Estimated reading time: 8 minutes

Paying property tax in Kerala online has become seamless with the Sanchaya portal and the tax.lsgkerala.gov.in website. Whether you’re looking to pay your building tax, obtain a Sanchaya ownership certificate, or manage other municipal taxes, Kerala’s online tax payment system makes the process convenient and hassle-free.

In this blog, we’ll guide you through the step-by-step process of paying property tax in Kerala online, using the Sanchaya tax portal, and downloading essential documents like the ownership certificate. Whether you’re a first-time user or looking for an easier way to pay your property tax, this guide will help you navigate the online system with ease.

How to Pay Property Tax Online from Sanchaya in Kerala?

Paying property tax online in Kerala is quick and easy. Follow these steps to complete your payment:

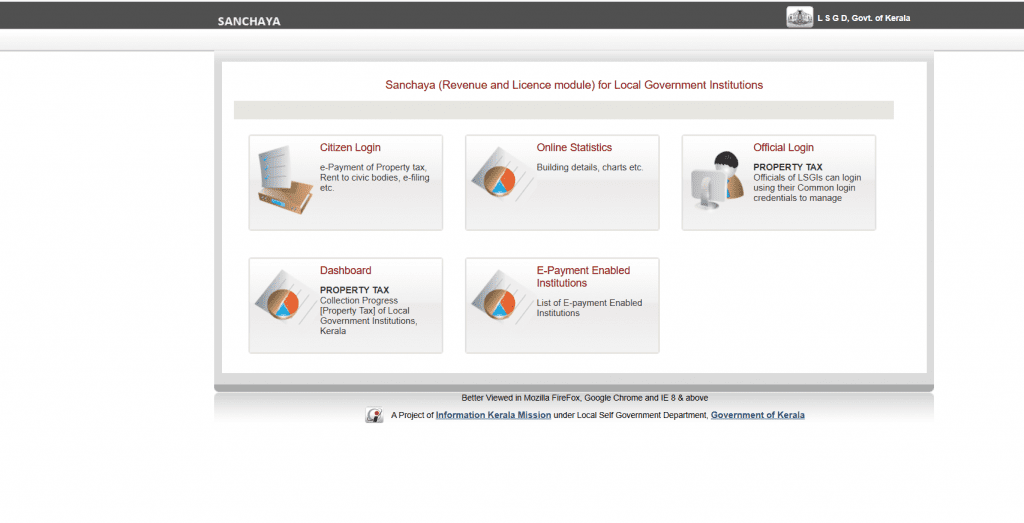

1. Visit the Official Sanchaya Website

Open your browser and go to sanchaya.lsgkerala.gov.in.

