Are you an employee of State Bank of India (SBI) looking to buy your dream home? SBI offers a range of exclusive benefits to its staff members through the SBI Staff Home Loan scheme. This comprehensive guide will walk you through the top benefits, ensuring you make an informed decision about financing your new home.

Own Your Dream Home with SBI Staff Home Loan – Save Big with Credit Dharma!

What is the SBI Staff Home Loan?

The SBI Staff Home Loan is a special loan product tailored specifically for employees of the State Bank of India. It offers favorable terms and conditions to help SBI staff members purchase, build, or renovate their homes. This loan scheme is an excellent example of SBI’s commitment to the welfare of its employees.

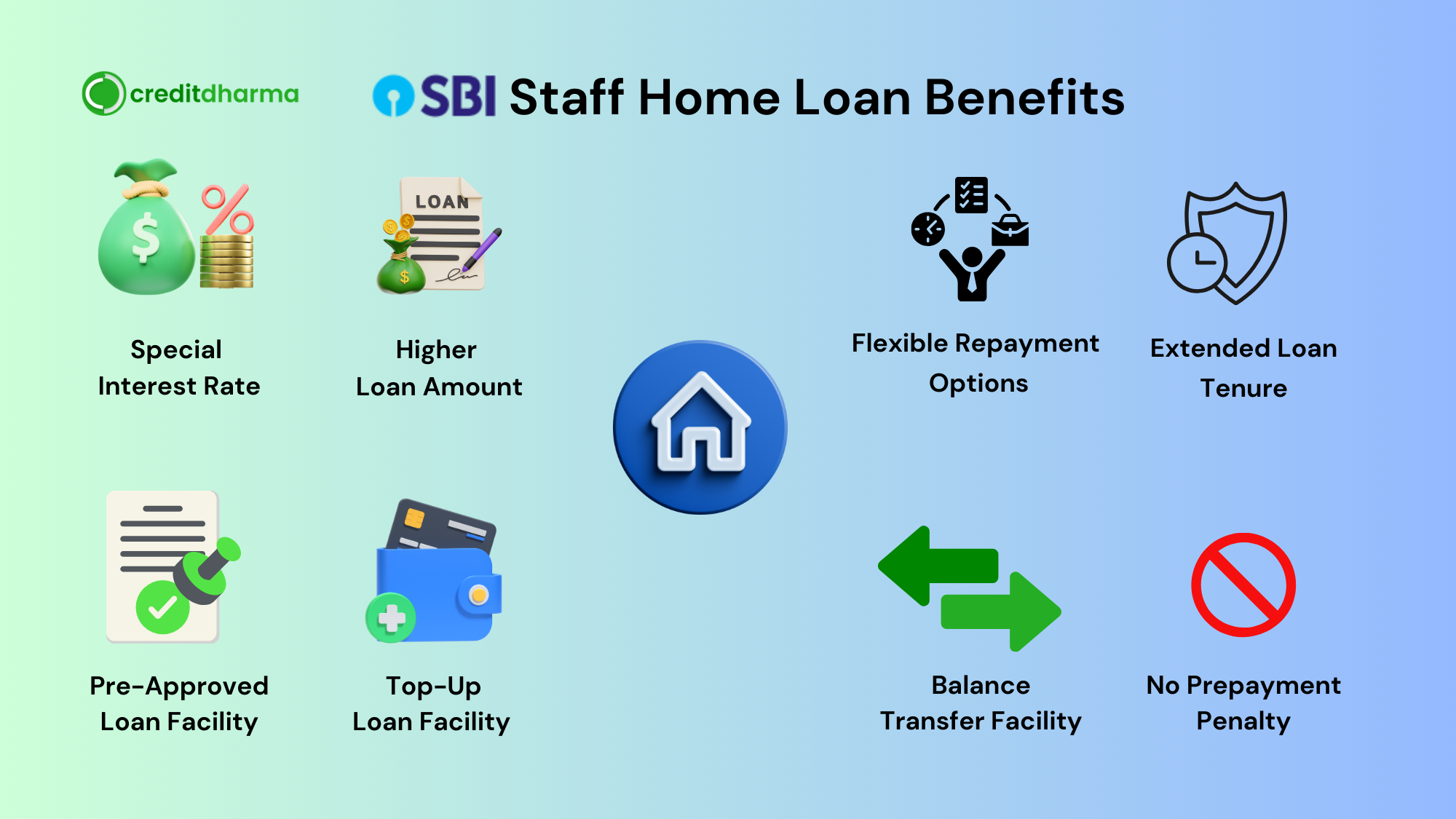

Benefits of SBI Staff Home Loan

Special Interest Rates

One of the most significant benefits of the SBI Staff Home Loan is the reduced interest rate. SBI offers lower interest rates to its employees compared to standard home loan rates available to the public. This reduction can lead to substantial savings over the loan tenure.

Higher Loan Amounts

SBI employees are eligible for higher loan amounts under the SBI Staff Home Loan scheme. This means you can borrow a larger sum to purchase your dream home without the worry of insufficient funds.

Flexible Repayment Options

SBI understands that financial situations can change. Therefore, the SBI Staff Home Loan provides flexible repayment options. Employees can choose from a variety of repayment plans that best suit their financial capabilities and goals.

Extended Loan Tenure

Another notable benefit is the extended loan tenure. SBI offers longer repayment periods to its employees, which reduces the monthly EMI burden and makes home ownership more affordable.

Simplified Documentation

The documentation process for the is streamlined and simplified. As an SBI employee, you can expect a hassle-free application process with minimal paperwork, ensuring a quick and efficient loan approval.

Pre-Approved Loan Facility

SBI staff members can benefit from pre-approved loan facilities. This feature allows employees to plan their finances better, knowing they have a pre-approved loan amount ready for their home purchase.

Top-Up Loan Facility

SBI also offers a top-up loan facility to its employees. If you need additional funds after availing the initial loan, you can apply for a top-up loan with ease, providing financial flexibility for further home improvements or other expenses.

Balance Transfer Facility

