Estimated reading time: 6 minutes

Managing your money is essential if you have an HDFC home loan and are a happy homeowner. One of the essential documents you’ll need to monitor is your home loan statement.

We’ll make sure you stay up to date on your loan details by taking you through the easy processes to read and download your HDFC home loan statement in this thorough tutorial.

Planning to get a home loan from HDFC Bank?

Reach out to our team of experts and make informed decisions!

Steps to view and download your HDFC home loan statement

Here are the steps to download your HDFC home loan statement:

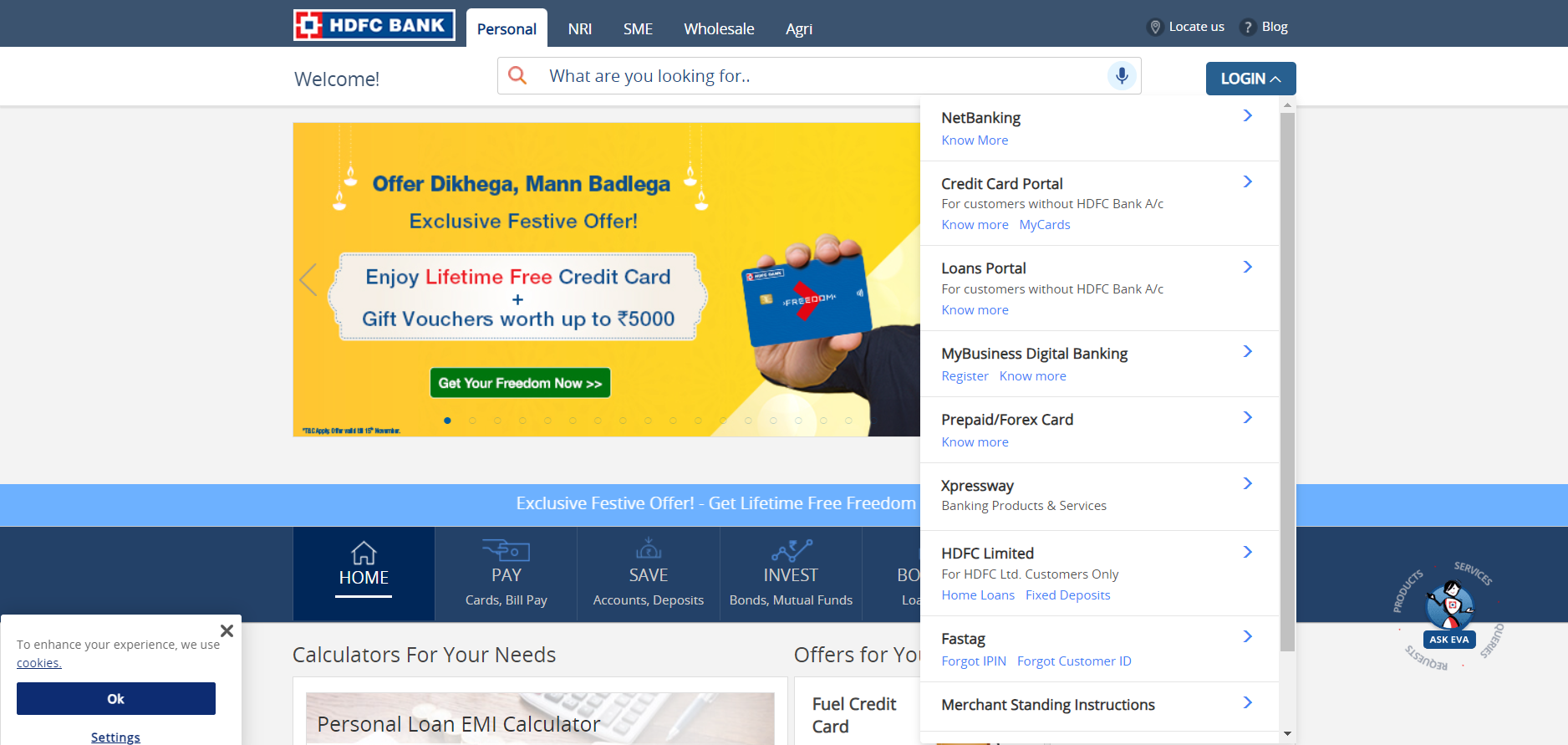

- First, go to the HDFC Net Banking Portal.

Open your preferred web browser and visit the official HDFC Bank website.

Search for the location of the Login option and click on Net Banking.

- Accessing Your Account

Put your password and customer ID in the appropriate spaces.

If you have not registered for the NetBanking page, search and click on the “Register” option and follow the instructions on the screen. - Navigating to the Loan Accounts Section

Once logged in, find the “Loan” section on the homepage or in the main menu.

