State Bank of India (SBI) has introduced the “HER Ghar” scheme, an initiative designed to empower women in their journey towards homeownership. This exclusive home loan program offers attractive interest rates and numerous benefits tailored specifically for female borrowers.

What is SBI Home HER Ghar?

SBI Home HER Ghar exclusively offers an online loan product for women property owners or those planning to acquire property in their name. This initiative aims to support women’s financial independence and homeownership dreams by offering concessional interest rates and other perquisites.

Also Read: Check SBI Home Loan Application Status Online

How to Apply for SBI Home HER Ghar Home Loan

Here mentioned is the step-by-step process to apply for the SBI Home HER Ghar Home Loan taking the first step towards owning your dream home.

- Official Website or Branch Visit

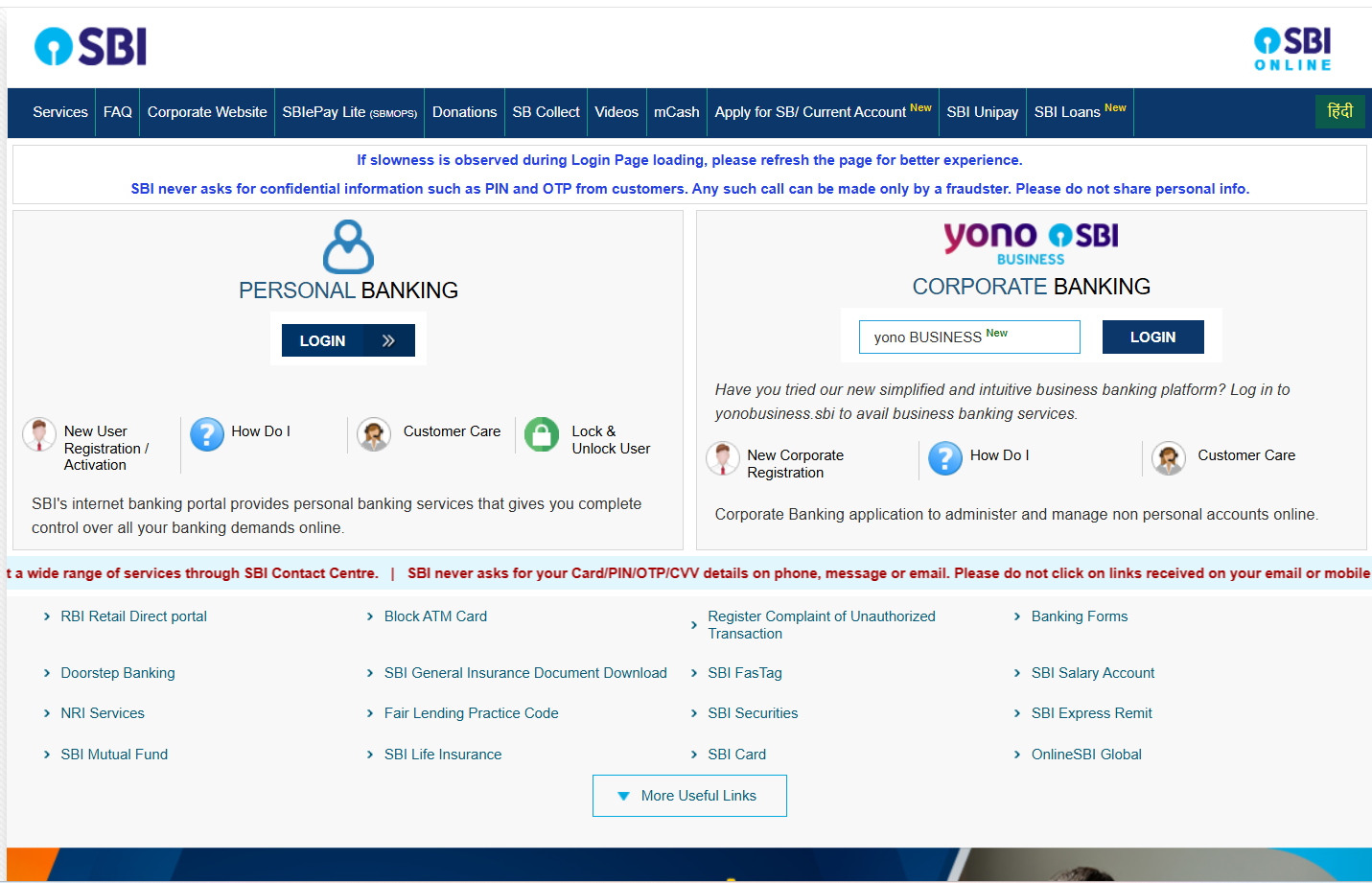

Visit the SBI website or your nearest SBI branch.

