TDS on the sale of property is crucial for both buyers and sellers dealing with immovable property transactions exceeding ₹50 lakh. Section 194IA outlines the tax responsibilities to ensure transparency and compliance in these high-value deals. This simple guide helps navigate the tax implications effectively.

TDS Deduction on Property Sales Over Rs 50 Lakhs

When you buy a property worth more than Rs 50 lakhs in India, it’s important to deduct Tax Deducted at Source (TDS). This applies to all non-agricultural immovable properties like homes and land. Here’s a simple breakdown of what you need to know:

- Who Deducts TDS: The buyer is responsible for deducting the TDS, not the seller.

- Deduction Rate: 1% of the total payment made to the seller.

- When to Deduct: The payer must deduct TDS at the time of payment, which can include installments.

- Inclusive Costs: Calculate TDS on the total amount, including any additional charges such as club membership fees, parking fees, and utility fees if you agreed on these after September 1, 2019.

- PAN Requirement: The buyer must use the seller’s PAN for the transaction. If the seller’s PAN is not available, deduct TDS at 20%.

- Filing TDS: File TDS using Form 26QB within 30 days from the end of the month in which you deducted TDS.

- Issuing TDS Certificate: After depositing TDS, the buyer must furnish a TDS certificate, Form 16B, to the seller, which is available approximately 10-15 days after the deposit.

Also read: Documents for Home Loan Application

Simple Steps to File TDS for Property Sales and Get Form 16B

Filing Tax Deducted at Source (TDS) when you buy a property over Rs 50 lakhs is straightforward.

Time needed: 2 minutes

Here’s how to do it online through Challan 26QB and secure your Form 16B:

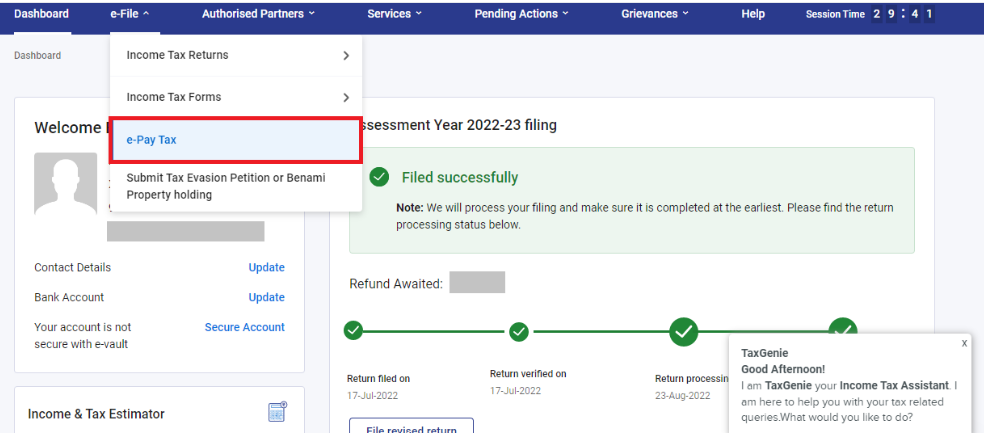

- Log In and Initiate Payment:

– Visit the Income Tax e-filing portal.

-Select ‘e-File’ and choose ‘e-Pay Tax’.

