When buying property in India, most buyers focus on sale deeds, property tax receipts, and Khata certificates. But there’s one critical legal document that often gets overlooked — the Encumbrance Certificate (EC). If you’re investing in real estate, understanding the EC could save you from future legal and financial troubles.

Why is an Encumbrance Certificate Crucial for Property Buyers?

An encumbrance certificate is vital in the following instances:

Property Title Verification

Property title verification is the process of confirming the legal ownership and rights of a property. It ensures that the title is clear, free from disputes, liens, or legal complications. This is a critical step before purchasing or investing in real estate.

Loan Eligibility

When applying for a home loan, mortgage loan, or loan against property, banks and financial institutions conduct thorough due diligence to ensure that the asset offered as collateral is free from any legal complications. One of the mandatory documents for this verification is the Encumbrance Certificate.

Avoiding Fraud

To avoid property fraud, always verify the Encumbrance Certificate (EC) from the official Sub-Registrar’s office or government portal. Ensure the EC reflects a clear title with no outstanding loans or legal disputes. Cross-check the EC with the sale deed, property tax receipts, and consult a legal expert for thorough title verification before any transaction.

Property Mutation

Property mutation is the process of updating the title of a property in the revenue records after a transfer of ownership. While an Encumbrance Certificate (EC) confirms the legal and financial history of a property, mutation ensures the ownership is recorded in government land revenue records, which is equally important for proving undisputed possession.

Loan against Property

An Encumbrance Certificate (EC) is a crucial document required when applying for a Loan against Property (LAP). It verifies that the property offered as collateral is free from legal or financial liabilities, such as existing loans, mortgages, or disputes. Banks and financial institutions mandate the EC to assess the ownership status, title clarity, and risk associated with the property.

Property Tax Records

Property tax records are important to check along with EC because:

- They help verify the current municipal ownership of the property.

- Confirm that there are no outstanding municipal dues.

- Support property mutation and transfer of ownership.

- Are often required for loan approvals and legal due diligence.

PF Withdrawals

Employees may withdraw funds from their PF account for specific purposes, including:

- Buying or constructing a house

- Repaying a home loan

- Purchasing land for a home

In such cases, the Employees’ Provident Fund Organization (EPFO) may ask for proof that the property is free from legal or financial liabilities, which is where the Encumbrance Certificate comes in.

What is an Encumbrance Certificate?

An Encumbrance Certificate is an official document issued by the Sub-Registrar’s Office that proves a property is free from any legal or financial liabilities such as mortgages, loans, or disputes. It shows the complete record of transactions related to the property over a specified period.

An Encumbrance Certificate (EC) is an official document that certifies whether a property is free from any legal or financial liabilities, such as loans, mortgages, or disputes, over a specified period. It is issued by the Sub-Registrar’s Office and is essential for property transactions, ownership verification, and loan approvals.

Types of Encumbrance Certificates

There are primarily two types of Encumbrance Certificates (EC) issued in India related to property transactions:

Form 15 Encumbrance Certificate

- Issued when the property has recorded encumbrances during the specified period.

- It details all transactions related to the property such as inheritance, sale, purchase, lease, mortgage, gifting, relinquishment, or partition.

- This form shows the presence of any legal or financial liabilities on the property during the requested timeframe.

- It provides a comprehensive history of the property’s ownership and any claims or charges registered against it.

Form 16 Encumbrance Certificate (Nil Encumbrance Certificate)

- Issued when the property has no recorded encumbrances during the specified period.

- It certifies that the property is free from any legal or financial liabilities, such as loans or liens, for the duration requested.

- This form is also known as the Nil Encumbrance Certificate and indicates a clear title to the property, making it safe for purchase or loan processing.

Additional Context on Encumbrances

While the encumbrance certificate types are mainly Form 15 and Form 16, the term “encumbrance” itself can refer to several kinds of claims or restrictions on a property, including:

- Easements (rights to use the property by others without ownership)

- Deed restrictions

- Encroachments (unauthorized use or intrusion)

- Liens (legal claims, such as mortgages or unpaid taxes)

List of Documents which we should ask from developer before giving token amount.

by u/two_wheel_soul in indianrealestate

Documents Required to Apply for Encumbrance Certificate

| Category | Documents Required |

|---|---|

| Proof of Identity | PAN Card or Form 60 |

| Proof of Address | Aadhar card, voter ID, electricity bill, water bill, etc. |

| Property Details | survey number, plot number, location and boundaries. Sale deed, partition deed or gift deed, if any deed has been executed in the past. Property registration document, title or possession deed. |

Who is Eligible to Apply for An Encumbrance Certificate?

