7 minutes

Gone are the days of long queues and paperwork. Paying your Gurgaon property tax online has never been easier. This article will walk you through the entire online payment process, highlighting the necessary steps, required documents, and common pitfalls to avoid, ensuring a seamless experience for all property owners.

How to Pay Gurgaon Property Tax Online?

Paying Gurgaon property tax online is a streamlined process available through the Municipal Corporation of Gurgaon’s official website, enabling property owners to complete transactions securely and efficiently from any location.

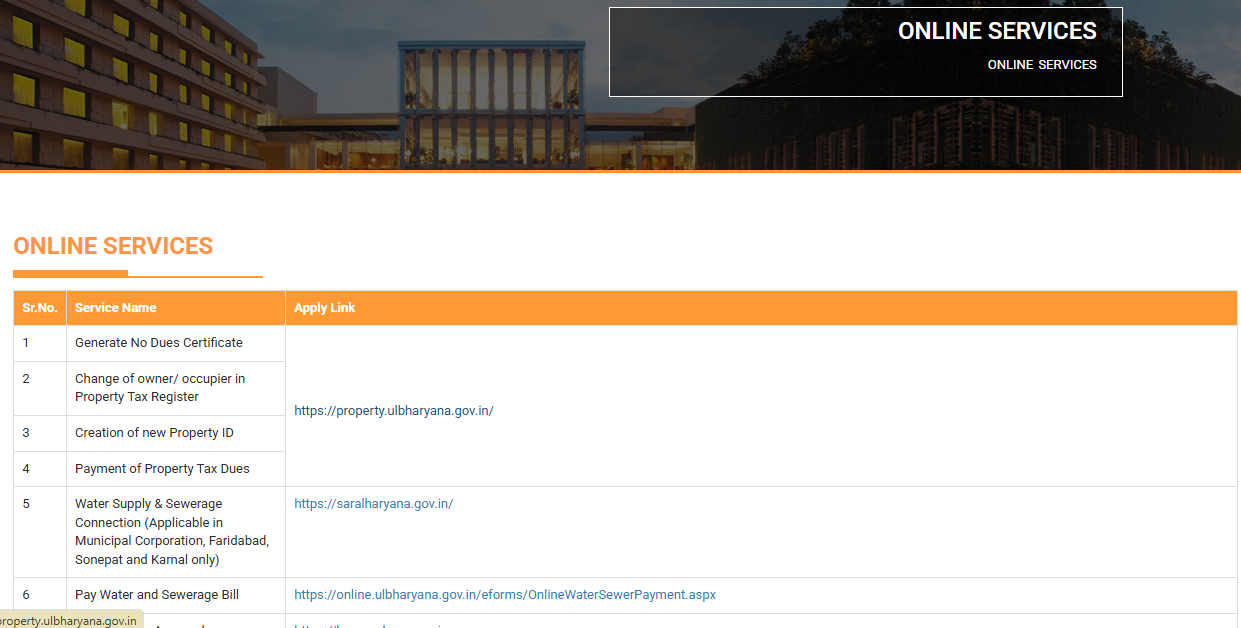

- Go to the official website of Municipal Corporation of Gurgaon.

- On the dashboard, click on “Online Services”

- Click on “Payment of Property Tax Dues”

