From standard EMI plans to unique options tailored to your income patterns, SBI home loan allows you to choose the plan that works best for your lifestyle and repayment capacity, ensuring stress-free home loan management.

How to Repay SBI Home Loan EMI Online via the official website?

Paying your home loan EMI doesn’t need to be complicated, especially with SBI. Here’s a simple guide to repay your EMIs quickly through their official website:

Time needed: 2 minutes

Step-by-step guide for repaying your SBI Home Loan online from the official website:

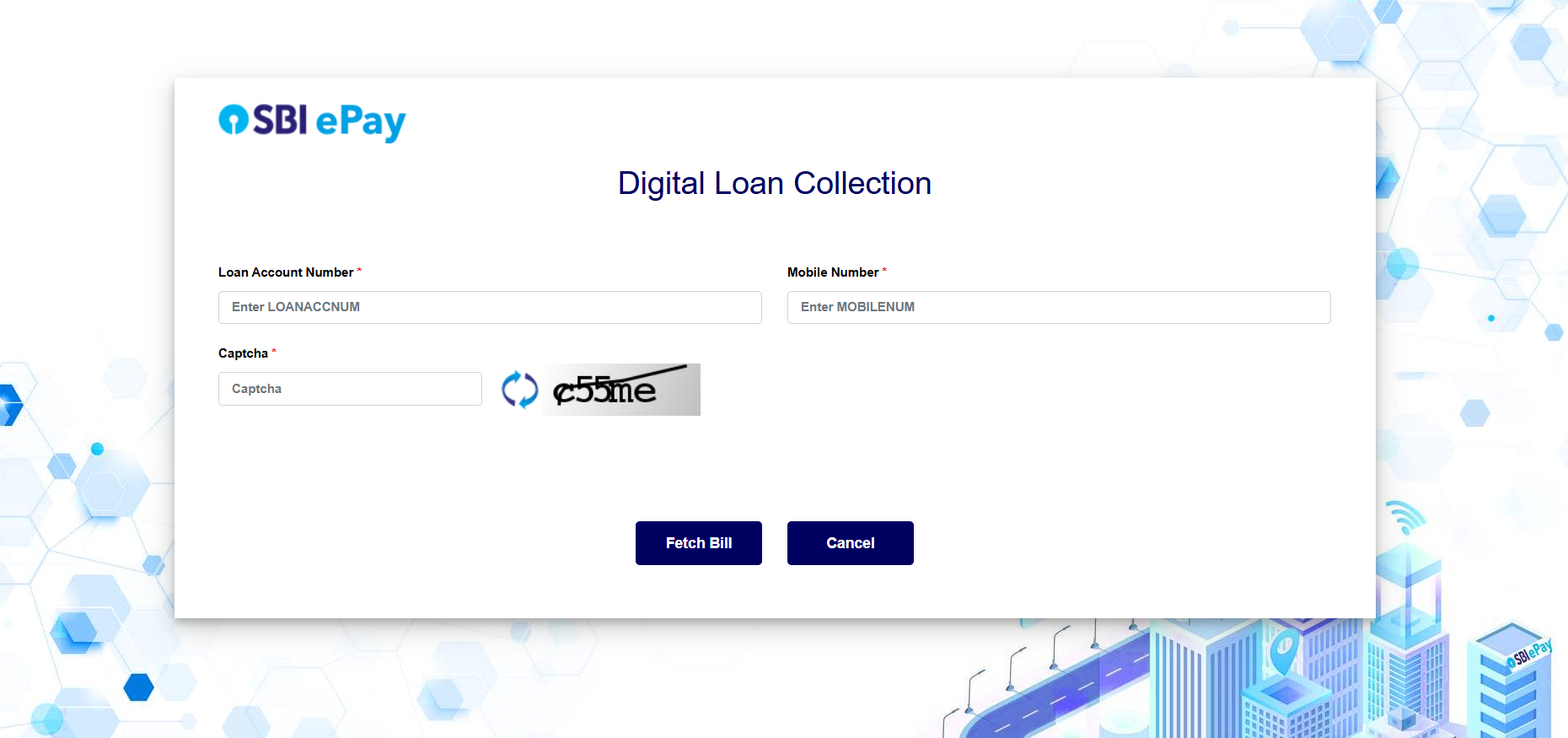

- Visit the official SBIePay website.

- Enter your loan account number, registered mobile number and the captcha code.

- Click Fetch Bill to retrieve your current EMI amount and due date.

- On the bill details page, verify your Loan Account, EMI Amount, and Due Date.

- You’ll be redirected to your bank’s secure payment gateway. Log in with your Internet Banking credentials.

- Authenticate the transaction by entering the OTP sent to your registered mobile number.

- Once payment is successful, you’ll see an on‑screen confirmation with a transaction reference number.

