borrower, the answer is almost always “No.” RBI rules bar banks and HFCs from levying prepayment charges on floating‑rate housing loans.

For fixed‑rate loans, most lenders still charge 1 – 3 % of the outstanding principal.

Many banks insist you wait six EMIs with online channels or up to 12 – 36 months under older fixed‑rate contracts. Floating‑rate borrowers usually face no lock‑in at all thanks to the RBI rule above.

If you want the biggest interest savings, ask the bank to cut the tenure; slicing years off the tail of the schedule compounds savings dramatically. Lowering the EMI gives breathing room in your monthly budget but saves less overall—great during cash‑flow crunches.

No. Prepayments simply speed up principal and interest repayment, both of which stay eligible—₹1.5 lakh for principal (80C) and up to ₹2 lakh for interest on a self‑occupied house (24[b]).

But: If you sell the property within five years of claiming 80C, the previously claimed principal benefit gets clawed back.

Yes. Any fee the bank levies—say a 2 % foreclosure charge—draws 18 % GST because it is treated as a financial service. If your loan is floating and penalty‑free, there is no fee and therefore no GST.

HDFC Home Loan

HDFC Home Loan SBI Home Loan

SBI Home Loan