Union Bank Of India offers home loans in 2025 with rates starting at 8.60% p.a. for salaried and self-employed individuals. With flexible terms, quick approvals, and minimal documentation, Union Bank of India caters to diverse needs like purchasing, constructing, or renovating homes. Rates are tailored according to credit score, loan amount, and tenure to ensure affordability.

Union Bank of India Home Loan Interest Rates by Employment

Union Bank Of India Home Loan Interest rates for 2025 will start from 8.60% per annum for salaried employees and for self employed borrowers. It is due to income consistency, credit score and repayment ability.

Union Bank of India Home Loan Interest Rates for Salaried Employees

| Home Loan Type | Home Loan Interest Rates |

|---|---|

| Home Loan For Salaried | 8.60% p.a. |

Union Bank of India Home Loan Interest Rates for Self Employed

| Home Loan Type | Home Loan Interest Rates |

|---|---|

| Home Loan For Self Employed | 8.60% p.a |

Union Bank of India Home Loan Interest Rates for NRIs

| Home Loan Type | Home Loan Interest Rates |

|---|---|

| Home Loan For NRIs | 8.60% p.a |

Union Bank of India All Schemes Home Loan Interest Rates

Union Bank Of India presents a range of home loan schemes in 2025, with interest rates beginning at 8.60% p.a., designed for salaried, self-employed, and NRI customers. The loans feature flexible tenures, easy documentation, and fast approvals.

| Home Loan Type | Home Loan Interest Rates |

|---|---|

| Union Green Home | 8.60% p.a onwards |

| Union Home | 8.60% p.a onwards |

| Union Awas | 8.60% p.a onwards |

| Union Loan For Plot Purchase | 9.00% p.a. to 10.95% p.a |

| Builder Tie-Ups (Approved Projects) | 8.60% p.a onwards |

| Union Smart Save | 9.30% p.a. to 10.90% p.a |

Read More: Union Bank Home loan Eligibility Checklist

All Schemes Offered by Union Bank of India: A Detailed Overview

Explore all the loan schemes offered by Union Bank Of India home loans, business loans, personal financing and many more planned to suit numerous financial needs through flexible terms.

Union Green Home

Union Green Home is an eco-friendly home loan scheme by Union Bank of India, promoting sustainable housing with attractive interest rates and benefits.

| Features | Details |

|---|---|

| Interest rate | 8.60% p.a onwards |

| Maximum loan amount | up to 90% of the property value |

| Loan tenure | Up to 30 years |

| Processing fees | 0.50% (Max. Rs.15,000/- +GST) |

| Eligibility | New and Existing Bank Customers |

Union Home

Union Home is a housing loan scheme by Union Bank of India, offering flexible financing options for purchasing, constructing, or renovating a home.

| Features | Details |

|---|---|

| Interest rate | 8.60% p.a. |

| Maximum loan amount | Up to Rs. 30 lakh |

| Loan tenure | Up to 30 years |

| Processing fees | 0.50% (Max. Rs.15,000/- +GST) |

| Eligibility | New and Existing Bank Customers |

Union Awas

Union Awas is a home loan scheme by Union Bank of India designed to provide affordable housing finance for individuals in rural and semi-urban areas.

| Features | Details |

|---|---|

| Interest rate | 8.60% p.a onwards |

| Maximum loan amount | Up to Rs. 20 lakh |

| Loan tenure | Up to 30 years |

| Processing fees | 0.50% (Max. Rs.15,000/- +GST) |

| Eligibility | New and Existing Bank Customers |

Union Loan for Plot Purchase

Union Loan for Plot Purchase is a financing option by Union Bank of India that helps individuals purchase residential plots with flexible repayment terms.

| Features | Details |

|---|---|

| Interest rate | 9.00% p.a. to 10.95% p.a |

| Maximum loan amount | Up to Rs. 10 crore |

| Loan tenure | Maximum of 360 months or 70 years age of borrower |

| Processing fees | 0.50% (Max. Rs.15,000/- +GST) |

| Eligibility | New and Existing Bank Customers |

Builder Tie-Ups (Approved Projects)

Union Loan Builder Tie-Ups (Approved Projects) offers home loans for properties in approved builder projects, ensuring a smooth and hassle-free financing process.

| Features | Details |

|---|---|

| Interest rate | 8.60% p.a onwards |

| Maximum loan amount | up to 80% of the property value |

| Loan tenure | Up to 30 years |

| Processing fees | 0.50% (Max. Rs.15,000/- +GST |

| Eligibility | New and Existing Bank Customers |

Union Smart Save

Union Smart Save is a home loan scheme that helps borrowers reduce interest costs by linking their loan account to a savings or current account.

| Features | Details |

|---|---|

| Interest rate | 9.30% p.a. to 10.90% p.a |

| Maximum loan amount | Up to Rs. 75 lakh |

| Loan tenure | Up to 30 years |

| Processing fees | 0.50% (Max. Rs.15,000/- +GST |

| Eligibility | New and Existing Bank Customers |

Check Out: Union Bank EMI Calculator

How to Get Lowest and Best Home Loan Interest Rates at Union Bank of India

- Check your credit report: the tradeoff is that the higher your score is, the greater chance to qualify for a lower rate of interest.

