Ever found yourself needing a little extra cash even though you’re already paying off a loan? Maybe you’re planning some home improvements, facing unexpected expenses, or just need additional funds for personal reasons. Good news—you might not need to apply for a whole new loan. Let’s talk about eligibility criteria of top-up loans and see if they’re the right fit for you!

Need Additional Funds? Boost Your Home Loan Today with Competitive Rates and Easy Approval!

Eligibility Criteria of Top Up Loans

| Criteria | Details |

|---|---|

| Nationality | Must be an Indian citizen residing in India. |

| Age | Salaried: 23 to 65 years at loan maturity. Self-Employed: 23 to 70 years at loan maturity. |

| CIBIL Score | 725+ |

| Occupation | Salaried employee Professional individual Self-employed individual |

| Property Status | Must be a complete residential property with no pending post-disbursal documentation. |

| Repayment History | Existing Borrowers: No more than 1 EMI bounce in the last year, and it must be cleared before the next EMI date. Clear repayment history is crucial. |

| Eligibility Period | Existing Home Loan Customers: Eligible for a top-up after six months of clear repayment. Top-Up with Loan Takeover from Another Bank: Requires one year of clear repayment track. |

| General Eligibility | Anyone with an existing home loan can apply for a top-up loan. Must wait at least one year before applying for a top-up loan. Top-up loan amount is based on the principal home loan amount and approved accordingly. |

Factors Affecting Top Up Loan Eligibility Criteria

- Existing loan status: Active loans must be in good standing.

- Timely repayment history: Consistent on-time payments increase eligibility.

- Remaining loan tenure: Shorter tenures may limit top-up loan options.

- Credit score: Higher credit scores improve chances of approval.

- Income stability: Steady and sufficient income is crucial for approval.

- Employment history: A stable job history boosts loan eligibility.

- Age of the current loan: Loans must typically be active for a minimum period.

- Loan-to-Value (LTV) ratio: The balance between property value and outstanding loan amount.

- Debt-to-income ratio: The proportion of income already committed to debts.

- Documentation: Complete and accurate financial documents are essential.

- Purpose of the loan: Clear, legitimate reasons for the loan enhance approval chances.

- Property valuation: The current market value of the property impacts eligibility.

- Bank’s policies: Lender-specific criteria and guidelines may affect approval.

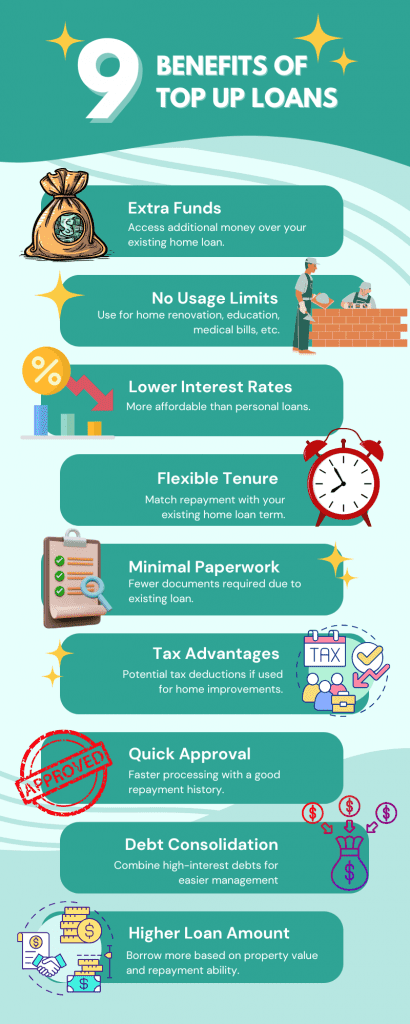

Features and Benefits of Top Up Loans

Additional funding: You receive extra funds over your existing home loan.

No end-use restrictions: You can use the loan for purposes like home renovation, medical expenses, or education.

Lower interest rates: You enjoy lower interest rates compared to personal loans.

Flexible tenure: You can align the repayment period with the remaining home loan tenure.

Minimal documentation: You submit fewer documents as the loan links to your existing home loan.

Tax benefits: You may claim tax deductions on interest if used for home improvement or construction.

Quick processing: You get faster approval and disbursal, especially with a good repayment history.

Debt consolidation: You can consolidate high-interest debts, simplifying financial management.

Get a Home Loan

with Highest Eligibility

& Best Rates

Conclusion

In conclusion, understanding the eligibility criteria for a top-up loan is crucial to increasing your chances of approval. Factors like your existing loan status, credit score, income stability, and property valuation all play significant roles in determining eligibility.

Looking for a top-up loan to meet your financial needs? Credit Dharma can help you find the best options and guide you through the process. Explore your eligibility, compare loan offers, and get expert advice to secure the most favorable terms.

Frequently Asked Questions

Typically, six months of clear repayment is required.

A credit score of 725 or above is ideal, but some lenders may consider lower scores with other strong factors.

Yes, it depends on the Loan-to-Value (LTV) ratio and the value of your property.

Stable and sufficient income improves your chances of approval.

Yes, NRIs are eligible based on specific lender guidelines

HDFC Home Loan

HDFC Home Loan SBI Home Loan

SBI Home Loan