Property tax payments have traditionally been a hassle, but technology is changing that. With digital tools, BBMP is streamlining the process, making it faster and more user-friendly. However, there are still challenges and opportunities to further improve the system for a seamless experience. Let’s explore how future innovations can transform the way we handle BBMP property tax payments.

What is BBMP Property Tax?

BBMP property tax is a tax that property owners in Bengaluru must pay to the Bruhat Bengaluru Mahanagara Palike (BBMP) every year. If you own a home, land, or building in Bengaluru, you are liable to pay this tax. The tax is essential for maintaining local infrastructure like roads, parks, and drainage systems.

How is BBMP Property Tax is Calculated?

In Bengaluru, the BBMP property tax is calculated using the Unit Area Value (UAV) system. This method depends on where your property is, its usage (like residential or commercial), and its size. Properties are divided into six zones, and each zone has a different tax rate.

To calculate the property tax, BBMP uses this formula:

Property Tax = (G – I) * 20% + Cess (24% of property tax)

Where:

- G is the Gross Unit Area Value (calculated based on tenanted and self-occupied areas).

- I is the depreciation value based on the age of the property.

Example

if your property is self-occupied in Zone A, your tax rate is ₹2.50 per sq. ft. Multiply this rate by your property’s size, and you get the taxable amount. The same process applies to commercial or tenanted properties but with different rates.

Steps for BBMP Property Tax Online Payment

Paying your BBMP tax payment online is simple. Here’s a step-by-step guide:

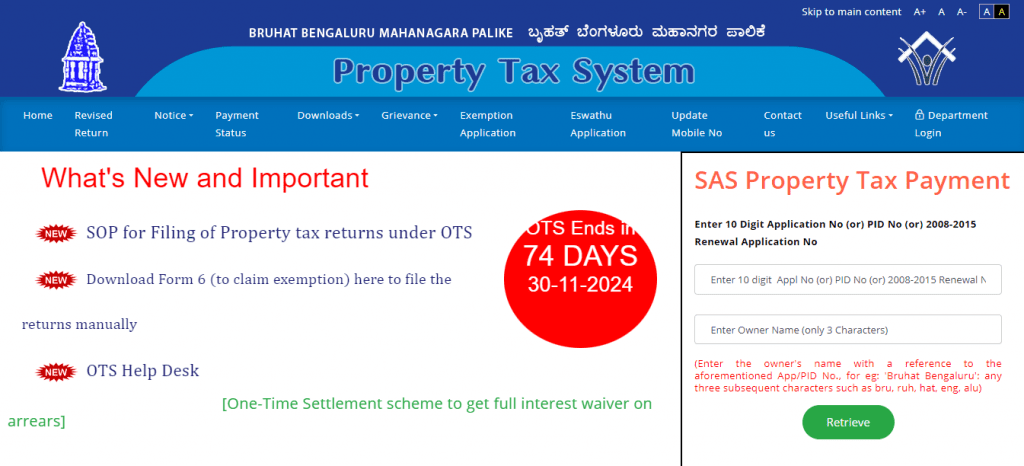

1. Visit the BBMP property tax website.

2. Enter your Property Identification (PID) number or SAS application number and your name, then click ‘Retrieve’ to access your property details.

3. If the details are correct with no changes, select Form IV. If there are changes, like property usage or size, choose Form V.

4. Review all the information to make sure it’s accurate.

5. Select your payment method—credit card, debit card, or net banking.

6. Choose to pay in full or in instalments.

7. After payment, a receipt number will be generated. You can download or print the BBMP property tax receipt after 24 hours.

How to Pay BBMP Property Tax Offline?

If you prefer to pay your BBMP property tax offline, follow these steps:

- Visit the nearest Bangalore One Centre or BBMP office to start the payment process.

- Submit the correct form based on your property type. You can get the forms at the center or download them from the BBMP website before visiting.

- Choose your preferred payment method—cheque, demand draft, or card at the center.

- If you prefer paying through a bank, BBMP has partnered with HDFC, Canara Bank, ICICI, and Axis Bank. Visit any of these banks to make your payment.

BBMP Property Tax Forms: Which One Do You Need?

When paying BBMP property tax, you must choose the correct form based on your property details. Here’s a breakdown of each form:

Form I

Use this form if your property has a Property Identification Number (PID). The PID is a unique code that identifies your property’s ward, street, and plot.

Form II

If your property does not have a PID but has a Khata number, use Form II. The Khata number refers to your property’s official registration details.

Form III

For properties without a PID or Khata number, Form III is the right choice. These are often unauthorised or unregistered properties.

Form IV and V

Use Form IV if there are no changes to your property, such as usage or size. Choose Form V if there are alterations, like adding a new floor or changing the property’s usage.

Form VI

If your property is exempt from property tax but you need to pay service charges, use Form VI.

BBMP Property Tax Deadlines and Rebates

Paying your BBMP property tax on time is important to avoid extra charges and benefit from available rebates. Here’s a breakdown:

- Early Payment Rebate:

- Pay the full tax amount before July 31.

- Get a 5% rebate on the total amount.

- This helps you save money while staying ahead of your tax obligations.

- Late Payment Penalty:

- A 2% interest charge per month applies if you miss the deadline.

- Delays in payment can quickly add up, increasing your total tax bill.

- Instalment Payment Option:

- You can pay your property tax in two instalments without interest.

- However, this option does not qualify for the 5% rebate.

- While it offers flexibility, paying the full amount early avoids penalties and secures savings.

How to Check BBMP Property Tax Payment Status?

To check your BBMP bill status online, follow these simple steps:

- Visit the BBMP Portal

- Go to the official BBMP property tax website.

- Click on Payment Status on the dashboard.

- Enter Your Details

- Type in your application number or the property owner’s name in the required fields.

- Check and Confirm Payment Status

- After entering the details, click ‘Retrieve’.

- Your payment status will appear.

- If the payment is successful, you can download or print the receipt.

How to Get Your BBMP Property Identification Number (PID)?

To retrieve your Property Identification Number (PID) from BBMP, follow these steps:

- Visit the BBMP Official Website

- Go to the BBMP website and look for the GEPTIS (Geographical Information System) option.

- Use Map-Based Navigation

- Once logged in, navigate the interactive map to locate your property.

- Move your cursor over the property, and the PID will appear along with other property details.

- Save the PID for Future Use

- Once you have the PID, save it for future property tax payments and status checks.

- This number makes it easier to access your property details on the BBMP portal.

Conclusion

The ongoing transformation of BBMP property tax payments is just the beginning of a broader trend towards digital governance. By staying ahead of technological advancements and focusing on user needs, BBMP has the opportunity to create a model of efficiency that other municipalities can follow.

Looking for a hassle-free home loan experience? Credit Dharma makes it easy for you to secure the financing you need with quick approvals, competitive rates, and personalized service.

Frequently Asked Questions

You can apply for BBMP Khata Transfer online through the BBMP portal or visit a BBMP office with the required documents.

The last date is usually July 31, 2024, to avail a 5% rebate, but you can pay until March 31.

You will be charged a 2% interest per month for late payments.

You can call the BBMP head office at 1533 or email them at comm@bbmp.gov.in.

You can pay BBMP property tax 2024-25 online through the official BBMP tax portal using your PID or SAS application number.

You can file a BBMP complaint online through their official portal or visit the nearest BBMP office to submit your complaint in person.

HDFC Home Loan

HDFC Home Loan SBI Home Loan

SBI Home Loan