In an ambitious stride towards social equity and economic empowerment, the Kerala government has rolled out the LIFE Mission 2024—an affordable housing initiative aimed at providing homes to the state’s landless and homeless populations.

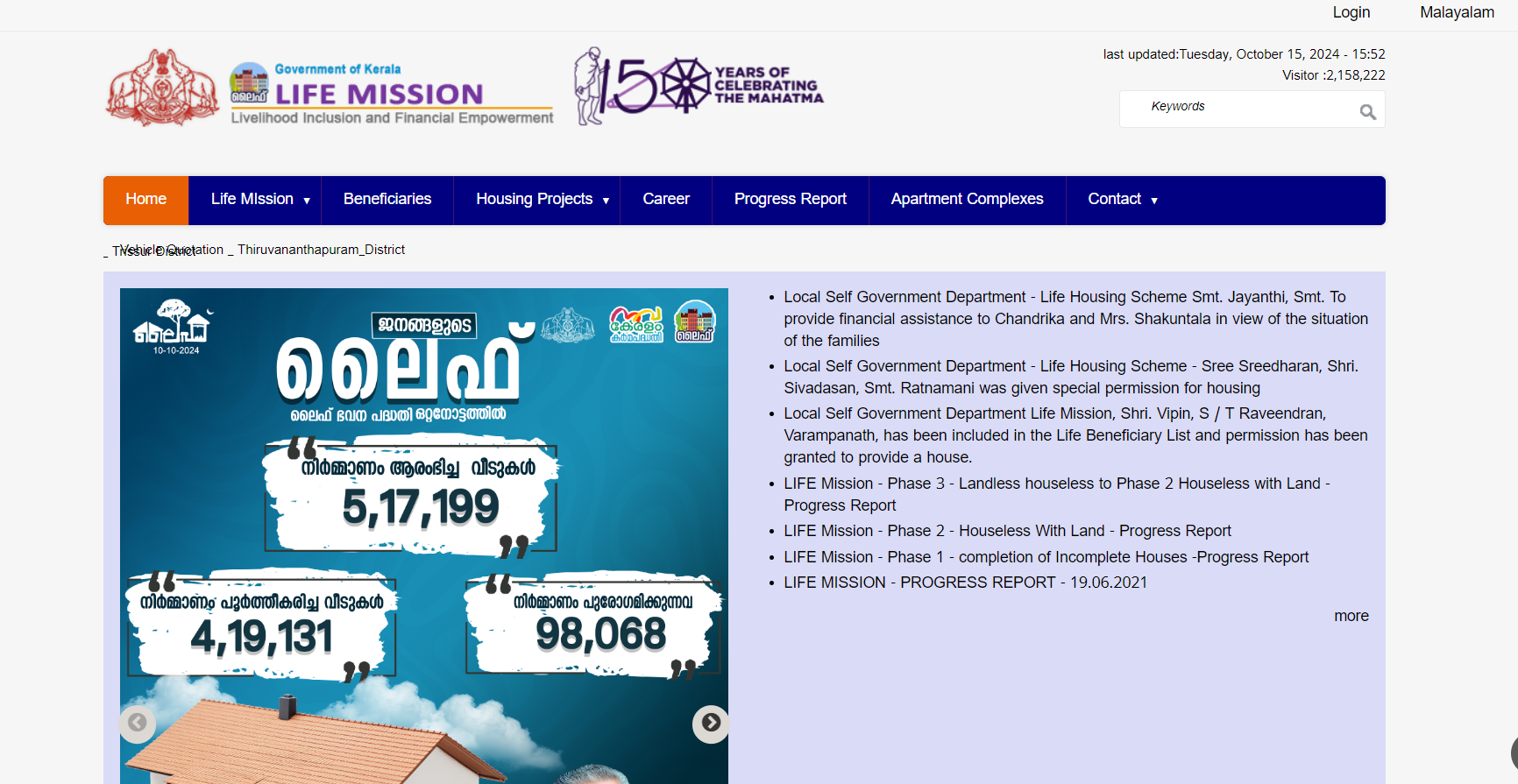

This comprehensive scheme, standing for Livelihood Inclusion and Financial Empowerment, envisions the construction of over 500,000 houses, marking a significant milestone in Kerala’s journey towards inclusive growth.

What is LIFE Mission Kerala?

LIFE (Livelihood, Inclusion, and Financial Empowerment) Mission is a comprehensive housing scheme launched by the Government of Kerala aimed at providing free houses to homeless and landless families in the state.