- Comparison: Rate should be Union Bank Of India interest rate Compare it with others too.

- Earn steady income to hand it over: it is more vital to be drawing a salary over time.

- Decide to Choose the Best-Wanted Loan: Fixed interest is good because it means relaxation, yet floating rates typically start lower.

- Opt for the higher tenure: The duration of the loan becomes longer so that the EMI decreases while the total amount of interest increases.

- Make Profitable Investment: Cut down the loan amount by major payment options and receive improved rates.

- Express Interest in Special Offers: Especially for the female and Union Bank Of India account holders, there are no special offers for female customers and Union Bank Of India account holders presently.

- Get a discount on higher loan amounts: For loans drawn in higher amounts, the predominant factors are what reduction has been given on it.

- Check Loan Attachment: Look to swap or refinance in case of better loan terms available anymore.

- Negotiate on Processing Charges: With reference to some of those charges in terms of variations, you need to bargain out the ‘take-it-or-leave-it’ stance adopted by them.

Factors that Affect Union Bank of India Home-Loan Interest Rate

- If you have a good credit score, then you can benefit from the lower interest rates.

- Qualifying for larger loan amounts allows you to enjoy lower interest rates.

- A loan-lasting time of fewer years always yields lower interest for any long-dated deals.

- Employees who receive salaries generally are given the lowest interest rate, in comparison to self-employed people.

- The new loans have added a high rate of property and a lower loan-to-value ratio along with lower rates.

- Locations and survey nature (residential/commercial) of property influences that rate for home loans.

- Home Loans directly affected by the repo rates of The Reserve Bank of India.

- For long-time clients, Union Bank Of India offers special rates, better than the lowest published rate.

- LOW LTV ratios get more favorable at imposing lower interest rates.

- Loan Rates are comfortably affected by Economic factors like Inflation and Housing Markets.

Types of Home Loan Interest Rates

| Interest Rate Type | Definition | Pros | Cons |

|---|---|---|---|

| Fixed | Rate remains constant throughout a predetermined period or entire tenure. | – Predictable EMIs for budgeting – Protection against rising interest rates | – Typically higher rates compared to floating – No benefit if market rates go down |

| Floating (Variable) | Linked to market benchmarks (e.g., Repo Rate, MCLR) and changes over time | – Often cheaper when rates fall – Can partly or fully prepay with lower penalties | – EMIs fluctuate with market conditions – Costs may rise if rates increase |

How is Union Bank of India Interest Rates Calculated

Union Bank Of India calculates its home loan interest rates after analyzing certain key elements:

- Benchmark Rate: Based on the RBI guidelines and market conditions, Union Bank Of India uses either MCLR or EBLR.

- Spread or Markup: An individual and the type of loan granted it determines the spread added by Union Bank Of India.

- Credit Score: A higher credit rating often translates into lower interest rates.

- Type and Term of Loan: Other factors such as the loan type also play a key role in determining interest.

- Loan-to-Value (LTV) Ratio: A higher LTV ratio is likely to result in higher interest rates.

- Economical Factors: How interest rates swing given the current circumstances; inflation will help you understand how these factors will influence such borrowing rates as the Repo Rate set by the RBI.

- Loan Amount: Higher loan amounts can help avail better interest rates, but this insight is subjective to how lenders perceive your risk grade.

How to Switch my Union Bank of India home loan from Fixed to Floating Interest Rates?

Migrate from a fixed interest rate to a floating home loan interest rate from Union Bank Of India:

- Check Eligibility: Your loan account should be eligible to be converted. Subject to some terms and conditions in your existing loan agreement.

- Please get in touch with Union Bank: Contact the customer care or your relationship manager from Union Bank Of India requesting the switch from fixed to floating rate.

- Just Fill up the Form: Sometimes it is required to fill a formal request for beginning the conversion process physically or via an online submitted form.

- T&Cs will follow: The terms will follow about the prevailing floating rates, charges, and the re-definition of loan tenure or Emi Post-after discussion.

- What you are to know: You have to be cautious about the charges that may apply during the conversion like the processing fees or administrative charge or both even.

- Sign the Agreement: Sign a formal document if the conversion is approved to switch in reality to floating rates.

- Wait for Confirmation: Union Bank Of India will acknowledge the request after completion and put your home loan under the floating interest rate.

