If you have a home loan with the Bank of India (BOI), downloading the home loan statement is a straightforward process that can be completed online, saving you time and effort.

Bank of India home loan EMIs weighing you down?

Get a Home Loan Balance Transfer with Credit Dharma!

How to Download Bank Of India (BOI) Home Loan Statement for Income Tax Online?

Checking your Bank of India home loan statement online is quick and convenient. With just a few steps, you can access your statement anytime through Internet Banking.

- Visit the Official Website of Bank of India.

- Enter your registered credentials to access internet banking.

- Once logged in, locate and click on the ‘Enquiries’ tab.

- Choose ‘Home Loan Provisional Certificate’ from the available options.

- You can download, print, or view the statement as per your requirement.

Check Out: Bank Of India Home Loan Interest Rates 2025

How to Download Bank Of India (BOI) Home Loan Statement for Income Tax Offline?

If you need to check your home loan balance or obtain a provisional statement offline, follow these steps:

- Call the Bank – Contact the loan officer or the bank representative handling your case. Alternatively, you can call the Bank of India customer care at:

- Toll-free number: 1800 103 1906

- Landline number: (022) 4091919

- Visit a Branch – Go to the nearest Bank of India branch and request your home loan statement. If you haven’t received it already, you may need to provide your loan account details and identity proof for verification.

Check Out: Bank Of India Home Loan EMI Caclulator

How to Download Bank Of India Home Loan Statement for Income Tax via Mobile Application?

Downloading your Bank of India (BOI) home loan statement through the mobile app is quick and convenient, especially when you’re preparing documents for income tax purposes. Just follow these simple steps:

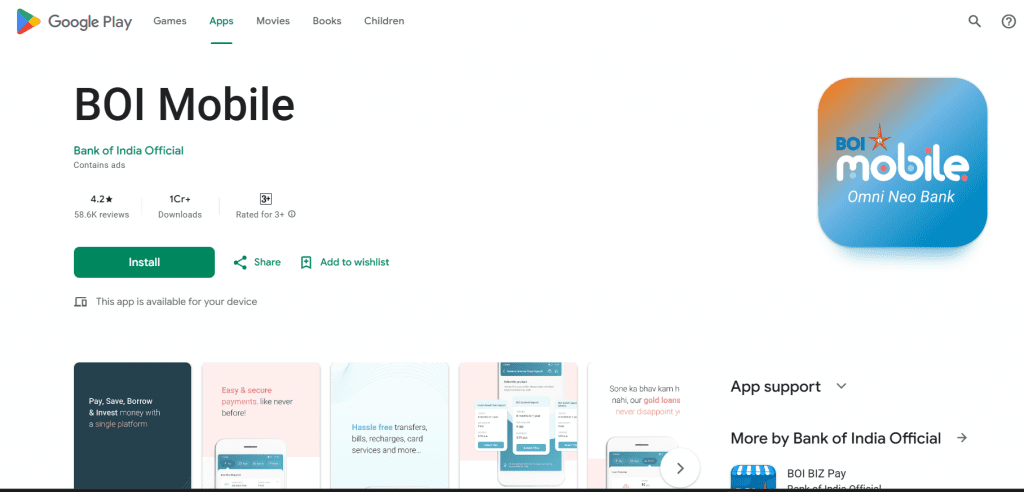

- Download and Install the BOI Mobile App

If you haven’t already, download the official BOI Mobile app from the Google Play Store or Apple App Store.

- Login to Your Account

Open the app and log in using your registered mobile number and MPIN or internet banking credentials. - Navigate to Loan Account

From the dashboard, select the ‘Accounts’ tab and then tap on your Home Loan account. - Select ‘Loan Statement’ Option

Look for the ‘Statements’ or ‘Account Statement’ option. Tap on it and choose the desired date range, typically the financial year (e.g., April 1 to March 31). - Download or Email the Statement

Once generated, you can either download the PDF directly to your phone or opt to email it to your registered email address. - Use for Income Tax Filing

The downloaded statement will include all interest and principal repayment details needed for claiming deductions under sections 24(b) and 80C.

