Owning a home is one of the biggest financial commitments many people make, and protecting it with insurance is wise and necessary. However, home insurance premiums can sometimes strain the household budget, especially when costs rise unexpectedly. And we often wonder, how to reduce home insurance premiums?

The good news is that there are practical strategies to lower these expenses without compromising on essential protection. By taking a few proactive steps, homeowners can keep their premiums manageable while ensuring their property and belongings remain well-covered.

Factors Affecting Home Insurance Premiums

Understanding what drives your home insurance premium can help you make informed decisions when selecting or adjusting your policy. Here are some of the main factors insurers consider:

- Location of the Property: Homes in areas prone to floods, earthquakes, or high crime usually attract higher premiums due to increased risk.

- Age and Condition of the Home: Older homes may have outdated systems or wear and tear, increasing the chances of a claim and, therefore, the premium.

- Construction Materials: The materials used in your home’s construction —such as wood versus concrete—impact how well it can withstand damage, influencing the insurance cost.

- Replacement Cost: The amount it would take to rebuild your home from scratch affects how much coverage you need and, in turn, the premium.

- Coverage Type and Limits: Comprehensive policies or higher coverage limits are more expensive than basic plans with minimal protection.

- Claims History: If you’ve made several insurance claims in the past, insurers may consider you a higher-risk customer, leading to increased premiums.

Tips to Lower Home Insurance Premiums

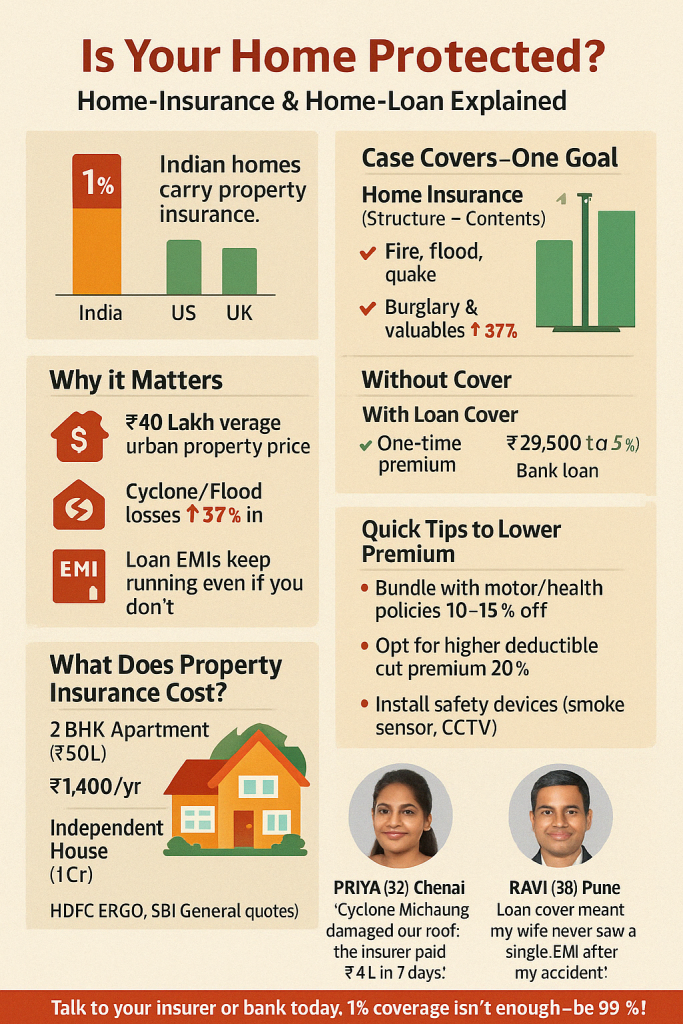

Home insurance doesn’t have to be expensive. With a few strategic decisions, you can enjoy robust coverage while keeping your premiums affordable. Here are some effective ways to reduce your property insurance costs:

Compare Policies

Don’t settle for the first quote you receive. Different insurers offer varying coverage options and pricing for similar policies. Use online aggregators or consult agents to compare multiple plans. This helps you identify the cheapest option and the one with the best value for money.

Opt for a Higher Deductible

A deductible is paid out of pocket before your insurance kicks in. Increasing your deductible can lower your premium, as you agree to bear a larger share of the initial cost in case of a claim. However, make sure the amount is affordable during emergencies.

Bundle with Other Insurance Plans

Many insurers offer discounts when you buy multiple policies from them, such as when you combine home and car insurance. Bundling not only saves money but also simplifies premium payments and policy management.