The mission has several key objectives:

- Provide affordable housing to economically weaker sections

- Improve public infrastructure

- Strengthen agriculture

- Enhance natural resource management

Key Features:

- Targets homeless and landless families in Kerala

- Offers houses to families with annual income not exceeding Rs 3 lakh

- Prioritizes Scheduled Tribes, Scheduled Castes, fishermen communities, and flood-affected sections

Progress and Achievements:

- Over 3.7 lakh houses have been constructed as of February 2024

- Total project spend estimated at over Rs 4,000 crore

- Funding raised from state agencies, local bodies, and the Union government

Eligibility Criteria:

- Must be a Kerala resident

- Must be landless

- Must have a state-issued ration card

- Annual income should not exceed Rs 3 lakh

- Government sector employees are not eligible

The mission goes beyond just providing housing, as it also aims to equip beneficiaries with vocational training and livelihood support, ultimately working towards the goal of ensuring every Kerala resident has a home and employment.

Data Source: Life Mission – Navakeralam Karma Padhathi – Government of Kerala.

Application Process: Step-by-Step Guide

Applying for the LIFE Mission Kerala housing scheme is straightforward and can be completed online. Here’s how:

Time needed: 2 minutes

Step-by-step application process:

- Register Online:

Kerala’s LIFE Mission: Progressing towards housing for all.

Kerala’s LIFE Mission: Progressing towards housing for all.

– Visit the LIFE Mission Kerala website.

– Click on “New Registration” and enter your mobile number and name to receive an OTP.

– Verify the OTP and create a secure password to complete the registration. - Log In:

Access your account using your mobile number and password.

- Check Eligibility:

Use the eligibility checker on the right side of the website.

Select the appropriate forms from the left side and proceed. - Provide Details:

– Enter your 10-digit ration card number.

– Fill in personal information, including address, Aadhaar number, caste, and community details.

– Provide bank account information and details about any land or buildings you own. - Upload Documents:

Prepare and upload necessary documents such as:

– Caste certificate

– Aadhaar card

– Income certificate

– Medical certificate (for differently-abled applicants)

– Ration card - Submit Application:

Review all entered information and click on “Submit Application.”

By focusing on landless and homeless individuals, the scheme aims to offer not just shelter but also avenues for sustainable livelihoods and social integration.

Also Read: Stamp Duty and Registration Charges in Kerala.

Selling a House Under LIFE Mission Kerala

Selling a house under the Kerala LIFE Mission comes with specific conditions and potential restrictions. Here are the key details:

Technical Possibility of Selling

It is technically possible to sell a plot with a LIFE Mission house, but there are important considerations:

- While there are no absolute technical barriers to selling, doing so may violate the original agreement with the executing authorities

- Selling the house could potentially breach the contract signed with the mission’s implementation officers

Conditions and Restrictions

The Kerala government has established guidelines for selling houses constructed under the LIFE Mission:

- Beneficiaries who have constructed houses with financial assistance from local self-government institutions face specific restrictions

- If selling becomes unavoidable, there are general standards and protocols that must be followed

Financial Implications

Selling a LIFE Mission house may involve:

- Potential repayment of the financial assistance received

- Possible penalties for breaching the original housing agreement

Recommendation

Before attempting to sell a LIFE Mission house, beneficiaries should:

- Carefully review their original contract

- Consult with local LIFE Mission authorities

- Understand the potential financial and legal consequences of selling

For specific details about selling a LIFE Mission house, it is advisable to contact the LIFE Mission directly at lifemissionkerala@gmail.com or call 0471 2335524.

Core Objectives of the LIFE Mission

The LIFE Mission Kerala targets four pivotal areas to ensure holistic development:

1. Affordable Housing:

Construction of cost-effective homes to make housing accessible to all eligible beneficiaries.

2. Public Infrastructure Development:

Enhancing the quality of living through improved infrastructure within housing complexes.

3. Agriculture Support:

Providing resources and support to beneficiaries engaged in agricultural activities, ensuring their economic stability.

4. Natural Resource Management:

Promoting sustainable practices to manage and conserve natural resources effectively.

With an estimated budget of over ₹4,000 crore, the funding for this mission is sourced from state agencies, local governments, the Union government, and various social sector organizations.

Alignment with National Housing Initiatives

The LIFE Mission Kerala aligns with the Union Government’s Pradhan Mantri Awas Yojana (PMAY) by modifying its framework to better suit the state’s unique socio-economic landscape.

The goal is to construct 500 square feet of houses at a cost of ₹4 lakhs each, making homeownership attainable for nearly 430,000 homeless individuals over the next five years.

This initiative not only provides housing but also integrates essential social services such as primary healthcare, skill development programs, and financial services within the housing complexes.