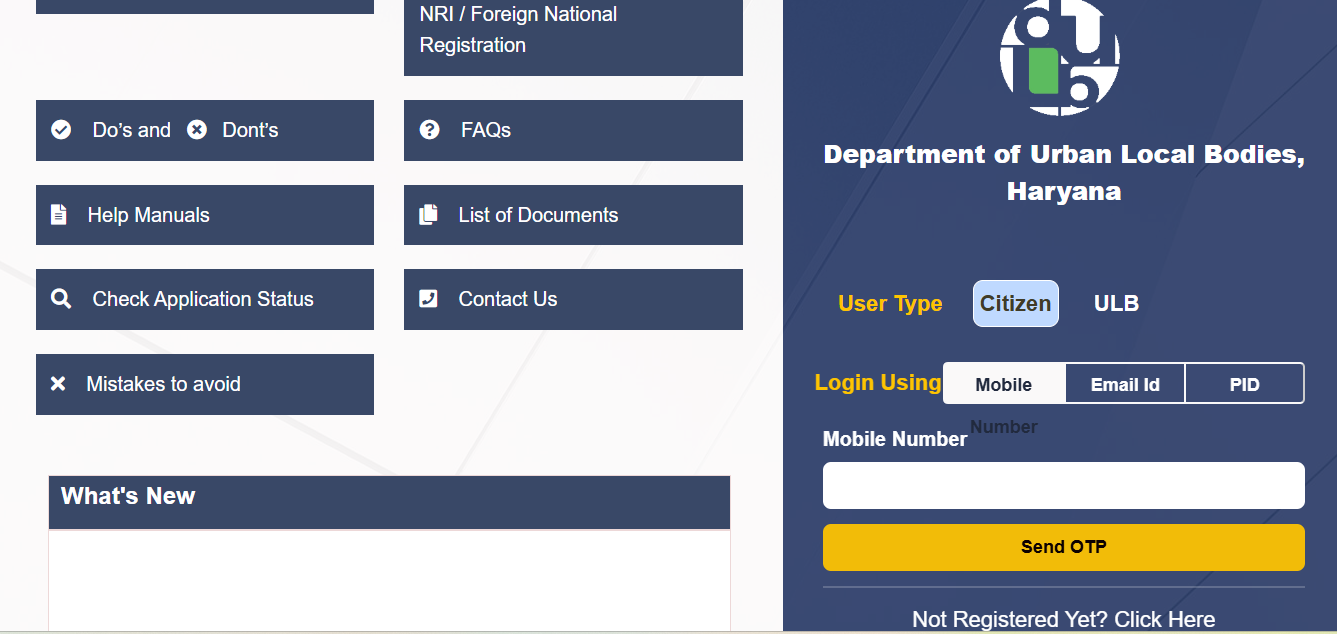

- Sign in using your mobile number, email address, or property ID.

- Enter Property Details

Input your unique property ID, along with the locality, owner’s name, and complete property address.

- View Tax Amount

The system will automatically calculate and display the property tax due for the selected year, including any outstanding arrears.

- Choose the Payment Method

Select your preferred payment option, such as debit/credit card or net banking, and proceed with the payment.

- Receive Confirmation

After the payment is successfully processed, a receipt will be generated, which you can download or save for your records.

Read More: Gurgaon Circle Rates

How to Pay MCG Property Tax Offline?

For those who prefer traditional methods, the Municipal Corporation of Gurgaon (MCG) provides offline channels to pay property tax, including designated payment centers and authorized banking institutions.

- Go to the Municipal Corporation of Gurgaon office or any nearby property tax center available throughout the city.

- Present your property ID, name, and complete address to the staff at the counter.

- Select to pay either by cash or using a debit/credit card.

- Finalize your payment and obtain an official receipt as proof of payment.

MCG Property Tax Rates for Various Property Types

The Municipal Corporation of Gurugram (MCG) imposes property taxes based on the type and size of properties. Below is a comprehensive overview of the tax rates applicable to different categories of properties:

1. Residential Properties (Independent Houses)

| Area (in sq yards) | Tax Rate (₹ per sq yard per year) |

|---|---|

| Up to 300 | ₹1 |

| 301 to 500 | ₹4 |

| 501 to 1,000 | ₹6 |

| 1,001 to 2 acres | ₹7 |

| Above 2 acres | ₹10 |

Notes:

- These rates apply to properties with only a ground floor.

- Owners with additional floors receive a tax rebate:

- 40% discount for the first floor.

- 50% discount for the second floor.

- If each floor is owned separately, no rebate is available.

- Basements used exclusively for parking are exempt from property tax.

2. Residential Flats in Housing Societies

| Carpet Area (in sq ft) | Tax Rate (₹ per sq ft per year) |

|---|---|

| Up to 2,000 | ₹1 |

| 2,001 to 5,000 | ₹1.20 |

| Above 5,000 | ₹1.50 |

3. Vacant Residential Plots

| Plot Size (in sq yards) | Tax Rate (₹ per sq yard per year) |

|---|---|

| Up to 100 | Nil |

| 101 to 500 | ₹0.50 |

| Above 500 | ₹1 |

4. Commercial Properties (Shops)

| Area (in sq yards) | Tax Rate (₹ per sq yard per year) |

|---|---|

| Up to 50 | ₹24 |

| 51 to 100 | ₹36 |

| 101 to 500 | ₹48 |

| 501 to 1,000 | ₹60 |

Notes:

- These rates apply to shops located on the ground floor.

- Owners of entire buildings receive a tax rebate:

- 40% discount for the first floor.

- 50% discount for the second floor.

- For leased portions of the space, a rate of 1.25 times the standard rate is applicable.

