Struggling with a low CIBIL score and delayed loan approvals? Imagine turning your credit woes into winning loan offers – in just 5 minutes, you can learn how!

Applying for a loan is a big financial decision, and one of the key factors lenders consider is your CIBIL score. Axis Bank, like many other Indian banks, relies on your Axis Bank cibil score to assess your creditworthiness before approving a loan.

Minimum CIBIL Score Requirements for Axis Bank Home Loan

| CIBIL Score Range | Meaning |

|---|---|

| 800 – 900 | Excellent score; indicates timely payments with no defaults, making loan approval easy and interest rates favorable. |

| 750 – 800 | Very good; helps in negotiating lower interest rates due to a strong credit history. |

| 625 – 750 | Average score; acceptable but may attract slightly higher interest rates and stringent terms. |

| 300 – 625 | Poor score; frequent missed payments and defaults. Loan approvals are difficult without improving this score. |

Suggested Read: CIBIL vs. CIRF Score

Suggested Read: AXIS Bank loan against property – EMIs, interest rates, and eligibility details

How to Check Your Credit Score Online for Free?

Use the online credit checker by Credit Dharma for a quick summary of your credit report, including credit scores, history, and areas for improvement.

You deserve a better home loan interest rate. Check your CIBIL Score Today!

How to Check Your CIBIL Score Before Applying for Axis Bank Home Loan?

Checking your Axis Bank free CIBIL score online is simple and can be done using your PAN number. Here’s a quick guide to help you access your CIBIL score online.

Time needed: 2 minutes

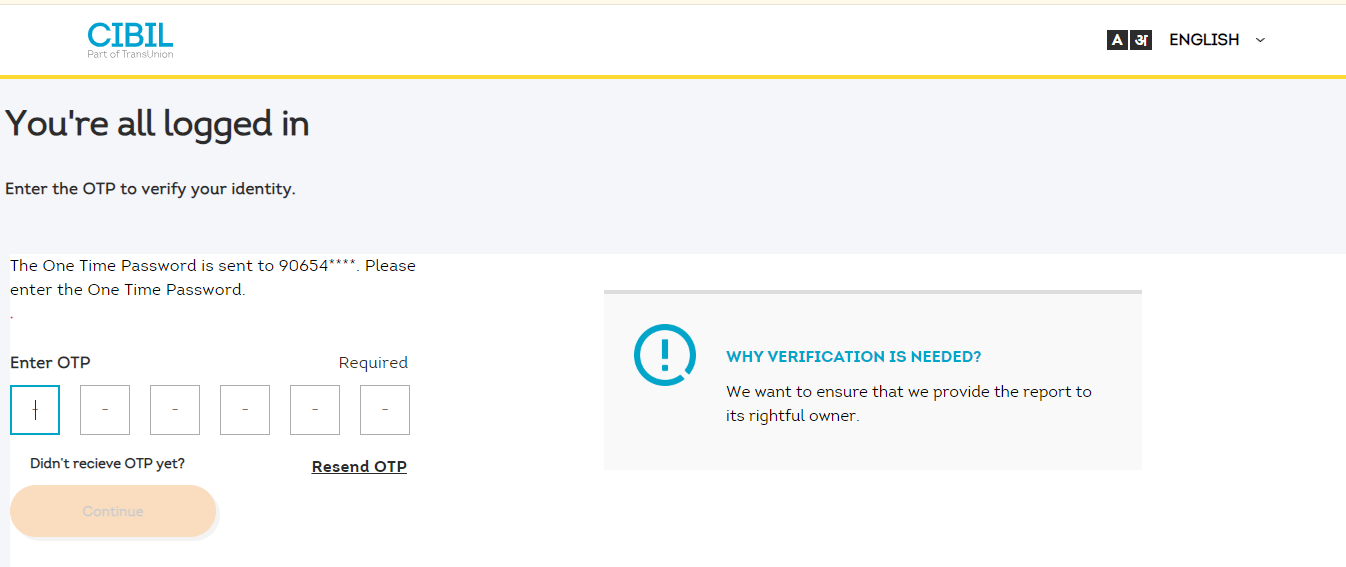

Step-by-step guide for obtaining your official credit report from CIBIL’s website:

- Visit the official website of CIBIL.