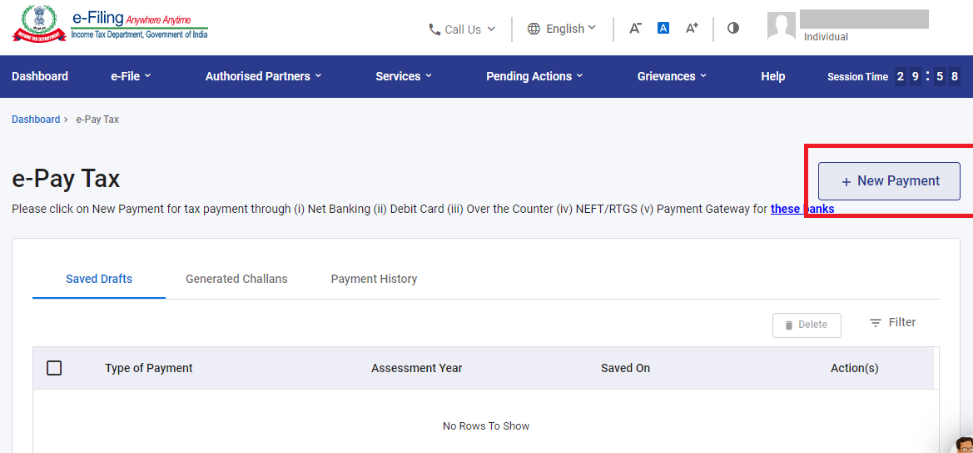

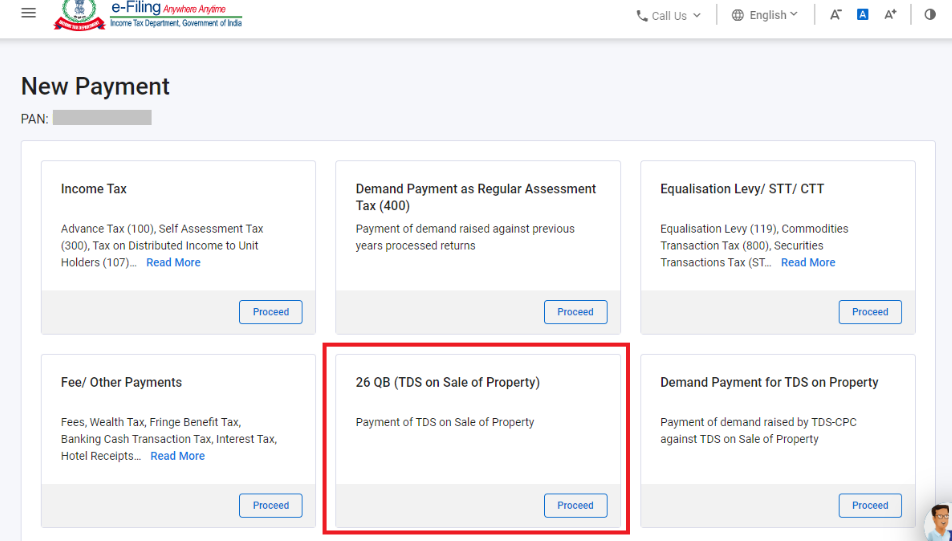

-Start a new payment by clicking ‘+ New Payment’ and proceed with ‘26QB- TDS on Property’.

