We all know the stress that comes with waiting for home loan approval. The constant wondering about where your application stands can be overwhelming. Well, no more! Track your Bank of Baroda home loan application status effortlessly and get the clarity you need, without all the hassle.

How to Check Bank of Baroda Home Loan Application Status Online?

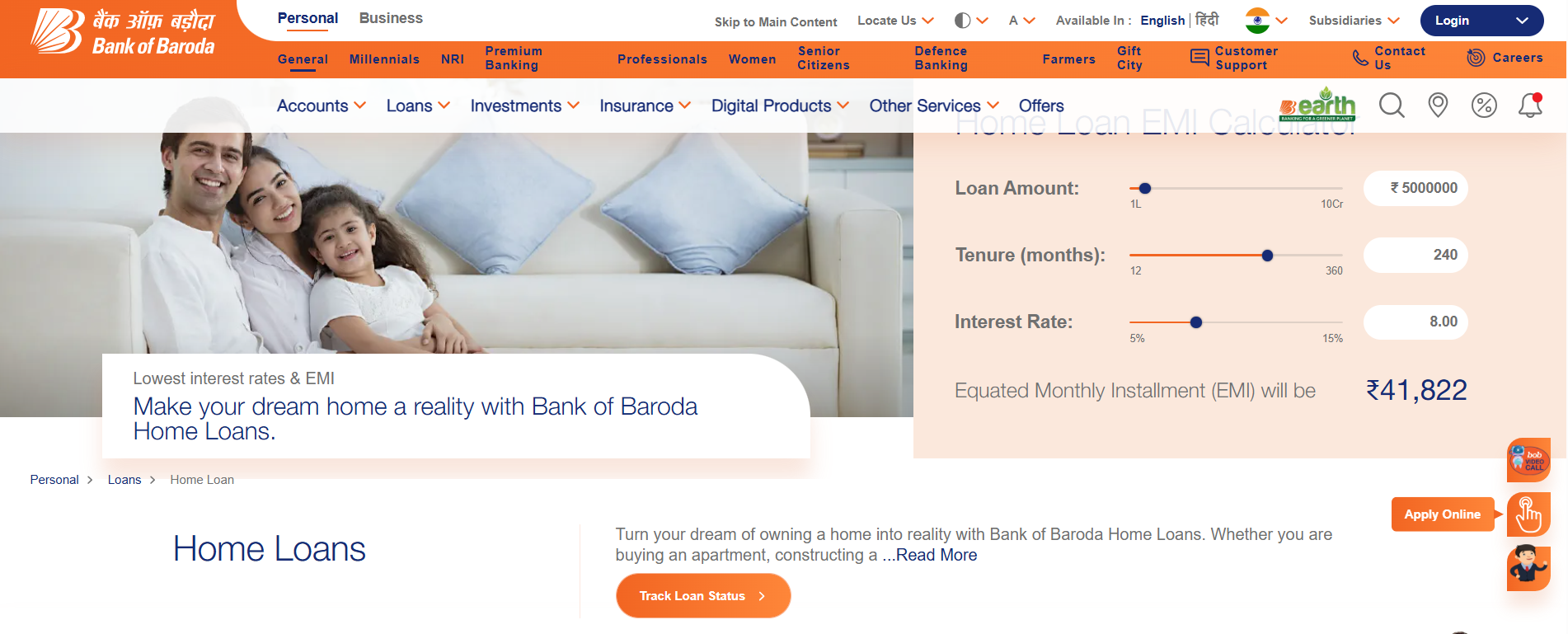

- Visit the official Bank of Baroda Home Loan page. Click on “Track Loan Status.”