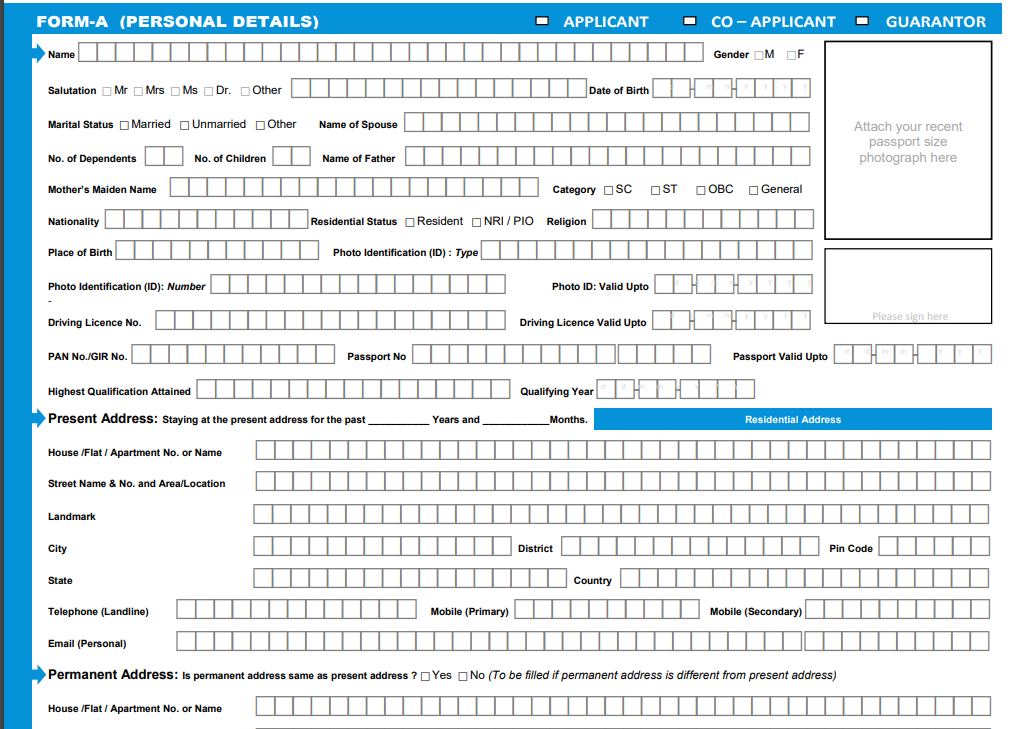

- Loan Application Form

Fill out the loan application form.

- Submission of Documents

Submit the required documents, including:

– Three passport-size photographs

– PAN card

– Identity proof

– Address proof

– Bank account statements for the last 6 months

– Income proof and tax documents. - Loan Approval Process

Undergo the loan approval process.

- Documentation

Once approved, complete the property documentation.

- Sign Loan Agreement

Sign the loan agreement and receive disbursement.

Read More: How to Apply For SBI Home Loan?

Key Features of SBI HER Ghar

- Exclusive for women: The scheme targets female applicants, including housewives.

- Property ownership: The property must be in the woman’s name or with HER as the first owner if jointly owned.

- Flexible repayment options: Borrowers can choose from a range of repayment plans that suit their monthly budget.

- Zero processing fee: Unlike standard home loans, this scheme comes with no upfront costs.

- Dedicated support: SBI executives provide thorough guidance throughout the loan processing journey.

Also Read: Discover Home Loan Benefits for Women in India

SBI Home Loan Interest Rate for Female Borrowers

Under the HER Ghar scheme, SBI offers two types of interest rates for women borrowers:

| Loan Scheme | Eligibility | Interest Rate |

|---|---|---|

| HER Ghar Scheme | Eligible for HER Ghar Scheme | 9.40% p.a. (As of January 4, 2024) |

| Standard Home Loan | Women not eligible for HER Ghar Scheme | Starts from 8.40% p.a. (As of November 1, 2024) |

SBI adds 20 basis points (bps) to the current Marginal Cost of Lending Rate (MCLR) to calculate the HER Ghar scheme interest rate.

Read More: SBI Home Loan Interest Rates 2025

Benefits of SBI Home HER Ghar

Below mentioned are the benefits of SBI Home HER Ghar Scheme:

- Lower interest rates: Women enjoy reduced interest rates compared to standard SBI home loans.

- Extended loan tenure: Repayment can be spread over up to 30 years.

- High loan amount: SBI offers up to 90% of the property’s cost.

- No prepayment charges: Borrowers can repay the loan early without incurring additional fees.

- Empowerment: The scheme supports women’s financial independence and property ownership.

Also Read: SBI Staff Home Loan Benefits

Eligibility Criteria for SBI Home HER Ghar

Find out the criteria mentioned below for the qualification for SBI Home HER Ghar, a scheme made to provide a low rate of interest and other benefits to women.

| Criteria | Requirement |

|---|---|

| Gender | Woman |

| Applicant Status | A sole applicant or first co-applicant |

| Age | 18 to 70 years old |

| Residency | Indian resident |

| Property Ownership | Registered in the woman’s name or as the first owner if jointly owned |

| Income | Reliable source of income (occupation not specified) |

Also Read: SBI General Home Loan Interest Rates & Eligibility.

Conclusion

Buying a home is a big step. Getting a home loan can be hard, but we make it easy. Choosing Credit Dharma for your home loan simplifies this process. We offer expert advice and personalized assistance to make everything hassle-free. You’ll receive timely updates on your loan application and disbursement progress.

From the initial application to the final disbursement, we provide comprehensive support. Enjoy clear and honest communication at every stage, with no hidden surprises.

Frequently Asked Questions

Yes, the HER Ghar loan can typically be used for plot purchase and construction. However, specific terms and conditions may apply, and it’s best to confirm with SBI for your particular case.

The maximum loan amount typically depends on factors like the property value, the applicant’s income, and repayment capacity. SBI generally offers up to 90% of the property cost, subject to their assessment.

HDFC Home Loan

HDFC Home Loan SBI Home Loan

SBI Home Loan