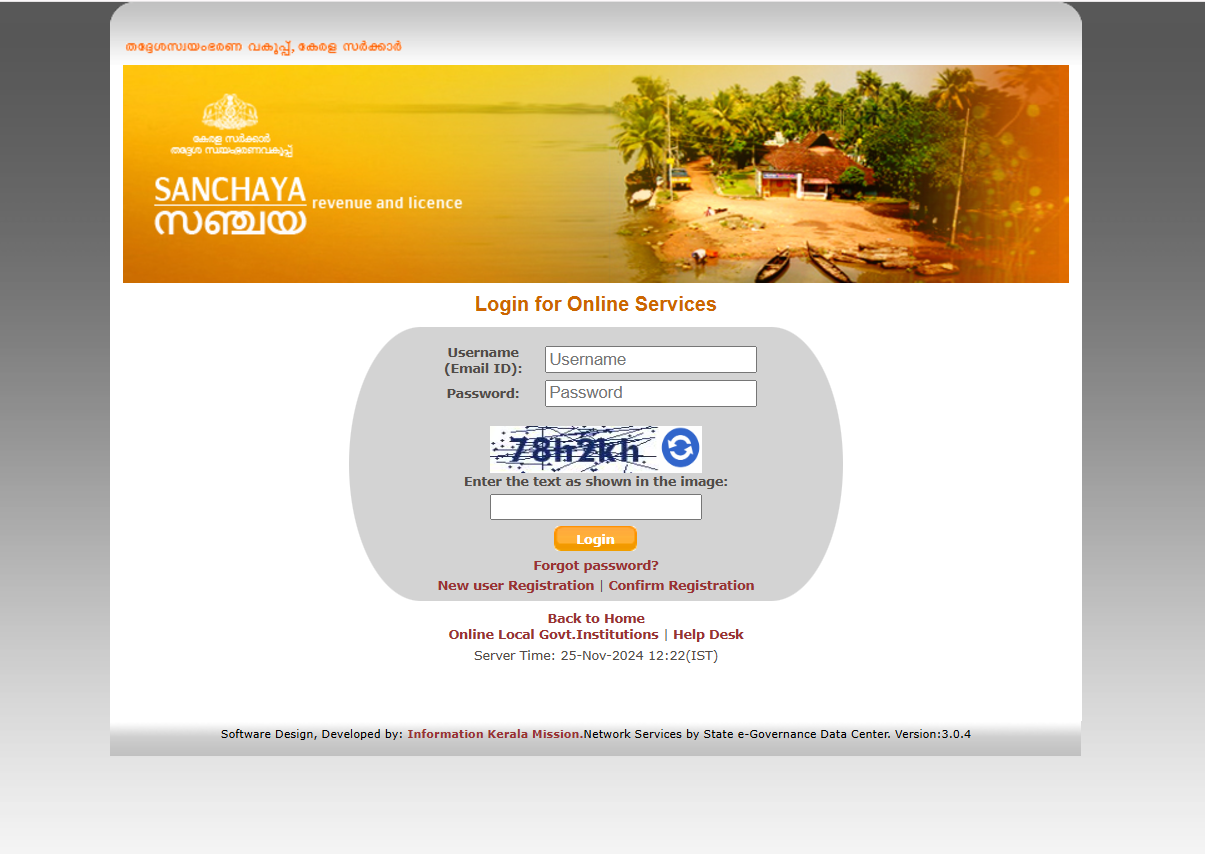

2. Log in as a Citizen

Click on “Citizen Login” and enter your username and password to access your account.

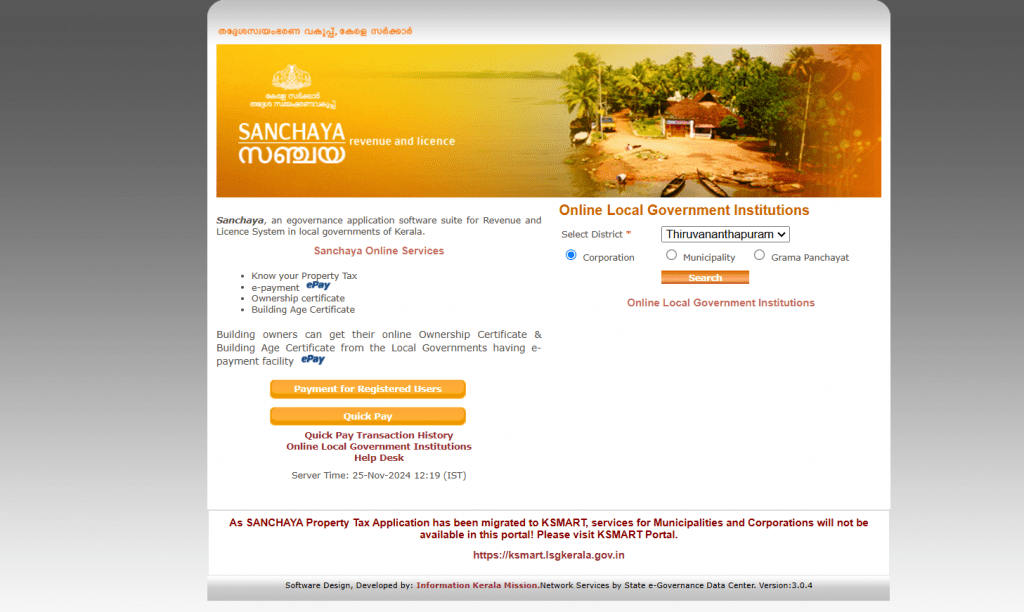

3. Choose Payment Option

Select “Payment for Registered Users” if you are already registered.

4. Select Your Local Body

Choose your Corporation, Municipality, or Gram Panchayat. Then, select the district where your property is located.

5. Enter Property Details

Provide details like your ward number, door number, or sub-number. Click “Search” to view your property tax details.

