Logging into your Bank of Baroda home loan account gives you quick access to your home loan details and services. Whether you’re a new user or need help with account recovery, the process is simple and efficient. This guide will cover all the steps for a hassle-free Bank of Baroda home loan account login.

How to Login to Bank of Baroda Home Loan Account Online?

You can login to Bank of Baroda home loan account using the mentioned ways:

Using Online Banking Portal

To login into your Bank of Baroda net banking portal you need to follow these simple steps:

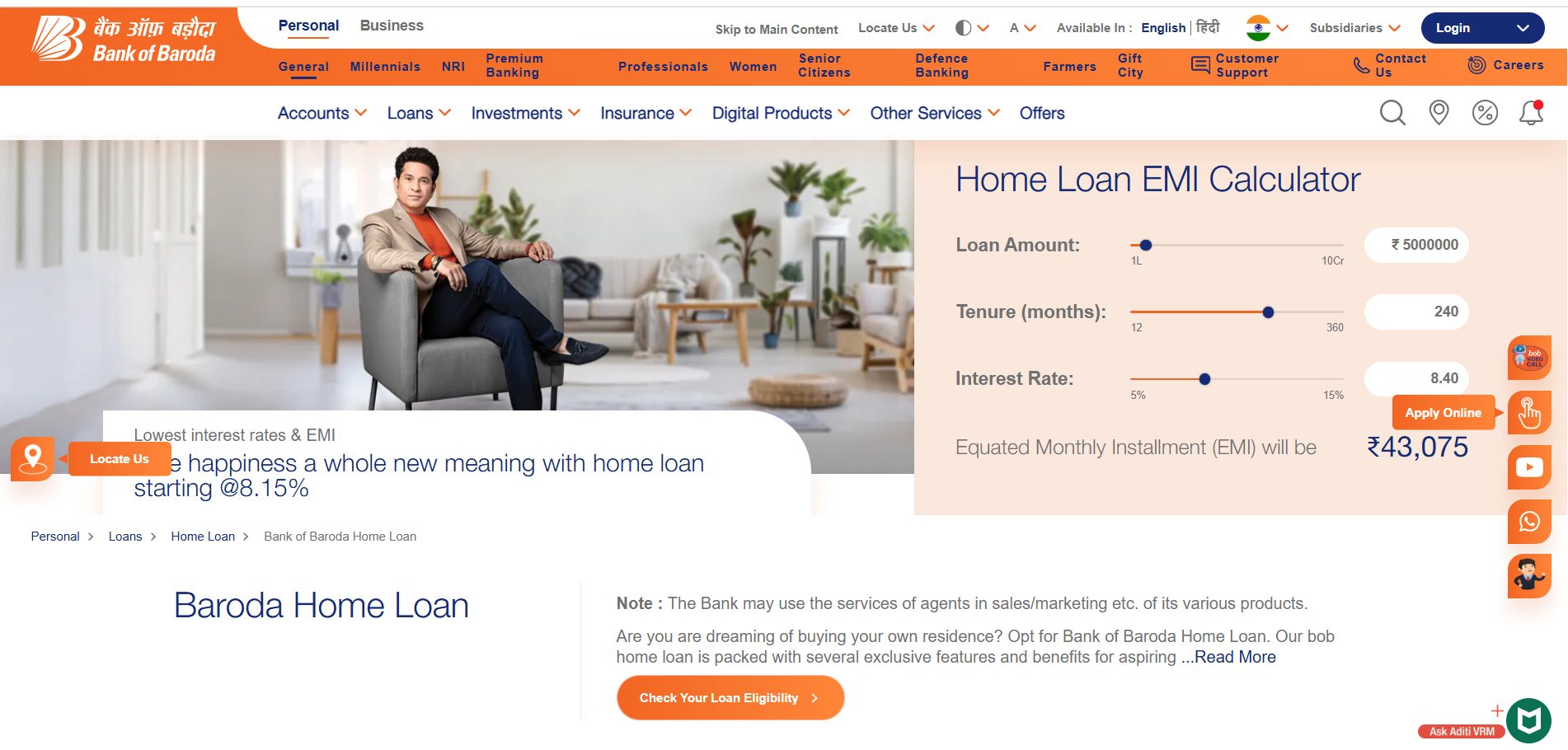

- Visit the Official Bank of Baroda Website

Open the Bank of Baroda homepage on your browser.

