Looking to download your RBL Bank Home Loan statement? It’s a handy document that gives you a clear picture of your loan repayment history, showing the principal and interest paid, outstanding balance, and any charges applied.

Whether you’re tracking your EMIs or preparing for tax season, this statement makes managing your loan simple and hassle-free. Let us help you with this guide to understand how to download it easily!

How to Download RBL Bank Home Loan Statement Online

RBL Bank offers a convenient online banking platform that allows you to access your home loan statement from the comfort of your home. Follow these steps to download your statement:

Time needed: 2 minutes

Here’s how you can download the Home Loan Statement

- Visit the official RBL Bank website

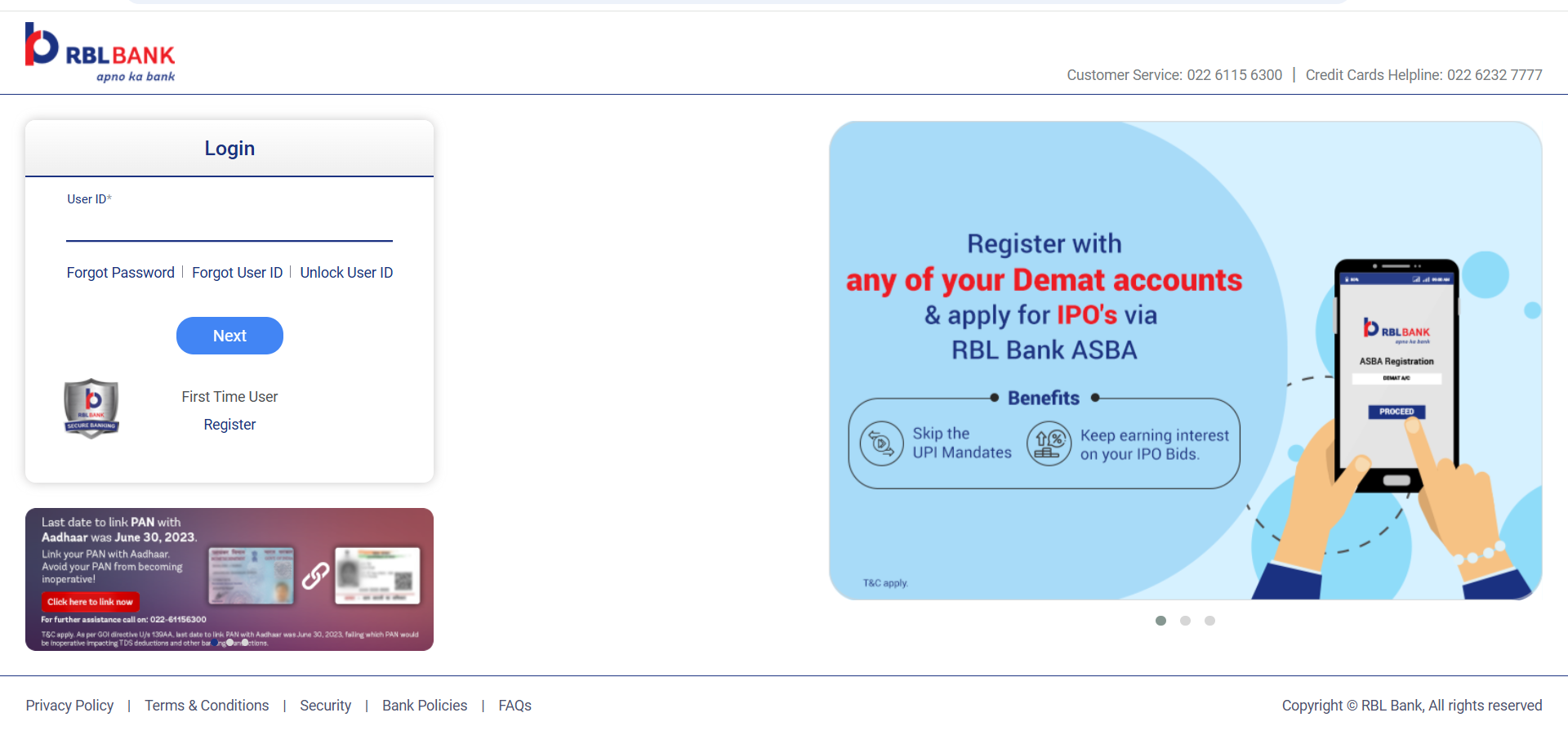

- Log in to your RBL Bank Net Banking account using your credentials.

- Navigate to the “Loans” section in the menu.

- Select “Home Loan” from the available loan options.

- Click on “Download Loan Statement” or “Loan Account Details.”

- Choose the required date range for the statement.

- Download the statement in PDF format.

Check out: RBL Bank Home Loan Eligibility Calculator

Steps to Obtain an RBL Bank Home Loan Statement Offline

If you prefer to obtain a physical copy of your home loan statement or don’t have access to online banking, you can visit your nearest RBL Bank Branch.

Here’s what you need to do:

- Locate your nearest RBL Bank branch using the bank’s website or mobile app.

- Visit the branch during working hours (typically 10 AM to 4 PM on weekdays).

- Approach the customer service desk and request a home loan statement.

- Provide your loan account number and valid photo ID proof (such as Aadhaar card, PAN card, or passport).

- Fill out any necessary forms as directed by the bank staff.

- Specify the period for which you need the statement.

- Wait for the bank representative to process your request and print the statement.

- Verify the details on the statement before leaving the branch.

Note that some branches may charge a nominal fee for providing physical statements, especially for older records. It’s advisable to call your branch beforehand to confirm any charges and the expected processing time.

Why do you need RBL Bank Home Loan Statement?

| Statements | Details |

|---|---|

| Track Repayments | Regularly reviewing your loan statement keeps you informed about the total amount paid towards your loan. |

| Monitor Outstanding Balance | Stay updated on the remaining loan amount, which helps in planning future finances. |

| Plan Future Repayments | Use the statement to strategize your RBL bank repayment schedule and ensure timely payments. |

| Strategic Prepayments | Identify opportunities to make prepayments and reduce your overall debt burden. |

| Efficient Financial Management | Regular monitoring of your loan statement supports better financial planning and management. |

| Accessibility | You can access your loan statement anytime during the year, either online or by visiting a physical RBL Bank branch |

Conclusion

Managing your RBL Bank home loan statement online is straightforward and beneficial. By following the outlined steps, you can quickly access your financial information, enabling you to make informed decisions about your home loan.

Utilize the RBL Bank online home loan platform fully and manage your accounts efficiently. For additional support with your RBL Bank loan payment, RBL Bank loan details, or RBL Bank loan track, our team of experts is ready to assist you throughout the process. Credit Dharma is your trusted partner for navigating loans, credit, and financial planning.

Frequently Asked Questions

Log in to RBL Bank’s internet banking or mobile app, visit the loan section, and check your home loan balance, or contact customer care for assistance.

A loan statement is a detailed document provided by the lender that outlines your loan account activity, including outstanding balance, payments, interest, and due dates.

Improve your CIBIL score by paying bills on time, maintaining low credit utilization, avoiding multiple loan inquiries, and regularly checking your credit report.

The full form of RBL Bank is Ratnakar Bank Limited, a leading private sector bank in India.

Yes, RBL Bank is a trusted private sector bank in India, regulated by the Reserve Bank of India (RBI) and known for its reliable services.

No, RBL Bank is a private sector bank, not a government-owned bank.

HDFC Home Loan

HDFC Home Loan SBI Home Loan

SBI Home Loan