6. Review Tax Information

Check the displayed tax details, including the total amount due. Verify the information before proceeding.

7. Proceed to Payment

Click the “Pay Now” button to start the payment process.

8. Choose Payment Method

Select your preferred payment method, such as credit card, debit card, UPI, net banking, RTGS, or mobile wallet.

9. Complete Payment

Enter your payment details and confirm the transaction. Once done, you will receive an instant receipt.

Check Out: Kerala Land Records 2025

How to Register on the Sanchaya Portal?

Registering on the Sanchaya portal is simple. Follow these steps to set up your account and start using the services:

- Visit the Official Website

Open your browser and go to sanchaya.lsgkerala.gov.in.

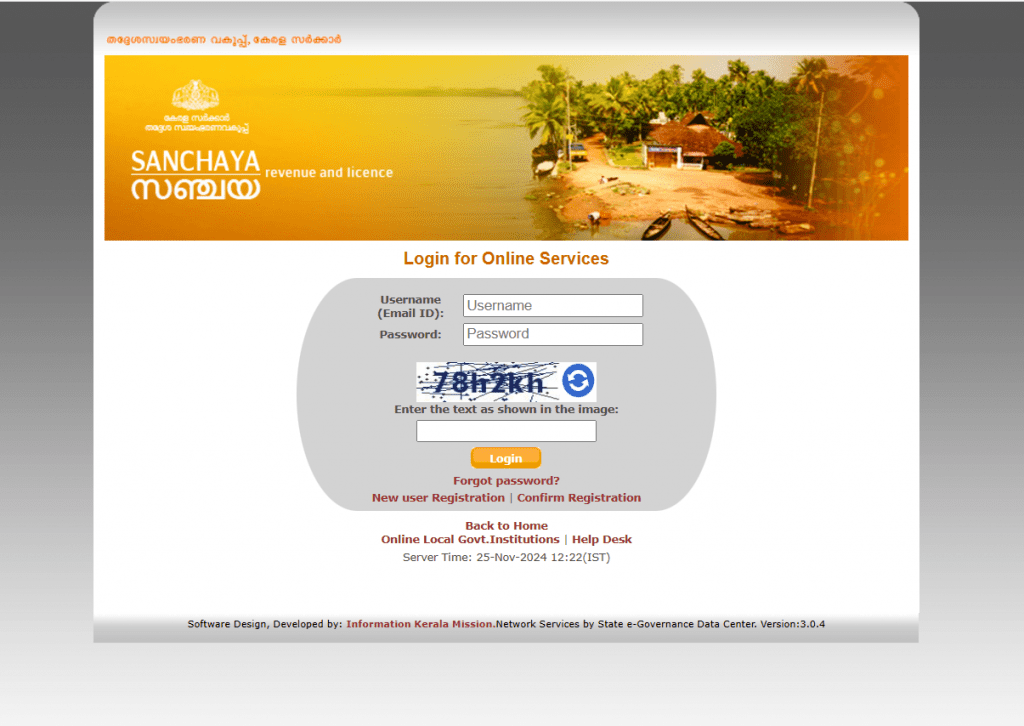

- Click on Citizen Login

On the homepage, select the “Citizen Login” option. It will take you to the registration page.

- Choose New User Registration

If you don’t have an account, click on the “New User Registration” button.

- Enter Your Details

Fill in your full name, email address, and mobile number. You will also need to enter the captcha code displayed on the screen.

- Submit the Form

Double-check your details and click the “Submit” button.

- Receive Confirmation

After submitting, you will get a confirmation message. This confirms that your registration is successful.

- Log in to Your Account

Use your email ID and the password you created to log in. You can now access the portal’s services.

Also Read: Land Registeration Charges in Kerala 2025

How to View Tax Reciepts in Sanchaya?

To check property tax payment receipts on the Sanchaya portal, follow these steps:

- Go to the official Sanchaya portal.

- Choose your District from the available drop-down menu.

- Pick your respective local body—Corporation, Municipality, or Gram Panchayat.

- Click on the ‘Select’ button adjacent to the EPay section.

- Navigate to the ‘e-Payment Status’ tab.

- Choose the transaction type and year, then click on ‘Search’.

- Your payment status and receipt details will be shown on the screen

How Do You Check Your Property Tax Details in Kerala?