Key Details Included in Your Home Loan Statement

Your Bank of India home loan statement serves as an essential financial document, especially for income tax filing and tracking your loan progress. Here are the key details typically included in the statement:

- Loan Account Number

A unique identifier for your home loan account. - Borrower Details

Name, contact information, and co-applicant details (if any). - Property Information

Basic details of the property against which the loan was sanctioned. - Disbursement Summary

Information on the total loan amount sanctioned, amount disbursed, and disbursement dates. - Repayment Schedule

EMI start date, tenure, monthly EMI amount, and due dates. - Interest and Principal Breakdown

A monthly or annual summary showing how much of your EMI goes towards interest and how much reduces the principal — crucial for income tax claims under Sections 24(b) and 80C. - Outstanding Loan Balance

The remaining balance of your loan as of the statement date. - Prepayment Details (if any)

Records of any additional payments made towards the loan, outside of regular EMIs.

How to Use Your Home Loan Statement for Tax Benefit Claims?

Your home loan statement is a crucial document for availing tax benefits on both the interest and principal components of your loan. Here’s how you can use it effectively during tax season:

- Download Your Home Loan Statement

Ensure you have the latest home loan statement that covers the entire financial year. It will contain a detailed breakup of principal and interest paid. - Understand the Tax Deduction Sections

- Section 80C: You can claim a deduction of up to ₹1.5 lakh per year on the principal portion of your EMI.

- Section 24(b): Allows you to claim up to ₹2 lakh per year on the interest paid for a self-occupied property.

- Review the Interest and Principal Split

The statement will show month-wise or yearly totals of how much EMI was paid toward interest and how much went toward principal repayment. Use these figures for your tax return. - Submit to Employer (For Salaried Individuals)

If you’re a salaried employee, submit the statement to your HR or payroll department along with any other required documents so they can adjust your TDS accordingly. - File Income Tax Return (ITR)

While filing your ITR:- Enter the principal repaid under Section 80C.

- Enter the interest paid under Section 24(b). Make sure the amounts match what’s reflected in your home loan statement.

- Keep a Copy for Records

Always keep a copy of the statement and any related documents safely stored in case of future audits or queries from the Income Tax Department.

Check Out: Home Loan Tax Savings Calculator

Get a Home Loan

with Highest Eligibility

& Best Rates

Troubleshooting Bank of India Home Loan Statement Issues

If you’re experiencing issues with your Bank of India (BOI) home loan statements or tax certificates, here’s a guide to help you address and resolve these problems effectively.

Common Problems When Downloading Bank of India Loan Statements

If you’re facing trouble accessing or downloading your Bank of India home loan statement, here are some common issues and how to deal with them:

- Login Issues

Users often face problems logging into the BOI mobile app or net banking. Double-check your user ID and password. If you’ve forgotten your credentials, use the “Forgot Password” option to reset them. - Statement Not Showing

Sometimes the home loan statement may not be visible due to system updates or downtime. Try checking again after a while. If the problem continues, you might need to contact customer support or visit your nearest branch. - App or Site Glitches

Outdated app versions or browser cache can cause functionality issues. Update the app to the latest version or try accessing the statement through a different browser or device. - Incomplete Statement

If the statement doesn’t show the full financial year or is missing some details, manually select the correct date range before generating the statement.

What to Do If Your Tax Certificate Is Incorrect

If you notice any errors in your home loan tax certificate, such as incorrect interest or principal figures, follow these steps:

- Cross-Verify Information

Compare the certificate with your loan repayment history and EMI schedule to identify what’s inaccurate. - Collect Supporting Documents

Gather previous statements, payment receipts, and any communication with the bank that supports your correction request. - Contact Customer Support

Reach out to BOI’s customer care through their helpline or email. Clearly explain the issue and attach scanned copies of your supporting documents, if possible. - Visit the Branch

If you’re unable to resolve the issue remotely, visit your loan branch in person with the necessary paperwork. Speaking directly with a loan officer can often speed up the resolution. - Request a Revised Certificate

Once the error is acknowledged, ask for a corrected tax certificate to be issued, ideally well before the income tax filing deadline.

