CIDCO to Launch Lottery for 22,000 Homes in Navi Mumbai by June-End, Includes 16,000 Unsold Units.

The City and Industrial Development Corporation (CIDCO) is set to launch one of its biggest housing lotteries yet, offering around 22,000 affordable homes across key nodes of Navi Mumbai by June-end 2025.

This includes over 16,000 unsold units from previous schemes, available in areas like Vashi, Juinagar, Kharghar, Taloja, and Dronagiri. With online registration, PMAY benefits, and financial tie-ups for home loans, the CIDCO Lottery 2025 offers a massive opportunity for Maharashtra residents to own a home in the rapidly developing Navi Mumbai region.

CIDCO Lottery 2025: Quick Facts

| Fact | Details |

|---|---|

| Authority | City and Industrial Development Corporation (CIDCO), Maharashtra |

| Scheme Name | CIDCO Lottery 2025 (includes “My Preferred CIDCO Home” mass-housing inventory) |

| Total Homes on Offer | ≈ 22,000 new allotments |

| Unsold Units Carried Forward | 16,000 + homes from earlier schemes (mainly “My Preferred CIDCO Home”) |

| Locations (Nodes) | • Vashi • Juinagar • Kharghar • Taloja • Dronagiri (+ existing stock in Mansarovar, Panvel, Kalamboli, Ulwe, Kharkopar, Khandeshwar) |

| Tentative Launch / Announcement | By end-June 2025, post Board of Directors’ approval |

| Application Mode | Online only – via CIDCO Homes portal / CIDCO Lottery mobile app |

| One-time Registration Fee | ₹ 236 (non-refundable) |

| Official Portals | https://cidco.maharashtra.gov.in https://cidcohomes.com |

Suggested Read: India’s Affordable Housing Schemes

CIDCO Lottery 2025: Documents Required

| Category | Documents to Upload |

|---|---|

| 1. Basic ID & Contact | • Aadhaar card/number • PAN card • Mobile number linked to Aadhaar • Email ID • Recent photo (≤ 90 days old) • Co-applicant’s Aadhaar & PAN (if any) |

| 2. Housing-ownership Declarations | • EWS: Self-declaration that applicant / spouse / unmarried children own no pucca house in India • LIG: Self-declaration that applicant / spouse / unmarried children own no house in Navi Mumbai |

| 3. Financial & Domicile Proofs | • Latest income proof • Maharashtra domicile certificate (15 + years stay; not required for ex-servicemen) • PMAY registration slip (for subsidy claim) • LIG – Form B (income declaration) |

| 4. Statutory Reservation | • Caste certificate • Caste-validity certificate |

| 5. Disability (Divyang) | • Government-issued disability certificate |

| 6. Non-Statutory / Special Categories | • State-govt employee: Form C on department letterhead • CIDCO employee: Form C on CIDCO letterhead (only LIG tiers) • Journalist: Certificate from CIDCO PRO + Form D (declaration) • Religious minority: School-leaving certificate + Form E (notarised affidavit) • Project-affected person (PAP): PAP certificate, award copy, 7/12 extract, family-tree affidavit • Ex-servicemen / serving defence & paramilitary (incl. dependents): Service ID / discharge book / certificate from district military board • Mathadi workers (MMR): Mathadi Board certificate |

Suggested Read: DDA Housing Scheme

Income Eligibility – CIDCO Lottery 2025

| Category | Annual Household Income | Additional Benefit |

|---|---|---|

| EWS (Economically Weaker Section) | Less than ₹6 lakh | Eligible for PMAY subsidy up to ₹2.5 lakh |

| General / LIG | Above ₹3 lakh | No PMAY subsidy mentioned |

Suggested Read: The Growth of Affordable Housing in India

How to Apply for CIDCO Lottery 2025?

