The minimum CIBIL score required for an SBI home loan is generally considered to be 650.

However, while SBI does not specify a strict minimum score, having a CIBIL score above 650 significantly improves your chances of loan approval.

It can lead to better interest rates and loan terms. Scores below 650 may result in loan rejection or higher interest rates.

In this blog, we discuss expert tips on improving your chances of getting a home loan from SBI even with a low CIBIL score.

Can you get a Home Loan from SBI? Check your Home Loan Eligibility Score now.

Our Home Loan Score tool combines your income and credit profile to give you a full picture of your home loan eligibility:

How Do SBI Home Loan Interest Rates Change As Per The CIBIL Score?

The SBI home loan offer varies significantly based on the applicant’s CIBIL score, impacting interest rates, fees, and other loan terms.

Here’s a table showing how your SBI home loan interest rate changes according to your CIBIL score

| CIBIL Score Range | Interest Rate Range | Comments |

|---|---|---|

| 800 and above | 8.15% p. a. Onwards | Best Credit Worthiness: Lowest rate, rapid approval, higher loan limit, longer tenure, full concessions. |

| 750 – 799 | 8.25% – 8.35%* p. a. | Great Credit Profile: Competitive rate, quick approval, high eligibility, campaign fee waivers possible. |

| 700-749 | 8.35% – 8.45%* p. a. | Good Credit Profile: Moderate rate, approval likely with extra checks, limited premium offers, stay disciplined to prevent hikes. |

| 650-699 | 8.45% – 8.65%* p. a. | Fair Credit Score: Higher rate, slower processing, strict checks, bigger down payment, smaller loan, no concessions. |

| 550-649 | 8.65% – 8.85%* p. a. | Poor Credit Score: Sanction uncertain; high rate, stricter terms: co‑applicant or collateral, higher fees, shorter tenure, capped amount. |

| Below 550 | Above 10.15% | Very Poor Credit Profile: Usually declined; rare approvals come with very high rates and the toughest terms. It is advised to improve the score first before loan application. |

How do SBI home loan processing charges change with different CIBIL Scores?

Typically, processing fees are the same for all borrowers, but you are eligible for special loan offers if you have a great credit profile.

- Some special schemes like SBI Privilege Home Loan or SBI Shaurya Home Loan offer a full waiver on processing fees.

- Foreclosure or prepayment charges are generally nil for SBI home loans, which is beneficial for borrowers.

- The processing fee for SBI home loans typically starts at 0.25% to 0.35% of the loan amount, with a minimum and maximum cap (e.g., minimum Rs. 2,000 and maximum Rs. 10,000), and this fee is generally consistent regardless of the CIBIL score.

Additional impact of your credit profile on home loan approvals

- Concessions and Premiums: Women borrowers receive a 0.05% interest rate concession, applicable irrespective of the CIBIL score but subject to minimum effective borrowing rate (EBR).

- Loan Amount and Tenure: While the maximum tenure can be up to 30 years, approval for longer tenures and higher loan amounts is easier with higher CIBIL scores.

- Loan Sanction Probability: SBI does not sanction home loans for applicants with CIBIL scores below 550. For scores between 550 and 650, loans might be approved but at a premium interest rate and possibly stricter scrutiny.

- External Benchmark Linked Rate: SBI home loans are linked to the External Benchmark Lending Rate (EBLR), which fluctuates with market conditions, but the base rate offered depends on the applicant’s creditworthiness including CIBIL score.

How to Check Your CIBIL Score Before Applying for SBI Home Loan?

