Checking your Canara Bank Home Loan Application Status is an essential step to track the progress of your loan request. With multiple convenient methods like net banking, the mobile app, and customer care, you can easily stay updated on your application.

This blog will show you how to check your application status using all available methods.

How to Check Canara Bank Home Loan Application Status Online?

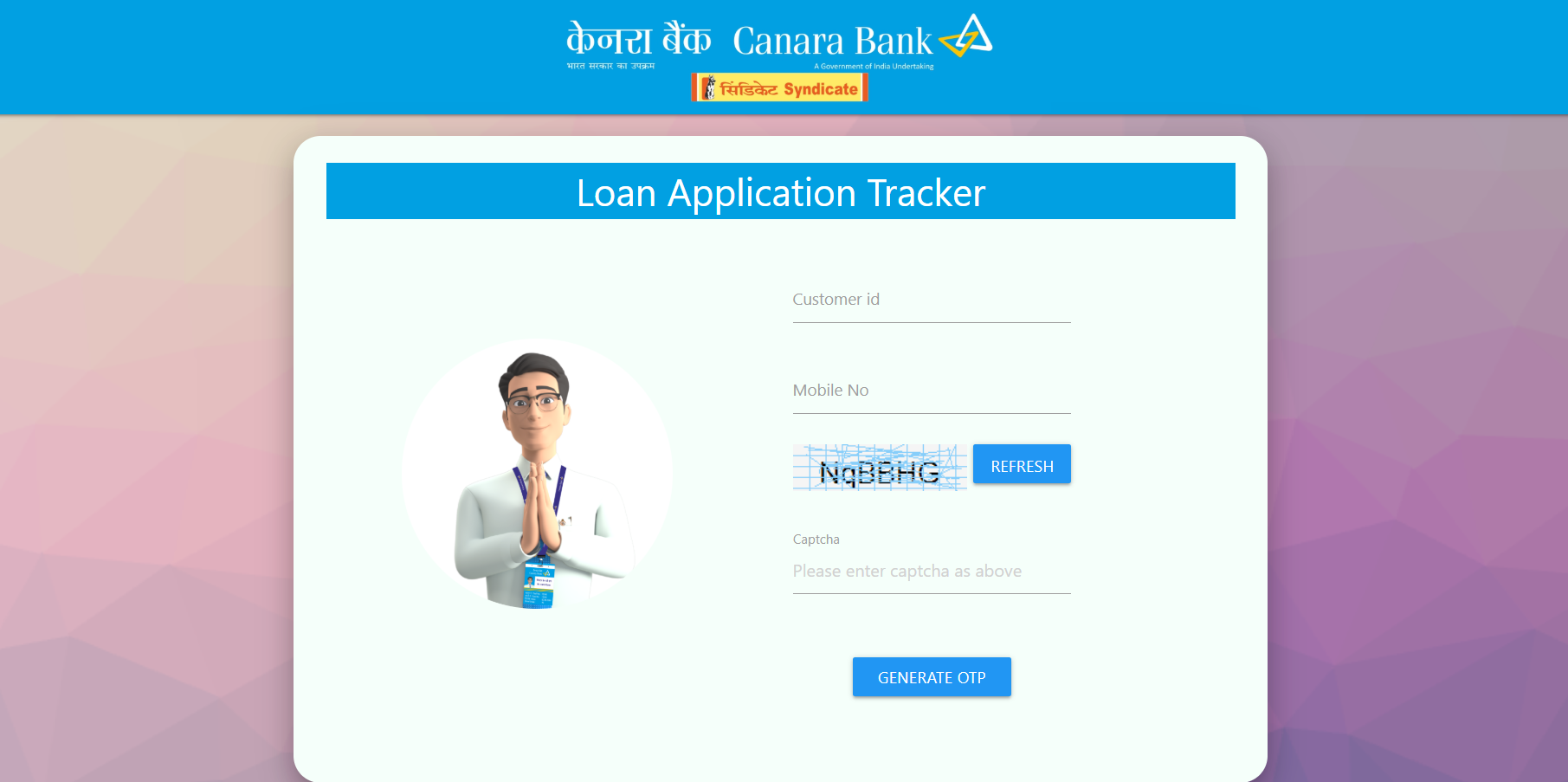

To check the status of your Canara Bank Home Loan Application online, follow these steps:

- Visit the official Canara Bank’s Loan Application Tracker.

