Estimated reading time: 13 minutes

Prepaying your home loan can save you a substantial amount of interest over the loan tenure. With HDFC’s online services, prepaying your home loan has become a straightforward and convenient process. This guide will walk you through the steps of HDFC home loan prepayment online and how to use the HDFC home loan prepayment calculator.

Prepay Your HDFC Home Loan Smartly with Credit Dharma!

Steps for HDFC Home Loan Prepayment Online

HDFC Home Loan Online Prepayment Process

HDFC provides a seamless online platform for prepaying your home loan. Follow these steps:

- Log in to Your HDFC Loan Account

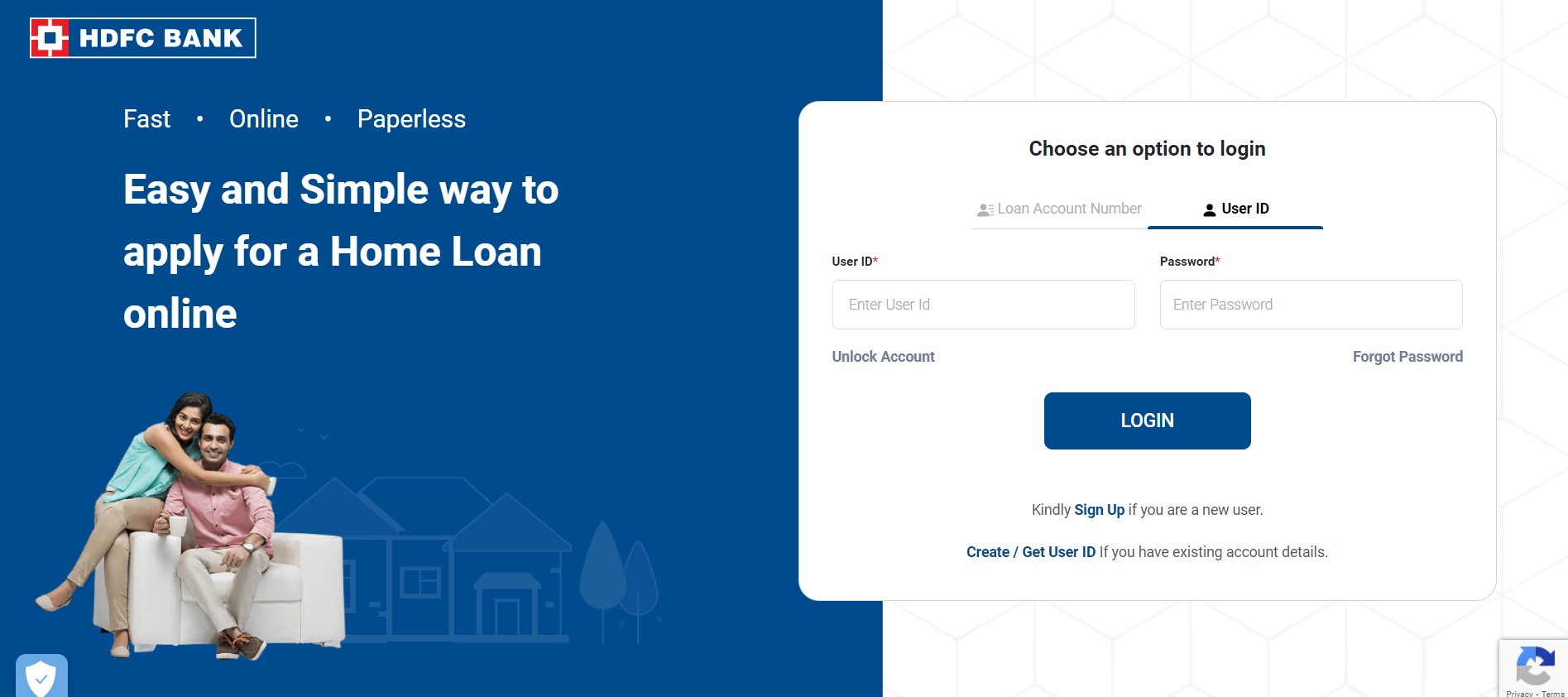

Visit the HDFC Home Loan Portal.

Log in using your Loan Account Number (LAN) and password.

- Navigate to the Prepayment Section

Once logged in, select ‘Loan Details’ from the dashboard.