Anyone with a legal interest in a property can apply for an Encumbrance Certificate (EC). This includes property owners, prospective buyers, legal heirs, or authorized representatives like power of attorney holders. It’s commonly used to verify that a property is free from legal or financial liabilities.

| Category | Description |

|---|---|

| Property Owners | Individuals who legally own the property and need to verify its title or encumbrance status. |

| Prospective Buyers | Buyers conduct legal due diligence before purchasing property. |

| Legal Heirs | Heirs applying for EC to verify inheritance-related transactions or settle ownership claims. |

| Financial Institutions | Banks or NBFCs verifying property before loan sanction or mortgage processing. |

| Authorized Representatives | Advocates, legal agents, or power of attorney holders acting on behalf of the owner. |

How to Apply for an Encumbrance Certificate?

You can apply for an EC both online and offline.

Online Application (State Portals):

Follow these steps to apply online

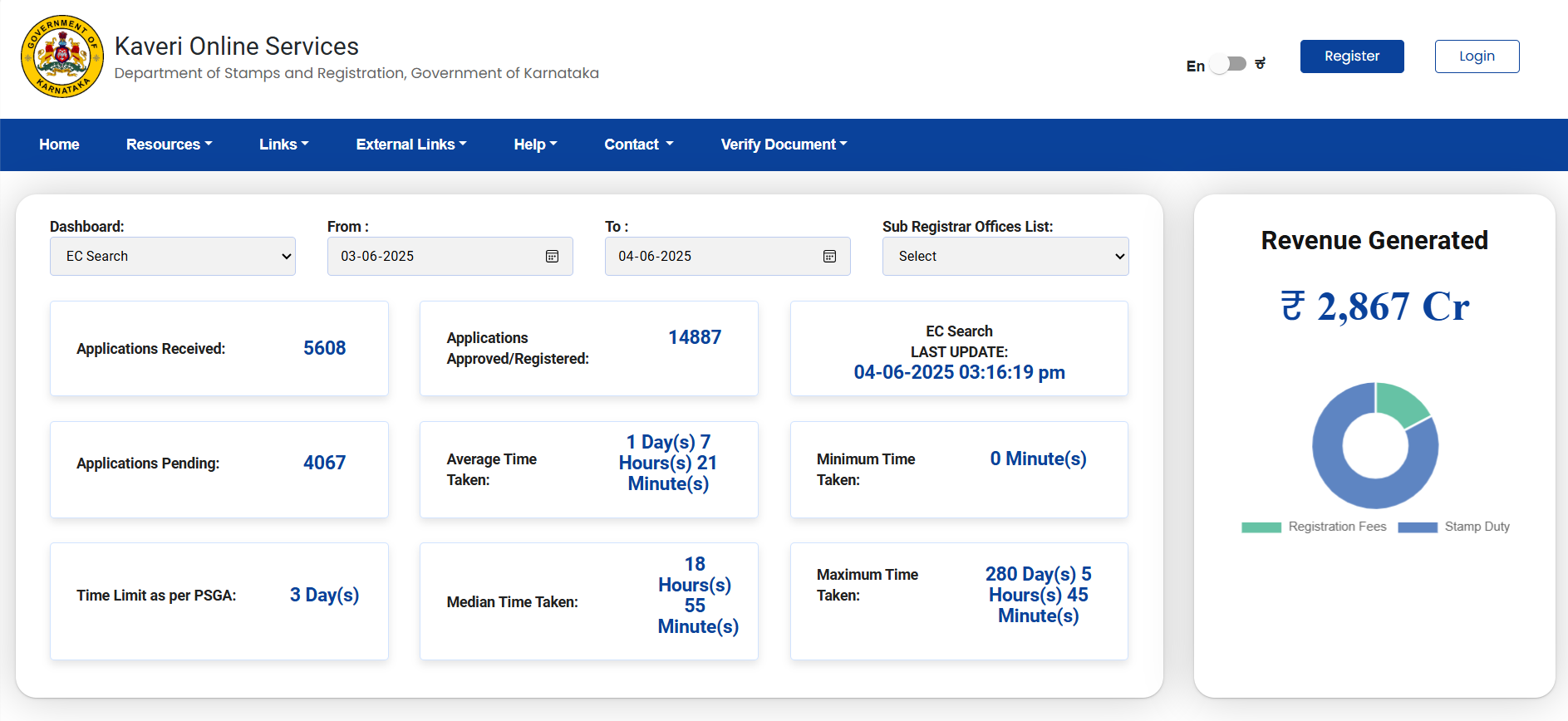

- Visit your state’s land registration website (e.g., Kaveri Online Services for Karnataka).

- Fill in the required property details.

- Upload supporting documents.

- Make the payment and download the EC once processed.

Offline Application (at Sub-Registrar Office):

- Submit Form 22 with property details.

- Specify the period for which you need the EC.

- Attach copies of property documents.

- Pay the applicable government fee.