If you have an existing home loan with another bank, SBI offers a balance transfer facility. You can transfer your existing loan to SBI to take advantage of the lower interest rates and other benefits offered to SBI employees.

Zero Prepayment Penalty

SBI Staff Home Loan allows for prepayment of the loan without any penalty. This means you can pay off your loan earlier than the stipulated tenure without incurring any extra charges, saving on interest payments.

Insurance Coverage

SBI provides comprehensive insurance coverage for the SBI Staff Home Loan. This ensures that in the unfortunate event of the borrower’s demise, the outstanding loan amount is covered, offering financial security to the family.

Get a Home Loan

with Highest Eligibility

& Best Rates

How to Apply for SBI Staff Home Loan

Applying for the Staff Home Loan is straightforward. Employees need to follow a few simple steps to avail of the loan. Here’s a quick guide:

- Check Eligibility: Ensure you meet the eligibility criteria set by SBI for the Staff Home Loan.

- Gather Documents: Collect the necessary documents such as employment proof, salary slips, ID proof, and address proof.

- Fill Application Form: Complete the home loan application form available on the SBI website or at any SBI branch.

- Submit Application: Submit the application form along with the required documents to the nearest SBI branch or online.

- Loan Processing: Once the application is submitted, SBI will process the loan and verify the documents.

- Loan Approval and Disbursement: After successful verification, the loan will be approved and the amount disbursed to your account.

Conclusion

The SBI Staff Home Loan is an excellent financial tool for SBI employees aspiring to own a home. With benefits like special interest rates, higher loan amounts, flexible repayment options, and more, it stands out as one of the best home loan schemes available to bank employees. Make the most of these exclusive benefits and take a step closer to owning your dream home with SBI.

Frequently Asked Questions

SBI employees typically receive home loans at interest rates lower than those offered to the general public. The exact rate can vary but is generally more favorable for staff members.

A staff home loan is a special loan product offered to employees of a bank, like SBI, with favorable terms such as lower interest rates, higher loan amounts, and flexible repayment options.

Yes, bank employees, including those at SBI, often get home loans at reduced interest rates compared to standard customer rates, making them cheaper and more affordable.

HDFC Home Loan

HDFC Home Loan SBI Home Loan

SBI Home Loan