Estimated reading time: 6 minutes

When buying a home or securing a home loan, you might come across the term “CERSAI” and wonder what it means. While it sounds complex, understanding CERSAI and the rates associated with it is actually quite simple. This article will break down CERSAI, its purpose, and how the rates affect you during property transactions.

CERSAI Rates Meaning

CERSAI was established in 2011 under the Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest (SARFAESI) Act, 2002. It is a centralized registry that records security interests created by borrowers in favor of banks and financial institutions. The primary goal of CERSAI is to reduce the chances of fraudulent activities, such as obtaining multiple loans on the same property, by providing a transparent platform for recording all collateral-based transactions.

Operating under the supervision of the Reserve Bank of India (RBI), CERSAI is essential in the Indian financial system for securing financial transactions and making it easier to verify asset encumbrances.

Key Functions of CERSAI

CERSAI is essential for anyone involved in secured financial transactions. Its key functions include:

1. Registration of Security Interests

One of the primary responsibilities of CERSAI is registering security interests. When a borrower takes a home loan or any secured loan, the financial institution registers the security interest (the collateral) with CERSAI. This registration creates a legal charge over the property or asset, ensuring that no fraudulent claims or multiple loans against the same property can occur.

2. Maintenance of a Centralized Database

CERSAI maintains a comprehensive and up-to-date database of all registered security interests. This database is accessible to banks, financial institutions, and other stakeholders, providing them with a centralized platform for real-time information about the status of assets.

3. Verification of Encumbrances

CERSAI plays a crucial role in the verification process for financial institutions. Before approving loans, lenders can access CERSAI’s database to check if the asset is already encumbered. This verification helps in due diligence and reduces the risk of fraud.

4. Facilitation of Asset Reconstruction

CERSAI also facilitates the securitisation and reconstruction of financial assets, particularly in the case of non-performing assets (NPAs). By registering such transactions, it helps streamline the resolution of bad loans and enhances the efficiency of asset management.

CERSAI Charges for Home Loans

Whenever a home loan is taken, the bank or financial institution registers the collateral (usually the property) with CERSAI. This registration is not free of charge, and borrowers must bear a nominal fee, known as CERSAI charges, as part of the loan process.

Here’s a breakdown of the CERSAI charges:

- For loans up to ₹5 lakhs: ₹50 + GST

- For loans above ₹5 lakhs: ₹100 + GST

- Reconstruction or securitisation of financial assets: ₹500

- Satisfaction of securitisation or reconstruction of assets: ₹50

How to Register and Log In to the CERSAI Portal

The CERSAI portal is an essential tool for both lenders and borrowers, allowing for easy registration and verification of security interests. Here’s a step-by-step guide on how to register and log in:

Registration Process:

- Visit the official CERSAI website.

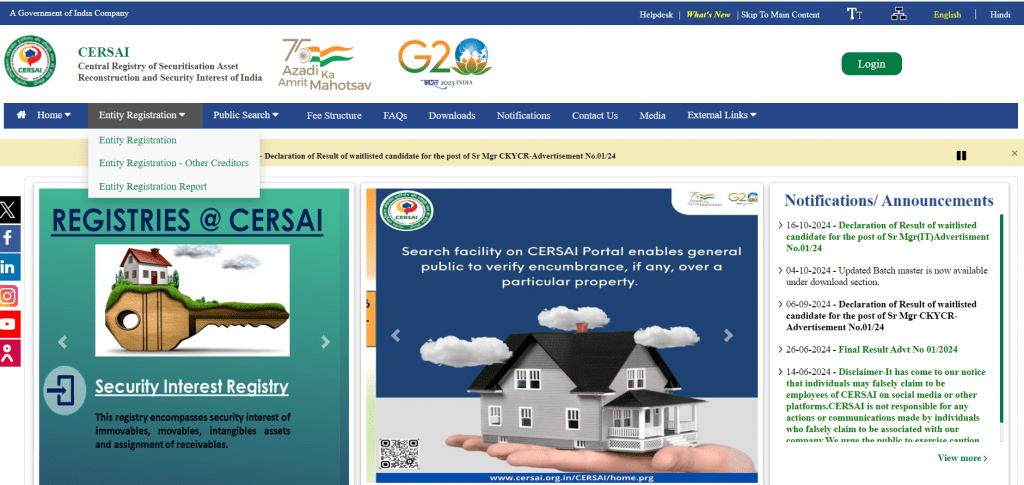

2. Click on the “Registration” tab.

3. Fill in the required details, including name, contact information, and documentation.

4. Submit the form and required documents for verification.

5. Once verified, you will receive your login credentials.

Login Process:

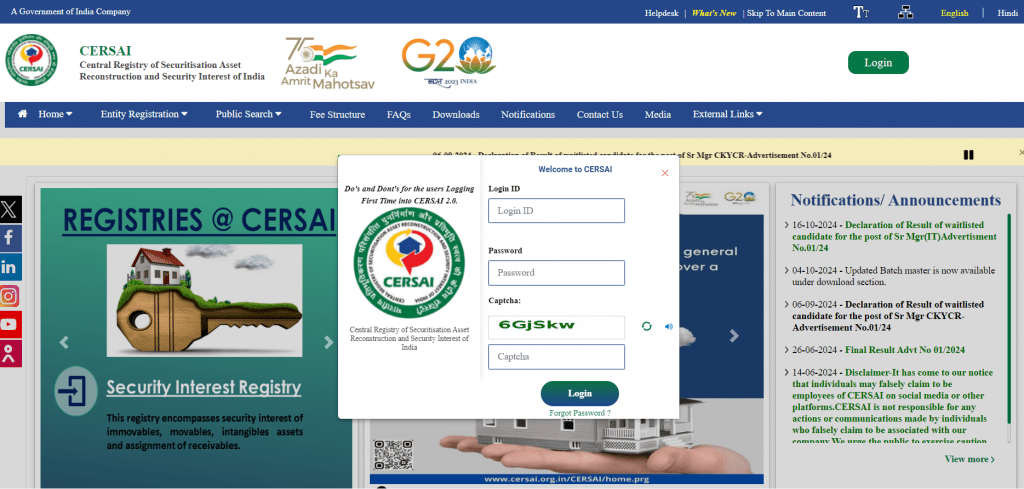

- Visit the CERSAI website.

2. Click on “Login.”

3. Enter your username and password.

4. Complete any security verification prompts.

5. Access your dashboard to manage or verify your information.

Why Are CERSAI Charges Necessary?

The registration of security interests with CERSAI protects both borrowers and lenders by:

- Preventing Fraud: It stops multiple loans from being taken on the same property by recording all security interests in a centralized database.

- Simplifying Legal Processes: In case of a loan default, registered security interests make it easier for lenders to enforce legal actions and recover the outstanding amount.

- Ensuring Transparency: Borrowers can be confident that their loan is secured and properly documented, while lenders can verify whether any encumbrances exist on the property.

The Importance of CERSAI for Home Loans

For homebuyers, CERSAI ensures that the property they are about to purchase is free of prior encumbrances. This makes it a valuable tool during the due diligence process of purchasing a home. Banks and financial institutions are required to check the CERSAI database to ensure that the property has not been pledged as collateral for any other loan, which reduces the risk of fraud.

Moreover, CERSAI provides a layer of protection for lenders. By registering security interests, lenders can confidently disburse loans, knowing that they have legal claims over the borrower’s property in case of default.

CERSAI Charges for Home Loans: Impact on Borrowers

The CERSAI charges, though nominal, are part of the overall home loan cost. It is important for borrowers to be aware of these charges and plan for them when budgeting for a home loan. For example, on a home loan of ₹50 lakhs, the CERSAI charge is ₹100 + GST, which is a small amount considering the protection and transparency it provides.

These charges are typically bundled into the loan processing fees, so they might not be separately mentioned in the loan documentation but are nonetheless a crucial part of securing your loan.

Conclusion

In the ever-evolving financial landscape of India, CERSAI plays a pivotal role in safeguarding the interests of both borrowers and lenders. Whether you’re taking a home loan, pledging assets, or involved in securitisation transactions, understanding CERSAI and its charges is essential. The small CERSAI charges provide peace of mind, knowing that your transaction is legally protected and transparent.

Looking to buy a home, but confused about the fees and charges? At Credit Dharma, we are committed to empowering you with the knowledge and tools needed to make informed financial decisions. If you’re considering taking a home loan or need assistance with understanding the complexities of secured transactions, our team is here to help.

Frequently Asked Questions

CERSAI’s purpose is to maintain a centralized registry of security interests, ensuring transparency and preventing fraud in financial transactions involving secured assets.

No, CERSAI charges apply to various financial transactions, including loans secured by collateral and securitisation transactions.

For loans up to ₹5 lakhs, the charge is ₹50 + GST. For loans above ₹5 lakhs, the charge is ₹100 + GST.

The CERSAI portal is used to register security interests, verify encumbrances, and facilitate asset securitisation and reconstruction transactions.

Yes, it is mandatory for lenders to register security interests related to loans with CERSAI.

CERSAI helps homebuyers by allowing them to verify property titles and ensure that the property is not pledged as collateral for another loan.

HDFC Home Loan

HDFC Home Loan SBI Home Loan

SBI Home Loan