It is simple to check property tax details online in Kerala. You can view pending bills and retrieve information using property identifiers like door number, ward, or plinth area. Follow these steps:

Steps to Check Pending Property Tax Bills

1. Visit the Sanchaya Portal

Go to sanchaya.lsgkerala.gov.in on your browser.

2. Log in to Your Account

Click on “Citizen Login” and enter your username and password to access your account.

3. Select Payment Option

Choose “Payment for Registered Users” if you have already registered.

4. Search for Pending Bills

Enter details like your ward number, door number, or sub-number. Click “Search” to view any unpaid bills.

5. Review the Details

The screen will show your pending tax amount, due date, and related information. Check everything carefully.

Also Read: RERA Fees and Charges in Kerala 2025

How to Retrieve Property Tax Details?

1. Choose the Search Criteria

Use identifiers such as plinth area, ward number, or door number to search for property tax details.

2. Provide Accurate Information

Enter the exact details as required for accurate results.

3. View Tax Information

Once the search completes, you can see details like tax amount, property description, and payment history.

Suggested Read: Stamp Duty Charges in Kerala 2025

Features of the Sanchaya Portal

- Property Tax Payment:

Pay property taxes online without visiting government offices. - Utility Bill Payments:

Pay for electricity, water, and telephone bills through the portal. - License Applications:

Apply for building ownership certificates and D&O licenses. - Tax Search Tools:

Check property tax details using the plinth area or property information. - Receipts and Records:

Download receipts for property tax and other payments.

Benefits of Using Sanchaya

- It saves time by reducing the need to visit government offices.

- Payments are secure, and users get instant receipts.

- It is accessible from anywhere, making it user-friendly.

- Residents can track payments and check tax details online.

Why Pay Kerala Property Tax Online?

Paying property tax online is quick, secure, and convenient. It simplifies the process and offers multiple benefits for property owners in Kerala.

Benefits of Paying Kerala Property Tax Online

- Saves Time:

You can pay your taxes without visiting government offices or standing in long queues. - Instant Receipts:

Receive digital receipts immediately after completing the payment. - Easy Access to Records:

View and download past payment details anytime through your account. - Error-Free Transactions:

Reduce the chances of manual errors in calculations or records. - Flexible Payment Options:

Use credit cards, debit cards, UPI, or net banking for payments. - Convenience:

Pay from anywhere, whether at home or on the go, using the Sanchaya portal. - Eco-Friendly:

Eliminate the need for paper bills and receipts by keeping everything digital.

How to Get Help with Property Tax Issues in Kerala?

If you face any problems while using the Sanchaya portal, you can contact the helpdesk for support. They provide assistance for issues like payment errors, incorrect data, or technical glitches.

Contact Details for Sanchaya Helpdesk

- Phone Number: 0471-2773160 (Available from 10 AM to 5 PM)

- Email: epayment.ikm@kerala.gov.in

Common Issues and How to Resolve Them

- Dual Payments:

If you accidentally make two payments reach out to the helpdesk with your payment details. - Data Errors:

For wrong tax details or discrepancies, contact your local Corporation, Municipality, or Gram Panchayat. - Login Problems:

If you cannot access your account, email the helpdesk using your registered email ID.

Get a Home Loan

with Highest Eligibility

& Best Rates

Conclusion

Paying property tax Kerala online through the Sanchaya portal makes the process simple and hassle-free. It saves time, offers secure payment options, and provides instant receipts. Timely payment of property taxes ensures you avoid penalties and contribute to the development of local infrastructure and services.

Credit Dharma’s home loan experts with decades of experience can help you shape the plan for your home loan. Connect with Credit Dharma today for a free consultation call.

Frequently Asked Questions

Property tax in Kerala is a tax paid to local authorities for property ownership. It funds public services like roads, sanitation, and utilities.

You can pay online through the Sanchaya portal by logging in and completing the payment using various methods like UPI or net banking.

Late payments result in penalties or extra charges. It is best to pay on time to avoid fines.

Property tax is based on factors like property type, location, plinth area, and market value.

Yes, log in to the Sanchaya portal, and you can view and pay pending bills.

You can contact the Sanchaya helpdesk at 0471-2773160 or email epayment.ikm@kerala.gov.in for assistance.

HDFC Home Loan

HDFC Home Loan SBI Home Loan

SBI Home Loan