From standard EMI plans to unique options tailored to your income patterns, Bajaj Housing Finance home loan allows you to choose the plan that works best for your lifestyle and repayment capacity, ensuring stress-free home loan management.

How do you repay Bajaj Housing Finance Home Loan EMI Online via the official website?

Paying your home loan EMI doesn’t need to be complicated, especially with Bajaj Housing Finance. Here’s a simple guide to repay your EMIs quickly through their official website.

Time needed: 2 minutes

5-Step Prepayment Process

- Visit the official website of Bajaj Housing Finance

- Log in by entering your registered email address/ mobile number.

- Under “Account Information,” select “Online Payment.”

- Choose the EMI amount payable.

- Enter the required details and authorize the payment.

How to Repay Bajaj Housing Finance Home Loan EMI Online via Mobile Application?

- Download the “Bajaj Housing Finance” mobile application via the Play Store or the App Store.

- Log in with your registered mobile number.

- Go to Account Information > Online Payment.

- Select EMI and any overdue payment, fill in the necessary details, and complete the payment.

How to Repay Bajaj Housing Finance Home Loan EMI Online via UPI Applications?

To repay your Bajaj Housing Finance Home Loan EMI online via UPI, follow these steps:

Prerequisites:

- Ensure your bank account is UPI-enabled and linked to a UPI app (e.g., Google Pay, PhonePe, BHIM, Paytm).

- Have your Bajaj Housing Finance loan account details handy.

- Sufficient funds in your UPI-linked bank account.

Step-by-Step Process:

- Open the UPI application on your mobile device.

- Navigate to the ‘Loan EMI Payment’ section.

- Select ‘Bajaj Housing Finance Ltd’ as your lender.

- Enter your Loan Account Number.

- Click on ‘Get Payable Amount’ to fetch your EMI details.

- Choose your preferred payment method (e.g., UPI, debit card, credit card, Paytm Wallet).

- Complete the payment and save the receipt for your records.

How to Repay Bajaj Housing Finance Home Loan EMI Offline?

If you’re someone who prefers making payments in person, Bajaj Housing Finance also offers multiple offline options to repay your home loan EMI. These methods are safe, widely accepted, and can be done by visiting authorized branches or through simple banking channels.

| Modes of Offline Payment | Steps & Key Details |

|---|---|

| Post-Dated Cheques (PDCs) | – Submit a series of cheques to Bajaj Housing Finance at the start of your loan. – Ensure the cheque date and amount match the EMI schedule. – Mention loan account number on the back. – Collect acknowledgement receipt. |

| Electronic Clearing Service (ECS) | – Fill out the ECS mandate form at your bank. – Submit it to Bajaj Housing Finance with bank details. – Monthly EMI auto-debited from your account. – No manual effort required every month. |

| NACH Mandate | – Fill and sign the NACH form. – Authorizes automatic EMI deductions. – Submit it at the branch or through your bank. – Secure and hassle-free recurring payment method. |

| Cash Payment at Branch | – Visit the nearest Bajaj Housing Finance branch. – Make payment in cash for the EMI amount. – Get an official payment receipt. – Useful for one-time or overdue payments. |

| Cheque/Demand Draft (DD) | – Write cheque/DD in favor of “Bajaj Housing Finance Limited.” – Mention your loan account number on the back. – Drop it at the branch or authorized collection point. – Always collect a receipt for confirmation. |

Bajaj Housing Finance Home Loan Repayment Options

When you take a home loan, knowing your repayment options helps you manage finances better. Bajaj Housing Finance offers flexible ways to repay your loan:

1. EMIs (Equated Monthly Instalments)

- You repay the loan in fixed monthly instalments.

- Each EMI includes both principal and interest.

- EMIs are auto-debited from your bank account on a set date.

- You can choose a repayment tenure that suits your budget — longer tenure means smaller EMIs, but higher total interest.

2. Part Prepayment

- You can pay a lump sum amount (more than your EMI) toward the loan.

- Helps reduce the outstanding principal faster.

- Leads to either lower EMIs or a shorter loan tenure.

- Bajaj Housing Finance usually does not charge fees for part prepayment if it’s a floating-rate loan taken by an individual.

3. Foreclosure (Full Loan Prepayment)

- You can repay the entire outstanding loan amount before the end of the tenure.

- Saves you from paying future interest.

- Ideal when you have a surplus of funds.

- Like part payment, foreclosure charges are usually nil for floating-rate individual loans.