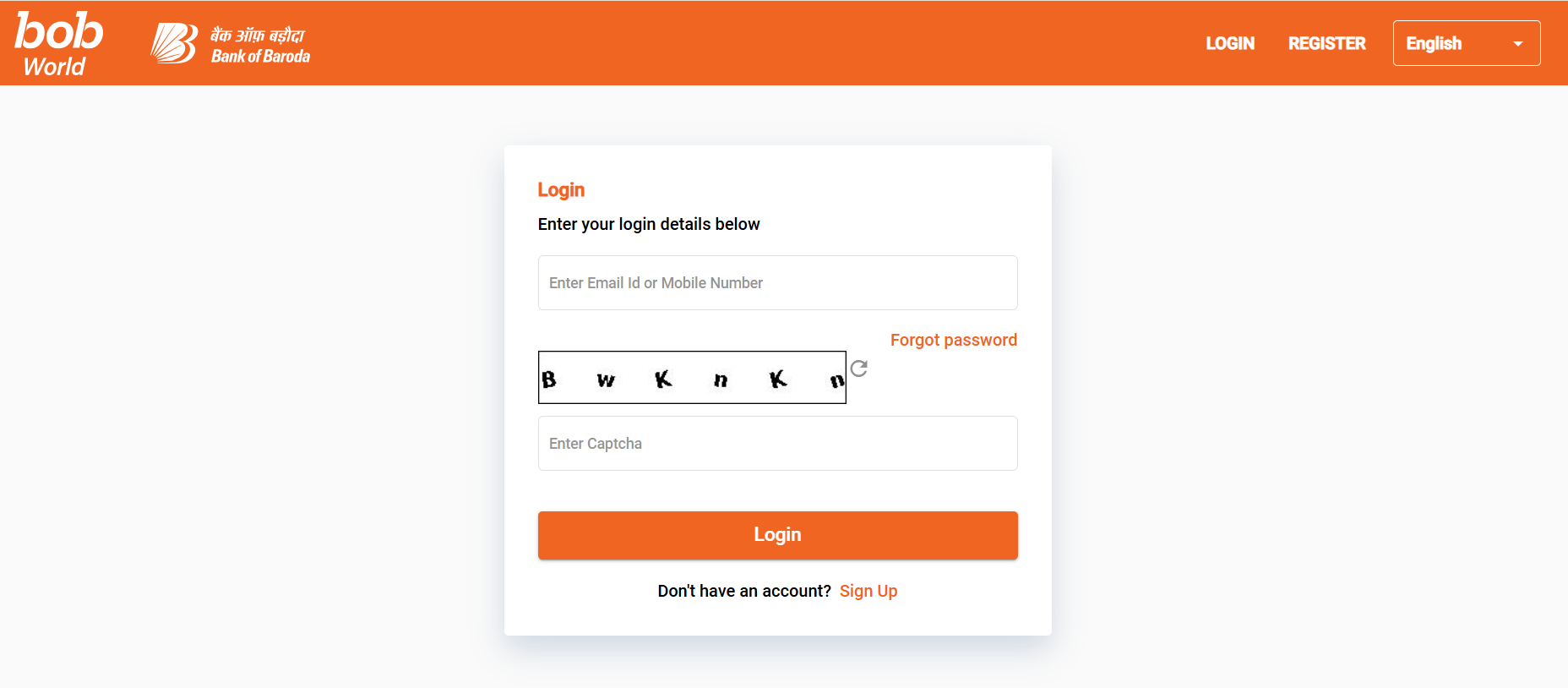

- Login using your registered email ID/ mobile number and captcha.

- Your home loan application status will be displayed on the screen.

Suggested Read: Bank of Baroda Home Loan Repo Rate Cut 2025

Check Bank of Baroda Home Loan Application Status via Mobile Application

- Install bob World: Open Play Store/App Store, search “bob World,” tap Install.

- Log in / Register: Sign in with mobile-banking credentials or register (net-banking, ATM, branch, or debit-card self-registration).

- Open Loan Tracker: From the dashboard, choose Loans → Track Application.

- Input details: Enter your Proposal Acknowledgement ID or Unique Tracking Number (the app links these to your registered mobile).

- View status: The screen shows your current Bank of Baroda home-loan application stage and any next actions.

Suggested Read: Bank of Baroda Home Loan Customer Care

How to Check Bank of Baroda Home Loan Application Status via Customer Care?

- Dial 1800 258 4455 or 1800 102 4455 → choose IVR language → press 2 (Banking) → press 3 (Product Info) → press 2 (Retail Loan) → give Proposal Acknowledgement ID to hear status.

- From overseas, call +91 79 6629 6009 and follow the same IVR sequence.

- Text BAL <last 4 digits of account> to 8422009988 to confirm the loan-linked account balance (useful for disbursement checks).

- Give a missed call to 8468001111 (balance) or 8468001122 (mini statement) from your registered mobile to verify loan-linked account activity.

- Ensure your mobile number is registered to receive instant SMS alerts on application progress.

Suggested Read: Bank of Baroda Home Loan Processing Fees

Check Bank of Baroda Home Loan Application Status Offline

- Drop by your nearest Bank of Baroda branch with a valid photo ID and your loan application documents.

- Request an update on your home loan application from the service desk or branch staff.