How to Obtain Union Bank of India Home Loan Interest Certificate

Time needed: 3 minutes

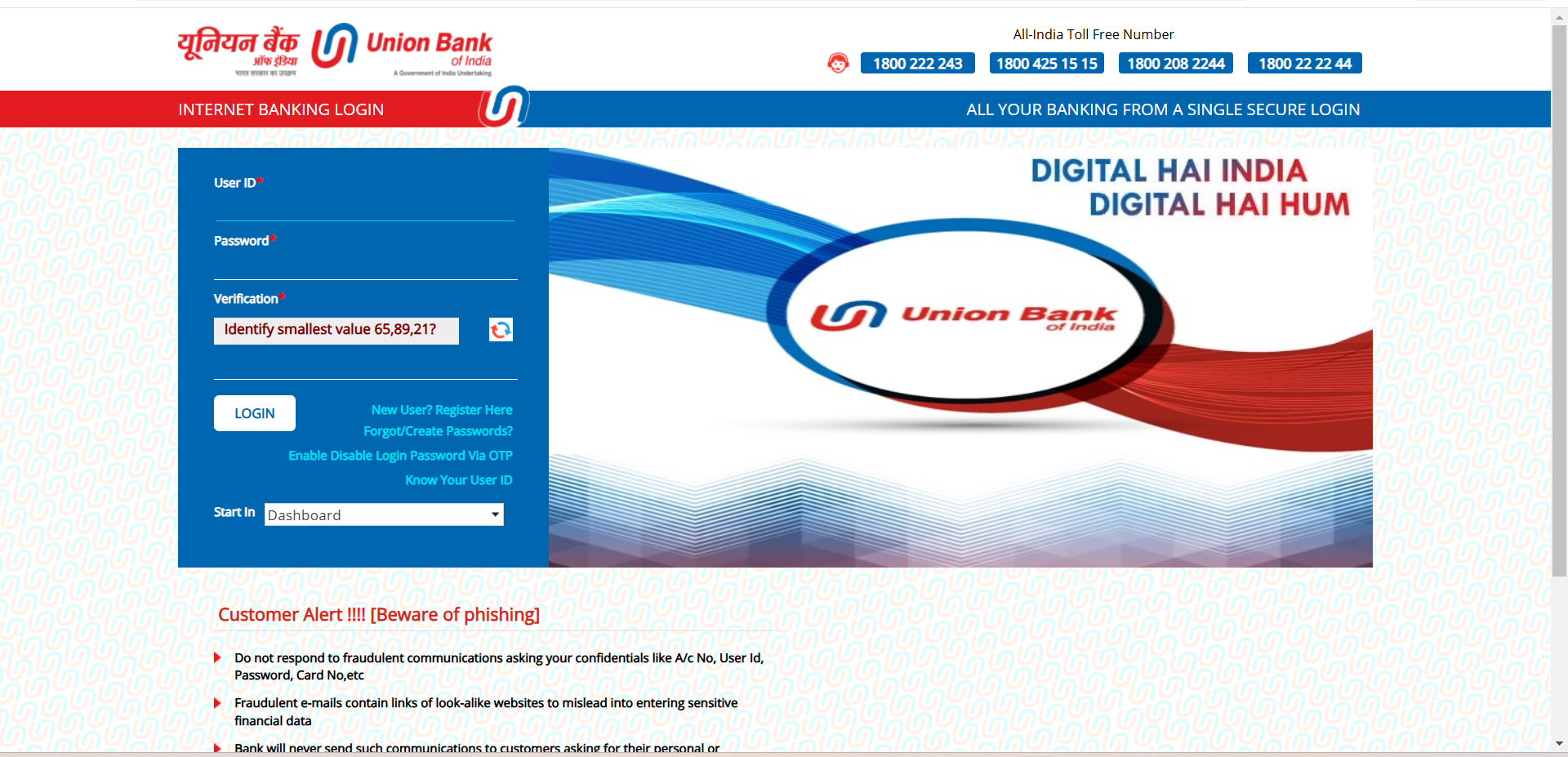

- Visit Union Bank Website

- Log in to your internet banking account using your credentials.

- Navigate to Loans: Click on the “Loans” or “Services” section in the menu.

- Select Home Loan: Choose your home loan account from the list.

- Download Certificate: Look for the “Interest Certificate” or “Provisional Certificate” option and click to download.

The interest certificate will include details of the interest paid on your home loan during the financial year, which is useful for tax purposes.

Secure the Lowest Union Bank of India Home Loan Interest Rates with Credit Dharma

Owning a house is a very big decision. Most people have a hard time getting a home loan. But we are here to make it easy for you-choosing to take Credit Dharma’s home loans is the best way to simplify all the processes. Our advice and personalized assistance can help alleviate your concerns.

Loan application progress status reports will be sent to you promptly to keep you informed.

Conclusion

The Union Bank Of India offers lower Home Loan Interest Rates with attractive flexible options, partnering with finance seekers to offer affordable and acceptable financing.

Frequently Asked Questions

The current home loan interest rate of Union Bank of India starts from 8.60% p.a. onwards, subject to eligibility and loan type.

Yes, Union Bank of India is a government-owned bank, fully owned by the Government of India.

Union Bank of India was founded in 1919, making it over 100 years old.

Union Bank of India merged with Andhra Bank and Corporation Bank in April 2020 to form a stronger entity.

Yes, Union Bank of India is a government-owned bank, ensuring safety and reliability for its customers.

Union Bank of India reported a 60% YoY increase in net profit for Q3FY24, reflecting strong financial performance.

HDFC Home Loan

HDFC Home Loan SBI Home Loan

SBI Home Loan