If you have applied for a home under Pradhan Mantri Awas Yojana, keeping track of your application’s progress is crucial.

From navigating the official PMAY website to entering your Aadhaar details, we’ll provide you with all the necessary steps to quickly and easily access your application information.

How do you check PMAY status with an Aadhaar card online?

Time needed: 2 minutes

Here’s how you can check your PMAY application status online with your Aadhaar number:

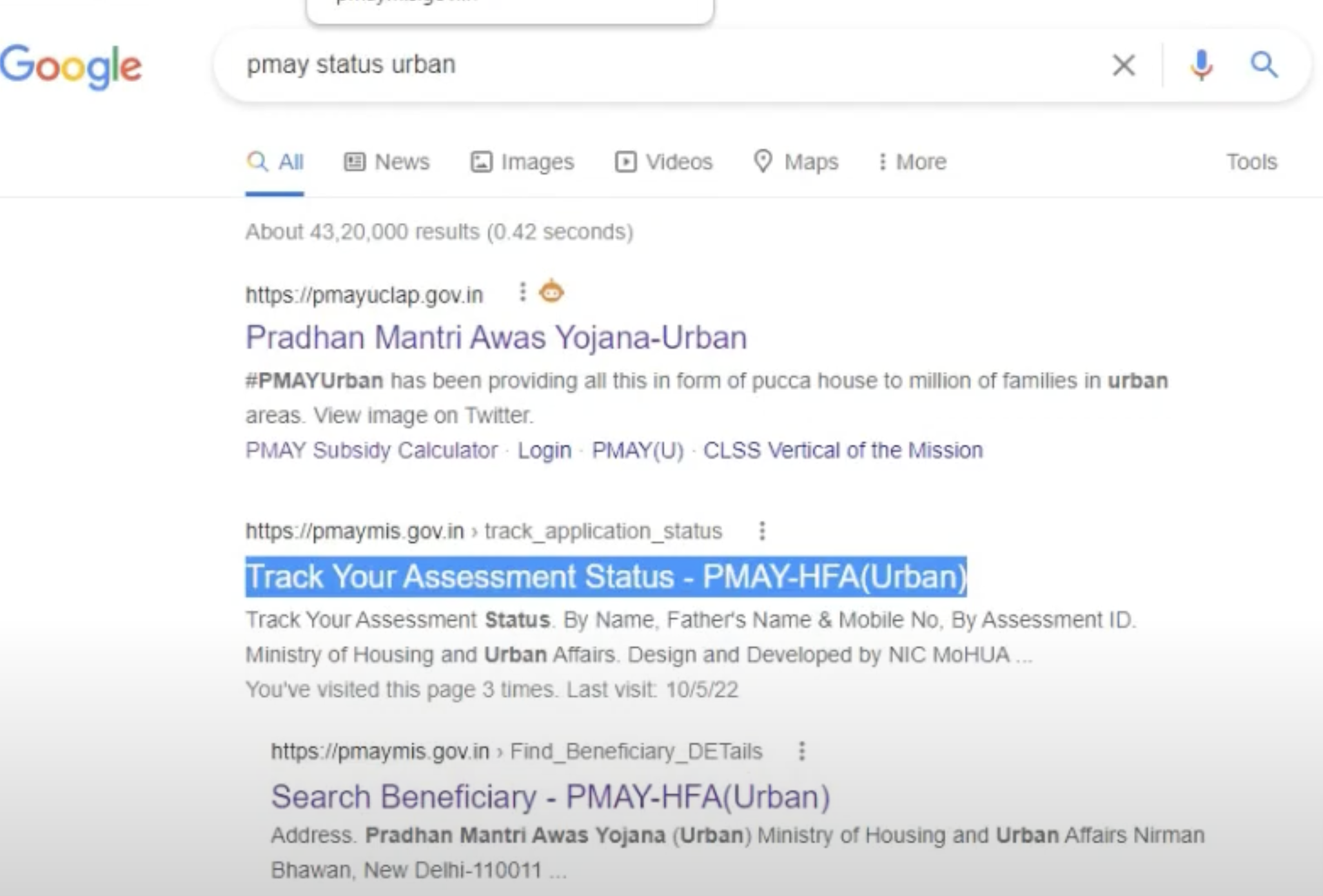

- Navigate to the official website of PMAY HFA Urban

Go to track your assessment status to check your status using the Aadhaar number.

