The Jammu and Kashmir government has introduced an innovative Online Property Return System (PRS) to streamline the process of filing annual property returns for its employees. This digital initiative aims to enhance transparency, efficiency, and data security while reducing the hassles associated with manual filing. In this comprehensive guide, we will explore the various aspects of the Online Property Return System, including its features, benefits, and a step-by-step guide on how to use it.

What is the Online Property Return System?

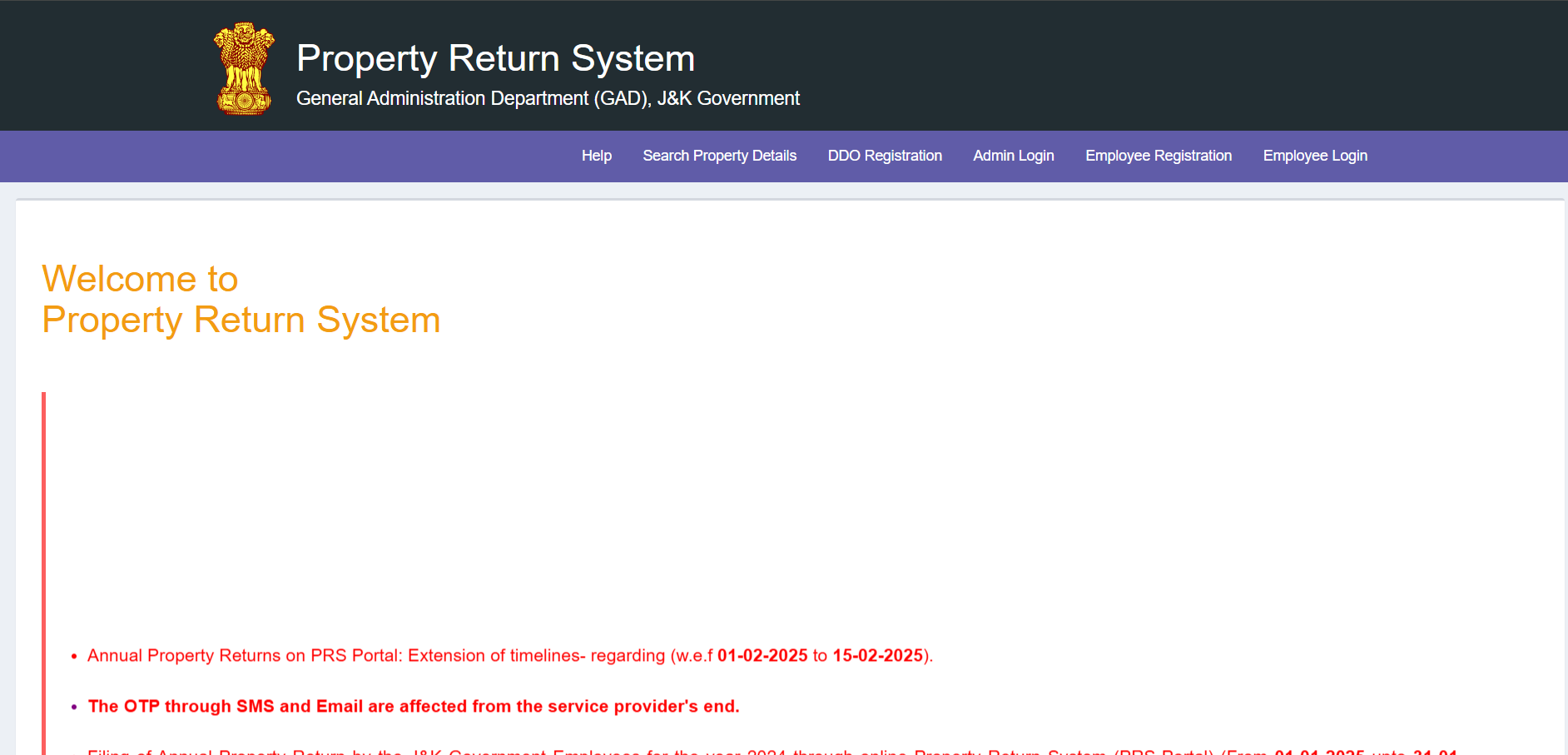

The Online Property Return System is a web-based portal developed by the Jammu and Kashmir government in collaboration with the Anti-Corruption Bureau (ACB), the University of Kashmir, the General Administration Department, and the Information Technology Department. The portal allows over 4.5 lakh government employees in the Union Territory to file their annual property returns online.

Why was the Online Property Return System Introduced?

Previously, government employees had to file their annual property returns manually, which often led to issues such as misplaced documents, delays, and non-receipt by the ACB. To address these challenges, the government launched the Online Property Return System, ensuring a more streamlined and transparent process.