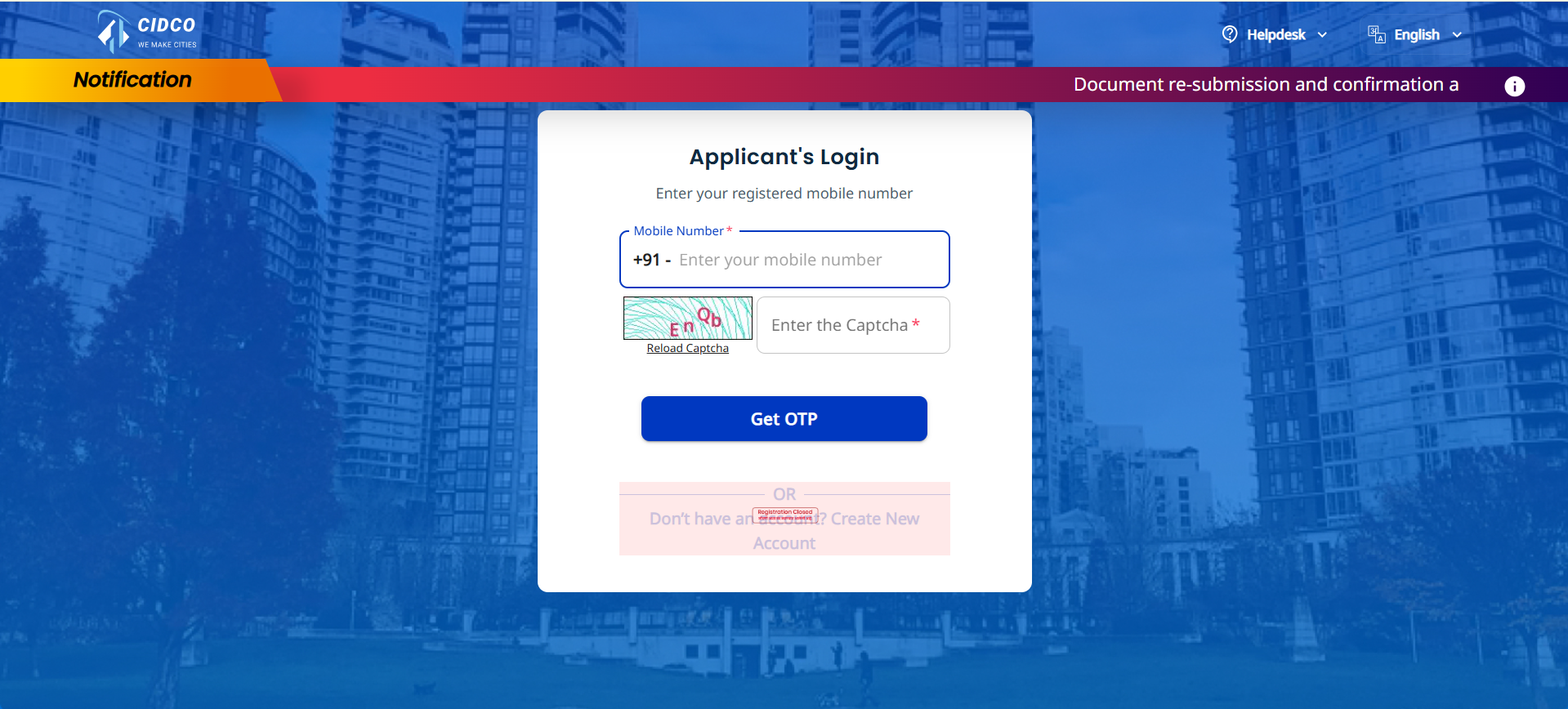

- Visit the official CIDCO website.

- Click “Register for Lottery” (new users only) and fill in basic details plus your mobile number (future communication).

- Enter PAN, Aadhaar, and bank details for refunds. Upload passport-size photo and cancelled cheque.

- Confirm registration. CIDCO will verify your documents within 24 hours.

- Once documents are approved, the “Apply” button activates. Select your desired scheme from the dropdown and note its code.

- Tick the Pradhan Mantri Awas Yojana option to claim subsidy benefits.

- Apply individually or jointly. Joint applicants must add co-applicant details (PAN, basic info) for CIDCO approval.

- Indicate location/unit preferences and confirm acceptance of terms. Optionally show interest in other schemes with vacant units.

- Verify all details, print the acknowledgment slip, sign it, upload it, and pay the Earnest Money Deposit (EMD) plus ₹236 registration fee via NEFT/RTGS, credit card, or net-banking.

Suggested Read: Gen Z’s Early Entry into Real Estate

Application Fee for CIDCO Lottery 2025

- Registration Fee: A non-refundable ₹236, payable once you create your online application.

- Earnest Money Deposit (EMD): Added to the registration fee and varies by income/flat category (e.g., ₹75,000 + GST for EWS, ₹1.5 lakh + GST for 1-BHK LIG, ₹2 lakh + GST for 2-BHK LIG).

