Applying for a home loan is easier with the Bank of India home loan application process, offering simple steps and quick approvals. By understanding eligibility criteria, required documents, and associated fees, you can make informed decisions. A streamlined application process ensures faster loan disbursal, helping you secure your dream home with ease.

Bank of India Home Loan: Online Application Process

To apply for a Bank of Baroda home loan online, follow these steps for a smooth and hassle-free process.

- Visit the Official Website

Go to the Bank of India homepage and click on ‘Apply Now’.

- Access the Online Application Form

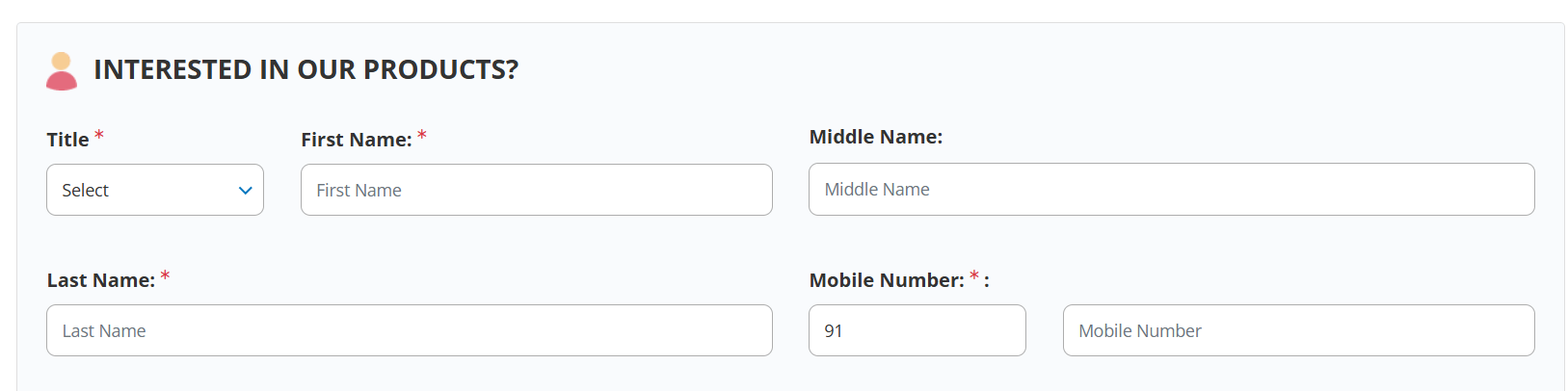

Click on ‘Apply Online’ under the home loan section to open the digital form titled “May We Reach You?”.

- Fill in Personal Details

Enter your Title, First Name, Middle Name, and Last Name.

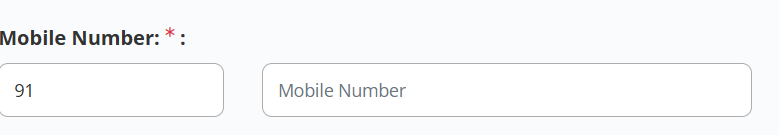

- Provide Contact Information

Input your valid Mobile Number and Email ID for communication purposes.

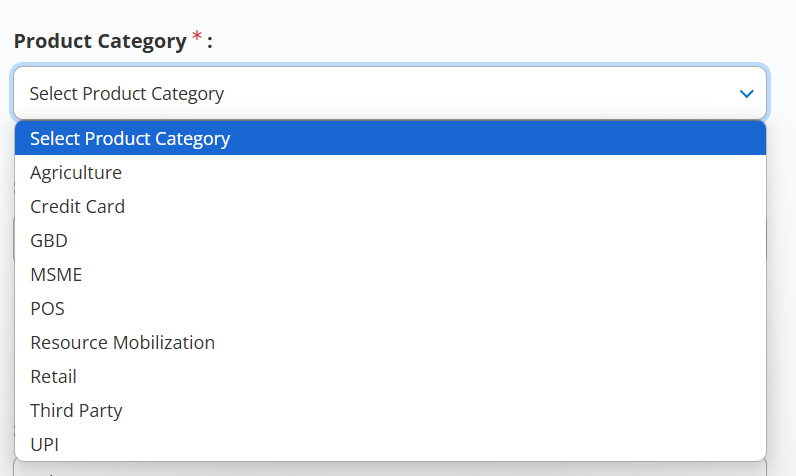

- Choose Loan Preferences

– Select Product Category, Product, and Sub Product.