Also Read: Essential Legal Documents Required for Property Loans

Key Features of the Online Property Return System

The Online Property Return System comes with several user-friendly features designed to simplify the process of filing annual property returns:

- Multi-Level and Multi-User Interface: The portal supports multiple users and levels, making it accessible to a large number of employees.

- Robust Admin Interface: The admin interface is designed to handle large volumes of data efficiently.

- Easy Registration: Employees can register easily using their CPIS or DDO number.

- Customized User Profiles: The portal allows users to create personalized profiles.

- Simple Navigation: The user-friendly interface ensures easy navigation.

- Data Security: The portal employs advanced security measures to protect user data.

- Quick Identification of Defaulters: The system can quickly identify employees who have not filed their annual property returns.

- Alerts and Notifications: Users receive alerts and notifications regarding the status of their property returns.

- Clear Visibility: Employees can view their filed property returns year-wise.

Benefits of the Online Property Return System

The Online Property Return System offers numerous benefits to both the employees and the ACB:

Benefits to ACB:

- Faster Data Collection: The portal enables quick collection and compilation of property return data.

- Increased Transparency: The digital system enhances transparency and reduces the chances of discrepancies.

- Quick Identification of Defaulters: The system can easily identify employees who have not filed their returns.

- Initiation of Action: The ACB can initiate actions against defaulters promptly.

Benefits to Employees:

- Efficient System: The online system is more efficient and user-friendly.

- No Misplacement of Forms: Digital filing eliminates the risk of misplaced documents.

- Easy Filing and Uploading: Employees can easily file and upload their property returns.

- Status Tracking: Users can track the status of their filed returns and receive notifications once accepted by the ACB.

- Year-Wise Records: Employees can access their property return records year-wise.

Also Read: Stamp Duty and Registration Charges in Jammu and Kashmir

How to Use the Online Property Return System: A Step-by-Step Guide

Using the Online Property Return System is straightforward. Follow these steps to register, log in, and file your annual property returns:

Registration Process:

- Visit the Official Website

- Employee Registration

Click on the “Employee Registration” tab.

- Enter CPIS Number

Input your CPIS number and click on “Fetch”.

- OTP Verification

Enter the OTP received on your registered mobile number and email.

- Set Password

Create a password and complete the registration process.

Login and Filing Property Returns:

- Employee Login: On the homepage, click on the “Employee Login” tab.

- Enter Credentials: Input your CPIS number and password.

- OTP Verification: Enter the OTP received on your registered mobile number and email.

- Select Declaration: From the notifications tab, select “Declaration of Property” and click on “Apply”.

- Fill Basic Details: Enter your office name, department, pay scale, designation, and other required details.

- Edit or Download Form: You can edit un-submitted forms or download the form as a PDF.

Checking Property Details:

- Visit the Official Website: Go to prs.jk.gov.in/Main/Default.aspx.

- Search Property Details: Click on “Search Property Details”.

- Enter Details: Select the notification, department, and enter your name, designation, and captcha to view your property details.

Also Read: Property Tax Online Payment in India

Offline Property Return System Form Sample

Before the introduction of the Online Property Return System, employees had to manually fill out offline forms. Here is a sample of the offline form for reference:

- Return of Assets and Liabilities Form: This form required employees to declare their movable and immovable assets.

- Statement of Immovable Property: This form was used to declare details of immovable properties.

Conclusion

The online property return system in Jammu and Kashmir is a significant step towards digitizing and streamlining the process of filing annual property returns for government employees. With its user-friendly interface, robust features, and enhanced security measures, the portal ensures a seamless and transparent experience for users. By adopting this digital system, the government aims to promote accountability, reduce discrepancies, and improve overall efficiency in the administration of property returns.

Frequently Asked Questions

The Online Property Return System is a web-based portal for government employees in Jammu and Kashmir to file their annual property returns online.

All government employees in Jammu and Kashmir can use the portal to file their annual property returns.

Visit the official website, click on “Employee Registration,” enter your CPIS number, and complete the OTP verification process.

CPIS stands for Centralized Personnel Information System, and each government employee is assigned a unique CPIS number.

No, you can only edit un-submitted forms. Once submitted, the form cannot be edited.

Log in to the portal and navigate to the notifications tab to check the status of your filed return.

Benefits include faster data collection, increased transparency, easy filing, and status tracking.

Yes, the portal employs advanced security measures to protect user data.

Use the “Forgot Password” option on the login page to reset your password.

Yes, you can download the form as a PDF before submission.

HDFC Home Loan

HDFC Home Loan SBI Home Loan

SBI Home Loan