How to Repay SBI Home Loan EMI Online via Mobile Application?

- Download & install the SBI YONO app from Play Store / App Store and log in with your Internet‑banking credentials (username, password and MPIN).

- From the home screen, tap YONO Pay.

- Select Bank Account → Own Account.

- Choose your Home Loan account from the list of linked accounts.

- In the Amount field, enter your EMI due.

- (Optional) Add any remarks, then tap Next.

- Review the payment details (loan A/c, EMI amount, debit A/c) and tap Confirm.

- Authenticate with your MPIN or the OTP sent to your registered mobile.

- Once processed, you’ll see an on‑screen confirmation with a reference/UTR number.

- Save or screenshot the receipt; you’ll also get an SMS/email confirmation.

How to Repay SBI Home Loan EMI Online via UPI Applications?

To repay your SBI Home Loan EMI online via UPI, follow these steps:

Prerequisites:

- Ensure your bank account is UPI-enabled and linked to a UPI app (e.g., Google Pay, PhonePe, BHIM, Paytm).

- Have your SBI home loan account details handy.

- Sufficient funds in your UPI-linked bank account.

Step-by-Step Process:

- Open the UPI application on your mobile device.

- Navigate to the ‘Loan EMI Payment’ section.

- Select ‘SBI’ as your lender.

- Enter your Loan Account Number.

- Click on ‘Get Payable Amount’ to fetch your EMI details.

- Choose your preferred payment method (e.g., UPI, debit card, credit card, Paytm Wallet).

- Complete the payment and save the receipt for your records.

How to Repay SBI Home Loan EMI Offline?

If you’re someone who prefers making payments in person, SBI also offers multiple offline options to repay your home loan EMI. These methods are safe, widely accepted, and can be done by visiting authorized branches or through simple banking channels.

| Modes of Offline Payment | Steps & Key Details |

|---|---|

| Post-Dated Cheques (PDCs) | – Submit a series of cheques to SBI at the start of your loan. – Ensure the cheque date and amount match the EMI schedule. – Mention loan account number on the back. – Collect acknowledgement receipt. |

| Electronic Clearing Service (ECS) | – Fill out the ECS mandate form at your bank. – Submit it to SBI with bank details. – Monthly EMI auto-debited from your account. – No manual effort required every month. |

| NACH Mandate | – Fill and sign the NACH form. – Authorizes automatic EMI deductions. – Submit it at the branch or through your bank. – Secure and hassle-free recurring payment method. |

| Cash Payment at Branch | – Visit the nearest SBI branch. – Make payment in cash for the EMI amount. – Get an official payment receipt. – Useful for one-time or overdue payments. |

| Cheque/Demand Draft (DD) | – Write cheque/DD in favor of “SBI.” – Mention your loan account number on the back. – Drop it at the branch or authorized collection point. – Always collect a receipt for confirmation. |

Suggested Read: SBI HER Ghar home loans: check exclusive offers for women homebuyers in India.

SBI Home Loan Repayment Options

When you take a home loan, knowing your repayment options helps you manage finances better. SBI offers flexible ways to repay your loan:

1. EMIs (Equated Monthly Instalments)

- You repay the loan in fixed monthly instalments.

- Each EMI includes both principal and interest.

- EMIs are auto-debited from your bank account on a set date.

- You can choose a repayment tenure that suits your budget — longer tenure means smaller EMIs, but higher total interest.

2. Part Prepayment

- You can pay a lump sum amount (more than your EMI) toward the loan.

- Helps reduce the outstanding principal faster.

- Leads to either lower EMIs or a shorter loan tenure.

- SBI usually does not charge fees for part prepayment if it’s a floating-rate loan taken by an individual.

3. Foreclosure (Full Loan Prepayment)

- You can repay the entire outstanding loan amount before the end of the tenure.

- Saves you from paying future interest.

- Ideal when you have a surplus of funds.

- Like part payment, foreclosure charges are usually nil for floating-rate individual loans.

Suggested Read: What is an SBI home loan certificate, and why is it important?

SBI Home Loan Pre-Payment Charges

No pre-payment/ pre-closure penalty will be levied on floating interest home loans irrespective of the period for which the account has run or source of funds, as per SBI home loan prepayment rules.

Factors to Consider When Choosing a Home Loan Repayment Option

- Monthly Budget: Choose an EMI that fits comfortably within your monthly income.

- Loan Tenure: A longer tenure reduces EMI but increases total interest outgo.

- Interest Rate Type: Fixed rates offer stability; floating rates may help save if rates fall.

- Prepayment Flexibility: Check if part prepayment or foreclosure is allowed without penalty.

- Income Stability: Opt for flexible plans if your income is variable or business-based.

- Future Financial Goals: Align your repayment plan with other financial commitments.

- Total Interest Payable: Compare repayment options based on total interest over the loan term.