- Enter your customer ID, registered mobile number, and the CAPTCHA Code.

- Click on “Generate OTP” and enter the OTP sent to your registered mobile number.

- Once logged in, you can see your home loan application status on the screen.

Also Check: How to Download Canara Bank Home Loan Statement?

How to Check Canara Bank Home Loan Application Status via Mobile Application?

- Download Canara ai1 from Google Play or the App Store (skip if already installed).

- Enter your 5-digit passcode to log in.

- New user? Tap “Register” and follow the prompts to set up your profile.

- From the home screen, tap “Loans.”

- In the Loans menu, select “Loan Enquiry.”

- Your home-loan application status appears with: Current status, Outstanding balance, Amount repaid, and Next payment date.

How to Check Canara Bank Home Loan Application Status via Customer Care?

To check your Canara Bank Home Loan Application Status via Customer Care:

| Method | Details |

|---|---|

| Phone Support | Call 1800 1030 (Toll-Free, available 24/7) |

| Email Support | Email to hocss1@canarabank.com with name, registered mobile, and application ID |

| WhatsApp Support | Send “Hi” to +91 90760 30001 on WhatsApp |

Read More: Canara Bank Customer Care Number

How to Register Canara Bank Home Loan Account Online?

- Visit the Canara Bank Net Banking portal and choose “Net Banking Login – Retail & Corporate.”

- Click “New Registration.”

- Fill in: account number, registered mobile number, and date of birth.

- You’ll receive a one-time password on your registered mobile.

- Enter the OTP to verify your identity.

- Set a User ID and Login Password of your choice. Submit to finish the Net-Banking signup.

Also Read: Documents Required for Canara Bank Home Loan

How Long Does It Take to Process a Canara Bank Home Loan Application?

Once you submit your application, Canara Bank usually takes about 3 to 7 working days to complete background checks and approve the loan.

Why Is My Canara Bank Home Loan Application Taking Longer Than the Estimated Timeline?

If your Canara Bank Home Loan Application Status shows a delay, it could be due to a few common reasons:

| Reason | Description |

|---|---|

| High Application Volume | A surge in requests can slow down processing times. |

| Document Issues | Missing, unclear, or additional verification of documents may cause hold-ups. |

| Internal Delays | Backend checks, approvals, or system glitches can affect timelines. |

| Complex Profile | Self-employed applicants or property-related concerns may require extra review. |

| Pending Response | Delays in responding to queries from the lender can pause the process. |

Check Out: Canara Bank Home Loan Interest Rates-2025

Is There a Way to Expedite My Canara Bank Home Loan Application Status?

Yes, you can speed up your home loan process by following a few smart steps. While checking your Canara Bank Home Loan Application Status, make sure you’ve done the following to avoid unnecessary delays:

| Tip | Description |

|---|---|

| Maintain a High Credit Score | A CIBIL score of 700+ increases your chances of quick approval. |

| Clear Existing Debts | Settle all outstanding loans or credit card dues before applying. |

| Apply with a Co-Applicant | Boost your eligibility by adding a co-applicant with strong financials. |

| Understand Loan Details | Be clear about the loan tenure, interest rate, and terms before applying. |

Check Out: Canara Bank Home Loan Eligibility Calculator

After Canara Bank Home Loan Approval, How Long Until Funds Are Disbursed?

After your Canara Bank home loan is approved, the disbursement of funds typically occurs within 3 to 7 working days, provided all necessary documentation is complete and the property verification is satisfactory.

Can a Co-applicant Check the Canara Bank Home Loan Status Independently?

Yes, a co-applicant can usually check the home loan application status independently through the lender’s website or mobile app. They can use details like their mobile number, date of birth, PAN, or loan account number—just like the primary applicant.

What happens if a co-applicant wants to withdraw from the application?

If a co-applicant decides to withdraw from a home loan application, it may affect the loan approval process, especially if their income or credit profile was key to eligibility. Here’s what usually happens:

- Eligibility Check: The bank will review if the main applicant still qualifies based on income or credit score.