Also Read: PMAY Housing Scheme Details in 2025.

Who Benefits from the LIFE Mission Kerala?

The scheme is tailored to support:

- Homeless Individuals: Those without any permanent residence.

- Incomplete Housing Beneficiaries: Individuals who have received partial aid from other schemes but have yet to complete their housing projects.

- Temporary Shelter Residents: People residing in temporary government-run shelters, especially in coastal and plantation areas.

Priority is accorded to marginalized communities, including Scheduled Castes, Scheduled Tribes, economically weaker sections (EWS), fishermen, and those affected by natural calamities.

LIFE Mission Kerala: Eligibility Criteria

To qualify for a house under the LIFE Mission, applicants must:

- Be a resident of Kerala.

- Be landless, as indicated by their ration card.

- Have an annual income not exceeding ₹3 lakhs.

- Not be employed by the government.

- Possess a state-issued ration card.

Selection Process for LIFE Mission Kerala

Once applications are submitted, officials cross-reference them with the Union Government’s socio-economic caste survey (2011). Field officers conduct on-site verifications to authenticate the information provided. Successful applicants are listed as beneficiaries, and those not selected have the option to appeal at the Panchayat level.

Progress and Achievements of LIFE Mission Kerala

As of January 2024, the LIFE Mission Kerala has made significant strides:

- Housing Units Completed: Over 367,867 houses across various districts, including major cities like Thiruvananthapuram, Kochi, and Kozhikode.

- Funding: The project has received substantial financial backing, with ₹375 crore from HUDCO in July 2019 and an additional ₹350 crore allocated by the state government in August 2024.

- Ongoing Construction: More than 150,000 homes are currently under construction, with numerous housing complexes completed to date.

LIFE Mission Kerala Contact Information

For inquiries and assistance regarding the LIFE Mission Kerala Housing Scheme, you can reach out through the following channels:

- Helpline Number: 0471 2335524

- Email: lifemissionkerala@gmail.com

- Office Address: BSNL Bhawan, 3rd Floor, Uppalam Road, Statue, Thiruvananthapuram – 695001

Conclusion: A Step Towards Inclusive Growth

The LIFE Mission Kerala is a testament to the state’s dedication to fostering an inclusive society where everyone has access to safe and affordable housing.

By addressing the needs of marginalized communities and integrating essential social services, the initiative provides shelter and paves the way for economic empowerment and social integration.

As the scheme progresses, it promises to transform the lives of millions and foster a more equitable and prosperous Kerala.

Contact Credit Dharma today for expert guidance and personalized support to secure the best home loan tailored to your needs. Let us help you achieve your homeownership goals with ease and confidence.

8 minutes

Frequently Asked Questions [FAQs]

The LIFE Mission Kerala 2024 (Livelihood Inclusion and Financial Empowerment Mission) is an affordable housing initiative by the Kerala government. It aims to construct over 500,000 houses for landless and homeless individuals, integrating social services to enhance beneficiaries’ quality of life and promote sustainable livelihoods.

Eligible applicants must be Kerala residents, landless as per their ration card, with an annual income below ₹3 lakh. Government employees cannot apply. Priority is given to Scheduled Castes, Scheduled Tribes, economically weaker sections, fishermen, and those from flood-affected or plantation areas.

Applications are cross-referenced with the Union Government’s socio-economic caste survey (2011). Field officers conduct on-site verifications to confirm details. Successful applicants are listed as beneficiaries on the official website. Unlisted applicants can appeal at the Panchayat level for reconsideration.

Benefits include affordable 500 sq. ft houses costing ₹4 lakhs each, integration of social services like health care and skill development, livelihood support, improved public infrastructure, and assistance in agriculture and natural resource management, ensuring comprehensive support for beneficiaries’ well-being.

The Kerala LIFE Mission provides housing support with each house costing Rs. 4 lakhs, funded through contributions from central, state, and local governments.

The houses are typically 500 square feet in size and designed for homeless and landless families.

The mission aims to construct around 4.30 lakh houses over five years, with a total project cost exceeding Rs. 4,000 crore.

Beneficiaries receive financial assistance, and each house comes with an additional insurance cover of Rs. 4 lakhs for three years.

The program is a comprehensive effort to address housing needs for economically disadvantaged families in Kerala, ensuring affordable and secure living spaces.

The income limit for the Kerala LIFE Mission housing scheme is Rs. 3 lakhs per year. Applicants with an annual income exceeding this amount are not eligible to apply for the housing scheme. This income criterion is one of the key eligibility requirements, along with being a resident of Kerala and being landless

HDFC Home Loan

HDFC Home Loan SBI Home Loan

SBI Home Loan