Estimated reading time: 6 minutes

Property tax represents a fundamental civic responsibility, essential for the development and maintenance of municipal services and infrastructure. In the context of Visakhapatnam, the Greater Visakhapatnam Municipal Corporation (GVMC) administers the property tax system, ensuring that local residents and property owners contribute fairly towards the community’s growth.

GVMC Property Tax Rates 2025

| ARV Range | Commercial/Non-residential Tax Rate | Residential Tax Rate |

|---|---|---|

| More than Rs. 3600 | 30% | 30% |

| Rs. 2401 to Rs. 3600 | 22% | 30% |

| Rs. 1200 to Rs. 2400 | 19% | 30% |

| Rs. 601 to Rs. 1200 | 17% | 30% |

| Up to Rs. 600 | Exempt (GVMC property tax payment not applicable) | 30% |

How to Pay GVMC Property Tax Online?

- Visit the official website of Commissioner & Director of Municipal Administration [Government of Andhra Pradesh]

- On the dashboard, under “Online Payments” click on “Property Tax”

- Select your district and corporation/ municipality/ nagar palika. Click on “Submit.”

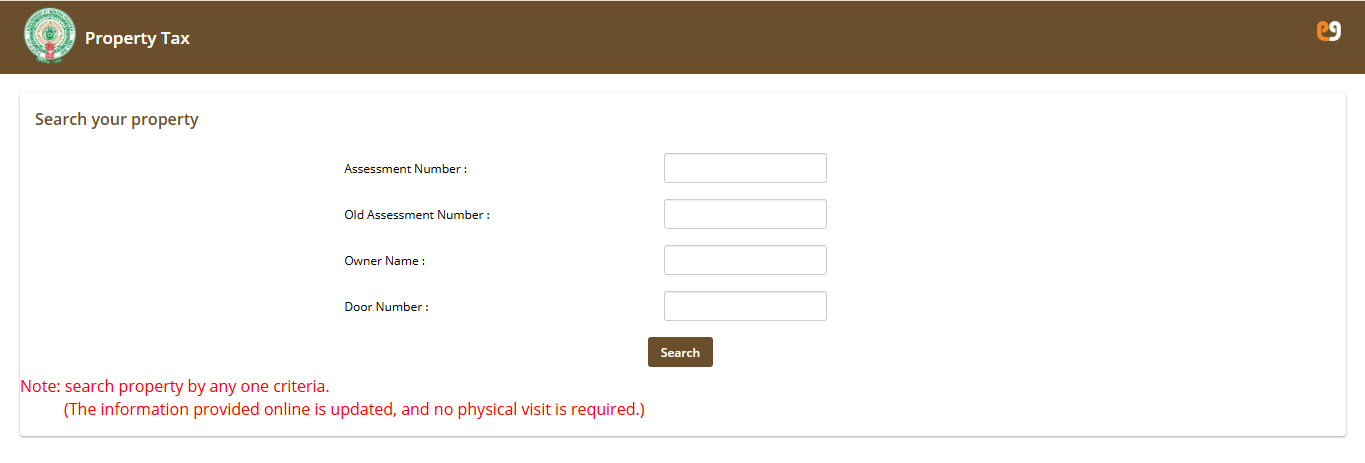

- Enter your new and old assessment number, owner name, and door number. Click on “Search.”

- Your property details will be displayed on the screen. Check the details and make the payment.

- On successful payment, you will receive a confirmation receipt. Save it for future reference.

Suggested Read: Meebhoomi AP Land Records

Land owners, see if your rent is up to par. Calculate your property rental yield and see where you stand.

Paying GVMC Property Tax via Mobile App

- Install the Pura Seva app.

- Register by providing your mobile number, email, username, and password, then verify with an OTP.

- Log in using your registered mobile number.

- Access the property tax section, enter your property details, and review the information.

- Choose your payment option—credit card, debit card, or net banking—and complete the transaction.

- Save the auto-generated receipt for your records.

Suggested Read: RERA Charges in Andhra Pradesh

How to Pay GVMC Property Tax Offline?

- Visit your local Purva Seva or citizen service centre.