How Long Does it Take to Process a Home Loan Application?

| Stage | Key Activities | Estimated Time | Factors Affecting Time |

|---|---|---|---|

| 1. Application Submission | Submit application (online/offline) with documents. | Online: Instant Offline: 1–2 days | Document completeness, submission mode (online vs. offline). |

| 2. Eligibility Check | Credit score assessment, income verification, debt analysis. | 3–5 business days | Credit profile, income stability, existing debts. |

| 3. Property Valuation | Third-party valuation of property’s market value. | 3–7 days | Property type (under-construction/ready), legal clarity. |

| 4. Loan Sanction | Approval of loan amount, interest rate, and terms. | 2–3 days post-valuation | Compliance with LTV ratio, valuation report. |

| 5. Legal & Technical Check | Verify property title, ownership, structural safety, and regulatory approvals. | 5–10 days | Property disputes, regulatory compliance, builder delays. |

| 6. Documentation | Loan agreement signing, mortgage registration, EMI setup. | 1–3 days | Applicant responsiveness, document accuracy. |

| 7. Disbursement | Funds transferred to seller/builder. | 1–3 days (ready property) | Builder coordination, escrow formalities. |

Total Processing Time

- Best Case : 2–3 weeks (ready property, no delays).

- Typical Case : 4–6 weeks (standard processing).

- Under-Construction : 6–8 weeks (phased disbursement).

Suggested Read: All Banks Home Loan Interest Rates 2025

Why is My Home Loan Application Taking Longer than the Estimated Timeline?

- Incomplete Documents: Missing or unclear papers trigger back‑and‑forth.

- Valuation Delays: Surveyor scheduling or site‑visit issues.

- Title & Legal Checks: Deep dive into property history.

- Credit & KYC Verification: Third‑party backlogs slow responses.

- High Workload: Peak season or end‑of‑FY surges.

- Compliance Reviews: Extra RBI or internal policy scrutiny.

- System/Integration Glitches: Portal or credit‑bureau hiccups.

- Non‑Working Days: Weekends and regional holidays.

Suggested Read: RBI Repo Rate Cut 2025

Is There a Way to Expedite My Home Loan Application?

- Submit Complete Documents: Double‑check and upload all KYC, income, and property papers in one go.

- Opt for e‑Sign & e‑KYC: Use digital signatures and Aadhaar‑based verification to avoid physical delays.

- Pre‑Pay Valuation Fees: Clear any fees upfront so the surveyor can schedule the site visit sooner.

- Stay Responsive: Answer bank queries (calls/emails) immediately to prevent hold‑ups.

- Use a Relationship Manager: Lean on your RM for priority escalation within the credit team.

- Choose Digital Channels: Track status via the app and net‑banking to catch outstanding requirements fast.

- Request a Fast‑Track Review: Politely ask the branch or credit desk if you qualify for any priority processing.

Suggested Read: Home Loan without ITR

After Approval, How Long Does it Take to Disburse Home Loan Funds?

- Ready/Resale Properties: Funds hit your account within 3–5 working days after you sign the sanction letter and submit all documents.

- Under‑Construction Properties: Each tranche is released in 3–5 working days following technical and legal clearance for that stage.

- Complex Cases: If extra verifications are needed, disbursal can extend to 10–15 working days.

Suggested Read: PMAY Scheme Details

Can a Co-Applicant Check Bank of Baroda Home Loan Status Independently?

Yes, in most cases, a co-applicant can check the loan status independently, but it depends on the policies of the lender and the level of access granted to the co-applicant. Typically, both the primary applicant and the co-applicant are equally responsible for the loan, so they often have the same rights to inquire about the loan status.

What Happens if a Co-Applicant Wants to Withdraw from the Home Loan Application?

- Novation Request: Submit a formal request to Bank of Baroda to remove the co‑applicant.

- NOC from Co‑Applicant: Get a signed no‑objection certificate from the co‑applicant.

- Eligibility Check: Primary applicant must demonstrate income and credit capacity solo.

- Re‑Underwriting: Lender re‑evaluates your profile and, if approved, issues a fresh loan agreement.

- Timeline: Typically takes 2–4 weeks, depending on document completeness and internal approvals.

- Alternate Option: If novation isn’t possible, consider refinancing under your name alone.

How Does a Co-Applicant’s Credit Score Affect the Home Loan Application Status?

- Combined Assessment: Bank of Baroda evaluates both applicants’ credit histories; a low co‑applicant score can drag down your overall eligibility.

- Interest Rate Impact: A weaker co‑applicant score may lead to a higher interest rate or tougher pricing.

- Sanction Amount: Poor credit on the co‑applicant side can reduce the maximum loan amount approved.

- Approval Probability: Very low scores for either applicant increase the risk of outright rejection.

- Credit Mix & History: Negative marks (late payments, defaults) on the co‑applicant record count equally in the underwriting decision.