You can easily check your credit score for free on Credit Dharma’s platform itself. Just enter your phone number and get your most updated credit score

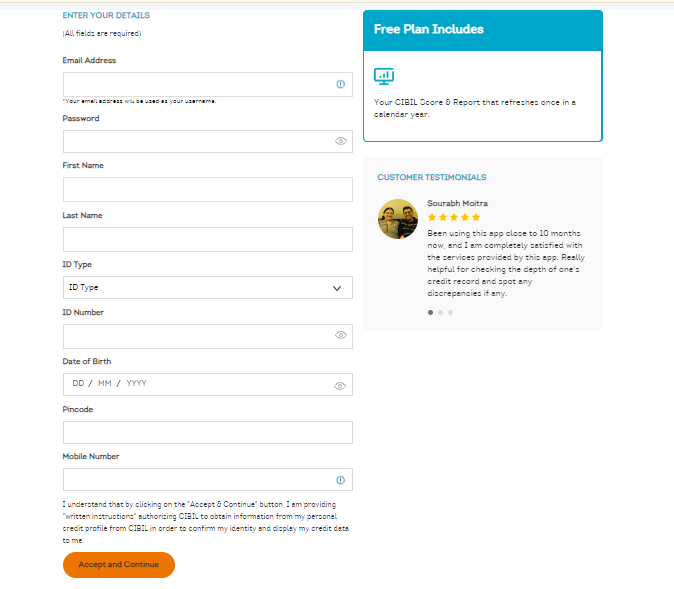

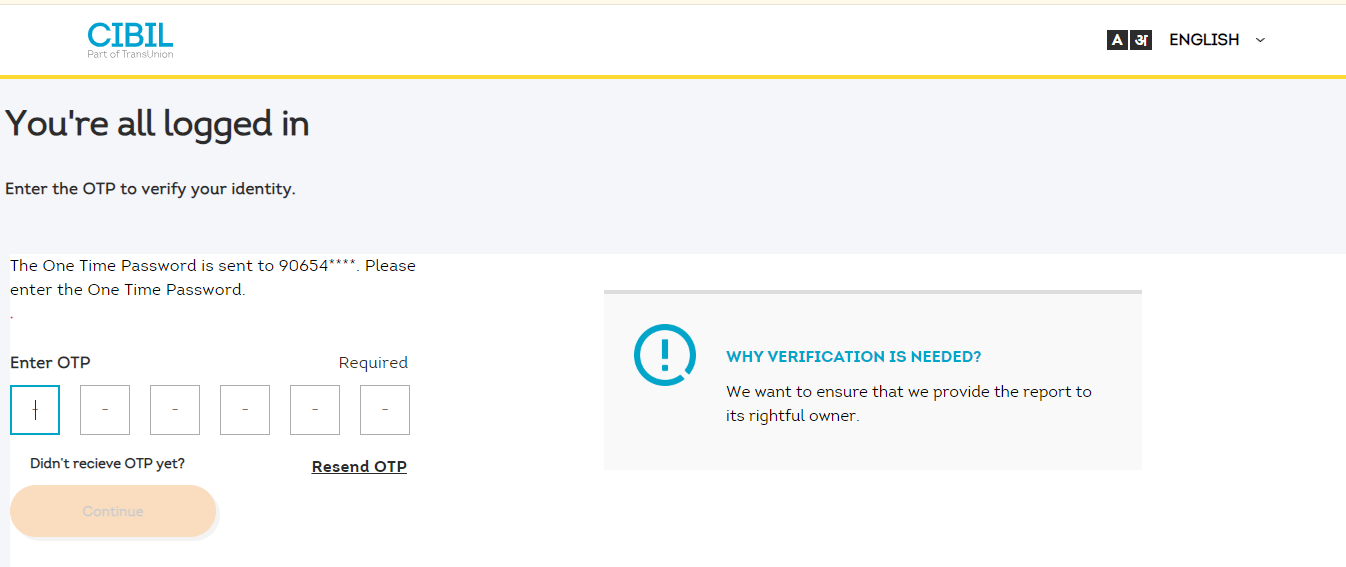

- Navigate to the official website of CIBIL.