Suggested Read: Maharashtra Rent Control Act

CIDCO Lottery 2025 Timeline

| Stage | Key Actions & Timelines |

|---|---|

| Draft List Published | Provisional list uploaded; objections allowed within 7 days |

| Objection Resolution | CIDCO resolves objections within the next 7 days |

| Final List Released | Confirmed list posted 5 days after objection window closes |

| Computerised Draw | Random digital draw selects winners |

| Results & Letter of Intent (LOI) | Winners announced online; LOIs issued; EMD refunded to non-winners within 30 days |

| Payment Schedule | Winners pay remaining amount as per LOI timeline |

| Document Verification | CIDCO checks documents; issues Allotment Letter with payment plan |

| Agreement Execution | Sale agreement signed after all instalments are paid |

| Possession & Key Handover | Keys handed over and possession granted once paperwork is complete |

My Preferred CIDCO Home: Inventory Details

| Locality | Exact Site / Sector | Configuration & Size | Units on Offer | Handover Target |

|---|---|---|---|---|

| Taloja | Sector 37 | 1 BHK · 398 sq ft | 816 | 30 Jun 2025 |

| Sector 39 | 1 BHK · 322 sq ft | 7,509 | 31 Dec 2025 | |

| Sector 28 | 1 BHK · 322 sq ft | 2,185 | 30 Jun 2025 | |

| Panvel | Bus Terminus, Sector 8 | 1 BHK · 322 sq ft | 172 | 30 Jun 2025 |

| Vashi | Truck Terminus, Sector 19 | 1 BHK · 322 sq ft | 3,131 | 31 Dec 2025 |

| Mansarovar | Station Terminus, Sector 39 | 1 BHK · 322 sq ft | 840 | 31 Dec 2025 |

| Kharghar | Bus Depot, Sector 14 | 1 BHK · 322 sq ft | 1,700 | 30 Jun 2025 |

| Bus Terminus, Sector 14 | 1 BHK · 322 sq ft | 340 | 30 Jun 2025 | |

| Railway Station, Sector 1A | 2 BHK · 540 sq ft | 1,803 | 31 Dec 2026 | |

| Khandeshwar | Railway Station, Sector 28 | 1 BHK · 322 sq ft | 1,470 | 30 Jun 2025 |

| Kalamboli | Bus Depot, Sector 17 | 1 BHK · 322 sq ft | 1,360 | 30 Jun 2025 |

| Ulwe / Kharkopar | Railway Station East P3 | 1 BHK · 322 sq ft | 2,113 | 31 Dec 2026 |

| Kharkopar 2A, Sector 16 | 1 BHK · 322 sq ft | 288 | 31 Dec 2025 | |

| Kharkopar 2B, Sector 8 | 1 BHK · 322 sq ft | 288 | 31 Dec 2025 | |

| Bamandongri | Sector 6 | 1 BHK · 322 sq ft | 1,700 | To be announced |

Suggested Read: 1 Acre Land Price in India

How to CIDCO Check Lottery Results List 2025?

- Visit

lottery.cidcoindia.com. - Open the Draft List; verify your name.

- After objections, view the Final List.

- On draw day, click “Search Lottery Result.”

- Enter your scheme code + category, then submit.

- The page instantly shows whether you’ve won.

Suggested Read: How to Calculate Agricultural Land Area?

PMAY Subsidy Checklist for CIDCO Lottery Winners (2025)

- Unmarried winner: Upload a self-affidavit (template on

cidco.nivarakendra.in→ Lottery Documents). - Married winner: Add your spouse as mandatory co-applicant.

- Registration costs: Pay stamp duty of ₹1,000 + 1 % of sale price (railway tax) and a 1 % registration fee

Suggested Read: How to Choose the Right Property for Maximum Rental Income?

Paying Online on the CIDCO Portal

- Open CIDCO’s official site in your browser.

- On the homepage, choose “Online Payment.”

- Select “Marketing / Housing / Shop Payment.”

- A new tab or window appears.

- Enter your reference number and hit “Submit.”

- Review the amount and other payment details shown on-screen.

- Complete the transaction via Debit Card, Net-Banking, or UPI.

Suggested Read: High vs. Low – How to Pick Perfect Apartment Floor?

How to Get EMD Refund for CIDCO Lottery?

- Automatic Refund for Non-Winners

- The earnest money deposit (EMD) is returned if you are not allotted a home.

- Debit/Credit-card payments are credited back to the same bank account.

- Demand-draft payments are refunded via a fresh demand draft.

- Option to Retain EMD

- You may leave the EMD with CIDCO to stay automatically eligible for the next lottery round.

- No interest is paid on the retained amount.

- Future participation will follow the prices and terms of the new scheme.