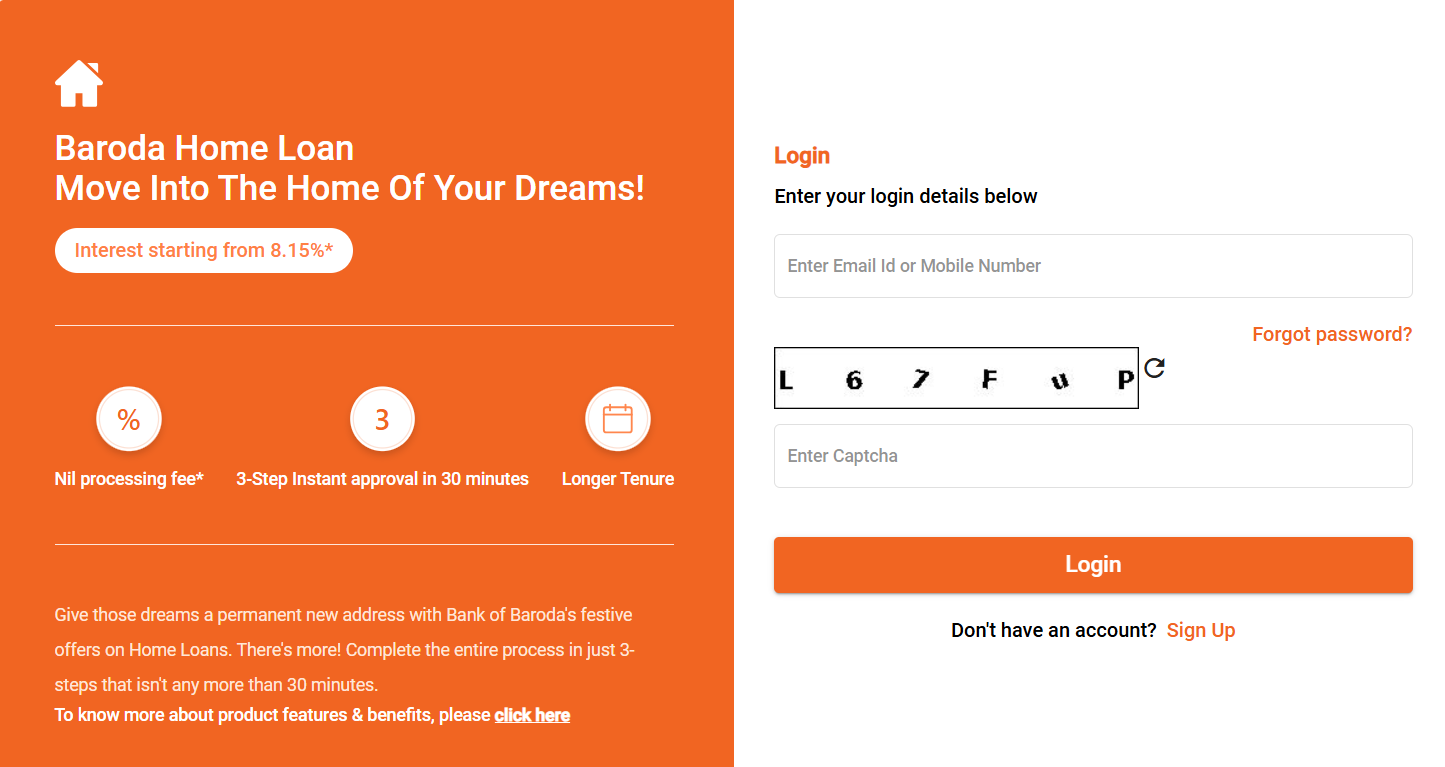

- Enter Your Login Details

– In the “Login” section, enter your Email ID or Mobile Number and password.

– If in case forgotten your password, click “Forgot password” to recover it.

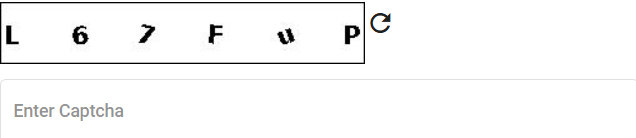

- Complete the Captcha for Security

For security, enter the Captcha and click “Login.”

- Access Your Home Loan Details

Once logged in, view your home loan details, check the balance, and make payments.

Using Mobile Banking App

You can also login to the BOB portal using the mobile app. Follow the simple steps:

- Download the Bank of Baroda Mobile App from the App Store or Google Play Store to get started.

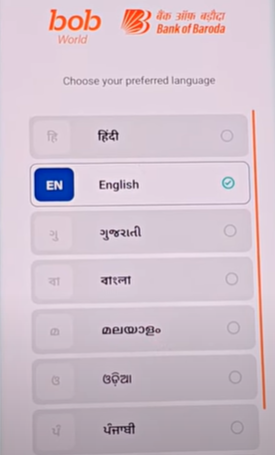

2. After downloading, choose the preferred language.

3. Register as a New User using your mobile number and debit card.

– Verify via OTP sent to your mobile number.

– Complete Registration by entering your 14-digit account number and the last 6 digits of your debit card.