– Indicate whether you are an Existing Customer.

– Enter the Desired Loan Amount.

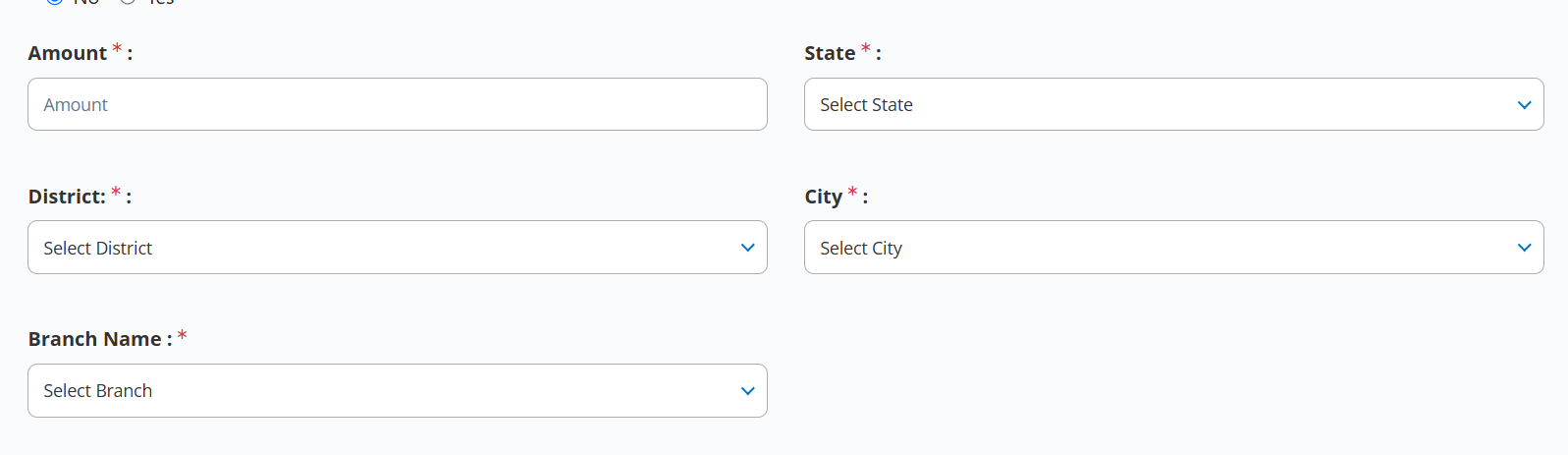

- Select Your Location and Branch

Choose your State, District, City, and preferred Branch Name.

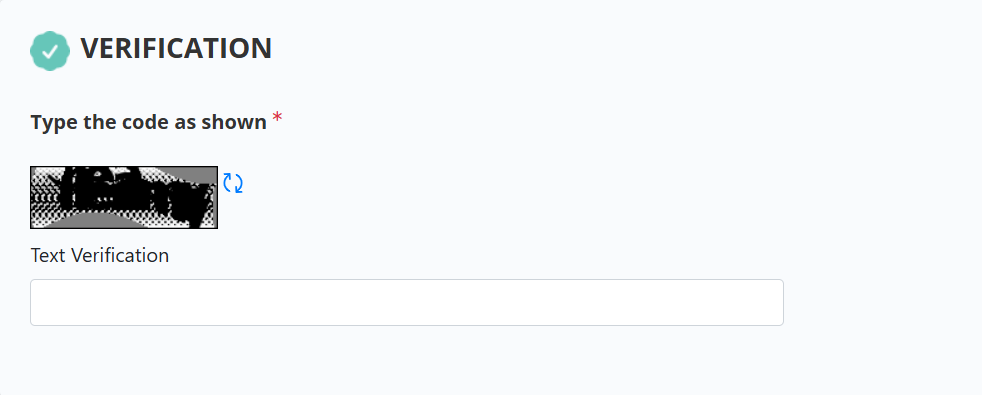

- Verify Your Identity

Type the text code shown in the Text Verification image to proceed.