Select the Home Loan option from the drop-down menu. - Choosing the Home Loan Account

Identify your specific home loan account from the list if you have multiple accounts.

Click on the relevant account number to proceed. - Locating the Statement Section

Look for the “Statement” or “Account Statement” option within your home loan account details.

Click on the statement option to access your statements. - Selecting the Statement Period

Choose the specific period for which you want to view or download the statement.

- Obtaining the Declaration

You can download a copy of your home loan statement by clicking the “Download” and also by “Generate PDF” button.

To open and see the statement you downloaded, make sure your device has a PDF reader installed. - Confirming the Data

Verify the statement again to make sure all the transactions and data match up.

Check the principal amount, interest rates, and any other pertinent details. - Recognizing the Statement’s Components

Learn about the main areas of the statement, including the repayment schedule, outstanding balance, principal and interest breakdown, and EMI data.

- Storing and Printing the Statement

Save the downloaded PDF to a secure location on your device.

Consider printing a hard copy for your records or future reference.

Additional Tips and Considerations

- Regularly Check Your Statements:

Make it a habit to review your home loan statements regularly to stay updated on your financial status.

- Contact Customer Support for Assistance:

If you encounter any issues or have questions about your home loan statement, don’t hesitate to reach out to HDFC’s customer support for assistance.

- Stay Informed About Changes:

Keep an eye out for any communication from HDFC regarding changes in interest rates, policies, or any other relevant updates.

- Explore Mobile Banking Options:

HDFC also provides mobile banking options for added convenience. Consider exploring the mobile app for quick access to your home loan details on the go.

Get a Home Loan

with Highest Eligibility

& Best Rates

Advantages to HDFC home loan customers

A Simple Guide on How to Download and Check Your HDFC Home Loan Statement Online, thus, opens up a plethora of benefits for homeowners, making the financial management of their housing loans more convenient and transparent. Moreover, let’s delve into the advantages that this user-friendly guide brings to HDFC home loan customers.

- Convenience and Accessibility:

- The foremost benefit lies in the convenience of accessing your home loan statement from the comfort of your home. Furthermore, there are no more hassles of visiting a bank branch or waiting for a physical statement in the mail.

- Online accessibility allows you to check your home loan statement anytime, anywhere, as long as you have an internet connection.

- Time-Saving Process:

- The guide effortlessly streamlines the process of obtaining your home loan statement, thereby saving you valuable time. Moreover, with just a few clicks on the HDFC NetBanking portal, you can promptly download and review your statement.

- Time efficiency is crucial in today’s fast-paced world; therefore, this guide ensures that homeowners can manage their finances efficiently and, consequently, without unnecessary delays.

- Immediate Updates:

- By providing a step-by-step approach to checking and downloading home loan statements, the guide therefore enables homeowners to receive immediate updates on their financial status.

- Quick access to the latest information not only helps in making timely decisions but also allows for adjustments to your budget or financial plans.

Other Advantages

- Enhanced Financial Awareness:

- Moreover, regularly checking your HDFC home loan statement enhances your financial awareness. As a result, you gain insights into your outstanding balance, interest rates, and the principal amount.

- Understanding the components of the statement, such as EMI details and the repayment schedule, empowers you to plan and manage your budget effectively.

- Transparent Financial Transactions:

- The guide ensures transparency in financial transactions related to your home loan. Furthermore, you can scrutinize each detail in the statement, ensuring that all transactions are accurate and align with your expectations.

- This transparency, therefore, builds trust between the homeowner and the lending institution; as a result, it fosters a positive financial relationship.

- Digital Record-Keeping:

- Downloading your home loan statement online facilitates digital record-keeping. Furthermore, you can store the PDF document securely on your device, thereby ensuring that you have a digital trail of your financial transactions.

- Digital records are not only eco-friendly but also protect against the risk of physical document loss or damage.

Conclusion

Accessing and managing your HDFC home loan statement is, therefore, a simple task in this digital age. Moreover, with just a few clicks, you can keep an eye on your HDFC home loan bills and take charge of your finances.

Still feel this a lot of information to process and it’s a tiring process, we’ve got you. Feel free to contact our team of experts who will guide you through every step seamlessly – Credit Dharma

Frequently Asked Questions

Log in to HDFC Net Banking, go to the “Loan” section, select your home loan account, and download the statement from the “Statement” option.

Log in to HDFC Net Banking, navigate to the “Loan” section, select your home loan account, and access the statement from the “Statement” option.

Log in to HDFC Net Banking, select the relevant account, and download the statement from the “Statement” option.

Use HDFC Mobile Banking app, visit a branch, or contact customer support for your personal loan statement.

HDFC Home Loan

HDFC Home Loan SBI Home Loan

SBI Home Loan