The Pradhan Mantri Awas Yojana (PMAY) is a visionary initiative by the Indian Government, aiming to provide affordable housing. If you’re in the market for a house and meet all the eligibility requirements, PMAY can be a transformative opportunity.

In this guide, we’ll take you through the detailed steps on how to apply for Pradhan Mantri Awas Yojana, ensuring you have all the necessary information to effectively apply for this beneficial program.

How to Apply for Pradhan Mantri Awas Yojana Scheme Online?

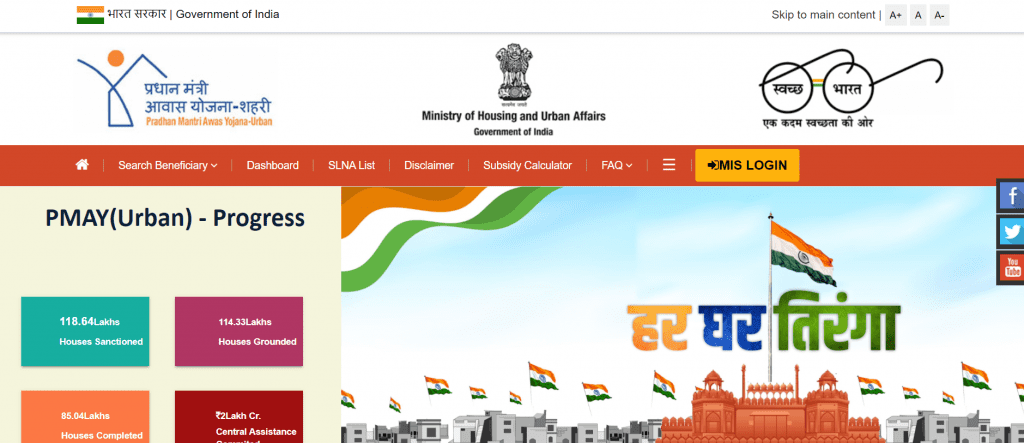

1. Visit the official website of PMAY – Urban

2. Under Citizen Assessment drop down, click on Slum Dwellers or Benefit Under 3 Components.

3. Enter your Aadhaar Number and click on Verify.

4. Once your Aadhaar is verified, a form will be displayed on the screen.

5. Fill out the form carefully and click on Submit.

How to Apply for Pradhan Mantri Awas Yojana Scheme Offline?

For offline applications, one must visit the Common Service Centers (CSC) established by state and union territory governments. At these centres, you will need to complete and submit the provided application form.

There is a nominal fee of Rs. 25 + GST for form processing. Note that only CSCs are authorized by the Ministry of Housing and Urban Affairs (MOHUA) to collect this fee. Private entities or individuals are not permitted to charge any fee related to this scheme.

Things to Remember While Applying For PMAY Online

- The PMAY online application is exclusively available for individuals from economically weaker sections (EWS) and lower-income groups (LIG).

- If an applicant provides incorrect information or facts, authorities may cancel the loan and pursue legal action.

- False income declarations may also lead to the rejection of the PMAY home loan application.

- You must link all PMAY loan accounts with your Aadhar card.

Who is Eligible For the PMAY Scheme?

The Pradhan Mantri Awas Yojana (PMAY) scheme primarily targets economically weaker sections (EWS), lower-income groups (LIG), and middle-income groups (MIG) of society. Here’s a breakdown of the eligibility criteria:

Income Criteria:

| Catergory | Annual Income of the Household |

|---|---|

| EWS | Up to Rs. 3 lakhs. |

| LIG | Rs. 3 lakhs – Rs. 6 lakhs |

| MIG I | Rs. 6 lakhs – Rs. 12 lakhs |

| MIG II | Rs. 12 lakhs – Rs. 18 lakhs |

Other Criteria:

- The beneficiary family should not own a pucca house in any part of India in the name of any family member.

- The beneficiary family must not have availed of any central assistance under any housing scheme from the Government of India.

- For married couples under the PMAY scheme, either spouse or both jointly can apply for a single house, provided they belong to one of the specified economically disadvantaged categories.

- To support women from economically weaker sections, the property should be solely or jointly owned by the female head of the family. If no adult female is present, the property can be registered under the male head of the household’s name.

- The scheme covers all statutory towns as per the Census 2011 and towns notified subsequently, including the planning area.

- The beneficiaries under this scheme should be first-time homebuyers.

Explore Your Home Loan Options with Credit Dharma

The Pradhan Mantri Awas Yojana provides a substantial opportunity for eligible individuals to own affordable homes in both urban and rural settings. By following the outlined steps, you can apply for the PMAY scheme either online or offline, ensuring you meet all criteria and submit the necessary documents. For more detailed guidance and to compare different home loan options, visit Credit Dharma.

Frequently Asked Questions

No, existing homeowners cannot apply for PMAY. The scheme specifically targets families that do not own a pucca house anywhere in India and have not received any central assistance under any housing scheme.

Yes, under PMAY, senior citizens and differently-abled individuals are given preference in ground floor housing allocations.

The time to receive the subsidy can vary, but typically, it takes about 3-4 months from the date of application if all documents are in order and eligibility criteria are met.

Yes, individuals living in rented houses who do not own a pucca house and meet other eligibility criteria can apply for PMAY.

PMAY defines a ‘pucca house’ as a strong house made of solid materials like cement and concrete, with a defined area and basic amenities.

The property must meet certain specifications and requirements outlined by PMAY, including affordability, basic amenities, and size specifications.

HDFC Home Loan

HDFC Home Loan SBI Home Loan

SBI Home Loan