Keep Up with Home Maintenance

Well-maintained homes are less likely to suffer damage due to water leaks, electrical faults, or structural weaknesses. Insurers consider such homes to be lower risk, which can positively affect premium amounts.

Take Precautions Against Natural Disasters

Reinforcing your home to withstand floods, earthquakes, or cyclones can lower your premium. Depending on your region’s vulnerability, this could include using disaster-resistant materials or installing shutters, sump pumps, or seismic retrofitting.

Upgrade Your Home’s Security

Installing modern security systems such as CCTV cameras, burglar alarms, smoke detectors, or smart door locks reduces the risk of theft and fire. Insurers often offer discounts for homes equipped with these features as they lower the likelihood of claims.

Review and Update Coverage Limits Annually

Your home insurance needs can change over time. If you’ve sold valuables or completed renovations, you might not need as much coverage as before. Reviewing and updating your policy annually ensures you don’t overpay for unnecessary coverage.

Maintain a Good Credit Score

In India, insurers may consider your credit score when determining premium amounts. A high credit score reflects financial discipline and reduces your perceived risk as a policyholder, earning you lower rates.

Avoid Raising Small Claims

Filing frequent or small claims can lead to higher premiums or even the denial of future coverage. If the repair costs are manageable, it’s better to cover them to maintain a clean claims history and retain your no-claim bonus.

Ask for Discounts

Insurers may offer various discounts that aren’t always advertised. These could include deals for senior citizens, long-term policyholders, or for installing eco-friendly systems. Always ask your insurer about any applicable discounts before finalising a plan.

Buy a House in a Safe Neighbourhood

If you’re still in the home-buying stage, location matters. Homes in gated communities or areas with low crime rates and good civic infrastructure are considered lower risk and may attract lower insurance premiums.

Wondering about Home Insurance Premiums?

Buy Add-ons Wisely

Add-on covers like protection for jewellery, electronics, or rent cover can be useful but come at an additional cost. Evaluate your needs and avoid overloading your policy with unnecessary riders inflating your premium.

Lowering your home insurance premium doesn’t have to mean cutting corners on coverage. With a thoughtful approach, you can reduce your costs while safeguarding your most valuable asset.

By understanding the factors that influence your premium and making smart choices- like comparing policies, maintaining your home, and taking advantage of available discounts- you can strike the right balance between affordability and protection.

Conclusion

Lowering your home insurance premium isn’t about cutting back on protection—it’s about getting smart with the levers you control. By comparing plans every renewal cycle, investing in sensible security and maintenance upgrades, and steering clear of small, avoidable claims, you can keep costs in check without exposing yourself to financial risk. Pair those tactics with a healthy credit score and a policy review whenever your home or belongings change in value, and you’ll stay protected for less—year after year.

Ready to put these ideas into practice? Start by reviewing your current policy today, make notes on the quick‑fix improvements you can handle this month, and then shop around with at least three insurers for a fresh quote. Small, proactive steps now can translate into substantial savings—and lasting peace of mind—down the road.

Get the Best Home Loan Offers with Credit Dharma

Credit Dharma is your trusted partner for securing the best Home Loan offers, with over ₹500 Cr+ loans handled and partnerships with 20+ leading banks. We provide exclusive access to the lowest interest rates and a seamless, digital process with fast approvals in just 1-2 weeks, backed by lifetime support from our home loan experts.

Why choose Credit Dharma? We provide:

- Lowest Interest Rates: Save more with every EMI.

- Maximum Funding: Get up to 100% funding for your dream home.

- Simple & Digital Process: No tedious paperwork or branch visits.

- Expert Guidance: Lifetime support from our team of specialists.

Compare, choose, and secure the best Home Loan offer with Credit Dharma — your home loan journey starts here!

Frequently Asked Questions [FAQs]

Yes. Raising your deductible—the amount you pay out-of-pocket before insurance coverage kicks in—can significantly lower your annual premium. For instance, increasing your deductible from $500 to $1,000 could save you up to 25% on premiums.

Home improvements that can reduce insurance premiums include:

– Upgrading your roof to impact-resistant materials.

– Installing storm shutters or reinforcing windows.

– Updating outdated electrical, plumbing, or heating systems.

– Adding a sprinkler system or fire-resistant materials.

In most states, insurers use credit-based insurance scores to determine premiums. A higher credit score often leads to lower premiums, as it’s associated with lower risk. Improving your credit score by paying bills on time and reducing debt can help decrease your insurance costs.

HDFC Home Loan

HDFC Home Loan SBI Home Loan

SBI Home Loan