Maintaining an accurate credit report is crucial for a healthy financial profile. Errors like typographical mistakes, incorrect personal details, or inaccurate account information can adversely affect your credit score, impacting your ability to secure loans or credit cards. This guide will walk you through the process of raising a CIBIL dispute to correct any discrepancies.

How to Initiate a CIBIL Dispute?

1: Log in to Your myCIBIL Account: Access your myCIBIL account using your credentials. If you obtained your report through a vendor, register directly with CIBIL and sign in to your new account.

2: Navigate to the Dispute Center Go to the Credit Reports section, find the Dispute Center, and select the Dispute an Item option.

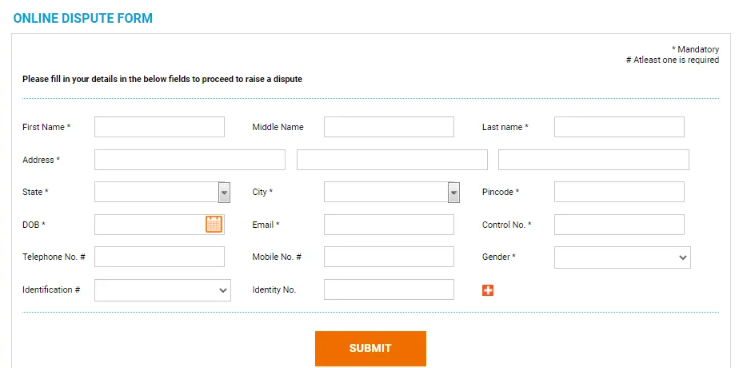

3: Complete the Online Dispute Form Fill out all necessary information in the Online Dispute Form that appears after you select the dispute option.

4: Select and Correct Identification Documents In the Identification # section, choose the document that needs correction and update the corresponding number at the bottom of the form.

5: Add Corrections for Multiple Documents Click the + symbol to add and correct information for any additional documents that require updates.

: Submit Your Dispute Once you have addressed all errors, click the Submit button to finalize your dispute.

How to Raise a CIBIL Dispute Offline?

Prepare a clear and concise letter that outlines each discrepancy found in your CIBIL report, specifying the exact errors and providing relevant details.

Ensure that you attach copies of all supporting documents, such as identification proofs, payment receipts, or correspondence, to substantiate your claims and facilitate the resolution process.

TransUnion CIBIL Limited

One World Center, 19th Floor, Tower 2A and 2B,

Senapati Bapat Marg,

Lower Parel, Mumbai – 400 013

What Happens Next?

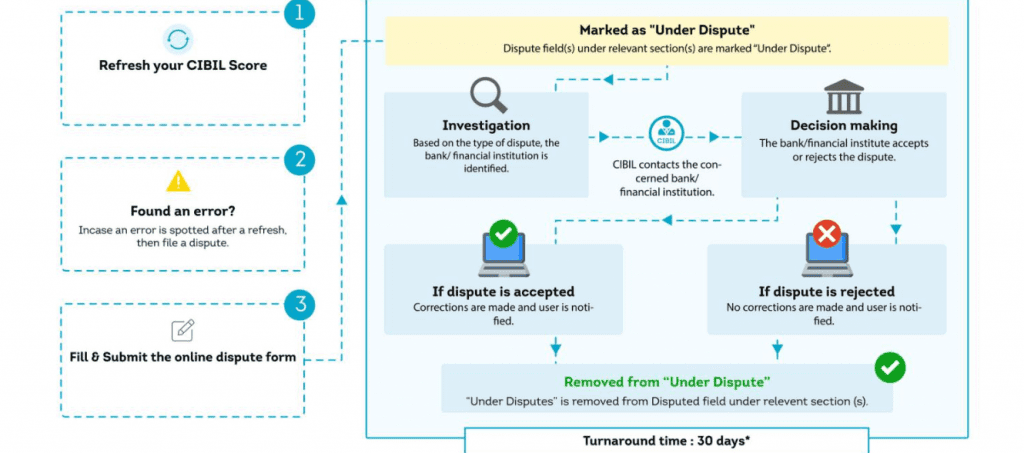

- Under Dispute When you submit your dispute, CIBIL marks the disputed items as “Under Dispute” in your report.

- Verification Process CIBIL contacts the respective lender to verify the information you provided.

- Resolution After the lender confirms the details, CIBIL updates your credit report with the necessary changes.

- Timeline The entire process can take up to 30 days. You will receive email updates every seven days and an SMS once CIBIL completes the correction.

Types of CIBIL Disputes

Understanding the nature of the errors in your report is the first step toward rectifying them. CIBIL disputes generally fall into two categories:

1. Individual Disputes

These involve inaccuracies in your personal information or account details:

- Personal Information Errors: Mistakes in your name, address, or date of birth. For example, “Sumit Malhotra” might be incorrectly listed as “Sumit Mehrotra.”

- Duplicate Accounts: A single loan account appearing multiple times, which can lower your credit score due to the inflated amount of credit.

2. Company/Commercial Disputes

These pertain to errors in company credit reports, such as incorrect ownership details or duplicate accounts. Authorized signatories can initiate the dispute resolution process by filling out the CIBIL dispute form.

Note: Certain information like account numbers, member names, enquiry dates, and control numbers cannot be changed through the dispute process.

Conclusion

Regularly reviewing your CIBIL report is essential to ensure all information is accurate. Discrepancies can hinder your financial opportunities, but by following the steps outlined above, you can effectively address any issues.

Frequently Asked Questions

Yes, you can dispute any incorrect information regardless of how old it is.

Certain details like account numbers, member names, enquiry dates, and control numbers cannot be altered through the dispute process.

No, CIBIL does not charge any fees for dispute resolution.

If you’re unsatisfied, you can escalate the issue by contacting the lender directly or seeking assistance from the banking ombudsman.

Yes, you should raise a dispute to have the status updated to “Closed” or “Settled” to reflect accurate information.

HDFC Home Loan

HDFC Home Loan SBI Home Loan

SBI Home Loan