1 minute

In Tamil Nadu, Patta Chitta plays a crucial role in land ownership and property transactions. Whether you are looking to view Patta Chitta online or need to understand the difference between Patta and Chitta, it’s essential to know how these documents impact land ownership. A Patta is an official document that serves as proof of ownership, while Chitta provides information about the land’s classification and usage.

The Tamil Nadu government has made it easier than ever to access TN Patta records online. Now, you can effortlessly access Tamil Nadu Patta Chitta through online portals to view your Patta or Chitta Patta in just a few steps. In this blog, we’ll guide you on how to check your Patta Tamil Nadu and explore the online services for TN Patta Chitta.

Difference Between Patta and Chitta

| Aspect | Patta | Chitta |

|---|---|---|

| Definition | Official document proving land ownership. | Document providing information about land classification and usage. |

| Issued By | State government. | Village Administrative Officer (VAO). |

| Content | Includes owner’s name, survey number, land area, and tax info. | Specifies whether the land is wetland (Nanjai) or dryland (Punjai), size, and ownership history. |

| Purpose | Establishes legal ownership of land. | Describes land classification and historical usage. |

| Importance | Used for property transactions, loans, and legal matters. | Provides details about land classification and historical land usage. |

| Current Status | Merged with Chitta to create Patta Chitta in 2015. | Merged with Patta to create Patta Chitta in 2015. |

How to Check Patta Chitta Record Online in Tamilnadu?

To access Patta Chitta records, follow these simple steps:

- Visit the online website https://eservices.tn.gov.in/eservicesnew/index.html

- From the dropdown menu, select your district.

- Choose your area type (Rural or Urban).

- Click on the ‘Submit’ button.

- Select the following options from the available dropdowns:

Taluk

Town

Ward

Block - Enter the Survey Number and Sub Division Number as mentioned in the instructions.

- Type in the Authentication Value shown on the screen.

- Finally, click the ‘Submit’ button to view the Patta Chitta details.

What is Patta and Chitta?

Patta and Chitta are fundamental land records in Tamil Nadu and are essential for property transactions and home loan applications. These documents provide crucial information about land ownership and classification, playing a vital role in the property market.

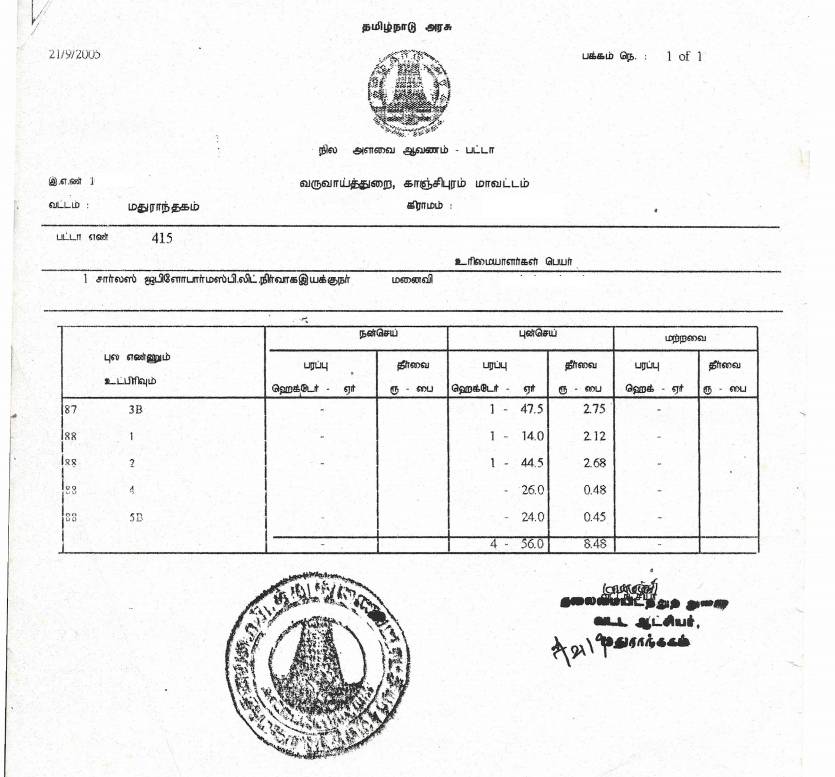

Patta: The Ownership Document

Patta, also known as “Pattathar” or “Pattedar,” is a legal document that establishes ownership of a piece of land. It serves as a primary proof of ownership, recognized by government authorities and financial institutions.

Key features of Patta include:

- Survey number of the land

- Owner’s name and details

- The extent of the land (in square feet or acres)

- Tax assessment details

According to recent statistics, approximately 92% of registered properties in Tamil Nadu have a corresponding Patta document.