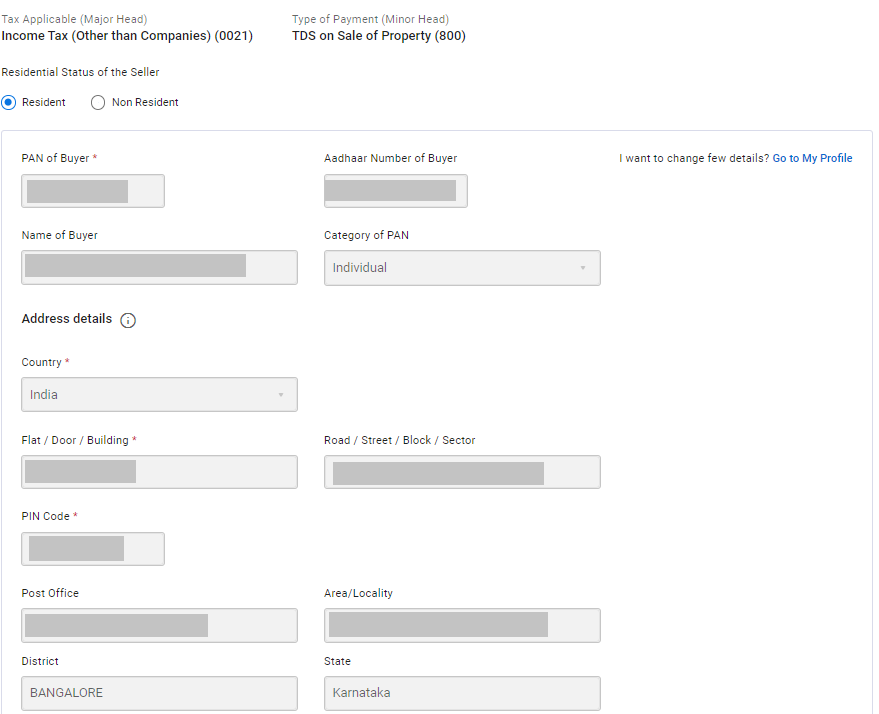

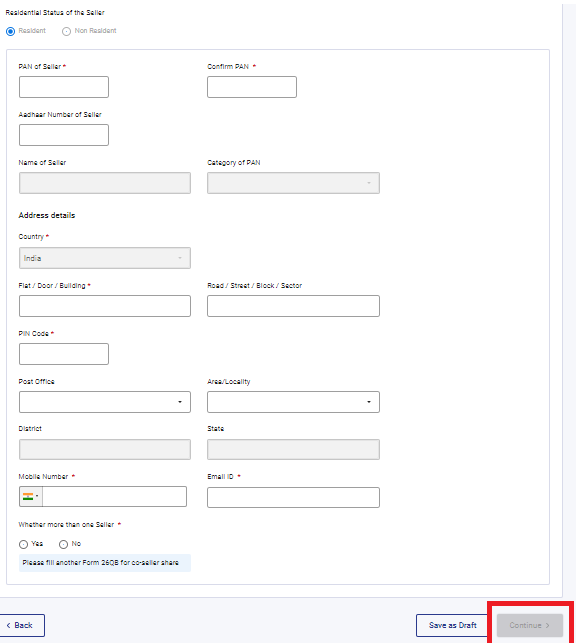

- Enter Transaction Details:

-Enter the buyer’s details. It auto-populates or can be edited as necessary.

-Add the seller’s details, including PAN and address.

-Input details about the property like type, location, date of the agreement, and total value. The system calculates the tax automatically.

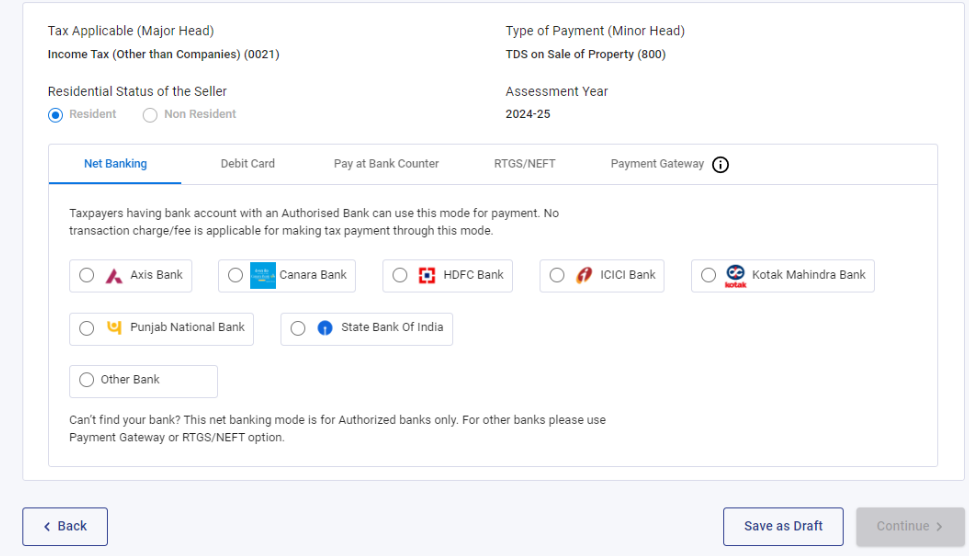

- Complete the Payment:

-Choose your payment method and submit the payment.