- Mitigation: You can request removal of a high‑risk co‑applicant or add a higher‑scoring co‑borrower to improve your profile.

Suggested Read: 15 vs. 30 Year Home Loan Tenure

Why was My Home Loan Rejected?

Applying for a home loan can feel like navigating a maze—and getting a rejection notice at the end only adds to the frustration. You’ve gathered your documents, crunched the numbers, and imagined your dream home, so seeing “declined” can really sting.

Let’s break down the most common reasons lenders say no, so you can pinpoint the hiccup, fix it, and get back on track toward approval.

- Low credit score or adverse credit history

- Incomplete, inconsistent or missing documents

- Insufficient income or too high existing EMIs (debt‑to‑income ratio)

- Applicant (or co‑applicant) outside acceptable age limits

- Unstable job profile or frequent employment changes

- Property issues (unapproved builder/project or low valuation)

- Missing NOCs for previously closed loans

- Multiple recent loan applications triggering credit alerts

If Rejected, How Soon Can I Reapply for a Home Loan?

- No Mandatory Cooling‑Off: You can reapply as soon as you’ve fixed the reason for rejection.

- Credit‑Score Issues: Allow 1–3 months after clearing dues or disputing errors for your bureau to update.

- High EMI Load: Once you’ve paid down outstanding loans or reduced your DTI ratio, you can reapply immediately.

- Documentation Gaps: After you secure missing papers (NOCs, title deeds), submit a fresh application without delay.

- Property Concerns: As soon as builder approvals or valuations are rectified, you’re free to reapply.

- Smart Timing: Space repeat applications at least 4–6 weeks apart to avoid multiple hard pulls on your credit report.

Suggested Read: Impact of CIBIL Score on Home Loans

How Can I Improve my Application if it was Previously Rejected?

- Identify the Cause: Request feedback on why you were declined and target that issue first.

- Boost Your Credit Score: Clear outstanding dues, settle any defaults, and correct errors on your credit report.

- Lower Your Debt‑to‑Income Ratio: Pay down existing EMIs or reduce your monthly obligations before reapplying.

- Strengthen Income Documentation: Provide up‑to‑date salary slips, bank statements, Form 16, or professional income proofs.

- Perfect Your Paperwork: Ensure title deeds, builder approvals, NOCs, and all KYC documents are complete and consistent.

- Add a Strong Co‑Applicant: Include a family member or spouse with a solid credit history and stable income.

- Improve Property Credentials: Get a fresh valuation, builder’s completion certificate, and clear any legal or municipal issues.

- Get Pre‑Sanctioned: Seek a conditional approval to understand your eligibility and fix gaps ahead of full application.

- Space Out Applications: Wait 4–6 weeks before reapplying to avoid multiple hard enquiries on your credit file.

Will a Home Loan Rejection Affect my Credit Score?

A home‑loan rejection itself doesn’t ding your credit score—the real impact comes from the “hard” inquiry your lender made when you applied, which may shave off a few points temporarily. The rejection note shows on your report but carries no extra penalty beyond that inquiry. Most scoring models bundle multiple enquiries for the same loan within a short window into one, so avoid repeated applications.

Check Out: Home Loan Budget Calculator

Conclusion

Buying a home is a big step. Getting a home loan can be hard, but we make it easy. At Credit Dharma, we make this possible by offering lowest guaranteed interest rates that keep your monthly payments manageable, allowing you to enjoy more of what truly matters.

But that is not it. We offer:

- Guaranteed up to 100% funding

- Receive lifetime assistance and expert guidance long after your loan is approved.

- Enjoy a fully digital process with minimal paperwork

- Get your loan approved within just 1-2 weeks.

Frequently Asked Question

Keep your Application ID/Reference No., registered mobile, and sometimes DOB or PAN handy—these identifiers are common across trackers and mobile apps.

Call the bank’s loan customer‑care number or visit the branch with your Application ID and KYC. The officer can print or email your current status on request.

Digital files with complete documents can clear in 48 hours to one week; traditional files may take 7 – 21 days. Average timelines published by ICICI Bank, PNB Housing, Basic Home Loan and SBI hover around the 1‑to‑2‑week mark.

Common bottlenecks are incomplete KYC/income proofs, low credit score, property title doubts, or internal legal/valuation delays. Supplying missing docs quickly and following up with the credit‑processing team usually unblocks the file.

Yes. First obtain the rejection reason (credit score, income, documentation, or property issue). Rectify it—e.g., improve CIBIL, add a co‑applicant, or choose another property—then re‑apply either with the same lender or a different bank/HFC.

HDFC Home Loan

HDFC Home Loan SBI Home Loan

SBI Home Loan