Applying for a home loan can be an exciting yet stressful process. You’ve gathered all necessary documents, submitted your application, and now you’re eagerly waiting for approval. But how can you track the status of your application?

This article will guide you through the steps to check your PNB home loan application status, ensuring you stay informed every step of the way.

How to Check Punjab National Bank Home Loan Application Status Online?

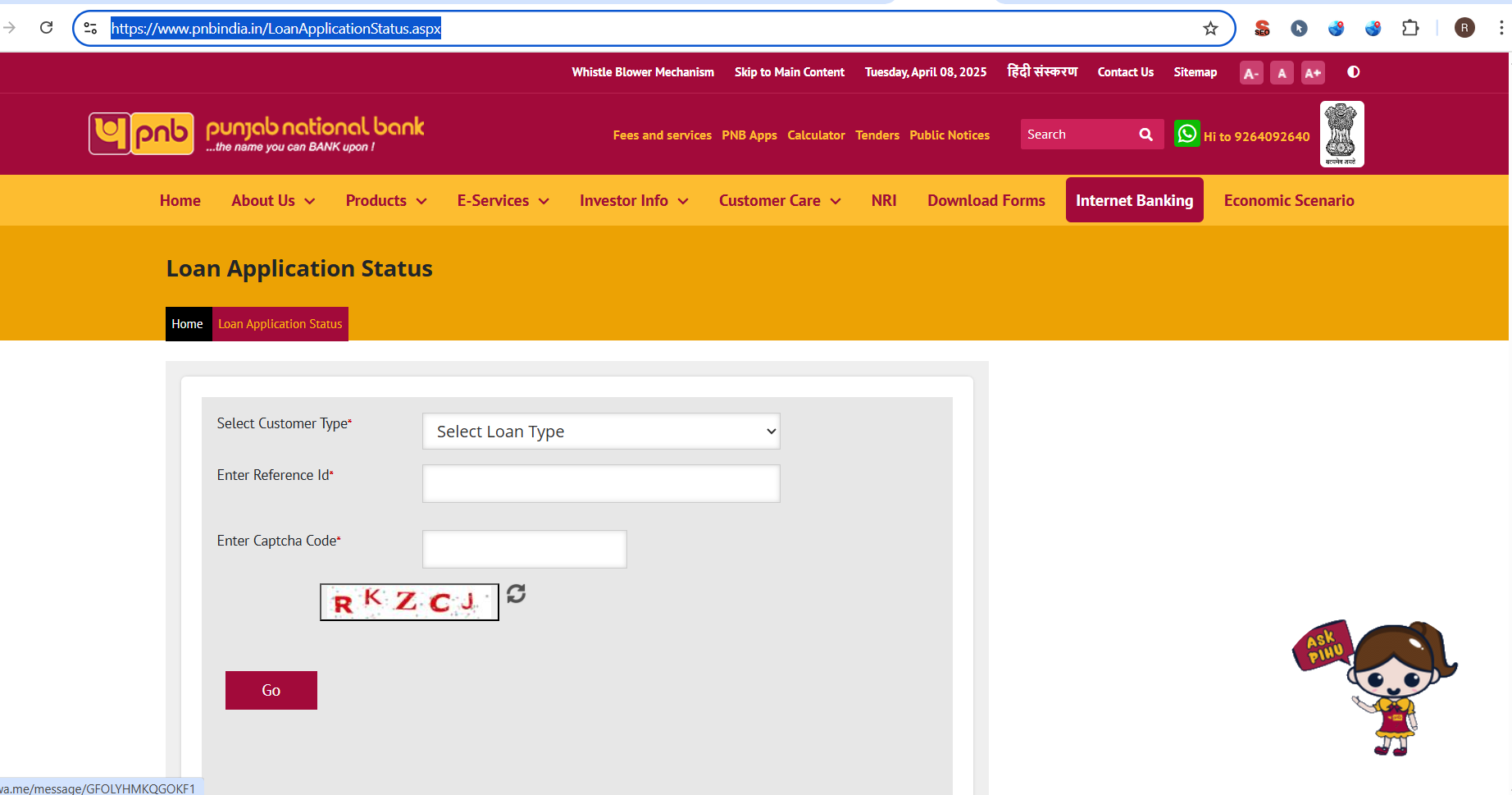

Checking your PNB home loan application status online is a convenient and time-saving option. Follow these simple steps to check your home loan application status online:

- Visit the PNB Housing Loan Official Website

- From there Navigate to the “Home Loan Application Status” Link.