5. Industrial and Institutional Properties

| Plot Size (in sq yards) | Tax Rate (₹ per sq yard per year) |

|---|---|

| Up to 500 | Nil |

| 501 and above | ₹5 |

6. Paying Guest (PG) Accommodations

- PG accommodations are classified as ‘lodging houses’ for tax purposes.

- The tax rate is ₹1,000 per bed per year.

Read More: Home Loan in Gurgaon

Get a Home Loan

with Highest Eligibility

& Best Rates

Gurgaon Property Tax Rebate Eligibility Criteria

Eligibility for a Gurgaon property tax rebate is determined by specific criteria established by local authorities, ensuring that only qualified property owners receive financial relief based on defined conditions.

| Rebate Type | Eligibility Criteria | Rebate Percentage | Deadline |

|---|---|---|---|

| Early Payment Rebate | Pay tax dues before July 31 of the assessment year | 10% | July 31 of the assessment year |

| One-Time Settlement Rebate | Clear all outstanding tax arrears within 45 days of notification issuance | 30% | Within 45 days of notification issuance |

Read More: Luxury Properties For Sale in Gurgaon

Gurgaon Property Tax: Special Category Exemptions

Special category exemptions for Gurgaon property tax are available to certain groups of property owners, allowing them to benefit from reduced or waived tax obligations in accordance with regulatory provisions.

Freedom Fighters and Their Spouses

- Exemption: Full exemption for self-occupied residential properties.

- Requirements: Certificate of recognition as a freedom fighter and proof of property ownership.

Defence and Paramilitary Personnel

- Exemption: Full exemption for self-occupied residential properties owned by serving or retired personnel and their families.

- Requirements: Service or discharge certificate, proof of property ownership, and a self-declaration of self-occupation.

Families of Deceased Soldiers

- Exemption: Full exemption for self-occupied residential properties.

- Conditions:

- No ownership of other residential properties in Haryana.

- The property must not be sub-let.

- Requirements: Death certificate of the soldier, proof of relationship, property ownership documents, and a self-declaration of no other residential property ownership in Haryana.

Religious Properties

- Requirements: Registration documents of the religious institution and proof of property ownership.

- Exemption: Buildings and land attached to religious establishments such as temples, gurudwaras, mosques, or churches are exempt from property tax.

Read More: Real Estate Development Near Dwaraka Expressway

Gurgaon Property Tax: Rebate Application Process and Documentation

The rebate application process for Gurgaon property tax involves submitting the required documentation and following the prescribed procedural steps to ensure accurate evaluation and approval by the municipal authorities.

Early Payment and One-Time Settlement Rebates

- Process: Rebates are automatically applied when payments are made within the specified timeframes. No separate application is required.

- Documentation:

- Property Identification Number (Property ID)

- Payment receipts for records

For Special Exemptions

| Category | Exemption | Conditions | Required Documentation | Process |

|---|---|---|---|---|

| Freedom Fighters and Their Spouses | Full exemption for self-occupied residential properties | NA | – Certificate of recognition as a freedom fighter – Proof of property ownership | Submit application with documents to Municipal Corporation of Gurgaon (MCG) |

| Defence and Paramilitary Personnel | Full exemption for self-occupied residential properties owned by serving or retired personnel and their families | NA | – Service or discharge certificate – Proof of property ownership – Self-declaration of self-occupation | Submit application with documents to MCG |

| Families of Deceased Soldiers | Full exemption for self-occupied residential properties | – No ownership of other residential properties in Haryana – Property must not be sub-let | – Death certificate of the soldier – Proof of relationship – Property ownership documents – Self-declaration of no other residential property ownership in Haryana | Submit application with documents to MCG |

| Religious Properties | Exemption for buildings and land attached to religious establishments (e.g., temples, gurudwaras, mosques, churches) | NA | – Registration documents of the religious institution – Proof of property ownership | Submit application with documents to MCG |

Read More: Everything You Should Know About Trump Towers

MCG Gurgaon Property Tax: Grievance Redressal

Residents can easily report their concerns by calling the toll-free helpline at 1800-180-1061, which connects them directly to the appropriate officials. This service eliminates the need for in-person visits to MCG offices, providing a convenient and effective solution for managing property tax grievances.

Read More: Land Prices in 2025

Frequently Asked Questions

The deadline is July 31st each year.

A 10% rebate is available if you pay by the deadline.

Late payments incur a 1.5% monthly interest and additional fines.

Unpaid taxes can hinder loan approval and increase interest rates.

You can pay online via the MCG website or offline at collection centres and banks.

HDFC Home Loan

HDFC Home Loan SBI Home Loan

SBI Home Loan