Estimated reading time: 6 minutes

Are you dreaming of owning a home in a rural area but concerned about the financial burden? If you’re sitting there wondering how you can transform this vision into reality, you’re in the right place.

This guide isn’t just about forms and formalities; it’s your first step toward building the home you’ve always wished for. Learn everything you need to know about applying online for PMAY Gramin.

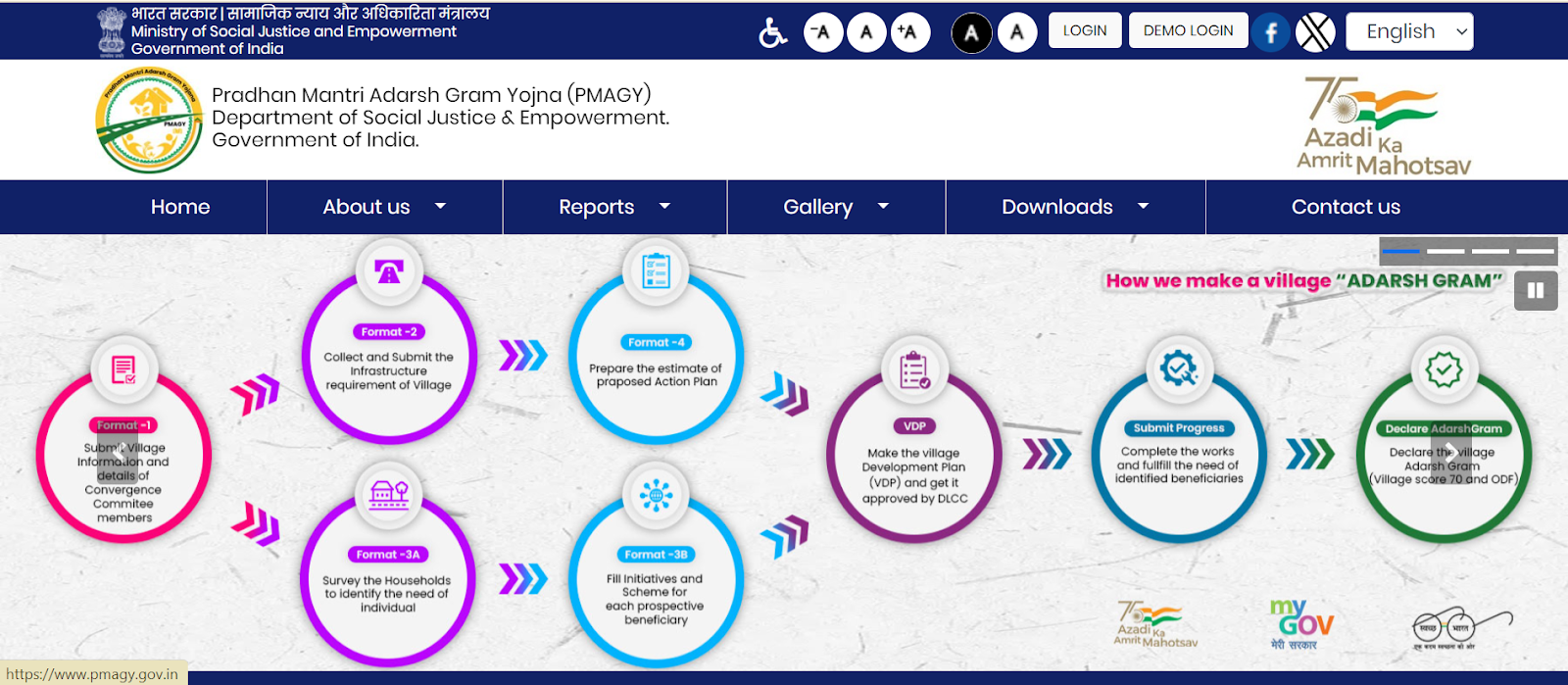

How to Apply For PMAY – Gramin Online

Here are the steps to Apply For PMAY:

- Log in to the official PMAY-G website.

- Fill in all required fields with the beneficiary’s personal details, such as gender, Aadhaar number, mobile number, among others.

- Attach the complete consent letter that permits the use of the beneficiary’s Aadhaar information.

- Click on the ‘search’ button to reveal details about the beneficiary and check if they are marked as a ‘priority’.

- After verifying the details, click on ‘Register’ to add the beneficiary to the system.

- Ensure all the displayed information is correct.

- Fill in any remaining fields, including Aadhaar, nominee details, and bank account information.

- If the beneficiary wants to apply for a loan under this scheme, select ‘Yes’ and specify the desired loan amount.

- Enter details for SBM and MGNREGS as required.

- Once all data is entered, the system will allow you to submit the application.