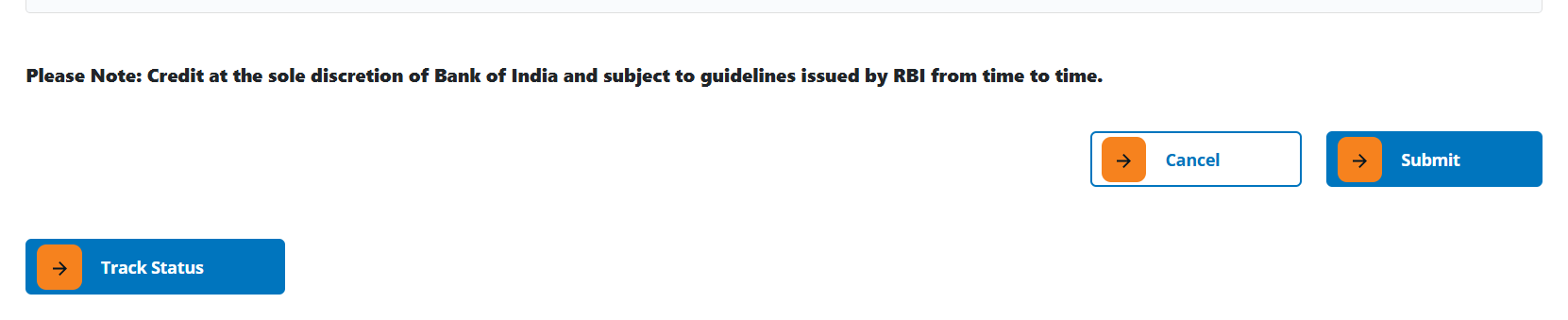

- Submit Your Application

Review the details and click Submit. Your request will be processed as per BOI and RBI guidelines.

Also Read: How to Download Bank of India Home Loan Statement

Bank of India Home Loan: Offline Application Process

To apply for a Bank of India home loan offline, follow these steps for a seamless application process.

| Step | Description |

|---|---|

| 1. Visit the Nearest Branch | Go to your nearest Bank of India branch to initiate the home loan application process. |

| 2. Fill Out the Application Form | Request and complete the home loan application form with your personal and financial details. |

| 3. Provide Required Documents | Submit necessary documents, including ID proof, address proof, income proof, and property details. |

| 4. Eligibility Assessment | The bank will assess your eligibility based on the information and documents provided. |

| 5. Loan Discussion | The bank representative will discuss the loan amount, tenure, and interest rates. |

| 6. Sign the Loan Agreement | Once approved, you will need to sign the home loan agreement. |

| 7. Disbursement Process | After completing all formalities, the loan will be disbursed as per the agreed terms. |

Bank of India Home Loan Application Process with Credit Dharma

Get your Bank of India home loan through Credit Dharma with expert help, the best offers, and a seamless digital journey.

Easy Steps with Credit Dharma:

- Share Your Requirements:- Fill out a quick form with your home loan needs—takes less than 2 minutes.

- Get Expert Advisory:- A dedicated Credit Dharma loan expert guides you with tailored advice.

- Compare Best Offers:- Instantly explore top Bank of India home loan deals matched to your profile.

- Enjoy a Seamless Process:- Your personal advisor handles paperwork, follow-ups, and keeps you updated.

- Fast Approval & Disbursal:- Benefit from fast loan approvals, quick disbursals, and up to 100% funding.

The Bank of India Home Loan Application Process with Credit Dharma gives you access to the lowest interest rates, lifetime support, and a simple, digital experience—all backed by India’s most trusted loan advisory platform.

Bank of India Home Loan Application Checklist

Get ready to apply with this quick checklist covering eligibility and essential documents.

| Category | Details |

|---|---|

| Eligibility | Resident Indian / NRI / PIO; Individuals (Salaried/Self-employed/Professionals); Non-Individuals (Group, HUF, Corporates); Trusts not eligible |

| Age Criteria | Minimum 18 years, Maximum 70 years at final loan repayment |

| Identity Proof (Any one) | PAN Card, Passport, Driving Licence, Voter ID |

| Address Proof (Any one) | Aadhaar Card, Passport, Driving Licence, Electricity/Telephone/Gas Bill |

| Income Proof – Salaried | Last 6 months’ salary slips, 1 year ITR or Form 16 |

| Income Proof – Self-employed | Last 3 years’ ITR, Profit & Loss Account, Balance Sheet, Capital Statement |

| Non-Individual Applicants | KYC of Partners/Directors, PAN Card of Entity, Partnership Deed/MOA/AOA, Certificate of Incorporation |

| Financial Documents | Last 12 months’ bank statements, Audited Financials for 3 years |

Also Read: Bank Of India Home Loan Eligibility Criteria 2025

Bank of India Home Loan Application to Disbursement Stages

Here’s a quick look at the entire journey from applying for a home loan to receiving the funds in your account.