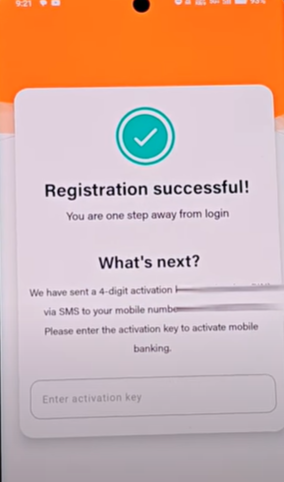

– After doing it, your registration will be shown successful.

4. Access your home loan account and manage your BOB loan details.

Also Read: How to Download Bank of Baroda Home Loan Statement

How to Register on Bank of Baroda Home Loan Online Portal?

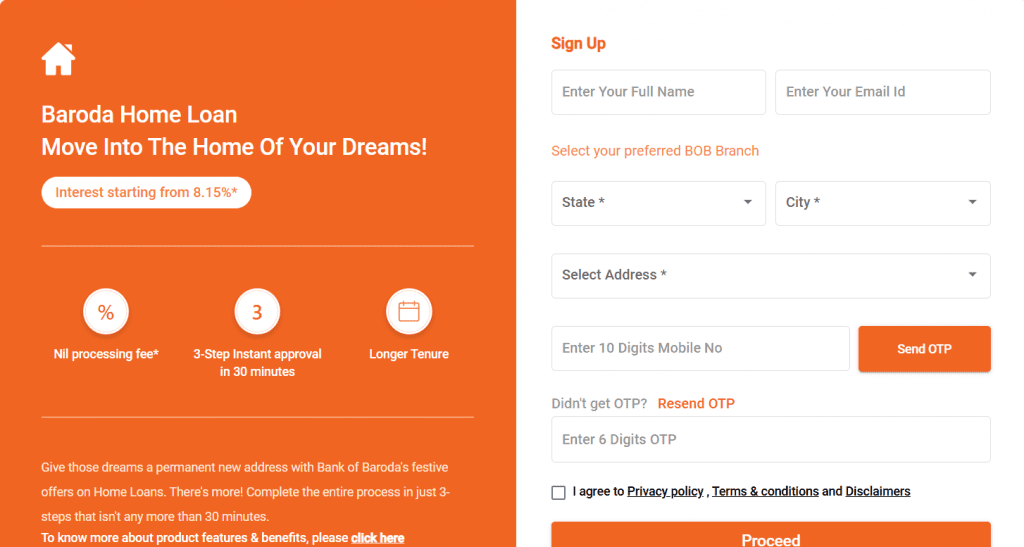

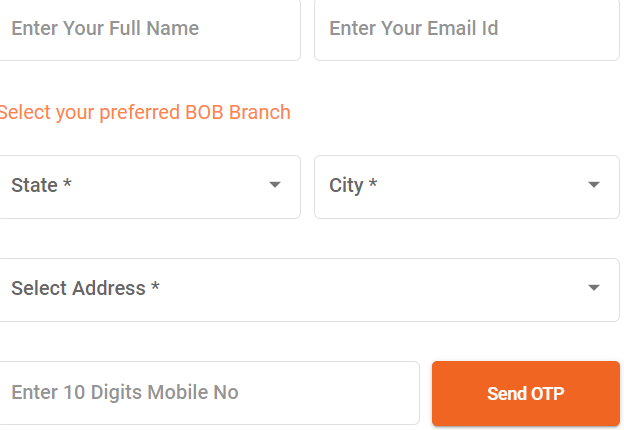

- Fill Out the Application Form online through signup or obtain it at any Bank of Baroda branch.

2. Enter Your Details including full name, email ID, preferred branch, state, city, address, and a 10-digit mobile number.

3. Verify with OTP by entering the code sent to your mobile. Click “Resend OTP” if you don’t receive it.

4. Agree to Terms by accepting the Privacy Policy and Terms & Conditions.

5. Complete Registration and use your credentials for Bank of Baroda loan account login to access your home loan details.

What to Do if My Name is Incorrect on BOB Home Loan Login?

If your name is incorrect on the Bank of Baroda home loan login page, it’s important to correct it to avoid any issues. Here’s what you can do:

- Visit Your Base Branch

Approach your base branch to request an update for your name in the bank’s records. - De-register from Mobile Banking

Use any of the following methods to de-register from mobile banking:

A. ATM

B. Internet Banking (Baroda Connect)

C. Base Branch - Re-register and Update Your Details

After de-registration, re-register to fix the name issue and proceed with your Bank of Baroda loan account login.

Read More: Bank of Baroda Home Loan Application Step-by-Step Process

What Services are Available on the Bank of Baroda Home Loan Login Page?