- The designated authority will then review and process the addition of the beneficiary.

Looking for an affordable home with low-interest rates?

Pradhan mantri Awas Yojana Gramin (G) – All Details

| Contact Criteria | Details |

|---|---|

| PMAY – G Official Website | https://www.pmagy.gov.in/ |

| Help Desk | +91-11-24364468 |

| Email Address | support.pmayg@gov.in |

What is PMAY – Gramin?

The Pradhan Mantri Awas Yojana – Gramin (PMAY-G), previously known as the Indira Awaas Yojana, is a flagship scheme by the Indian government aimed at providing affordable housing to the rural poor. Launched in 2016 as part of a broader initiative to ensure housing for all by 2024, PMAY-G focuses on promoting accessibility, affordability, and quality of rural housing.

Who is Eligible to Apply For PMAY – Gramin Scheme?

Here is the Eligiblity Criteria for PMAY:

- Landless or homeless families, aiming to support the most vulnerable in rural areas.

- Families residing in one or two-room kutcha houses, where the structures are not made of permanent materials like concrete.

- Households without a literate male adult over 25 years old, highlighting the focus on educational disadvantage.

- Families without any members aged between 15 and 59 years, addressing those lacking in workforce age support.

- Families with a disabled member, ensuring support for differently-abled individuals.

- Individuals who rely solely on casual labour for income, addressing those without stable employment.

- Members of Scheduled Castes, Scheduled Tribes, and minorities, to promote inclusivity and support for underrepresented communities.

Documents Required For PMAY – Gramin

To apply for PMAY – Gramin, applicants must provide the following documents:

- Aadhaar Card

- MGNREGA Job Card

- Bank Account Details

- Swachh Bharat Mission (SBM) Number

- Property Documents

- Caste Certificate (for reserved category applicants)

Get a Home Loan

with Highest Eligibility

& Best Rates

Benefits of the Pradhan Mantri Awaas Yojana Gramin (PMAYG)

Financial Assistance and Subsidies

- Housing Support:

- In plain areas, each unit receives up to ₹1.20 lakh.

- In hilly states, northeastern states, and the Union Territory of Jammu & Kashmir, the assistance increases to ₹1.30 lakh per unit.

- For Union Territories like Ladakh, financing is fully provided by the Central Government.

- Affordable Loans:

- Beneficiaries have the option to secure a loan up to ₹70,000 at a reduced interest rate, 3% lower than typical market rates for non-subsidized loans.

- Interest Subsidy:

- The scheme offers an interest subsidy for a principal amount up to ₹2,00,000.

- This can significantly reduce the amount of EMI payable, with a maximum subsidy reach of ₹38,359.

Employment and Additional Support

- MGNREGA Employment: Provides 95 days of wage employment at ₹90.95 per day, alongside skill-building opportunities.

- Toilet Construction: Offers up to ₹12,000 for building toilets under the Swachh Bharat Mission-Gramin (SBM-G).

Enhanced Living Conditions

- Comprehensive Amenities: Includes piped water, electricity, LPG connections under Pradhan Mantri Ujjwala Yojana, and waste treatment.

- Direct Payments: Funds are directly transferred to Aadhaar-linked accounts for transparency and efficiency.

How to Check PMAY Application Status

To monitor the progress of your PMAY G application, you can easily check its status through the official Pradhan Mantri Awas Yojana Gramin website by following these steps:

- Visit the PMAYG official website.

- Click on the “FTO Tracking” option located under the “Awaassoft” section on the website.

- Input your Fund Transfer Order (FTO) number or Public Finance Management System (PFMS) ID to view the current status of your application.

Conclusion

Applying for the Pradhan Mantri Awaas Yojana Gramin (PMAY-G) can significantly improve your living conditions by providing financial assistance, affordable loans, and additional benefits such as employment opportunities and essential amenities. If you’re eligible and in need of housing support, don’t hesitate to apply through the official PMAY-G platform.

For further guidance on your PMAY-G application, visit us at Credit Dharma. We’re here to help you navigate through your home financing journey and ensure you make the best choices for your future.

Frequently Asked Questions

The scheme targets families with no adult members between the ages of 16 to 59, no literate adults over 25 years, households with no male adult members or disabled members, and families that do not own land and earn from casual labour.

Yes, beneficiaries under PMAY-G can also use the subsidy to upgrade or expand their existing kutcha or semi-pucca house to a pucca house.

The scheme provides for the construction of a house covering a minimum area of 25 square metres, including a dedicated area for hygienic cooking.

The Gram Sabha plays a crucial role in the identification and selection of beneficiaries under the scheme to ensure transparency and that the assistance reaches those genuinely in need.

HDFC Home Loan

HDFC Home Loan SBI Home Loan

SBI Home Loan