- Click on Get Your FREE CIBIL Score

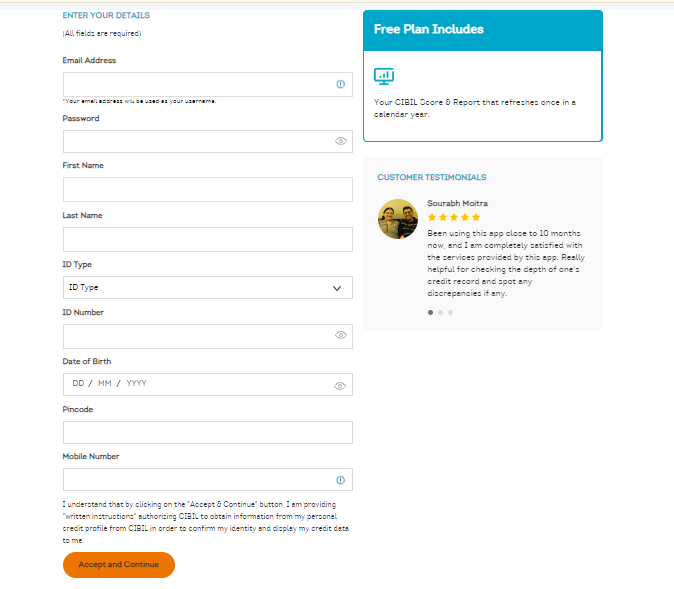

- Enter your basic details, including, Email Address, Name, ID Proof (PAN CARD), Date of Birth, and Mobile Number. Click on Submit.

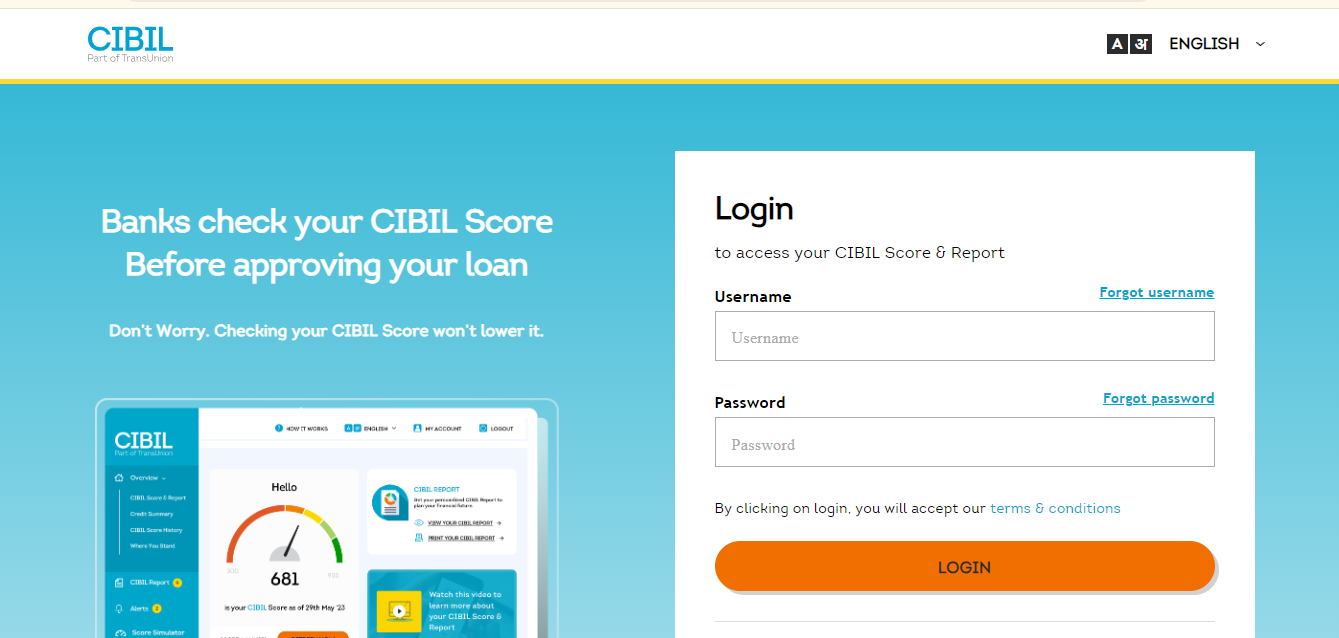

- Once you have created your account, login using your Email ID and Password.

- Once you have created your account, login using your Email ID and Password.

