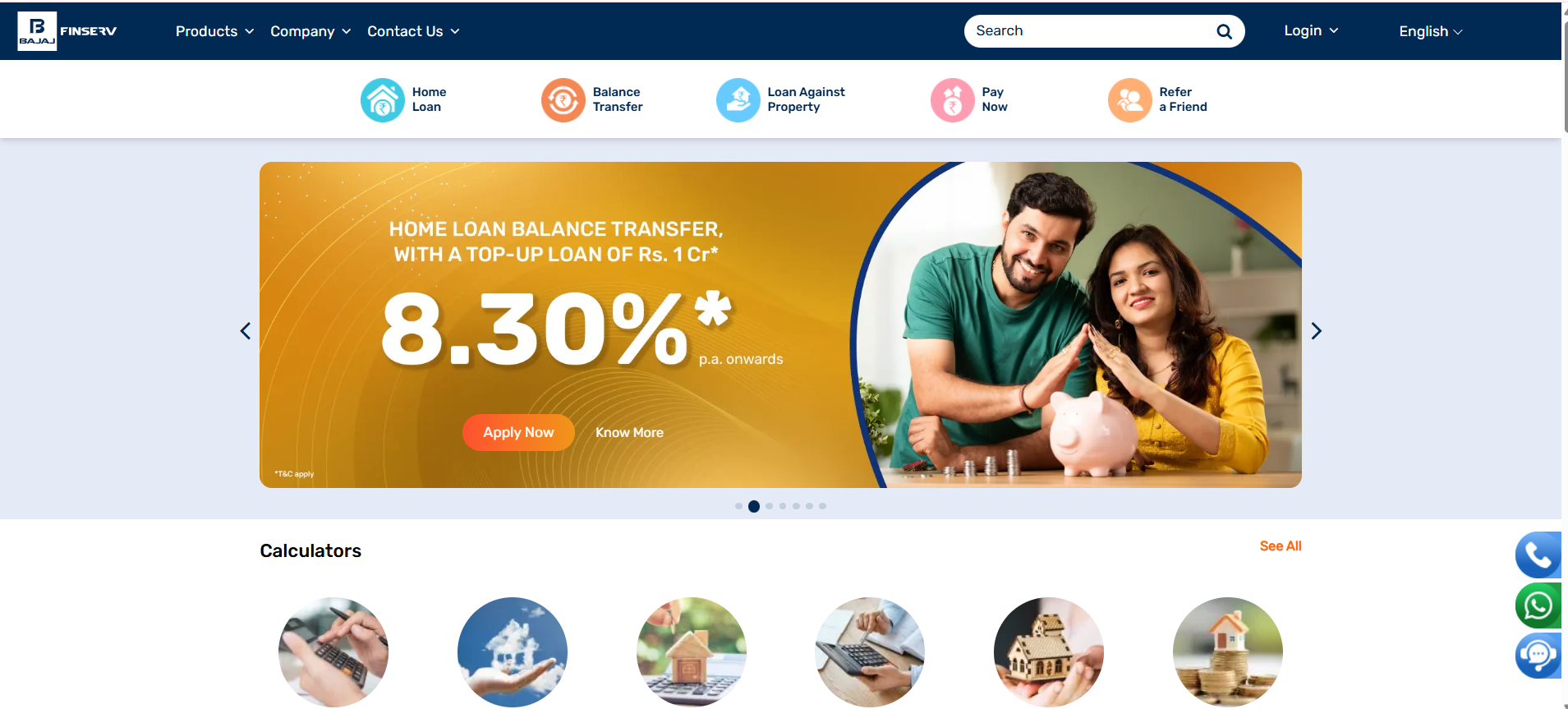

Keeping track of your home loan payments doesn’t have to be difficult.

Bajaj Housing Finance’s online portal lets you effortlessly log in, view your loan details, and monitor repayment schedules in real-time.

How to Login to Your Bajaj Housing Finance Home Loan Account via Net Banking?

Managing your home loan is easier when you can access your account online. Logging in via net banking takes just a few steps. Whether you want to check your loan balance, view statements, or make payments, here’s how to get started quickly and securely.

