Are you planning to buy a new home but worried about the costs? The Pradhan Mantri Awas Yojana (PMAY) could be your ticket to substantial savings. With the Pradhan Mantri Awas Yojana Loan Subsidy Calculator, you can quickly find out how much subsidy you qualify for, making your dream home more affordable than ever. This guide will walk you through using the calculator effectively, helping you unlock financial benefits that could transform your home-buying journey.

What is a PMAY Subsidy Calculator?

The PMAY Subsidy Calculator is an online tool that helps potential homebuyers determine the subsidy they can avail under the Pradhan Mantri Awas Yojana (PMAY). This subsidy is part of a government initiative to make affordable housing accessible to various economic segments in urban areas.

The calculator assesses your eligibility based on parameters like income, loan amount, and other relevant details. It then calculates the interest subsidy you are entitled to receive, significantly reducing the effective interest rate of your home loan

How to Use the PMAY Subsidy Calculator?

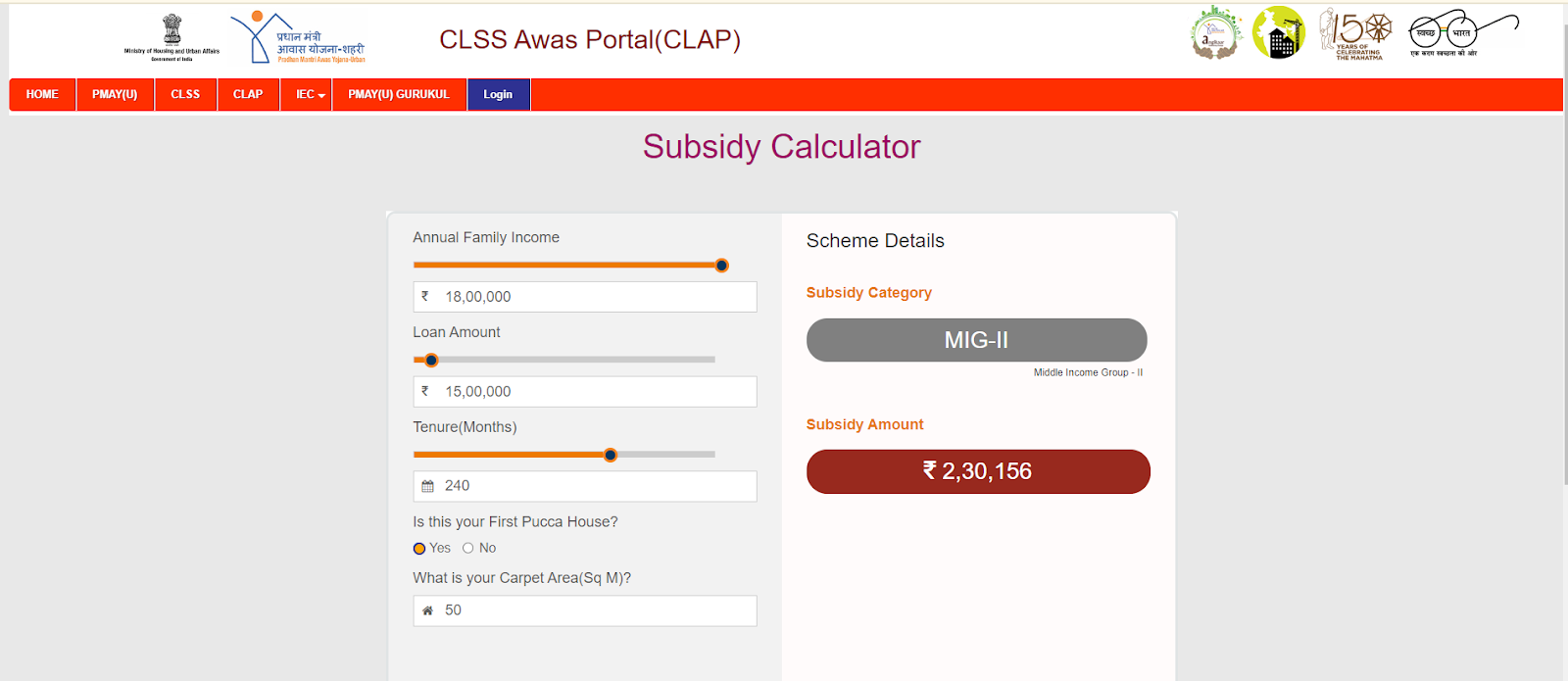

- Visit the official PMAY Calculator website.

- Enter your annual family income, loan amount required, and a tentative tenure.

- Mention if this is your first pucca house or not and the carpet area of your current home.

- Now, the calculator will display the subsidy amount according to the information you’ve provided.

Benefits of PMAY Subsidy Calculator

- Automatically calculates the exact subsidy amount based on loan details and eligibility.

- Quickly delivers results, eliminating the need for manual calculations or bank consultations.

- Aids in financial planning by providing a clear picture of potential investments and loan repayments after subsidy application.

- Accessible online for easy eligibility checks from any location.

- Enables informed decision-making regarding loan procurement under the PMAY scheme.

- Ensures transparency, minimising misinformation and miscalculations.

- Motivates potential buyers by highlighting the financial benefits and encouraging home ownership.

Factors Affecting Pradhan Mantri Awas Yojana Subsidy Amount

- Income Level: The subsidy amount varies based on the economic category the applicant falls into (EWS, LIG, MIG I, MIG II).

- Loan Amount: Higher loan amounts may receive a larger subsidy, but are capped under specific limits for each category.

- Loan Tenure: The subsidy is calculated for a maximum tenure of 20 years; shorter loans may receive less subsidy.

- Property Area: Subsidy variations occur depending on whether the property is in a metropolitan area or a non-metropolitan area.

- Existing Home Ownership: Applicants who already own a home are typically not eligible, affecting the subsidy availability.

- Family Composition: Eligibility and subsidy amount can be influenced by the family’s composition, such as the presence of female head of household or minorities.

Conclusion

Ready to take the next step in securing your dream home with affordable financing? Visit Credit Dharma today to make the most of the Pradhan Mantri Awas Yojana benefits. Explore comprehensive financial solutions and tools designed to streamline your home-buying process.

With Credit Dharma, discover how easy it is to apply for a home loan with the Pradhan Mantri Awas Yojana subsidy and move closer to owning your perfect home. Start your journey with Credit Dharma now and transform your dream into reality!

Frequently Asked Questions

The PMAY subsidy is available per household, irrespective of the number of co-owners. If both spouses are co-owners and eligible, the authorities will process the subsidy as a single claim under the household’s name.

The PMAY subsidy is primarily for the purchase or construction of new homes. However, for the EWS and LIG categories, there is a provision for availing of subsidy for renovation or extension of existing homes to meet the family’s requirement of additional space.

If you sell your PMAY-subsidized home within five years of possession, you must repay the subsidy. This rule ensures you use the benefits of the scheme for the intended purpose of long-term homeownership.

HDFC Home Loan

HDFC Home Loan SBI Home Loan

SBI Home Loan