Bajaj Housing Finance Home Loan Pre-Payment Charges

You can pay extra lump sum amounts toward your home loan before the end of the tenure. Here’s what you should know about charges:

For Loans with Floating Interest Rates (Non-Business Purposes):

- No part-prepayment charges

- Term Loan: Nil

- Flexi Term Loan: Nil

For Loans with Floating Rates (Business Purposes) or Fixed Interest Rates:

- Charges apply

- Term Loan: 2% of the part-prepayment amount

- Flexi Term Loan: Nil

Other things to note:

- GST is applicable and will be added to any charges.

- No charges apply if you repay from your own sources (like savings or salary).

- For dual-rate loans (fixed initially, then floating), charges depend on the rate type at the time of payment.

Bajaj Housing Finance Home Loan Foreclosure Charges

If you decide to close your home loan before the tenure ends, Bajaj Housing Finance allows foreclosure with specific terms based on your loan type and purpose:

For Loans with Floating Interest Rates (Non-Business Purposes):

- No foreclosure charges

- Term Loan: Nil

- Flexi Term Loan: Nil

For Loans with Floating Rates (Business Purposes) or Fixed Interest Rates:

- Charges apply

- Term Loan: 4% of the outstanding principal

- Flexi Term Loan:

- 4% on the sanctioned amount during the interest-only repayment phase

- 4% on the available loan limit during the Flexi Term Loan phase

Other important points

- GST is extra and will be added to the foreclosure charges, if applicable.

- No foreclosure charges if the loan is paid off using your own funds (not borrowed from any bank, NBFC, HFC, or financial institution).

- For dual-rate loans (fixed initially, then floating), the applicable charges depend on the loan type at the time of foreclosure.

Factors to Consider When Choosing a Home Loan Repayment Option

- Monthly Budget: Choose an EMI that fits comfortably within your monthly income.

- Loan Tenure: A longer tenure reduces EMI but increases total interest outgo.

- Interest Rate Type: Fixed rates offer stability; floating rates may help save if rates fall.

- Prepayment Flexibility: Check if part prepayment or foreclosure is allowed without penalty.

- Income Stability: Opt for flexible plans if your income is variable or business-based.

- Future Financial Goals: Align your repayment plan with other financial commitments.

- Total Interest Payable: Compare repayment options based on total interest over the loan term.

- Charges & Fees: Be aware of hidden costs like processing fees, foreclosure charges, etc.

- Lender’s Terms: Always review the fine print of repayment clauses before signing.

Is it Better to Prepay your Home Loan or Invest in a Mutual Fund?

| Factors | Home Loan Prepayment | SIP Investment |

|---|---|---|

| Interest Rate vs. Returns | Compare your home loan interest rate (post-tax) with SIP returns. – If loan rate > SIP returns (e.g., loan at 12% vs. SIP at 8%), prepay. – If SIP returns > loan rate (e.g., loan at 8% vs. SIP at 10–12% long-term), invest. | Historically, equity SIPs average 10–12% returns over 5+ years. Returns are market-dependent and not guaranteed. |

| Tax Implications | Loss of tax deductions on home loan interest (if applicable). | Tax-efficient if investing in equity (LTCG taxed at 10% post-₹1 lakh exemption). ELSS SIPs offer tax deductions under Section 80C. |

| Risk Tolerance | No risk: Guaranteed savings via reduced interest. | Market risk: Volatile in short-term but potential for higher long-term gains. |

| Financial Goals | Prioritize becoming debt-free (short-term goals). | Build wealth for long-term goals (retirement, education). |

| Job Security/Income | Safer if income is unstable. | Requires stable income to withstand market volatility. |

| Age/Life Stage | Better for those nearing retirement (debt reduction). | Ideal for younger investors (long compounding horizon). |

| Emotional Factor | Peace of mind from reduced debt burden. | Motivation from growing wealth and financial freedom. |

| Loan Tenure Impact | Prepay early to save more interest. Partial payments reduce tenure. | No direct impact on loan; focus on wealth creation. |

| Emergency Fund | Ensure 6–12 months of expenses saved before prepaying. | Ensure emergency funds exist before investing. |

| Future Credit Needs | – Invest in SIPs if the loan rate is 8–10% (equity outperforms long-term). – Compounding in SIPs can yield a higher corpus over 20+ years. | Closing a loan may affect the credit mix/score. |

| Expert Opinion | – Prepay if the loan rate is high (e.g., 12–15%). – Avoid prepayment if leveraging low-interest loans for real estate gains. | – Invest in SIPs if the loan rate is 8–10% (equity outperforms long-term). – Compounding in SIPs can yield higher corpus over 20+ years. |