| Stage | Description |

|---|---|

| Loan Approval Notification | Receive loan approval notification via email/SMS, including approved loan details. |

| Loan Agreement Signing | Receive a formal sanction letter with final loan amount, interest rate, EMI, and loan tenure. |

| Submission of Original Documents | Submit all required original property documents and sale agreements. |

| Verification of Documents | Bajaj Housing Finance conducts legal and technical verification of submitted documents. |

| Final Sanction Letter Issuance | Receive a formal sanction letter with the final loan amount, interest rate, EMI, and loan tenure. |

| Payment of Processing Fees | Submit a formal request for disbursement with supporting documents (e.g., builder’s demand letter). |

| Request for Loan Disbursement | Submit formal request for disbursement with supporting documents (e.g., builder’s demand letter). |

| Loan Amount Disbursal | Begin regular EMI payments as per the repayment schedule in your loan agreement. |

| Loan Repayment Commencement | Begin regular EMI payments as per repayment schedule in your loan agreement. |

How Long Does it Take to Process a Home Loan Application?

| Stage | Key Activities | Estimated Time | Factors Affecting Time |

|---|---|---|---|

| 1. Application Submission | Submit application (online/offline) with documents. | Online: Instant Offline: 1–2 days | Document completeness, submission mode (online vs. offline). |

| 2. Eligibility Check | Credit profile, income stability, and existing debts. | 3–5 business days | Credit profile, income stability, existing debts. |

| 3. Property Valuation | Credit score assessment, income verification, and debt analysis. | 3–7 days | Property type (under-construction/ready), legal clarity. |

| 4. Loan Sanction | Approval of loan amount, interest rate, and terms. | 2–3 days post-valuation | Compliance with LTV ratio, valuation report. |

| 5. Legal & Technical Check | Verify property title, ownership, structural safety, and regulatory approvals. | 5–10 days | Property disputes, regulatory compliance, builder delays. |

| 6. Documentation | Loan agreement signing, mortgage registration, EMI setup. | 1–3 days | Applicant responsiveness, document accuracy. |

| 7. Disbursement | Funds transferred to seller/builder. | 1–3 days (ready property) | Builder coordination, escrow formalities. |

Total Processing Time

- Best Case: 2–3 weeks (ready property, no delays).

- Typical Case: 4–6 weeks (standard processing).

- Under-Construction: 6–8 weeks (phased disbursement).

Get the Best Home Loan Offers with Credit Dharma

Credit Dharma is your trusted partner for securing the best Home Loan offers, with over ₹500 Cr+ loans handled and partnerships with 20+ leading banks. We provide exclusive access to the lowest interest rates and a seamless, digital process with fast approvals in just 1-2 weeks, backed by lifetime support from our home loan experts.

Why choose Credit Dharma? We provide:

- Lowest Interest Rates: Save more with every EMI.

- Maximum Funding: Get up to 100% funding for your dream home.

- Simple & Digital Process: No tedious paperwork or branch visits.

- Expert Guidance: Lifetime support from our team of specialists.

Compare, choose, and secure the best Home Loan offer with Credit Dharma — your home loan journey starts here!

Conclusion

Applying for a Bank of India home loan is easy, with a simple process from checking eligibility to getting the loan. Just gather your documents and fill out the application form.

Frequently Asked Questions

Individuals aged between 18 and 70 years, including salaried employees, self-employed professionals, and Non-Resident Indians (NRIs), are eligible to apply for a BOI home loan.

You can apply online through the BOI website by selecting the ‘Apply Now’ option under the desired home loan product, or visit the nearest BOI branch to complete the application process.

BOI offers home loans up to ₹5 crore, with higher amounts considered for eligible applicants based on their repayment capacity and property value.

The maximum repayment tenure is up to 30 years, subject to the borrower’s age and retirement status.

Yes, the processing fee is 0.25% of the loan amount for individuals, with a minimum of ₹1,500 and a maximum of ₹20,000.

Yes, you can prepay your home loan. BOI does not levy any prepayment charges for loans under the floating interest rate scheme.

Yes, BOI provides a balance transfer facility, allowing you to transfer your existing home loan from another bank to BOI.

Yes, BOI offers free accidental insurance coverage up to a limit of ₹5 crore for home loan borrowers.

HDFC Home Loan

HDFC Home Loan SBI Home Loan

SBI Home Loan