- Charges & Fees: Be aware of hidden costs like processing fees, foreclosure charges, etc.

- Lender’s Terms: Always review the fine print of repayment clauses before signing.

Suggested Read: Is it mandatory to get a home loan insurance to apply for a home loan from SBI?

Is it Better to Prepay your Home Loan or Invest in a Mutual Fund?

| Factors | Home Loan Prepayment | SIP Investment |

|---|---|---|

| Interest Rate vs. Returns | Compare your home loan interest rate (post-tax) with SIP returns. – If loan rate > SIP returns (e.g., loan at 12% vs. SIP at 8%), prepay. – If SIP returns > loan rate (e.g., loan at 8% vs. SIP at 10–12% long-term), invest. | Historically, equity SIPs average 10–12% returns over 5+ years. Returns are market-dependent and not guaranteed. |

| Tax Implications | Loss of tax deductions on home loan interest (if applicable). | Tax-efficient if investing in equity (LTCG taxed at 10% post-₹1 lakh exemption). ELSS SIPs offer tax deductions under Section 80C. |

| Risk Tolerance | No risk: Guaranteed savings via reduced interest. | Market risk: Volatile in short-term but potential for higher long-term gains. |

| Financial Goals | Prioritize becoming debt-free (short-term goals). | Build wealth for long-term goals (retirement, education). |

| Job Security/Income | Safer if income is unstable. | Requires stable income to withstand market volatility. |

| Age/Life Stage | Better for those nearing retirement (debt reduction). | Ideal for younger investors (long compounding horizon). |

| Emotional Factor | Peace of mind from reduced debt burden. | Motivation from growing wealth and financial freedom. |

| Loan Tenure Impact | Prepay early to save more interest. Partial payments reduce tenure. | No direct impact on loan; focus on wealth creation. |

| Emergency Fund | Ensure 6–12 months of expenses saved before prepaying. | Ensure emergency funds exist before investing. |

| Future Credit Needs | – Invest in SIPs if the loan rate is 8–10% (equity outperforms long-term). – Compounding in SIPs can yield a higher corpus over 20+ years. | Closing a loan may affect the credit mix/score. |

| Expert Opinion | – Prepay if the loan rate is high (e.g., 12–15%). – Avoid prepayment if leveraging low-interest loans for real estate gains. | – Invest in SIPs if the loan rate is 8–10% (equity outperforms long-term). – Compounding in SIPs can yield higher corpus over 20+ years. |

Key Takeaways

Prepay If :

- Loan interest rate > SIP returns (post-tax).

- You prioritize stability and debt freedom.

- Uncertain income or nearing retirement.

Invest in SIP If :

- SIP returns > loan rate (e.g., equity SIPs over 8–10% loan rates).

- Comfortable with market risk and focused on long-term wealth.

- Younger with stable income and a 5–10+ year horizon.

Example :

- A ₹50 lakh loan at 9% (20 years) costs ₹76 lakh total. Prepaying ₹5 lakh early saves ₹12+ lakh in interest.

- Investing ₹25,000/month via SIP averaging 12% returns yields ₹3.5 crore in 20 years.

Suggested Read: Should you invest that extra cash or prepay your SBI home loan? Calculate now.

Conclusion

Buying a home is a big step. Getting a home loan can be hard, but we make it easy. At Credit Dharma, we make this possible by offering the lowest guaranteed interest rates that keep your monthly payments manageable, allowing you to enjoy more of what truly matters.

But that is not it. We offer:

- Guaranteed up to 100% funding

- Receive lifetime assistance and expert guidance long after your loan is approved.

- Enjoy a fully digital process with minimal paperwork

- Get your loan approved within just 1-2 weeks.

Frequently Asked Questions

Use SBIs online EMI calculator, which factors in loan amount, tenure, and interest rate. Manual calculation: EMI = [P × R × (1+R)^N] / [(1+R)^N-1], where P = principal, R = monthly interest rate, N = tenure in months

Yes, if you have a floating-rate home loan for non-business purposes, SBI typically does not levy prepayment charges. However, fixed-rate loans or loans taken out for business purposes may attract prepayment fees.

For floating-rate home loans taken out for non-business purposes, foreclosure charges are generally waived. However, fixed-rate loans or those for business purposes may incur foreclosure fees, typically around 4% of the outstanding principal. Always refer to your loan agreement for precise details.

Yes, SBI allows part-prepayments. For floating-rate loans taken out for non-business purposes, there are usually no charges. However, fixed-rate loans or those for business purposes might attract fees. It’s best to confirm the terms specific to your loan.

SBI usually sets a fixed EMI date, often the 2nd of every month. While changing the date might be challenging, it’s recommended to discuss this directly with the lender to explore any available options.

HDFC Home Loan

HDFC Home Loan SBI Home Loan

SBI Home Loan