- Updated Documents: You’ll need to submit new documents showing the change.

- Possible Delay: Removing a co-applicant might slow down the process. You can track updates by checking your Canara Bank Home Loan Application Status.

How does a co-applicant’s credit score affect the application status?

A co-applicant’s credit score has a big impact on your home loan approval. Here’s how in simple terms:

- Stronger Application: If the co-applicant has a good credit score, it makes the loan application stronger and may lead to better interest rates and faster approval.

- Better Eligibility: Combining both incomes helps reduce the debt-to-income ratio, which improves your chances of getting the loan.

- Future Benefits: Paying the loan on time improves credit scores for both, making it easier to get loans in the future with better terms.

Read More: Is Adding a Co-Applicant to Your Home Loan the Right Choice for You?

Why Was My Canara Bank Home Loan Application Rejected?

A home loan application can be rejected due to several reasons, including a low credit score, insufficient income, unstable employment, high debt-to-income ratio, incomplete documentation, or issues with the property or location. Understanding the specific cause of rejection can help you rectify the issue before reapplying.

If rejected, how soon can I reapply?

If your home loan application is rejected, you can apply again after fixing the issues. It’s usually a good idea to wait 3 to 6 months. Use this time to improve your credit score, pay off any debts, and make sure all your documents are correct and complete.

How can I improve my application if it was previously rejected?

- Improve Credit Score: Pay bills on time, reduce outstanding debt, and maintain a low credit utilization ratio.

- Clear Debts: Pay off existing loans to lower your debt-to-income ratio.

- Correct Documentation: Ensure all documents are accurate and complete to avoid suspicion.

- Stable Employment: Maintain job stability to prove income reliability.

Will a rejection affect my credit score?

Yes, a loan rejection can have a minor impact on your credit score, especially if you apply with multiple lenders in a short period. However, if you improve your credit habits, the effect can be minimal and short-lived.

You can track your progress by checking your Canara Bank Home Loan Application Status after addressing the issues.

Read More: Tips to Maintain a High Credit Score

Get the Best Home Loan Offers with Credit Dharma

Credit Dharma is your trusted partner for securing the best Home Loan offers, with over ₹500 Cr+ loans handled and partnerships with 20+ leading banks. We provide exclusive access to the lowest interest rates and a seamless, digital process with fast approvals in just 1-2 weeks, backed by lifetime support from our home loan experts.

Why choose Credit Dharma? We provide:

- Lowest Interest Rates: Save more with every EMI.

- Maximum Funding: Get up to 100% funding for your dream home.

- Simple & Digital Process: No tedious paperwork or branch visits.

- Expert Guidance: Lifetime support from our team of specialists.

Compare, choose, and secure the best Home Loan offer with Credit Dharma — your home loan journey starts here!

Conclusion

Tracking your Canara Bank Home Loan Application Status helps you stay informed at every stage of the loan process. For quick updates, use online platforms, mobile banking, or contact customer care.

For expert assistance and guidance on home loan tax-related matters, contact Credit Dharma today!

Frequently Asked Questions

You can check your application status by visiting the Canara Bank Loan Application Tracker. Enter your mobile number, date of birth, and Unique Reference Number (URN) to view the status.

To track your application, you’ll need:

Mobile Number, Date of Birth, Unique Reference Number (URN).

Yes, you can. Download the Canara ai1 mobile app, log in, navigate to the Loans section, and select Loan Enquiry to view your application status.

You can:

Call Customer Care at 1800 1030

Visit the nearest Canara Bank branch where you applied and inquire with the loan officer

Yes, Canara Bank will notify you via SMS, email, or a formal letter upon approval of your home loan application.

While the mobile number is essential, you’ll also need your Date of Birth and Unique Reference Number (URN) to track the application status online.

If you haven’t received any updates:

Call Customer Care at 1800 1030

Visit the branch where you applied

Email the bank at hocanc@canarabank.com

Yes, NRIs can use the Canara Bank Loan Application Tracker by entering their registered mobile number, date of birth, and URN to check the status.

HDFC Home Loan

HDFC Home Loan SBI Home Loan

SBI Home Loan