How to File a Grievance in CIDCO Lottery 2025?

| Method | What to Do | When / Where |

|---|---|---|

| Online (faster) | 1. Visit the CIDCO portal → Citizen Login. 2. Log in with your credentials. 3. Click Lodge Complaint and submit the form. 4. Note the complaint reference number for tracking. | Available anytime |

| Offline | Visit the Chief Grievance Redressal Officer in person. | Office hours: 2 pm – 5 pm |

Log in again → select View Grievance Status → enter your reference number → view the latest update on-screen.

Selling a CIDCO-Allotted Flat

You must hold the flat for five years from the allotment date. A sale is allowed only if the buyer already holds power of attorney for the property.

CIDCO Lottery Customer Support

| Query Type | Contact |

|---|---|

| General / Post-Lottery Issues | 022-6272 2250 ✉ cidconivarakendra@gmail.com |

| Payment-Related Questions | Toll-Free 1800-223-466 7065 454 454 |

| Additional Support | Helpline 022-6272 2255 (office hours) |

Common Rejection Triggers – CIDCO Lottery 2025

| Rejection Reason | Why It Happens | How to Avoid / Fix |

|---|---|---|

| No Maharashtra Domicile Certificate | CIDCO cancels even a winning allotment if a valid domicile is missing. | • Apply online on Aaple Sarkar (cheapest; takes time) or • Visit a lawyer with birth / school-leaving certificate (≈ ₹3 k; 2-3 days). Upload the approved PDF before the verification deadline. |

| Incorrect Income Category | If declared income doesn’t match the chosen bracket (EWS, LIG, General), the allotment is voided. | Confirm your annual household income first; select the correct category in the form. If in doubt, clarify with CIDCO’s help desk before final submission. |

Suggested Read: Micro Market Analysis for Land Investment

Conclusion

Buying a home is a big step. Getting a home loan can be hard, but we make it easy. Choosing Credit Dharma for your home loan simplifies this process. We offer expert advice and personalized assistance to make everything hassle-free. You’ll receive timely updates on your loan application and disbursement progress.

From the initial application to the final disbursement, we provide comprehensive support. Enjoy clear and honest communication at every stage, with no hidden surprises.

Frequently Asked Questions

Yes, the CIDCO Lottery has special provisions for the Economically Weaker Section (EWS). These provisions include reserving a certain number of housing units for eligible candidates from the EWS category, often at more subsidized rates than other categories.

The City and Industrial Development Corporation (CIDCO) Lottery is a housing scheme introduced by the Maharashtra government to provide affordable housing options to various sections of society, including the Economically Weaker Section (EWS) and the General Category. The scheme primarily covers areas in Navi Mumbai.

Generally, the CIDCO Lottery is designed to benefit those who do not already own a home. Specific guidelines on property ownership will be outlined in the eligibility criteria, so it is crucial to review the CIDCO guidelines for the current year.

The typical documents required for CIDCO Lottery registration include:

Proof of Identity (Aadhaar Card, Voter ID, etc.)

Proof of Address

Income Certificate

Age Proof

Passbook or Bank Statement

Ensure to check the official documentation list provided by CIDCO for any additional requirements.

Nivara Kendra refers to housing centers established under the CIDCO Lottery scheme, providing affordable housing solutions. These centers aim to support urban development by offering planned housing accommodations to the economically weaker sections and ensuring better living standards.

The CIDCO Lottery 2024 offers approximately 26,600 affordable housing units in several key areas of Navi Mumbai, including Kharghar, Taloja, Vashi, Ulwe, Panvel, Khandeshwar, and Mansarovar.

These locations are strategically selected for their proximity to railway stations, ensuring convenient commuting for residents.

The lottery primarily targets Economically Weaker Sections (EWS) and Lower Income Group (LIG) applicants.

CIDCO (City and Industrial Development Corporation of Maharashtra) recently launched the My Preferred CIDCO Home scheme on October 12, 2024, offering approximately 26,502 affordable housing units in Navi Mumbai for Economically Weaker Sections (EWS) and Low-Income Groups (LIG) under the Pradhan Mantri Awas Yojana (PMAY).

The online registration period, initially set to end on January 10, 2025, was extended due to high demand, with over 100,000 applications received.

The scheme allows applicants to select their preferred units based on location and floor during a subsequent selection phase.

Looking ahead, CIDCO is expected to launch the 2025 Lottery, aiming to provide around 70,000 homes for low-income families, further enhancing urban living standards in Maharashtra.

CIDCO, or the City and Industrial Development Corporation of Maharashtra, is primarily responsible for the development of Navi Mumbai.

This planned city was established to alleviate congestion in Mumbai and provide a modern urban environment.

HDFC Home Loan

HDFC Home Loan SBI Home Loan

SBI Home Loan