Click on ‘Prepayment/Part Payment’ under the available options. - Enter Prepayment Details

Enter the amount you wish to prepay. Ensure it adheres to the minimum prepayment criteria set by HDFC.

Review the revised EMI or loan tenure based on the prepayment. - Confirm & Pay

Choose your payment method (net banking, UPI, debit card, etc.).

Confirm the details and complete the transaction.

Note: Deduction is only available if loan is taken for purchase/construction/renovation of a residential property.

How to Pay HDFC Home Loan Prepayment Online via the HDFC Mobile App

You can also prepay your loan using the HDFC mobile app:

- Open the HDFC App: Log in to your account.

- Navigate to the ‘Loan Section’ and tap on ‘Make a Prepayment.’

- Enter the prepayment amount and select your payment method.

- Confirm the payment and save the receipt for future use.

Note: Deduction is only available if loan is taken for purchase/construction/renovation of a residential property.

Charges for HDFC Home Loan Prepayment

It’s crucial to be aware of potential HDFC prepayment charges to avoid surprises. Here are the standard charges:

| Loan Type | Time Period | Prepayment Charges |

|---|---|---|

| Adjustable Rate Loans (ARHL) Combination Rate Home Loan (CRHL) (Variable Rate Period) | First 6 months | 2% (plus applicable taxes) on the prepaid amount. |

| 6 to 36 months | Up to 25% of opening principal per financial year: No charges. Beyond 25%: 2% on excess amount. | |

| After 36 months | Own sources: No charges. Refinanced funds: 2%. | |

| Fixed Rate Loans (FRHL) Combination Rate Home Loan (CRHL) (Fixed Rate Period) | First 6 months | 2% (plus applicable taxes) on the prepaid amount. |

| 6 to 36 months | Up to 25% of opening principal per financial year: No charges. Beyond 25%: 2% on excess amount. | |

| After 36 months | Own sources: No charges. Refinanced funds: 2%. |

Refer to the HDFC Prepayment Policy for the most accurate and up-to-date information on charges.

Why Prepay Your HDFC Home Loan?

Benefits of Prepayment

Prepaying your home loan can significantly reduce your interest burden and shorten the loan tenure. It offers the following advantages.

| Benefit | Description |

|---|---|

| Interest Savings | Reduce the total interest payable over the loan term. |

| Shortened Loan Tenure | Pay off your loan faster. |

| Improved Credit | Boost your credit score with timely prepayments or early closures. |

How to Use HDFC Home Loan Prepayment Calculator?

Step-by-Step Process

The HDFC home loan prepayment calculator is a useful tool to estimate the benefits of prepaying your loan.

Here’s how to use it:

- Access the Calculator: Visit HDFC’s official website and navigate to the home loan prepayment calculator.

- Input Loan Details: Enter your loan amount, interest rate, remaining tenure, and prepayment amount.

- Calculate: Click on the ‘Calculate’ button to see how your prepayment will affect your EMI and loan tenure.

- Analyze Results: Review the impact on your loan, including the new EMI amount and reduced tenure.

Maximizing the Benefits of HDFC Home Loan Prepayment

Tips for Effective Prepayment

| Tip | Description |

|---|---|

| Use Bonuses and Windfalls | Utilize extra income like bonuses or windfalls for prepayment. |

| Regular Prepayments | Make regular prepayments, even small amounts, to gradually reduce your loan burden. |

| Use the Prepayment Calculator | Regularly use the HDFC home loan prepayment calculator to plan your finances and prepayments. |

Get a Home Loan

with Highest Eligibility

& Best Rates

Conclusion

Prepaying your HDFC home loan online is a smart financial move that can save you money and reduce your loan tenure.

By using the HDFC home loan prepayment calculator, you can plan your prepayments effectively and make informed decisions. Follow the steps outlined in this guide to manage your home loan efficiently and maximize your financial benefits.

Frequently Asked Questions

Yes, HDFC home loan prepayment can be done online through HDFC’s NetBanking portal or mobile app, making it convenient and quick.

Yes, you can repay your HDFC home loan online without visiting the bank by using HDFC’s online services such as NetBanking or the mobile app.

HDFC does not charge for prepayment of floating rate home loans. However, there may be charges for prepayment of fixed-rate home loans.

Yes, loan prepayment can be done online through HDFC’s NetBanking and mobile app, offering a hassle-free process to manage your loan repayments.

HDFC Home Loan

HDFC Home Loan SBI Home Loan

SBI Home Loan