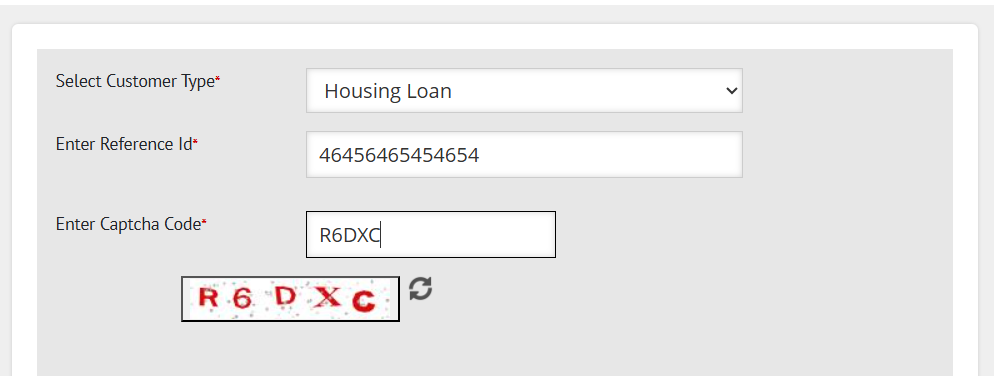

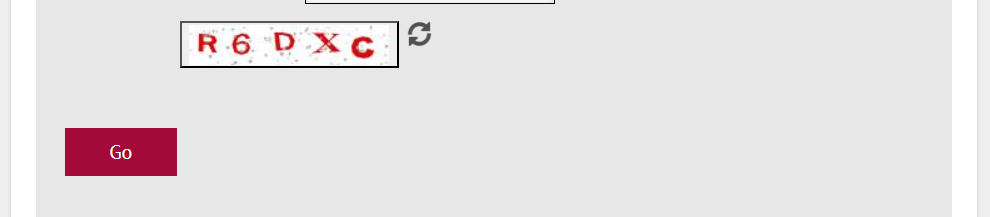

- Choose “Housing Loan” as the Customer Type and Enter your Reference ID and the Captcha Code for Verification

- Review the Details Displayed to Ensure Accuracy

- After Confirming the Details, Click on the Go Button to View your Application Status.

Benefits of checking your PNB Home Loan status online:

- Stay updated on your application progress in real-time

- Avoid long wait times and physical visits to the bank

- Get instant status updates from the comfort of your home

Also Check: How to Download PNB Home Loan Statement

How to Check PNB Home Loan Application Status via Mobile Application?

Tracking your PNB home loan application status through mobile is easy, convenient, and can be done in just a few steps.

Using the PNB Mobile Banking App:

- Download the PNB Mobile Banking app from the Google Play Store or Apple App Store.

- If you’re a first-time user, register using your account details. Existing users can directly log in with their credentials.

- Once logged in, go to the Loans section.

- Look for the option to check Home Loan Application Status.

- Enter your application reference number or other necessary details to view the status instantly.

Through SMS Alerts:

- Make sure you’ve opted for SMS alerts while applying for the loan.

- PNB sends regular updates regarding your home loan status directly to your registered mobile number.

How to Check Punjab National Bank Home Loan Application Status via Customer Care?

If you prefer personal assistance, checking your PNB home loan status through customer care is a reliable and simple option. Here’s how to check your home loan application status via PNB customer care:

- Call PNB’s toll-free customer care number 1800 120 8800 between 10 A.M. to 5 P.M., Monday to Saturday (excluding 1st & 2nd Saturdays and public holidays).

- Once connected, verify your identity by providing the required details.

- Request the status of your home loan application from the representative.

Additional Support Channels

| Support Channel | Contact Details |

|---|---|

| Email Support | For general queries: customercare@pnbhousing.com For NRI customers: nricare@pnbhousing.com |

| WhatsApp Support | Message on +91 8448198457 |

| Branch Assistance | Use the Branch Locator tool on the official PNB website to find your nearest branch if you prefer in-person support. |

Also Read: How to Apply for PNB Home Loan Online in Minutes?

How to Register a PNB Home Loan Account Online?

Registering your PNB Home Loan account online is the first step to accessing loan details, tracking application status, and managing your account digitally.