The Bank of Baroda home loan account login page offers various services to manage your home loan and other banking features, both with and without a login PIN.

Services Without Login PIN:

| Service | Description |

|---|---|

| Change Preferred Language | Switch to your preferred language for easier navigation. |

| Quick View Balance | View your balance without logging in. |

| Unlock/Forgot Login PIN | Reset your login PIN if you’ve forgotten it. |

| IFSC Search | Search for IFSC codes to make easy transfers. |

| Loan & Deposit Calculator | Calculate loan repayments or deposit interest. |

| ATM/Branch/E-lobby Locator | Find nearby ATMs, branches, and e-lobbies. |

| Apply for Financial Services | Apply for loans, insurance, credit cards, mutual funds, and more. |

| Watch Demo | View helpful demos related to your banking services. |

| Contact Us | Get in touch with customer support for assistance. |

| Raise Complaints | Submit complaints for resolution. |

Services Requiring Login PIN:

| Service | Description |

|---|---|

| Setup Biometric Login | Set up biometric login for easier access. |

| Setup Quick View Balance | Enable quick balance viewing after login. |

| Scan QR | Scan QR codes for various transactions. |

| Cash on Mobile (Cardless Withdrawal) | Withdraw cash without a card using your mobile. |

| Fund Transfer | Transfer funds between accounts. |

| Pre-approved Micro Personal Loans | Apply for small loans based on pre-approval. |

What to Do if my BOB Home Loan Account is Not Visible After Login?

If your Bank of Baroda home loan account is not visible after login, it could be due to eligibility or account settings. Here’s what you can do:

- Check Account Eligibility

Ensure your home loan account is eligible for online banking. Only certain account types (e.g., Savings, Current, Overdraft) are eligible for registration and visibility. - Verify Your Account Mode

Confirm that your home loan account is set up with an eligible mode of operation like “Self,” “Either or Survivor,” or “Anyone or Survivor.” - Ensure Proper Registration

If your account mode is eligible, ensure it is properly registered for online banking. Joint accounts require the registration to be done by all account holders. - Contact Customer Support

If your account should be visible but isn’t, contact Bank of Baroda support for further assistance with your Bank of Baroda loan account login.

Also Read: Documents Needed for Bank of Baroda Home Loan

Get a Home Loan

with Highest Eligibility

& Best Rates

Get the Best Home Loan Offers with Credit Dharma

Credit Dharma is your trusted partner for securing the best Home Loan offers, with over ₹500 Cr+ loans handled and partnerships with 20+ leading banks. We provide exclusive access to the lowest interest rates and a seamless, digital process with fast approvals in just 1-2 weeks, backed by lifetime support from our home loan experts.

Why choose Credit Dharma? We provide:

- Lowest Interest Rates: Save more with every EMI.

- Maximum Funding: Get up to 100% funding for your dream home.

- Simple & Digital Process: No tedious paperwork or branch visits.

- Expert Guidance: Lifetime support from our team of specialists.

Compare, choose, and secure the best Home Loan offer with Credit Dharma — your home loan journey starts here!

Conclusion

In conclusion, accessing your Bank of Baroda home loan account login provides a seamless way to manage your loan details and banking services. By following the steps outlined, you can ensure smooth login and account management.

Frequently Asked Questions

To access your home loan account online, visit the Bank of Baroda Digital Lending Platform at https://dil.bankofbaroda.in/homeloan. Click on the “LOGIN” button and enter your registered mobile number and password. If you haven’t registered yet, click on “REGISTER” to create an account.

Yes, you can access your home loan account details using the bob World mobile banking app. After logging in, navigate to the ‘Loans’ section to view your home loan information.

No, it’s not mandatory to have a salary account with Bank of Baroda to apply for a home loan. However, maintaining a savings account with any bank for the last six months with salary credits can enhance your loan eligibility.

You can track your home loan application status by logging into the Digital Lending Platform with your credentials and selecting the ‘Track Application’ option.

You can contact the Digital Lending Department at:

– Address: Digital Lending Department, Baroda Sun Tower, C-34, G-Block, Bandra-Kurla Complex, Mumbai 400 051, India.

– Phone: +91 22 67592873

– Email: dld.bcc@bankofbaroda.com

Along with the ‘In-principle sanction’ letter, you need to submit KYC documents (identity and address proof) and product-specific documents, such as property details for home loans.

To activate Bank of Baroda net banking, visit the official website, click on “Net Banking” and select “Activate.” Enter your account details and follow the instructions. You’ll receive an activation link or OTP to complete the process.

To generate a new MPIN for Bank of Baroda, log in to your account, go to the profile section, click on “Change login PIN,” enter your current PIN, and set a new one. Confirm and submit to complete the process.

HDFC Home Loan

HDFC Home Loan SBI Home Loan

SBI Home Loan