Time needed: 2 minutes

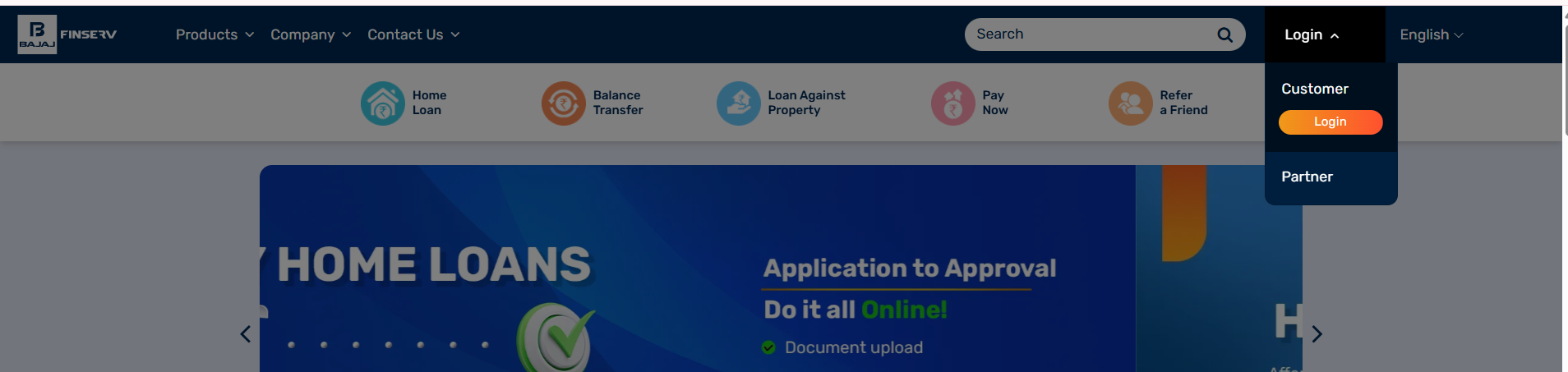

Here’s how to log into the Bajaj Housing Finance official customer portal:

- Visit the Bajaj Housing Finance official customer portal.

- Click on the ‘Login’ button in the top-right corner and select ‘Customer’.

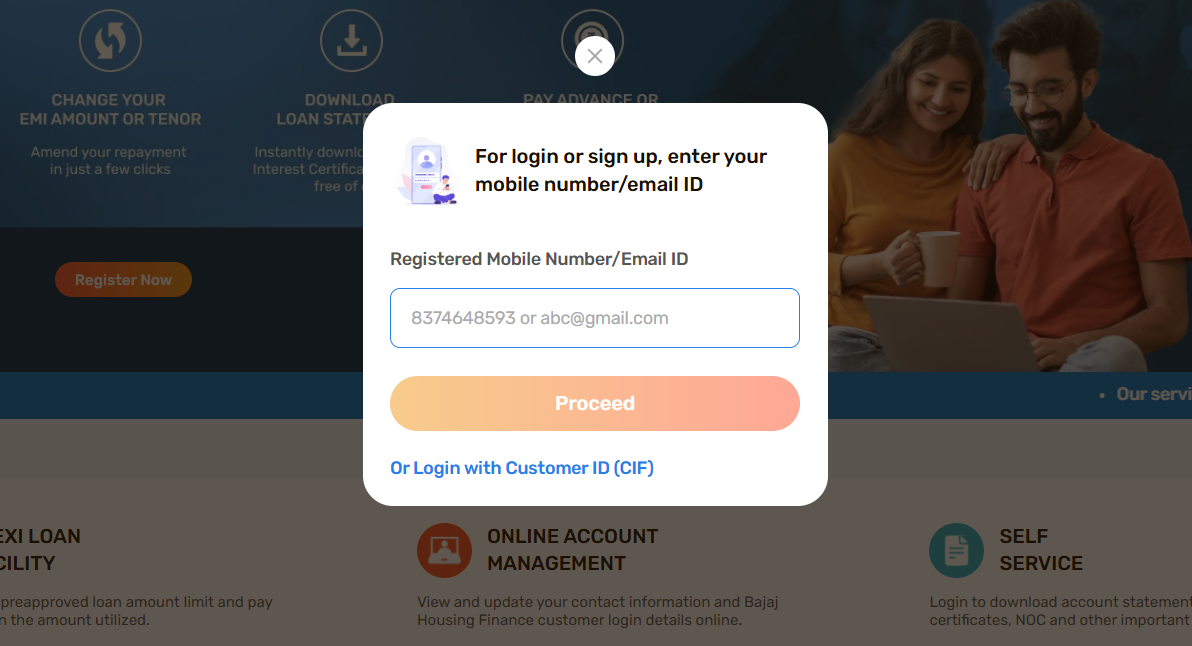

- Choose your preferred login method:

a. Registered mobile number

b. Registered Email ID

c. Customer ID and Password

How to Log in to Your Bajaj Housing Finance Home Loan Account via Mobile Application?

The Bajaj Housing Finance mobile app puts your loan details in your pocket. If you’re new to the app or just need a quick refresher, this guide will walk you through the login process step by step. All you need is your phone and a few details handy!

- Download the Bajaj Housing Application from Google Play or App Store

- Open the application and enter your MPIN to log in.

Details Required for Bajaj Housing Finance Home Loan Account Login

Before logging in, make sure you have the right information ready. From your loan account number to your password, we’ll list exactly what you need to access your account smoothly. No surprises—just straightforward prep!

| Category | Details |

|---|---|

| Login Credentials | Customer ID / User ID (provided by the bank at loan disbursal) Password (set by the user during registration) |

| Mobile Verification | Registered Mobile Number (linked with the bank account) One Time Password (OTP) (received on registered mobile/email) |

| Email Verification (optional but common) | Registered Email ID (for OTP verification or account recovery) |

| Personal and Loan Details | Loan Account Number Customer Identification File (CIF Number) (sometimes mandatory) Date of Birth (DOB) of the account holder Permanent Account Number (PAN) EMI Amount (sometimes used as a verification detail) |

| Security Verification | Security Questions & Answers (set during initial account setup, often used for password recovery) |

How to Register for Your Bajaj Housing Finance Home Loan Account for First-Time Users?

First-time users often feel unsure about registration. Don’t worry! Setting up your account is a simple one-time process. We’ll guide you through creating your login credentials and verifying your identity so you can start managing your loan with confidence.

Via Official Website:

- Visit the Bajaj Housing Finance official customer portal.

- Click on Login located in the top-right corner.

- Select ‘Customer’. Click on the ‘Register’ option provided for first-time users.

- Enter Customer ID, registered mobile number, email address, and date of birth.

- After entering the above details, enter the displayed Captcha.

- Click ‘Proceed’ or ‘Submit’.

- An OTP will be sent to your registered mobile number. Enter this OTP to verify your identity.

- After successful verification, you’ll be asked to set a strong password for future logins. Confirm your new password and submit it.

Via Application

- Download the Bajaj Housing Application from Google Play or App Store

- Open the application after installation.

- Enter your registered mobile number or email ID.

- An OTP will be sent to your registered contact; enter it to verify.

- Set up an MPIN for quicker future access.