Follow these simple steps to register your PNB Home Loan account online:

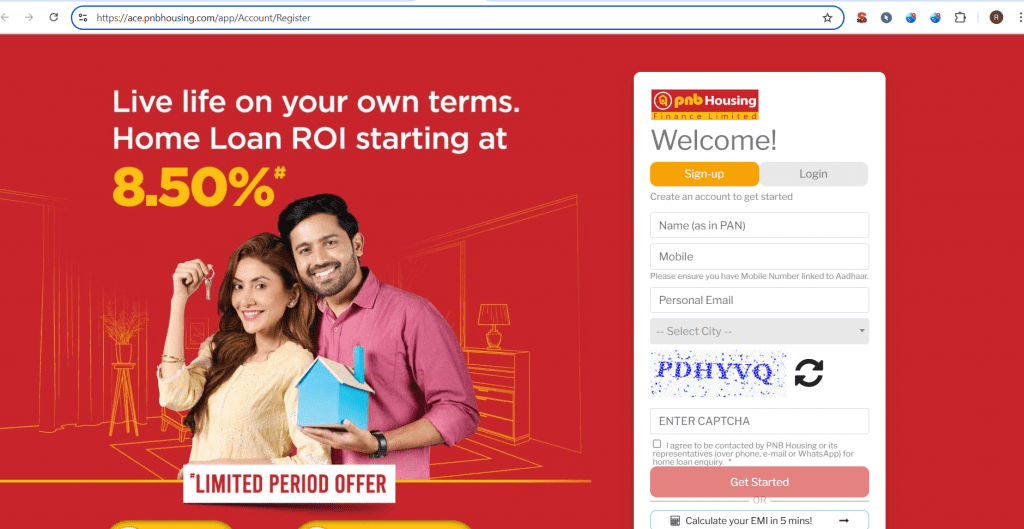

- Visit the official registration page by clicking on the link.

- On the welcome screen, click on ‘Sign-up’ to begin the registration process.

3. Fill in the required details:

– Full Name (as mentioned on your PAN card)

– Mobile Number (must be linked to your Aadhaar)

– Personal Email Address

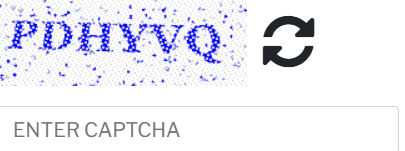

4. Enter the Captcha Code as displayed on the screen.

5. Check the box to agree to be contacted by PNB Housing via phone, email, or WhatsApp for loan-related updates.

6. Click on ‘Create Account’ or ‘Sign Up’ to complete the registration.

7. Once registered, log in using your credentials to explore services like loan tracking, document uploads, and more.

Read More: PNB Home Loan Eligibility Criteria 2025

How Long Does it Take to Process a Punjab National Bank Home Loan Application?

On average, it takes 4–5 business days for salaried individuals and 7–10 business days for self-employed applicants to get a home loan processed. The timeline includes application submission, document verification, eligibility checks, and property assessment. Digital applications are typically faster than traditional paper-based ones. Delays may occur due to incomplete documentation, property issues, or low credit scores.

Why is My Application Taking Longer than the Estimated Timeline?

If your PNB Home Loan Application Status shows a delay, it could be due to a few common reasons:

| Reason | Description |

|---|---|

| High Application Volume | A surge in requests can slow down processing times. |

| Document Issues | Missing, unclear, or additional verification of documents may cause hold-ups. |

| Internal Delays | Backend checks, approvals, or system glitches can affect timelines. |

| Complex Profile | Self-employed applicants or property-related concerns may require extra review. |

| Pending Response | Delays in responding to queries from the lender can pause the process. |

Also Read: PNB Housing Plot Loan Interest Rates and Eligibility 2025

Is There a Way to Expedite My Home Loan Application?

Yes, you can speed up your home loan process by following a few smart steps. While checking your PNB Home Loan Application Status, make sure you’ve done the following to avoid unnecessary delays:

| Tip | Description |

|---|---|

| Maintain a High Credit Score | A CIBIL score of 700+ increases your chances of quick approval. |

| Clear Existing Debts | Settle all outstanding loans or credit card dues before applying. |

| Apply with a Co-Applicant | Boost your eligibility by adding a co-applicant with strong financials. |

| Understand Loan Details | Be clear about the loan tenure, interest rate, and terms before applying. |

After Approval, How Long Until Funds are Disbursed?

Once your loan is approved and all required documents are submitted, the disbursal process typically takes 5 to 7 working days. Make sure there are no pending verifications or missing paperwork to avoid delays. You can track the progress through your PNB Home Loan Application Status online for real-time updates.

Get a Home Loan

with Highest Eligibility

& Best Rates

Can a Co-Applicant Check the Loan Status Independently?

Yes, a co-applicant can check the loan status independently by accessing the relevant portal or contacting customer care. They will need the application reference number and necessary details to view the status.