-Once paid, a challan is generated confirming your transaction. - Register and Download Form 16B:

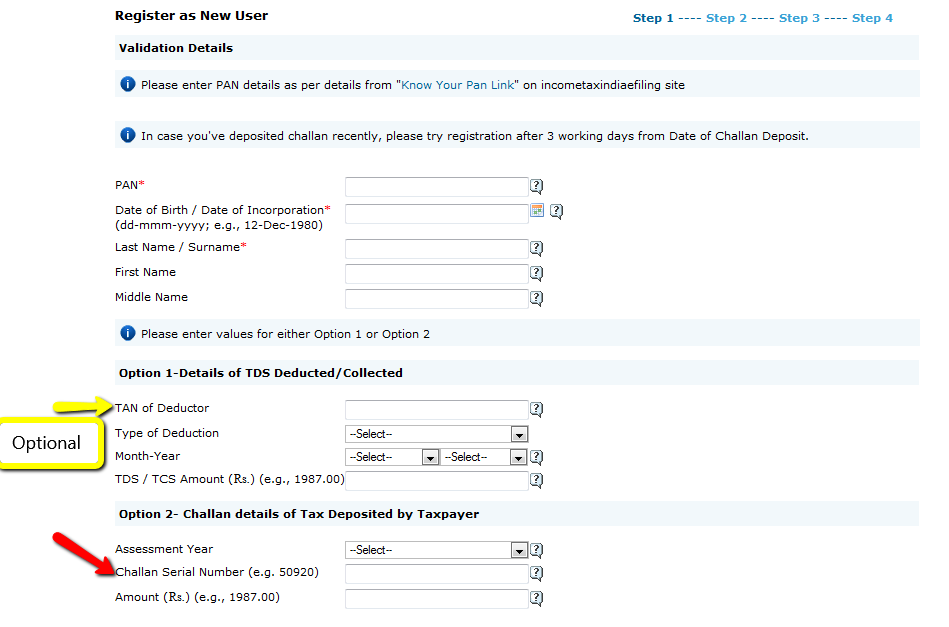

If new to the system, register on TRACES as a taxpayer using your PAN and challan information.

-After registration, check your Form 26AS in a week to see the TDS details.

-Download Form 16B from TRACES by entering the seller’s PAN and the transaction’s acknowledgement number.

-Once requested, download the form as a .zip file using the deductor’s date of birth as the password.

Filing TDS Form 26QB for Property Transactions

When purchasing a property over Rs 50 lakhs, it’s crucial to file TDS Form 26QB correctly to avoid legal notices. Here’s what you need to know:

- Tax Tracking: The Income Tax Department uses data from registrar offices to monitor property transactions.

- Notice Risk: If you fail to deduct 1% TDS or file Form 26QB on time, the department will issue a notice.

- Compliance: Ensure timely TDS deduction and form submission to prevent penalties and streamline your property purchase.

Example of a Tax Notice for Unfiled TDS Form 26QB

If you purchase a property valued over Rs 50 lakhs and neglect to file the required TDS Form 26QB, you might receive a tax notice similar to the one below:

Subject: Urgent: TDS Compliance Required for Property Purchase

Date: [Insert Date]

To: Property Buyer

PAN: [Insert PAN]

Notice:

Dear Property Buyer,

Our records show that you completed a property transaction over Rs 50 lakhs during the fiscal year [Insert Fiscal Year]. It appears that you have not filed the necessary TDS documentation through Form 26QB.

Please address this matter immediately by submitting the TDS Statement in Form 26QB and ensuring that the TDS Certificate in Form 16B is issued as per the guidelines available on the TRACES website.

This action will help you comply with the tax requirements and avoid potential penalties. Thank you for your prompt attention to this important matter.

[Tax Authority Name]

Why You Must File Form 26QB for Property Transactions

Filing Form 26QB is essential when buying property priced at Rs 50 lakhs or more. Here’s what you need to do in simple steps:

- Deduct 1% TDS: When you pay for the property, deduct 1% tax at source.

- Deposit the Tax: Use e-tax payment options like net banking to deposit this tax to the government.

- Timely Submission: Ensure this tax is credited to the government within seven days from the month’s end when you made the deduction.

- Provide PAN Details: Both buyer’s and seller’s PAN details must be entered in Form 26QB online through the NSDL TIN website.

- Download Form 16B: After depositing the tax, you can download Form 16B from the TRACES website to provide proof of tax payment to the seller.