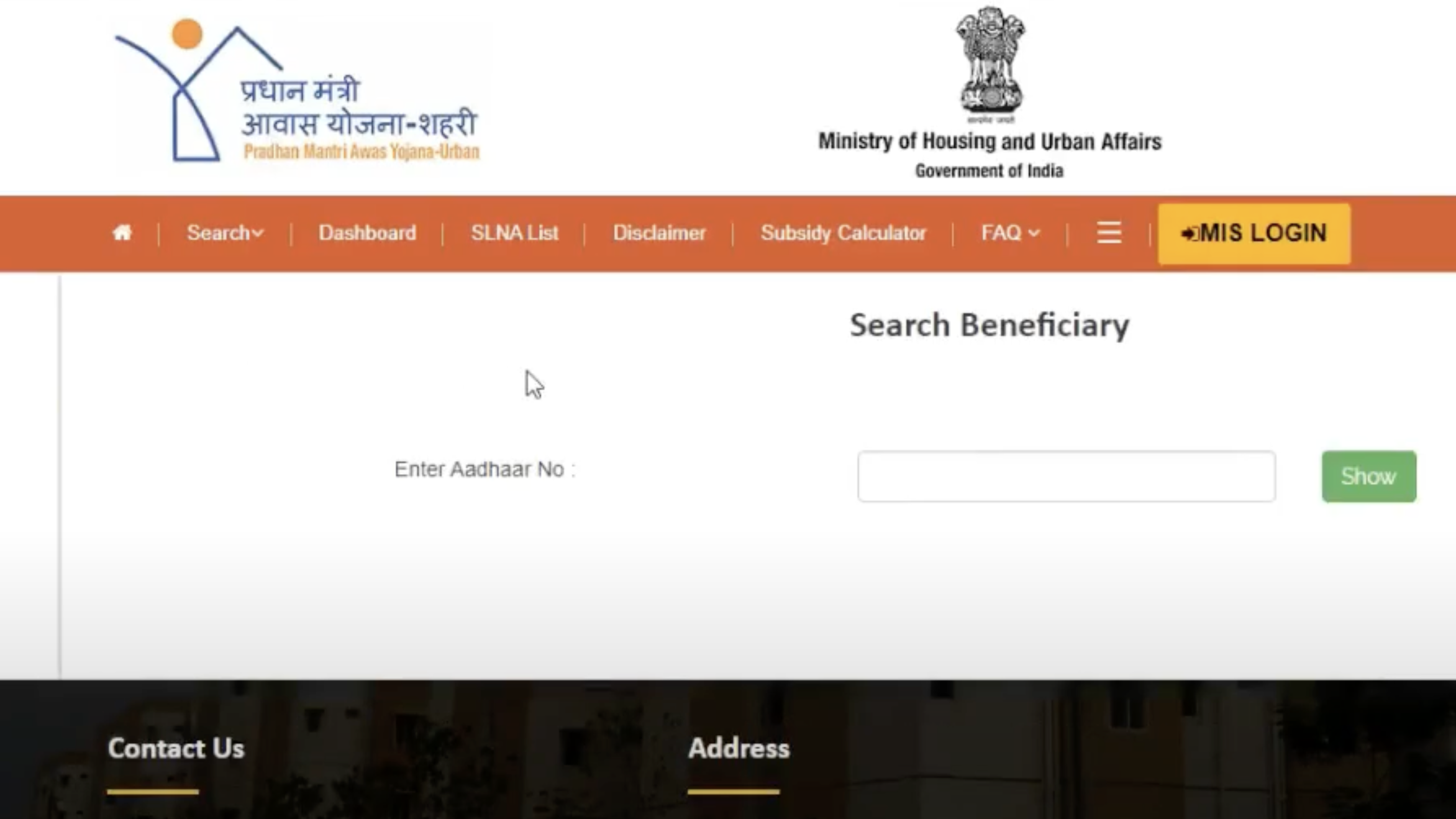

Go to track your assessment status to check your status using the Aadhaar number. - Enter your 12-digit Aadhaar Card Number and Click on Show.

- Once you enter your Aadhar number, you can track your PMAY application status.