- Provide the necessary property details (zone, district, corporation, municipality, etc.) along with supporting documents such as the assessment slip and property holding number.

- Complete your payment at the centre and obtain your receipt.

- If you need assistance, call the GVMC helpline at 1800 425 00009.

Suggested Read: Stamp Duty and Registration Charges in Andhra Pradesh

GVMC Property Tax: File Alteration

To modify your property tax application—such as converting from vacant land tax (VT) to house tax (HT)—follow these steps:

- Visit the official GVMC website.

- Go to the “Online Services” section.

- Select the “Property Tax” option.

- Click on “File Your Addition/Alteration.”

- Choose the correct property details (zone, district, corporation, municipality, etc.).

- Enter your property’s assessment number and submit your request.

Suggested Read: Impact of Location on Rental Income

GVMC Property Tax: File Tax Revision

If you wish to challenge the assessed tax amount, you can file a general revision petition within 15 days of receiving the special notice:

- Visit the official GVMC website.

- Navigate to the “Property Tax” section.

- Click on “Submit Your General Revision Petition.”

- Choose the appropriate property details (zone, district, corporation, municipality, etc.).

- Enter your property’s assessment number.

- Follow the on-screen instructions to complete your revision request.

Suggested Read: How to Save Income Tax on Rental Income?

GVMC Property Tax: Exemptions and Concessions

| Condition | Benefit |

|---|---|

| Payment before 30th April (Financial Year) | 5% rebate on the tax amount |

| Property age 25 years or less | 10% deduction on the Annual Rental Value (ARV) |

| Property age between 25 and 40 years | 20% deduction on the ARV |

| Property age over 40 years | 40% deduction on the ARV |

Suggested Read: Land Market Value in Andhra Pradesh 2025

How is GVMC Property Tax Calculated?

| Step | Description | Details/Calculation |

|---|---|---|

| Determine ARV | Estimate the Annual Rental Value (ARV) of your property. | ARV is based on factors like the property’s plinth area, location, age, and construction type. |

| Assess Property Parameters | Collect key property details needed for assessment. | Include property area, zone, type (residential or commercial), and building age. |

| Identify ARV Bracket | Classify your property based on its ARV range. | For example, ARV could be: Up to Rs.600, Rs.601–Rs.1200, Rs.1200–Rs.2400, Rs.2401–Rs.3600, or more than Rs.3600. |

| Apply Tax Rate | Determine the applicable tax rate based on the ARV bracket and property type. | Commercial properties have varying rates (e.g., 17%-30%), while residential properties are generally taxed at 30%. |

| Calculate Tax Amount | Compute the tax liability using the ARV and the applicable rate. | Multiply the ARV by the relevant tax percentage. |

| Factor in Exemptions/Rebates | Check for any applicable exemptions or rebates. | For instance, properties with very low ARV may be exempt, and early payment (before April 30) can yield a 5% rebate. |

Conclusion

In conclusion, taking care of your GVMC property tax is more than just a duty—it’s a way to help improve our community. Whether you prefer using the mobile app or visiting a service centre, the process is designed to be straightforward and stress-free. With options for exemptions, concessions, and even revisions, you can manage your property tax according to your needs.

Frequently Asked Questions

GVMC property tax is calculated based on the Annual Rental Value (ARV) of the property. The age, size, and use (residential or commercial) of the property also impact the tax rate.

For late payment, a penalty of 2% of the outstanding tax amount is charged each month until the payment is made.

ARV (Annual Rental Value) is the estimated yearly rental income a property can generate if it is rented out. This value is used by municipal authorities, like GVMC, to assess property taxes for both residential and non-residential properties. The ARV takes into account factors like the property’s location, size, type, and condition to determine its potential rental income. The higher the ARV, the higher the property tax.

As the new owner, you become responsible for any outstanding property taxes. It’s advisable to clear all dues to avoid penalties.

Generally, GVMC expects full payment of the annual tax. However, in some cases, they may offer installment options. Check with the GVMC office for current policies.

HDFC Home Loan

HDFC Home Loan SBI Home Loan

SBI Home Loan