A capital gain statement provides a clear record of your investment gains and losses. It’s essential for accurate tax calculations and effective financial planning. Let’s explore how it can guide your investment decisions.

How to Download Capital Gains Statements for Mutual Funds?

Downloading your capital gains statements for mutual funds is simple. Here’s how you can do it through various channels:

Online Investment Platforms:

- Log in to the investment platform’s website or app.

- Head to the ‘Investments’ section and select ‘Mutual Funds’.

- Click on ‘Reports & Statements’.

- Select ‘Capital Gain Statement’ and choose the relevant financial year.

- Hit ‘Download’ to get your statement.

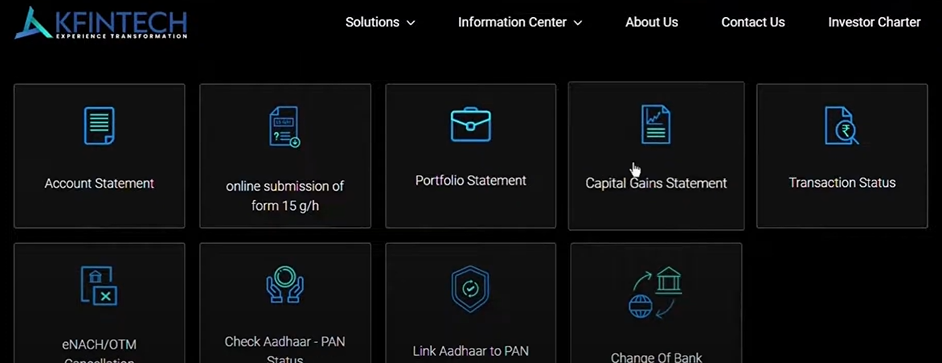

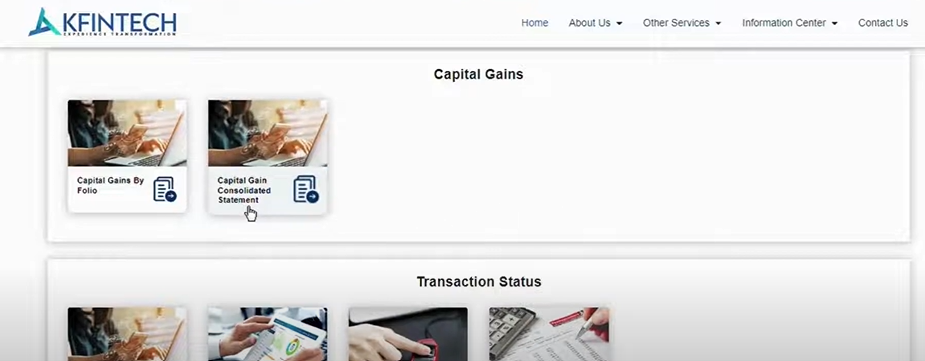

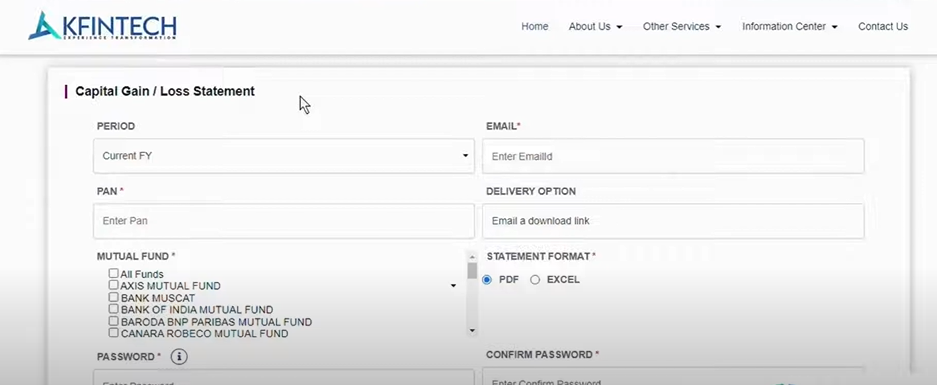

RTAs like CAMS and KFin Technologies Limited:

To download your capital gains statement, follow these steps:

- Visit the official website of the RTA:

2. Log in or create a new account if needed.

3. Go to the ‘Statements and Reports’ section and select ‘Capital Gains Statements.’

4. Choose ‘Consolidated Capital Gains Statement.’

5. Enter details like PAN and mutual fund type.

6. The statement will be sent to your registered email.

Mutual Fund Companies or AMCs:

1. Go to the official website of the mutual fund company. Here are few listed for you:

- HDFC Mutual Fund

- ICICI Prudential Mutual Fund

- SBI Mutual Fund

- Aditya Birla Sun Life Mutual Fund

- Kotak Mahindra Mutual Fund

2. Log in with your credentials.

3. Locate and download the capital gains report from the available options.

Check Out: Long Term Capital Gains on Sale of Property Calculator

What is a Capital Gain Statement?