- Click on Get Your FREE CIBIL Score

- Enter your basic details, including, Email Address, Name, ID Proof (PAN CARD), Date of Birth, and Mobile Number. Click on Submit.

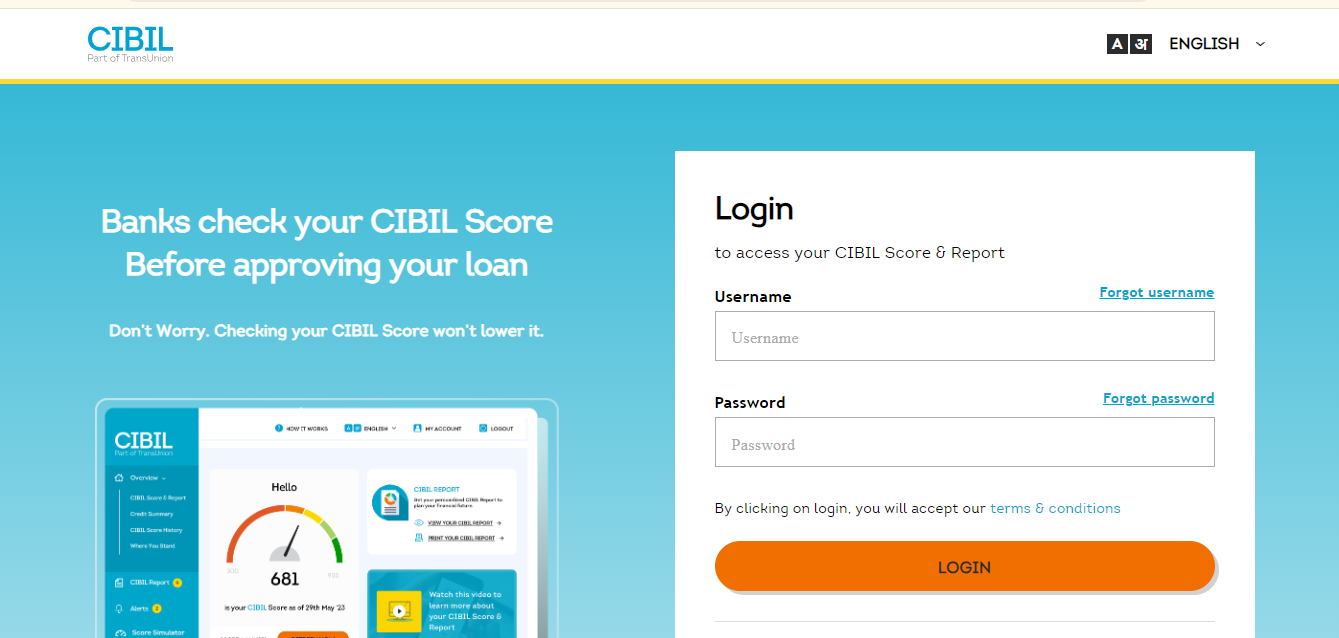

- Once you have created your account, login using your Email ID and Password.

- An OTP will be sent to your registered mobile number, enter the OTP and proceed.

- Your CIBIL Score will be displayed on the screen.

Read More: CIBIL Score Check Free Online by PAN Number

How to Get CIBIL Score Report Offline?

- Download the application form from the CIBIL website. Free CIBIL Score and Report.

- Fill out the form accurately with all your required details.

- You’ll need to pay a fee to acquire your CIBIL report. The amount varies depending on whether you just want the score or the detailed report.

- For both the CIBIL score and the complete report, the fee is Rs. 550.

- To receive only the CIBIL report, the fee is Rs. 164.

- Make a demand draft (DD) payable to “TransUnion CIBIL Limited” for the chosen amount.

- Mail the completed application form along with the DD to the following address:

TransUnion CIBIL Limited

One India Bulls Centre, Tower 2A, 19th Floor

Senapati Bapat Marg, Elphinstone Road

Mumbai – 400013

Download CIBIL Score Application Form here

Key Benefits of a Good CIBIL Score for SBI Home Loans

- A high CIBIL score speeds up the SBI home loan approval process.