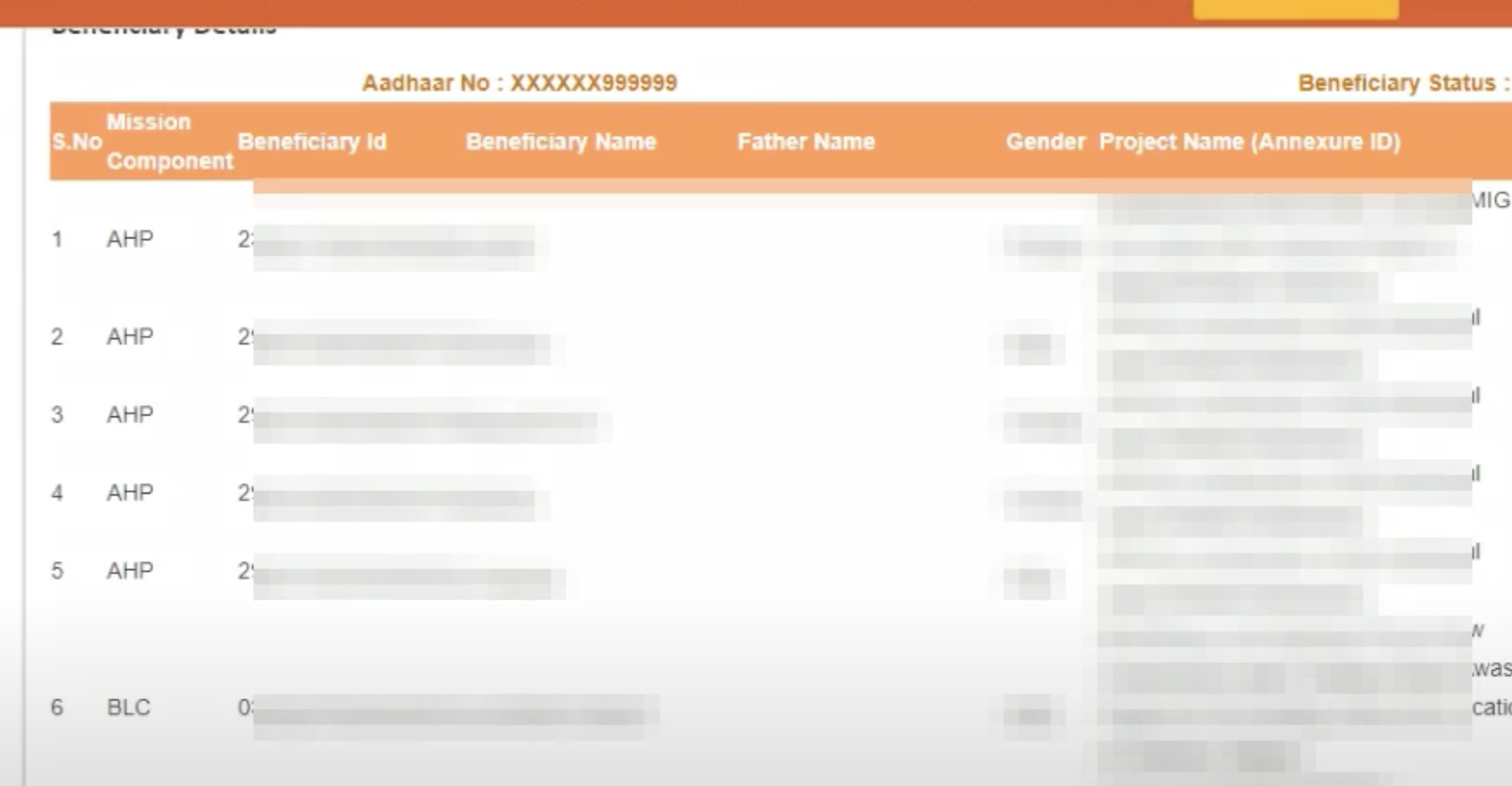

Once you have entered your Aadhaar information, you can see all your allotment statuses.

Once you have entered your Aadhaar information, you can see all your allotment statuses.

Alternative Ways of Checking PMAY Application Status

If your Aadhaar card is not accessible, you can still monitor the status of your Pradhan Mantri Awas Yojana (PMAY) application through other means. By using either your

- PMAY Application ID or

- your registered mobile number,

you can conveniently check and stay updated on the progress of your application online.

By Using PMAY Application ID

- Visit the official website of PMAY

- Click on By Assessment ID and enter the ID

- Your browser will redirect you to a new page where you can check your PMAY Application Status.

By Using Registered Mobile Number

- Visit the official website of PMAY

- Click on By Name, Father’s Name & Mobile No.

- Enter all the required details and click on submit.

- Your browser will redirect you to a new page where you can check your PMAY Application Status.

How to Check PMAY Status Offline?