A capital gain statement shows your earnings from selling assets like stocks or property. It compares what you paid and what you sold them for to calculate your profit or loss.

This statement helps you:

- Calculate taxes on investment profits.

- Track your investment performance.

- Stay compliant with tax laws.

- Make informed financial decisions.

Why Do You Need a Capital Gains Statement?

A Capital Gains Statement is key for anyone with investments. It shows your gains and losses from selling investments like mutual funds. Here’s why it matters:

- For Tax Filing: It ensures you report earnings accurately during tax time, keeping you in line with tax laws and avoiding fines.

- To Track Performance: This statement helps you see how well your investments are doing.

- For Smarter Financial Planning: Knowing your profits and losses helps you plan future investments more wisely and meet your financial goals.

- To Prevent Double Taxation: It keeps track of all your transactions, ensuring you don’t pay taxes twice on the same gain.

- During Audits: If audited, this statement provides a clear record of your financial activities to support your filings.

Also Read: How to Save Tax on Long Term Capital Gains

How Can You Calculate Capital Gains Correctly and Quickly?

Calculating your capital gains accurately is crucial for proper tax reporting and managing your investments. Here are straightforward tips to help:

- Track Purchase Dates: Remember when you bought your assets. This helps separate short-term gains from long-term ones.

- Include All Transactions: Make sure to count everything, like reinvested dividends, that affects your gains.

- Use Reliable Software: Pick good financial software to calculate gains. It reduces mistakes.

- Understand Indexation: For long-term gains, adjust for inflation. This can lower your taxable income.

- Calculate Net Gains: Subtract any losses from your gains to find your net gain or loss.

- Consult a Tax Expert: If unsure, talk to a tax professional. This avoids errors and ensures compliance.

Also Read: Capital Gain Tax on Sale of Property

How Can You Use Your Capital Gains Statement for Smarter Tax Planning?

Your capital gains statement is essential for smart tax planning. Here’s how to use it effectively:

- Identify Taxable Gains: Look at your statement to see your short-term and long-term gains. Short-term gains usually cost more in taxes.

- Use Tax-Loss Harvesting: Find any losses shown in the statement. You might sell these investments to reduce your taxable gains.

- Apply Indexation Benefits: For long-term investments, adjust the buying cost for inflation. This could lower your taxable gains.

- Plan for Tax Payments: Calculate the taxes you owe from your gains. Save enough money to cover these taxes.

- Make Better Investment Choices: Use what you learn from the statement to plan your next investments. Aim for choices that meet your financial goals.

- Talk to a Tax Advisor: If you have big gains or complex taxes, get advice from a tax expert. They can help you follow the rules and save money.

Conclusion

Managing your capital gain statement effectively ensures you stay on top of your investments and tax obligations. It simplifies tax filing and helps optimise your financial strategy. It’s a must-have for smart financial planning.

Frequently Asked Questions

Go to the mutual fund company’s website and log in to your account. Find the reports section, select the capital gains statement, and download it instantly.

Yes, CDSL allows investors to download their CAS online. Visit cdslindia.com, click Login at the top right, and follow the steps to access your statement.

Log in to your investment platform’s website or app. Go to the “Portfolio” or “Reports” section. Find the “Capital Gain Statement” option and select your folio number to download the statement.

Visit the NSDL e-Services website and log into your account. Go to the CAS statement section, select the relevant period, and download your statement. You can also subscribe to eCAS via email for future statements.

Select “Taxable income is above the exemption limit” as the reason for filing. Go to “Income Schedule,” click “Schedule Capital Gains,” choose the asset type, and enter the capital gains details accurately.

You must deposit in a Capital Gains Account within the allowed period, usually 2 to 3 years from the asset’s sale date. This ensures you meet tax exemption rules and avoid penalties.

Capital gains income is the profit earned from selling an asset at a higher price than its purchase cost. It is taxed as short-term or long-term, based on how long you held the asset before selling.

Capital gains up to ₹1.25 lakh per year from equity investments are tax-free. Long-term capital gains on equities are taxed at 12.5% beyond this limit.

HDFC Home Loan

HDFC Home Loan SBI Home Loan

SBI Home Loan