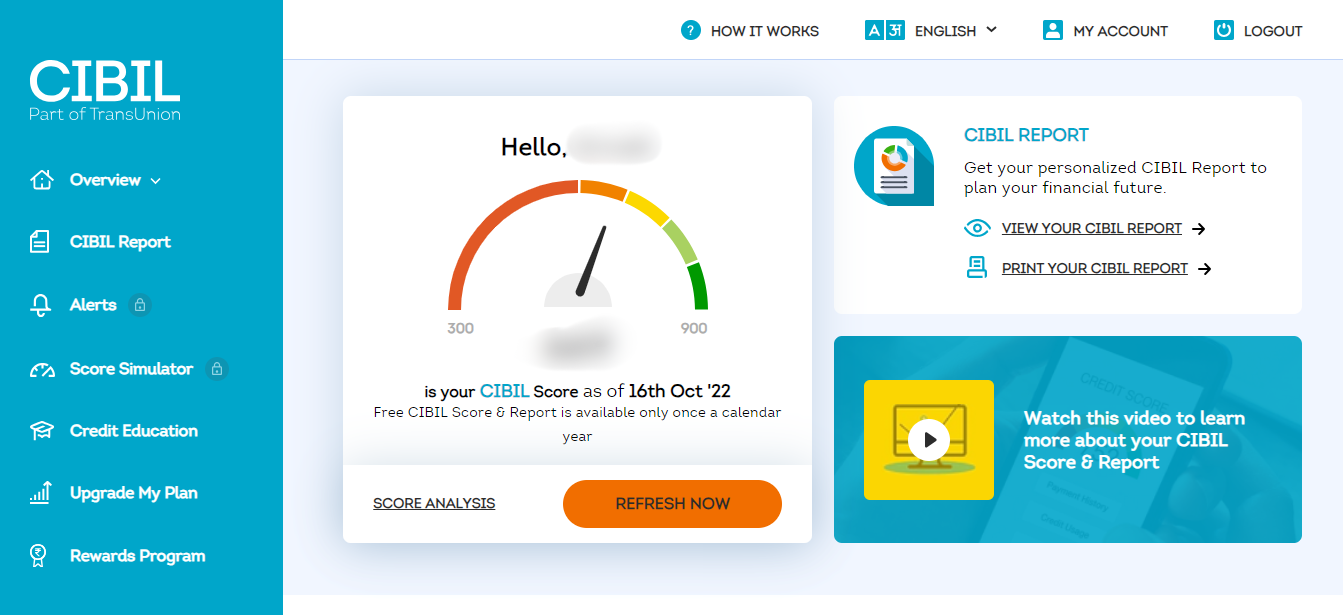

- Your CIBIL Score will be displayed on the screen.

Suggested Read: How to Increase CIBIL Score from 600 – 750?

How to Get CIBIL Score Report Offline?

- Download the application form from the CIBIL website Free CIBIL Score and Report.

- Fill out the form accurately with all your required details.

- You’ll need to pay a fee to acquire your CIBIL report. The amount varies depending on whether you just want the score or the detailed report.

- For both the CIBIL score and the complete report, the fee is Rs. 550.

- To receive only the CIBIL report, the fee is Rs. 164.

- Make a demand draft (DD) payable to “TransUnion CIBIL Limited” for the chosen amount.

- Mail the completed application form along with the DD to the following address:

TransUnion CIBIL Limited

One India bulls Centre, Tower 2A, 19th Floor

Senapati Bapat Marg, Elphinstone Road

Mumbai – 400013

Download CIBIL Score Application Form here

Key Benefits of a Good CIBIL Score for Axis Bank Home Loans

- A high CIBIL score speeds up the Axis Bank home loan approval process.

- It helps you secure lower interest rates on your home loan.

- A good score increases the maximum loan amount you can get.

- It allows you to choose from more flexible EMI and repayment options.

- You gain better negotiating power on interest rates and fees.

- It leads to faster disbursal of your sanctioned home loan.

- You become eligible for top-up loans with minimal checks.

- Lenders trust your profile more, reducing the chances of rejection.

Suggested Read: Impact of Home Loan on Credit History

How Does CIBIL Score Impact Home Loan Interest Rates and EMIs?

Here’s a simple explanation of how your CIBIL score affects home loan interest rates and EMIs:

1. Higher CIBIL Score = Lower Interest Rate

- A CIBIL score of 750 or above signals strong creditworthiness.

- Lenders are more confident and may offer lower interest rates (e.g., 8.35% instead of 9.50%).

2. Lower CIBIL Score = Higher Interest Rate

- If your score is below 700, lenders see you as a higher risk.

- This leads to higher interest rates, making your loan more expensive.

3. EMIs Increase with High Interest Rates

- Higher interest directly raises your monthly EMI.

- Example: For a ₹30 lakh loan for 20 years, a 1% increase in interest can raise EMIs by ₹1,800–₹2,000.

Suggested Read: Types of Credit Scores

How Does Adding a Co-Applicant Improve Your CIBIL Score Eligibility?

Adding a co-applicant to your loan application can significantly improve your CIBIL score eligibility. When you apply with a co-applicant, the lender considers both incomes, which boosts your overall repayment capacity. This makes it easier to qualify for higher loan amounts.

If your co-applicant has a strong CIBIL score, it strengthens your application and increases the chances of approval, especially if your own score is low.