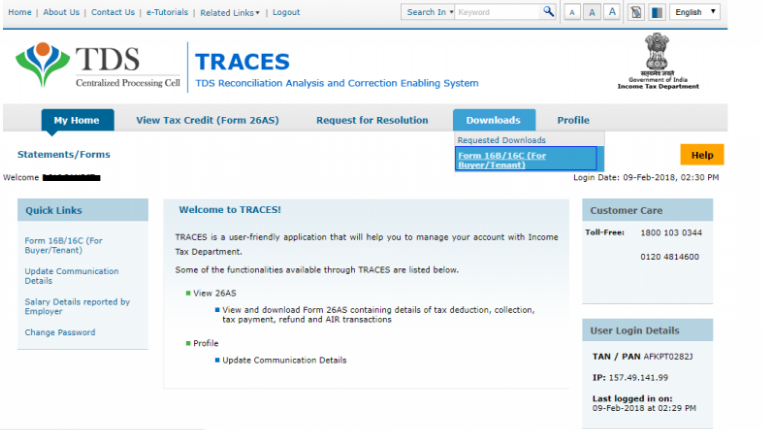

How to Provide Valid TDS Certificates with Form 16B from TRACES

After buying a property for Rs 50 lakhs or more, you must issue a TDS certificate to the seller. Here’s how to ensure the certificate is valid:

- Download from TRACES: Only TDS certificates downloaded from the TRACES website, the TDS Reconciliation Analysis and Correction Enabling System, are valid. You can access this system at TRACES.

- Mandatory Action: As a buyer, it’s your responsibility to generate and provide this certificate to the seller after completing your tax duties.

Read More: 194IA TDS on Property Sale: Key Things You Need to Know

Consequences of Delayed or Missing TDS Filings

Failing to file TDS statements on time can have serious financial consequences for both buyers and sellers of property:

| Stakeholder | Consequence |

|---|---|

| Buyer | Daily Penalties: Fined Rs. 200 per day for late filing as per Section 234E. |

| Additional Liabilities: Charges for late deduction and payments, potential penalties under Section 271H. | |

| Seller | Loss of TDS Credit: Cannot claim TDS credit if the buyer delays filing Form 26QB. |

| Mandatory Government Deposit: Tax deducted must be deposited within seven days post-deduction. |

Penalties for Failing to File Form 26QB

Failing to file Form 26QB for property transactions over Rs 50 lakhs can result in significant penalties:

| Violation | Penalty Description |

|---|---|

| Non-Deduction of TDS | Interest of 1% per month from the intended deduction date until the TDS is actually deducted. |

| Delayed Deposit of TDS | Interest of 1.5% per month from the deduction date to the payment date to the government. |

| Late Filing of Form 26QB | A late filing fee under Section 234E at Rs 200 per day, charged from the due date until the form is submitted. |

Conclusion

Understanding TDS on the sale of the property is crucial for compliance and avoiding penalties. This overview helps buyers and sellers ensure they meet their tax obligations efficiently. Always file and pay TDS on time to streamline your property transactions.

Frequently Asked Questions

TDS under Section 194IA applies only if the property transaction is ₹50 lakh or more. You must deduct it from the total sale value, not just the amount exceeding ₹50 lakh.

Under Section 194C, TDS is 1% for individual or HUF contractors and 2% for other entities. If the contractor does not provide a PAN, charge TDS at 20%.

The TDS rate for Form 26QB is 1% of the property’s total sale value. No TDS is required if the property price is less than ₹50 lakh. Buyers must ensure timely deduction and payment.

To lower TDS on property sales, apply for a Lower Deduction Certificate (LDC) using Form 13 on the TRACES portal. Submit the required documents to the Income Tax Assessing Officer before the transaction.

The updated rule requires buyers to deduct 1% TDS on property transactions where the total value exceeds ₹50 lakh. This deduction must be made from the payment to the seller.

Section 194IA of the Income Tax Act requires buyers to deduct 1% TDS on property transactions above ₹50 lakh. This applies to all types of immovable property, including residential, commercial, and land, ensuring tax compliance.

TDS at 2% applies to payments for taxable goods or services when the total value under a single contract exceeds ₹2.5 lakh. The buyer must deduct TDS to ensure compliance with tax rules.

HDFC Home Loan

HDFC Home Loan SBI Home Loan

SBI Home Loan