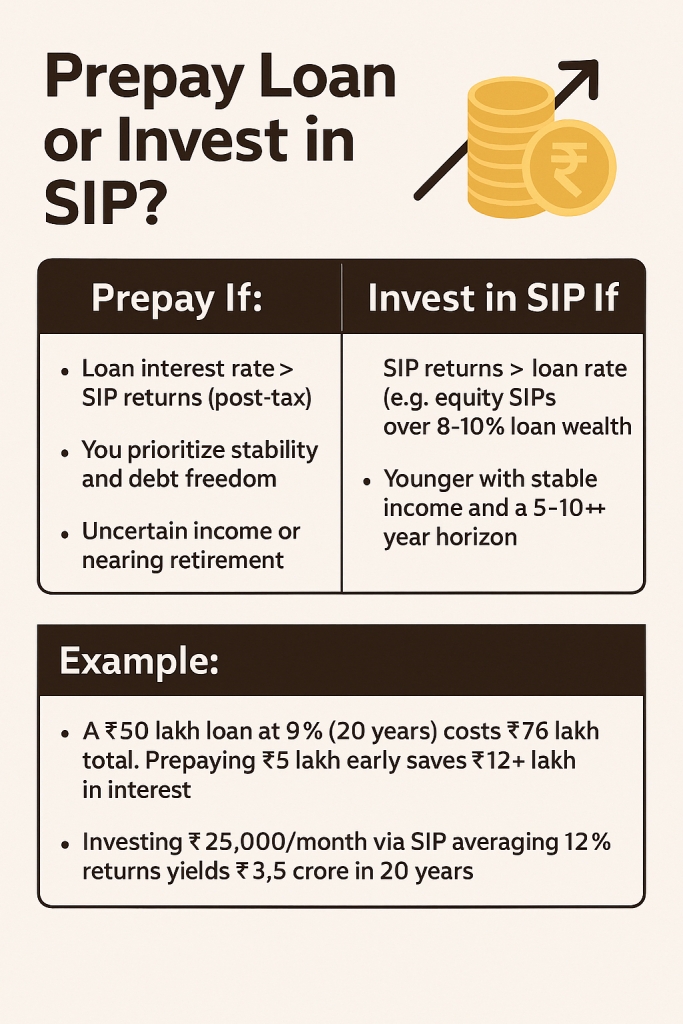

Key Takeaways

Prepay If :

- Loan interest rate > SIP returns (post-tax).

- You prioritize stability and debt freedom.

- Uncertain income or nearing retirement.

Invest in SIP If :

- SIP returns > loan rate (e.g., equity SIPs over 8–10% loan rates).

- Comfortable with market risk and focused on long-term wealth.

- Younger with stable income and a 5–10+ year horizon.

Example :

- A ₹50 lakh loan at 9% (20 years) costs ₹76 lakh total. Prepaying ₹5 lakh early saves ₹12+ lakh in interest.

- Investing ₹25,000/month via SIP averaging 12% returns yields ₹3.5 crore in 20 years.

Conclusion

Buying a home is a big step. Getting a home loan can be hard, but we make it easy. At Credit Dharma, we make this possible by offering the lowest guaranteed interest rates that keep your monthly payments manageable, allowing you to enjoy more of what truly matters.

But that is not it. We offer:

- Guaranteed up to 100% funding

- Receive lifetime assistance and expert guidance long after your loan is approved.

- Enjoy a fully digital process with minimal paperwork

- Get your loan approved within just 1-2 weeks.

Frequently Asked Questions

Use Bajaj’s online EMI calculator, which factors in loan amount, tenure, and interest rate. Manual calculation: EMI = [P × R × (1+R)^N] / [(1+R)^N-1], where P = principal, R = monthly interest rate, N = tenure in months

Yes, if you have a floating-rate home loan for non-business purposes, Bajaj Housing Finance typically does not levy prepayment charges. However, fixed-rate loans or loans taken out for business purposes may attract prepayment fees.

For floating-rate home loans taken out for non-business purposes, foreclosure charges are generally waived. However, fixed-rate loans or those for business purposes may incur foreclosure fees, typically around 4% of the outstanding principal. Always refer to your loan agreement for precise details.

Yes, Bajaj Housing Finance allows part-prepayments. For floating-rate loans taken out for non-business purposes, there are usually no charges. However, fixed-rate loans or those for business purposes might attract fees. It’s best to confirm the terms specific to your loan.

Bajaj Housing Finance usually sets a fixed EMI date, often the 2nd of every month. While changing the date might be challenging, it’s recommended to discuss this directly with the lender to explore any available options.

HDFC Home Loan

HDFC Home Loan SBI Home Loan

SBI Home Loan