Lenders also view joint applications as less risky, which can lead to better interest rates. Over time, if you repay the loan on time, it helps improve both your and your co-applicant’s credit scores.

This strategy is especially useful for those with a limited credit history or lower income, as it makes the application more stable and creditworthy.

How to Improve Your CIBIL Score in 3 Months?

- Pay all bills/EMIs on time to maintain a flawless payment history.

- Reduce credit card utilization below 30% of your total limit.

- Clear high-interest debts first (e.g., credit cards, personal loans).

- Avoid applying for new credit to prevent hard inquiries.

- Check and dispute errors in your CIBIL report immediately.

- Maintain a balanced credit mix (secured loans like home loans, unsecured like credit cards).

- Don’t close old credit accounts to preserve credit history length.

- Use a credit monitoring tool to track progress and alerts.

- Pay credit card bills in full instead of minimum payments.

- Request a credit limit increase (if possible) to lower utilization ratio.

Alternative Financing Options for Borrowers with Low CIBIL Scores

- Non-Banking Financial Companies (NBFCs): Offer home loans to low CIBIL scorers with higher interest rates or collateral requirements.

- Co-Signer/Co-Borrower: Add a family member with a strong credit profile to strengthen the application.

- Secured Loans Against Assets: Use gold, fixed deposits, or property as collateral for loans (e.g., gold loans, loan against FD).

- Government Housing Schemes: Explore PMAY (Pradhan Mantri Awas Yojana) subsidies or affordable housing schemes with relaxed eligibility.

- Loan Against Property (LAP): Use an existing property as collateral for a secured loan (even with low CIBIL).

Suggested Read: Minimum Credit Score for Top Banks

How to Check Your CIBIL Score for Axis Bank

Time needed: 5 minutes

Axis Bank provides a few ways to check your CIBIL score:

- Using the Axis Bank Mobile App

Download and log in to the Axis Bank mobile app.

Navigate to the ‘My Account’ section.

Look for the ‘Check CIBIL Score’ option.

Follow the prompts to view your CIBIL score. - Axis Bank Website

Visit the official Axis Bank website.

Log in to your net banking account.

Look for the ‘Check CIBIL Score’ option in the dashboard.

Follow the instructions to access your score.

Alternatively, you can check your CIBIL score directly through the TransUnion CIBIL website or other authorized credit score providers.

Suggested Read: AXIS Bank customer care services contact details for home loans

Get the Best Home Loan Offers with Credit Dharma

Credit Dharma is your trusted partner for securing the best Home Loan offers, with over ₹500 Cr+ loans handled and partnerships with 20+ leading banks. We provide exclusive access to the lowest interest rates and a seamless, digital process with fast approvals in just 1-2 weeks, backed by lifetime support from our home loan experts.

Why choose Credit Dharma? We provide:

- Lowest Interest Rates: Save more with every EMI.

- Maximum Funding: Get up to 100% funding for your dream home.

- Simple & Digital Process: No tedious paperwork or branch visits.

- Expert Guidance: Lifetime support from our team of specialists.

Compare, choose, and secure the best Home Loan offer with Credit Dharma — your home loan journey starts here!

Conclusion

In summary, your CIBIL score is a vital factor in determining your eligibility for Axis Bank loans. While a high score increases your chances of getting loans at favorable terms, a low score can make the process more challenging.

Understanding the importance of your CIBIL score and taking steps to maintain or improve it, can help you prepare better for your financial goals.

For personalized guidance related to any home loan requirements, visit Credit Dharma. Get exclusive low-interest rates from top banks, the highest funding, and dedicated home loan experts. Secure your family’s future now!

Frequently Asked Questions

While not impossible, it’s highly challenging. Axis Bank considers scores below 600 high-risk, significantly reducing approval chances. You may need to improve your score before applying.

No, checking your own CIBIL score is considered a soft inquiry and doesn’t impact your credit score or loan application with Axis Bank.

Axis Bank customers can check their CIBIL score for free via the mobile app.

While the CIBIL score remains a crucial factor, Axis Bank may also consider alternate data like utility bill payments or rental payment history, especially for applicants with limited credit history.

Axis Bank may offer secured credit cards or small personal loans to help build credit. These products often have less stringent CIBIL score requirements.

Axis Bank typically considers a CIBIL score of 750 or above as ideal for home loan eligibility. However, applicants with scores ranging from 650 to 749 may also be considered, though they might face higher interest rates or stricter terms.

Yes, having a co-applicant with a strong CIBIL score can enhance your loan eligibility and may lead to more favorable terms. The combined creditworthiness reduces the lender’s risk, potentially resulting in better interest rates or higher loan amounts.

HDFC Home Loan

HDFC Home Loan SBI Home Loan

SBI Home Loan