Fee for Obtaining Encumbrance Certificate

Here is an updated table detailing the Encumbrance Certificate (EC) fees across various Indian states. Please note that these fees are subject to change, and it’s advisable to consult the respective state’s official registration department for the most current information.

| State / Location | Fee Details |

|---|---|

| Andhra Pradesh & Telangana | Rs. 200 per certificate for search and issue up to 30 years; Rs. 500 for more than 30 years; Telangana also charges Rs. 25 service charge. |

| Kerala | Application fee Rs. 15; 5 years general search Rs. 105; 6 to 30 years Rs. 250; Over 30 years Rs. 250 + Rs. 30 per year exceeding 30 years. |

| Karnataka | Single search fee Rs. 25; Copying fee Rs. 5 per 100 words; Fee per page for computer registered docs (exact amount not specified). |

| Delhi | Request fee starts from Rs. 200 and increases depending on locality and number of years requested. |

| Tamil Nadu | Application fee Re. 1; Rs. 15 for first year; Rs. 5 for each additional year. |

What to Do if Encumbrance Certificate Has Errors/Not Clear?

Contact the issuing Sub-Registrar office immediately with supporting documents to request corrections. Some states allow online correction requests also.

Encumbrance Certificate vs Title Deed

The Encumbrance Certificate (EC) and the Sale Deed are two distinct but complementary legal documents involved in property transactions, serving different purposes:

Key Differences Between Encumbrance Certificate and Sale Deed

| Aspect | Encumbrance Certificate (EC) | Sale Deed |

|---|---|---|

| Purpose | Certifies whether the property is free from legal dues, liens, mortgages, or other encumbrances during a specified period. It shows the history of financial and legal liabilities attached to the property. | Acts as the legal document that transfers ownership rights of the property from the seller to the buyer. It proves the buyer’s ownership. |

| Content | Details all registered transactions affecting the property such as sale deeds, gift deeds, mortgages, leases, court orders, and any claims or charges. | Contains terms of sale, payment details, possession date, warranties, and declarations about the property’s status (including encumbrances). |

| Legal Significance | Used to verify if the property has a clear title without pending legal or financial claims. It does not prove ownership. | The primary document that legally establishes ownership and transfers title from seller to buyer. |

| Validity Period | Covers transactions for a specific period (usually up to 30 years) as requested. | Permanent record of ownership transfer, valid indefinitely. |

| Issued By | Sub-Registrar’s Office where the property is registered. | Drafted and executed by the parties, registered at the Sub-Registrar’s Office. |

| Role in Transactions | Helps buyers and lenders verify the property is free from encumbrances before purchase or loan approval. | Finalizes the sale and ownership transfer, legally binding both parties. |

How Does Encumbrance Certificate Impact Home Loan Disbursement?

- An Encumbrance Certificate is mandatory for home loan applications to prove that the property is free from legal and financial liabilities.

- A clear EC enhances loan eligibility, speeds up approval, and ensures safer transactions for both lender and borrower.

- Properties with encumbrances shown in the EC may face loan rejection or stricter loan conditions.

- The EC provides transparency, preventing fraud and protecting all parties involved in the loan and property transaction.

Thus, obtaining a clean and recent Encumbrance Certificate is a crucial step in securing a home loan and ensuring smooth disbursement.

Suggested Read: Big Wins for Homebuyers and Real Estate Sector

Recent News Updates

BBMP Removes Encumbrance Certificate Requirement For E-Khata

The Bruhat Bengaluru Mahanagara Palike (BBMP) has removed the mandatory requirement of an Encumbrance Certificate (EC) for e-Khata applications to simplify and expedite the process for property owners. Now, an EC is only required when the e-Khata is intended for property sale, registration, or mutation purposes. This change primarily benefits owners of properties registered before 2004, who previously faced delays and high costs—sometimes up to Rs 5,000—due to obtaining the EC.

Under the new system, property owners can complete their e-Khata applications online by submitting documents such as the registered deed number, Aadhaar-based e-KYC, self-assessment scheme application number, and a property photograph, without needing to visit BBMP offices. This move aims to reduce dependency on middlemen, curb corrupt practices, and ease access for the majority of property owners who do not frequently transact their properties. The updated rule took effect in late October 2024, as confirmed by BBMP officials

Source : The Times of India

Frequently Asked Questions

An Encumbrance Certificate is a legal document that certifies whether a property is free from any monetary or legal liabilities like loans, mortgages, or litigation.

Typically, you need:

Property details (survey number, document number)

Property address

Sale deed copy or registered title documents

ID proof

Application form

Applicable fee

It is important:

When buying or selling a property

For property loan approval

To verify the ownership and legal status of the property

For property mutation or registration

The EC is issued by the Sub-Registrar’s Office under the Department of Stamps and Registration in your respective state.

You can apply:

Online (available in many states through official property or land record portals)

Offline by visiting the Sub-Registrar’s Office

A Nil EC means there are no legal dues or encumbrances on the property during the requested period.

No. It shows the transaction history and encumbrances but is not a standalone proof of ownership. A sale deed or title deed is required to establish ownership.

An Encumbrance Certificate is important because it ensures that a property has a clear title, is free from encumbrances, and protects buyers & lenders from potential legal & financial issues.

You can obtain an EC online through state government portals or by visiting the local sub-registrar’s office with the required documents.

HDFC Home Loan

HDFC Home Loan SBI Home Loan

SBI Home Loan