- It helps you secure lower interest rates on your home loan.

- A good score increases the maximum loan amount you can get.

- It allows you to choose from more flexible EMI and repayment options.

- You gain better negotiating power on interest rates and fees.

- It leads to faster disbursal of your sanctioned home loan.

- You become eligible for top-up loans with minimal checks.

- Lenders trust your profile more, reducing the chances of rejection.

Planning To Get a Home Loan From SBI?

Check your CIBIL Score Now to Unlock The Best Offers!

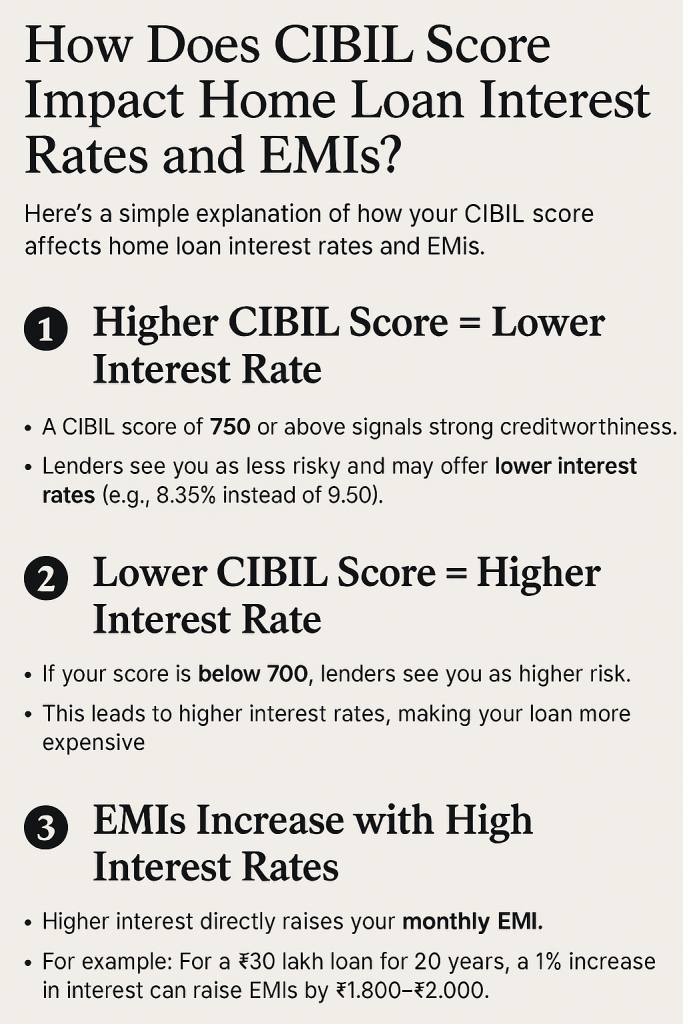

How Does CIBIL Score Impact Home Loan Interest Rates and EMIs?

Here’s a simple explanation of how your CIBIL score affects home loan interest rates and EMIs:

1. Higher CIBIL Score = Lower Interest Rate

- A CIBIL score of 750 or above signals strong creditworthiness.

- Lenders are more confident and may offer lower interest rates (e.g., 8.35% instead of 9.50%).

2. Lower CIBIL Score = Higher Interest Rate

- If your score is below 700, lenders see you as a higher risk.

- This leads to higher interest rates, making your loan more expensive.

3. EMIs Increase with High Interest Rates

- Higher interest directly raises your monthly EMI.

- Example: For a ₹30 lakh loan for 20 years, a 1% increase in interest can raise EMIs by ₹1,800–₹2,000.

How Does Adding a Co-Applicant Improve Your CIBIL Score Eligibility?