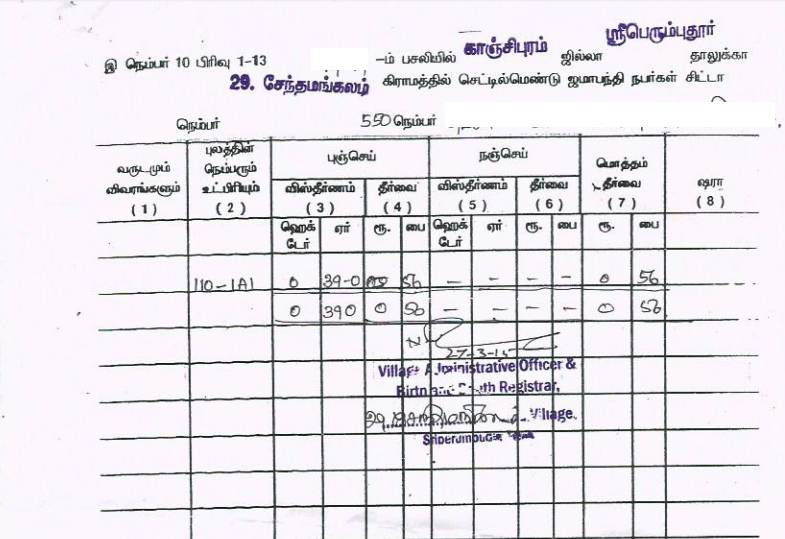

Chitta: Land Classification Record

Chitta is a land revenue record maintained by the Village Administrative Officer (VAO). It categorizes land based on its type and usage.

Important aspects of Chitta include:

- Classification of land (e.g., wetland or dry land)

- Survey number

- Sub-division details

- Owner’s name

For prospective homebuyers, familiarizing yourself with Patta and Chitta can:

- Reduce the risk of property disputes by up to 65%

- Increase transparency in property transactions by 80%

- Improve chances of loan approval by approximately 40%

It’s important to note that while Patta and Chitta are primarily used in Tamil Nadu, similar land record systems exist in other states under different names. Always consult local authorities or legal experts for region-specific information.

How to Obtain Chitta and Patta

Obtaining Patta and Chitta documents is a critical step in the home loan process. In Tamil Nadu, the process has been streamlined with the introduction of online services.

Here’s a detailed guide on how to obtain these essential land details for your home loan:

Online Application Process:

- Visit the Tamil Nadu e-Services portal (https://www.tnreginet.gov.in/)

- Select “Patta/Chitta” from the available services

- Choose your district and taluk

- Enter the survey number and subdivision number

- Pay the required fee (typically Rs. 20-50)

- Download the digitally signed copy

Required Documents: To apply for Patta and Chitta, you’ll need:

- Sale deed copy

- Latest property tax receipt

- Identification proof (Aadhaar card, PAN card, or Voter ID)

- Passport-size photographs

- Previous Patta copy (if available)

Processing Time:

- Online verification: Instant

- New Patta issuance: 15-30 days

- Chitta extract: 1-3 working days

Patta Registration Process

The Patta registration process is a critical step in securing land details for home loans. Here’s a detailed breakdown of the process:

- Application Submission:

- Fill out the Patta registration form (Form 23)

- Attach the necessary documents:

- Original sale deed

- Property tax receipts

- ID proof (Aadhaar, PAN, etc.)

- Passport-sized photographs

- Submit to the local Taluk office or online through the Tamil Nadu e-Services portal

- Pay the registration fee (varies by property value, typically 1-2% of the property cost)

- Document Verification:

- Officials verify submitted documents (takes 7-10 working days)

- 70% of applications pass this stage without issues

- Field Verification:

- Revenue officials conduct a site visit

- They verify property boundaries and measurements

- This step takes 5-7 working days on average

- Record Update:

- If verification is successful, land records are updated

- This process is completed in 3-5 working days for 80% of cases

- Patta Issuance:

- New Patta is generated and signed by the Tahsildar

- 90% of straightforward cases receive Patta within 30 days of application

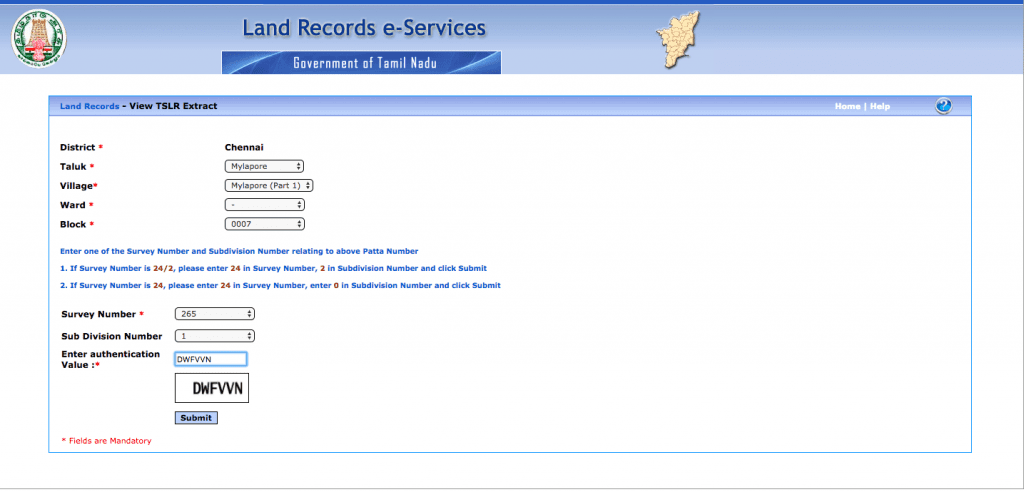

Online Verification of Patta Chitta

Verifying Patta Chitta online is a crucial step in the home loan process, especially in Tamil Nadu. This digital verification system has streamlined the process of checking land details for home loans, making it more efficient and accessible.