What Happens If a Co-Applicant Wants to Withdraw from the Application?

If a co-applicant wishes to withdraw from the loan application, it can impact the loan approval process, especially if their financials were critical to the eligibility. Here’s what happens:

- Eligibility Impact: The applicant’s eligibility may be reassessed based on the remaining income or credit score.

- Document Updates: The applicant will need to provide updated documents to reflect the change.

- Application Delay: Withdrawal of a co-applicant may lead to delays in processing. You can check your PNB Home Loan Application Status to stay updated on any changes.

How Does a Co-Applicant’s Credit Score Affect the Application Status?

A co-applicant’s credit score plays a significant role in the home loan application process. It can positively or negatively impact the overall eligibility and approval status. Here’s how:

- Improved Credit Profile: A co-applicant with a strong credit score can strengthen the application, leading to better loan terms and quicker approval.

- Debt-to-Income Ratio: The combined income of the primary applicant and co-applicant can lower the debt-to-income ratio, improving the chances of loan approval.

- Impact on Future Loans: Regular, on-time payments by both the applicant and co-applicant will boost their credit scores, benefiting future financial transactions and potentially lowering borrowing costs.

Why was My Home Loan Application Rejected?

A home loan application can be rejected due to several reasons, including a low credit score, insufficient income, unstable employment, high debt-to-income ratio, incomplete documentation, or issues with the property or location. Understanding the specific cause of rejection can help you rectify the issue before reapplying.

If Rejected, How Soon Can I Reapply?

After a rejection, you can reapply once the issues have been addressed. Typically, waiting at least 3-6 months is advisable to improve your credit score or financial situation. During this time, focus on clearing debts, improving your credit score, and submitting accurate documents.

How can I Improve my Application If it was Previously Rejected?

- Improve Credit Score: Pay bills on time, reduce outstanding debt, and maintain a low credit utilization ratio.

- Clear Debts: Pay off existing loans to lower your debt-to-income ratio.

- Correct Documentation: Ensure all documents are accurate and complete to avoid suspicion.

- Stable Employment: Maintain job stability to prove income reliability.

Will a Rejection Affect my Credit Score?

Yes, a loan rejection can have a minor impact on your credit score, especially if you apply with multiple lenders in a short period. However, if you improve your credit habits, the effect can be minimal and short-lived.

You can track your progress by checking your PNB Home Loan Application Status after addressing the issues.

Read More: Tips to Maintain a High Credit Score

Get the Best Home Loan Offers with Credit Dharma

Credit Dharma is your trusted partner for securing the best Home Loan offers, with over ₹500 Cr+ loans handled and partnerships with 20+ leading banks. We provide exclusive access to the lowest interest rates and a seamless, digital process with fast approvals in just 1-2 weeks, backed by lifetime support from our home loan experts.

Why choose Credit Dharma? We provide:

- Lowest Interest Rates: Save more with every EMI.

- Maximum Funding: Get up to 100% funding for your dream home.

- Simple & Digital Process: No tedious paperwork or branch visits.

- Expert Guidance: Lifetime support from our team of specialists.

Compare, choose, and secure the best Home Loan offer with Credit Dharma — your home loan journey starts here!

Conclusion

Don’t just wait around wondering about your home loan status—take charge! With easy online tracking, handy mobile apps, responsive customer service, and in-person branch visits, staying updated on your loan application has never been simpler. Why leave anything to chance? Consult Credit Dharma’s professional team today. We’ll provide expert guidance on tracking your home loan application status, ensuring you move swiftly from application to approval.

Frequently Asked Questions

Visit PNB’s official website, navigate to the ‘Loan Application Status’ section, select ‘Housing Loan’ as the loan type, enter your reference ID and captcha code, and submit to view your application status.

You’ll need your reference ID, which is provided at the time of application, and the captcha code displayed on the status tracking page.

Yes, you can track your application status using your registered mobile number and date of birth through PNB’s online tracking system.

PNB offers a mobile application that allows customers to check loan account details, including transaction summaries and disbursement information.

You can visit the PNB branch where you applied and inquire about your application status, or contact PNB’s customer care at 1800 120 8800 for assistance.

If you don’t have your reference ID, contact PNB’s customer care at 1800 120 8800 or visit the branch where you applied to retrieve your application details.

PNB aims to verify loan applications within 7 days. If additional documents are required, applicants will be notified promptly.

PNB typically updates applicants via SMS or email regarding the status of their loan applications. Ensure your contact details are accurate to receive timely updates.

HDFC Home Loan

HDFC Home Loan SBI Home Loan

SBI Home Loan