Adding a co-applicant to your loan application can significantly improve your CIBIL score eligibility. When you apply with a co-applicant, the lender considers both incomes, which boosts your overall repayment capacity. This makes it easier to qualify for higher loan amounts.

If your co-applicant has a strong CIBIL score, it strengthens your application and increases the chances of approval, especially if your own score is low.

Lenders also view joint applications as less risky, which can lead to better interest rates. Over time, if you repay the loan on time, it helps improve both your and your co-applicant’s credit scores.

This strategy is especially useful for those with a limited credit history or lower income, as it makes the application more stable and creditworthy.

How to Improve Your CIBIL Score in 3 Months?

- Pay all bills/EMIs on time to maintain a flawless payment history.

- Reduce credit card utilization below 30% of your total limit.

- Clear high-interest debts first (e.g., credit cards, personal loans).

- Avoid applying for new credit to prevent hard inquiries.

- Check and dispute errors in your CIBIL report immediately.

- Maintain a balanced credit mix (secured loans like home loans, unsecured loans like credit cards).

- Don’t close old credit accounts to preserve credit history length.

- Use a credit monitoring tool to track progress and alerts.

- Pay credit card bills in full instead of minimum payments.

- Request a credit limit increase (if possible) to lower the utilization ratio.

Alternative Financing Options for Borrowers with Low CIBIL Scores

- Non-Banking Financial Companies (NBFCs): Offer home loans to low CIBIL scorers with higher interest rates or collateral requirements.

- Co-Signer/Co-Borrower: Add a family member with a strong credit profile to strengthen the application.

- Secured Loans Against Assets: Use gold, fixed deposits, or property as collateral for loans (e.g., gold loans, loan against FD).

- Government Housing Schemes: Explore PMAY (Pradhan Mantri Awas Yojana) subsidies or affordable housing schemes with relaxed eligibility.

- Loan Against Property (LAP): Use an existing property as collateral for a secured loan (even with low CIBIL).

Conclusion

Securing a home loan with SBI significantly depends on your CIBIL score. By understanding and proactively managing your creditworthiness, you enhance your chances of approval and favorable loan terms.

Even if your current credit score is low, Credit Dharma can help you get a home loan by leveraging their expertise and tailored solutions to work around credit challenges.

Frequently Asked Questions

A CIBIL Score is a three-digit number ranging from 300 to 900 that reflects your creditworthiness. Factors influencing it include payment history, credit utilization, length of credit history, types of credit used, and recent credit inquiries.

While SBI does not specify a minimum CIBIL Score for home loan approval, a score of at least 650 is generally considered good, with higher scores (closer to 900) improving approval chances and loan terms.

SBI evaluates your creditworthiness by reviewing your CIBIL Score, which reflects your credit history and repayment behavior, aiding in determining loan eligibility and terms.

You can check your SBI CIBIL Score for free through the official CIBIL website or platforms like Credit Dharma, which offer free credit score checks.

Regular monitoring helps you maintain a good credit score, detect inaccuracies early, and protect against identity theft or fraud, ensuring better loan approval chances.

Improvement strategies include timely payment of dues, maintaining a low credit utilization ratio, having a healthy mix of credit types, applying for new credit cautiously, and regularly reviewing your credit history.

Member banks and financial institutions are required to share the credit information of all their customers with CIBIL monthly; exclusion from this reporting process is not permitted.

Both the primary applicant’s and co-applicant’s CIBIL Scores are considered; higher scores from both can enhance loan approval chances and may lead to better terms.

Dispute any inaccuracies by contacting CIBIL directly and notifying the respective bank or financial institution to ensure corrections are made.

It is challenging to secure an SBI home loan with a CIBIL score below 650. Applicants with lower scores may face higher interest rates or stricter loan terms. Improving your credit score before applying is advisable.

HDFC Home Loan

HDFC Home Loan SBI Home Loan

SBI Home Loan