Step-by-Step Process:

- Visit the Tamil Nadu e-Services portal (https://www.tnreginet.gov.in/)

- Select ‘View Patta/Chitta’ from the available options

- Choose the district where the property is located

- Enter the survey number of the land

- Provide the captcha code for security

- Click on ‘View’ to access the Patta Chitta details

Key Information Available:

| Information | Description |

|---|---|

| The current legal owner of the property | Unique identifier for the land |

| Owner Name | Current legal owner of the property |

| Land Type | Classification (e.g., Nanjai or Punjai) |

| Land Area | Exact measurement of the property |

| Tax Details | Information on property tax payments |

Risks of Buying Land Without Patta and Chitta

Purchasing land without a Patta in India, particularly in Tamil Nadu, can lead to significant complications, especially when seeking a home loan. Understanding these risks is crucial for potential homebuyers and loan applicants.

Major Risks:

- Legal Issues:

- Absence of clear ownership proof

- Potential for property disputes

- Risk of encroachment claims

- Loan Rejection:

- Banks typically reject loans for properties without clear titles

- Patta is a key document in the loan approval process

- Property Value Depreciation:

- Lack of Patta can decrease market value

- Difficulty in future resale or transfer

Comparison: Properties With vs. Without Patta

| Aspect | With Patta | Without Patta |

|---|---|---|

| Legal Security | High | Low |

| Loan Approval Chances | 85-90% | 20-30% |

| Resale Value | 100% | 80-85% |

| Risk of Disputes | Low | High |

Case Study:

In a recent incident in Chennai, a group of homebuyers faced legal challenges when they discovered that the land they purchased didn’t have a valid Patta.

This resulted in:

- Loan applications are being rejected by multiple banks.

- A 2-year legal battle to obtain proper documentation.

- An average financial loss of ₹5-7 lakhs per buyer.

Common Challenges and Solutions:

- Incomplete Documentation (affects 25% of applications):

- Double-check all required documents before submission

- Keep copies of all submitted documents

- Boundary Disputes (occur in 15% of cases):

- Resolve with neighbors before applying

- Consider a professional survey if needed

- Delays in Processing (impact 30% of applications):

- Follow up regularly with the Taluk office

- Use online tracking systems where available

- Errors in Existing Records (found in 20% of cases):

- File for corrections as soon as discovered

- Provide supporting documents to prove the correct information

By understanding and carefully following this Patta registration process, you significantly increase your chances of a smooth home loan application. Remember, 95% of home loans in Tamil Nadu require clear Patta documentation, making this process crucial for potential homeowners.

Get the Best Home Loan Offers with Credit Dharma

Credit Dharma is your trusted partner for securing the best Home Loan offers, with over ₹500 Cr+ loans handled and partnerships with 20+ leading banks. We provide exclusive access to the lowest interest rates and a seamless, digital process with fast approvals in just 1-2 weeks, backed by lifetime support from our home loan experts.

Why choose Credit Dharma? We provide:

- Lowest Interest Rates: Save more with every EMI.

- Maximum Funding: Get up to 100% funding for your dream home.

- Simple & Digital Process: No tedious paperwork or branch visits.

- Expert Guidance: Lifetime support from our team of specialists.

Compare, choose, and secure the best Home Loan offer with Credit Dharma — your home loan journey starts here!

Conclusion

Accessing Patta Chitta online in Tamil Nadu has made it incredibly convenient for landowners and potential buyers to verify ownership and land details. Understanding the difference between Patta and Chitta is crucial for any property-related transactions. Whether you need to view Patta Chitta for your land or need information on Tamil Nadu Patta Chitta, the online platform offers a seamless process for obtaining this vital land record.

By using the TN Patta services, you can easily access your Chitta Patta and ensure that all legal requirements are met for your land transactions. Be sure to utilize the Patta Tamil Nadu online services for hassle-free verification and record keeping.

Frequently Asked Questions

No, while having a Patta is essential, it is not enough to buy a house in Chennai.

You will also need approvals from the local municipal authorities and a proper sale deed registered with the sub-registrar.

Additionally, it is recommended to conduct legal due diligence before finalizing the purchase.

Not likely. Banks and financial institutions usually require additional documentation such as approved building plans, tax receipts, and a clear title deed before approving a home loan. A Patta alone is not sufficient for a home loan approval.

Buying unapproved land can pose several risks including legal disputes, lack of access to basic utilities, potential for demolition by government authorities, and difficulties in obtaining a home loan.

It is advisable to ensure that the land has proper approvals and clear titles before making a purchase.

HDFC Home Loan

HDFC Home Loan SBI Home Loan

SBI Home Loan