Get the Best Home Loan Offers with Credit Dharma

Credit Dharma is your trusted partner for securing the best Home Loan offers, with over ₹500 Cr+ loans handled and partnerships with 20+ leading banks. We provide exclusive access to the lowest interest rates and a seamless, digital process with fast approvals in just 1-2 weeks, backed by lifetime support from our home loan experts.

Why choose Credit Dharma? We provide:

- Lowest Interest Rates: Save more with every EMI.

- Maximum Funding: Get up to 100% funding for your dream home.

- Simple & Digital Process: No tedious paperwork or branch visits.

- Expert Guidance: Lifetime support from our team of specialists.

Compare, choose, and secure the best Home Loan offer with Credit Dharma — your home loan journey starts here!

Conclusion

If you have further doubts or questions along the way, don’t hesitate to contact Credit Dharma experts. Our dedicated team is here to assist you and provide guidance tailored to your specific needs. Feel free to reach out for personalized support on any aspect of your Bank of India home loan journey.

Frequently Asked Questions

You can apply for a BOI home loan online through the BOI Bank website, via the mobile app, or by visiting any BOI Bank branch. For online applications, go to the home loan section on BOIs official website, fill out the application form, and submit the required documents. For offline applications, visit your nearest branch with your documents for a face-to-face process.

To apply for a BOI home loan, you need to provide identity proof, address proof, and income proof. Additionally, you are required to submit property documents along with a completed loan application form, passport-sized photographs, and a processing fee cheque. Check with BOI for any additional required documents.

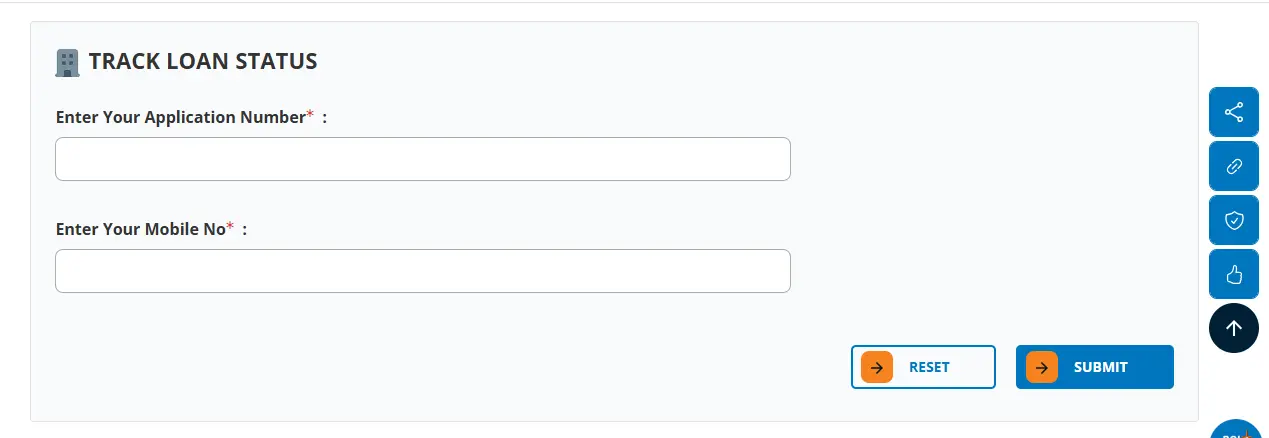

You can check the status of your BOI Bank home loan application by logging into your account on the Axis Bank website or mobile app. Additionally, you may receive updates through SMS or email.

To obtain a Bank of India (BOI) home loan statement, you can log in to your BOI Internet Banking account or use the BOI Mobile Omni Neo Bank App to access and download your statement. If you face any issues, you can contact BOI customer service at 1800 22 0229 for assistance or visit your nearest BOI branch to request a printed copy.

To get your Bank of India (BOI) account statement online, you can use either the BOI Internet Banking portal or the BOI Mobile Omni Neo app.

For Internet Banking, log in with your credentials, navigate to the account statement section, and download the statement for your preferred period in PDF format.

On the mobile app, log in, go to “My Account,” and select the statement option or use the “mPassbook” feature to view and download it.

You can also subscribe to e-statements to receive them via email regularly. These services are free of cost and accessible anytime

HDFC Home Loan

HDFC Home Loan SBI Home Loan

SBI Home Loan