To track the status of PMAY subsidies offline, applicants have different methods available depending on whether they are part of PMAY-Gramin (G) or PMAY-Urban (U).

For PMAY-G, individuals can visit their local Grama Panchayat or Block Panchayat offices for direct assistance and updates.

On the other hand, PMAY-U applicants can reach out via phone by calling dedicated toll-free helpline numbers. These include the:

- Ministry of Housing and Urban Affairs at 011 23063285 or 011 23060484

- The National Housing Bank at 1800 11 3377 or 1800 11 3388

- The Housing and Urban Development Corporation at 1800 11 6163

How to Check If Your Bank Account Has Received the PMAY Loan Amount?

Via UMANG Website

- Download the UMANG application on your Play Store.

- Search for Pradhan Mantri Awas Yojana – Gramin.

- Now, click on Instalment Details and enter your application/ registration number.

Via PMAY – URBAN Website

- Visit the official website of Pradhan Mantri Awas Yojana Urban

- Click on Search Beneficiary and select Beneficiary Wise Fund Release.

- Enter your registered mobile number.

- You will receive an OTP on your same number.

- Enter the OTP and click on Search.

- Your browser will be redirected to a new page where you can check if your home loan is credited or not.

PMAY Customer Care

You can contact the PMAY customer care team through several methods.

- For direct support, call their landline numbers at 011 2306 3285 or 011 2306 0484.

- Alternatively, you can send an email to their official email address: pmaymis-mhupa@gov.in.

Headquarters Address:

RK Gautam, Director (HFA-5)

Ministry of Housing and Urban Affairs

Room no 118, G Wing, NBO Building,

Nirman Bhawan, New Delhi-110011

Frequently Asked Questions [FAQs]

The PMAY subsidy calculates based on an interest rate subsidy that can reach up to 6.5% for a maximum loan tenure of 20 years, applied to a maximum loan amount of ₹6 lakhs. If your loan amount is less than ₹6 lakhs, the subsidy amount reduces proportionately. You calculate the present value of the subsidy using a discount rate and then deduct it from your loan amount.

Under PMAY, the subsidy amount is credited upfront to your loan account, reducing your total loan liability. This process reduces the effective loan amount and, thus, the EMI burden.

Yes, if you transfer your loan balance to another bank or prepay your loan, you can lose the PMAY subsidy. In such cases, you might forfeit the subsidy benefits that were previously granted.

PMAY is still available as of 2024. The government has extended the deadline for availing of PMAY benefits to the end of 2024, to assist more eligible beneficiaries in achieving homeownership.

Yes, government employees can apply for PMAY if they meet the other eligibility criteria set under the scheme, such as not owning a pucca house anywhere in India and falling within the specified income brackets.

You cannot apply for the PMAY subsidy twice. Once you claim and receive a subsidy for a property, you cannot claim it again for the same or another property under your name.

To check your name on the Pradhan Mantri Awas Yojana (PMAY) list online, visit the official websites: for PMAY Urban,

go to pmaymis.gov.in and select ‘Search Beneficiary’ to enter your mobile number and verify your details; for PMAY Gramin, visit pmayg.nic.in, choose ‘Stakeholders’,

then ‘IAY/PMAYG Beneficiary’ to search either by registration number or through advanced search options by filling in relevant details.

This process will allow you to verify your status under the PMAY scheme efficiently.

How do I check my PMAY list online?

The PMAY subsidy may not be received for several reasons.

Common issues include not meeting eligibility criteria under the Credit Linked Subsidy Scheme (CLSS), such as income limits or property requirements,

or failing to submit the required documents to the bank or housing finance company (HFC) during the loan application process.

Delays can also occur if the bank or HFC has not forwarded the subsidy claim to the National Housing Bank (NHB) or HUDCO for processing.

Additionally, discrepancies in the application details or incomplete information can result in rejection or delays.

Applicants can track their subsidy status through the CLSS Awas Portal (CLAP) at pmayuclap.gov.in or contact their bank/HFC for updates

To check your eligibility for the Pradhan Mantri Awas Yojana (PMAY) online, visit a PMAY eligibility calculator.

Enter your total annual household income, desired loan amount, loan tenure (up to 20 years), and property details (ensuring it is your first pucca home).

The calculator will then provide your eligibility status and the potential subsidy amount you may qualify for under the Credit Linked Subsidy Scheme (CLSS) based on your income category.

HDFC Home Loan

HDFC Home Loan SBI Home Loan

SBI Home Loan