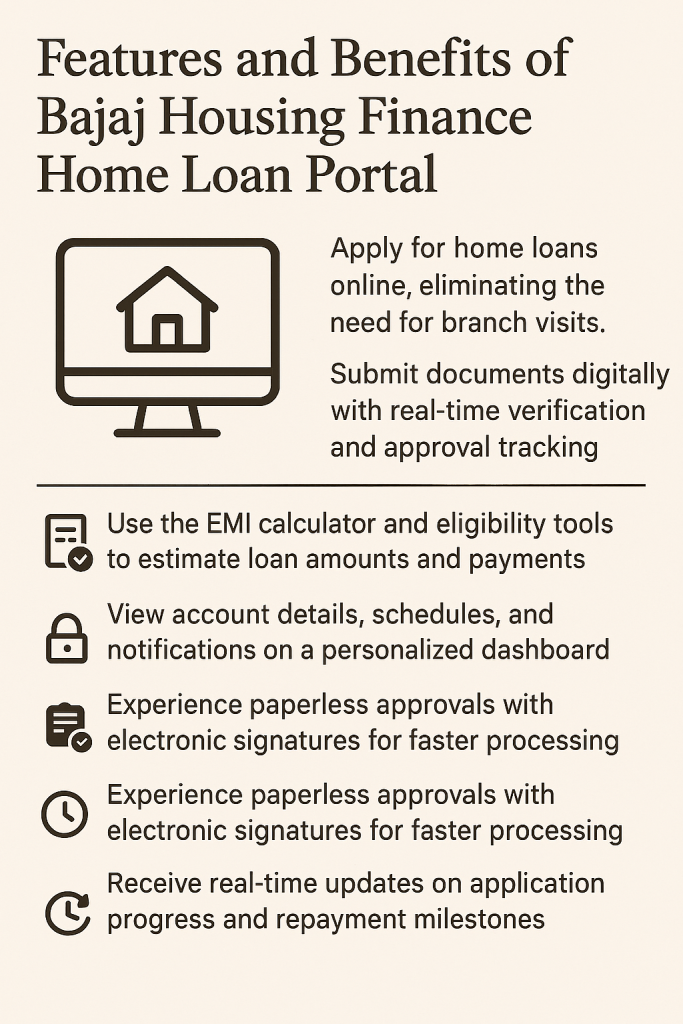

Features and Benefits of Bajaj Housing Finance Home Loan Portal

- Apply for home loans online, eliminating the need for branch visits.

- Submit documents digitally with real-time verification and approval tracking.

- Use the EMI calculator and eligibility tools to estimate loan amounts and payments.

- View account details, schedules, and notifications on a personalized dashboard.

- Enjoy secure access with multi-factor authentication and data encryption.

- Experience paperless approvals with electronic signatures for faster processing.

- Receive real-time updates on application progress and repayment milestones.

Troubleshooting Bajaj Housing Finance Home Loan Login Issues

Forgot your password? Facing an error message? Login issues can be frustrating, but most have quick fixes. We’ll cover common problems and solutions, so you can resolve them without stress. Let’s get you back into your account!

Forgotten Login Password

- Navigate to the Bajaj Housing Finance login page.

- Click on the “Forgot Password” or similar recovery link.

- Enter your registered email ID or mobile number as prompted.

- Follow the instructions sent to your email or SMS to reset your password.

Account Access Issues

- Check if your account is temporarily locked due to multiple failed attempts and contact support if needed.

- Clear browser cache/cookies, try another browser/device, and disable blocking extensions.

- Verify the portal’s operational status via service alerts or maintenance notifications.

- Ensure network/firewall settings aren’t blocking access; test with a different network.

- Update your browser to the latest version for compatibility.

- Contact Bajaj Housing Finance support with account details and error messages if issues persist.

Best Security Practices for Your Bajaj Housing Finance Home Loan Account

- Use a strong, unique password with a mix of letters, numbers, and symbols, and update it periodically.

- Enable two-factor authentication (2FA) for an added layer of security during login.

- Avoid phishing scams by verifying emails/SMS and never sharing OTPs, passwords, or personal details.

- Monitor transactions regularly via the official portal/app and report suspicious activity immediately.

- Secure devices and networks with antivirus software, updates, and avoid public Wi-Fi for account access.

Conclusion

Managing your Bajaj Housing Finance home loan account online is convenient, secure, and hassle-free. With easy login options, simple registration steps, and efficient troubleshooting methods, the online portal ensures you have full control over your loan details anytime, anywhere. By practicing recommended security measures, you further safeguard your account from potential threats.

Frequently Asked Questions

If you forget your login password, go to the portal, click ‘Forgot Password’, and verify your identity using OTP. You can then reset your password and access your account.

Yes, you can use the Bajaj Finserv mobile app to log in and view your loan account, payment history, EMI details, and download statements.

Log in to the customer portal, go to the ‘Document Centre’, select your loan account, and download your Statement of Account in PDF format.

After logging in, click on ‘Make Loan Payments’, choose the EMI or part-payment option, enter the amount, and proceed with payment via UPI, net banking, or debit card.

Ensure you’re entering correct credentials or try using OTP-based login. If the issue persists, contact Bajaj Housing Finance customer care for help.

Yes, after logging in, go to ‘Document Centre’ and select ‘Repayment Schedule’ under your loan account to view or download the EMI plan.

HDFC Home Loan

HDFC Home Loan SBI Home Loan

SBI Home Loan