Whether you’re looking to review your loan repayments, plan your finances, or simply keep track of your home loan details, having access to your Indian Bank Home Loan Statement can be immensely helpful. Indian Bank provides convenient options to download not just your home loan statement, but also your interest certificate—both online and offline.

How to Download Your Indian Bank Home Loan Statement Online?

Step 1: Visit Indian Bank’s official website and navigate to the home loan portal.

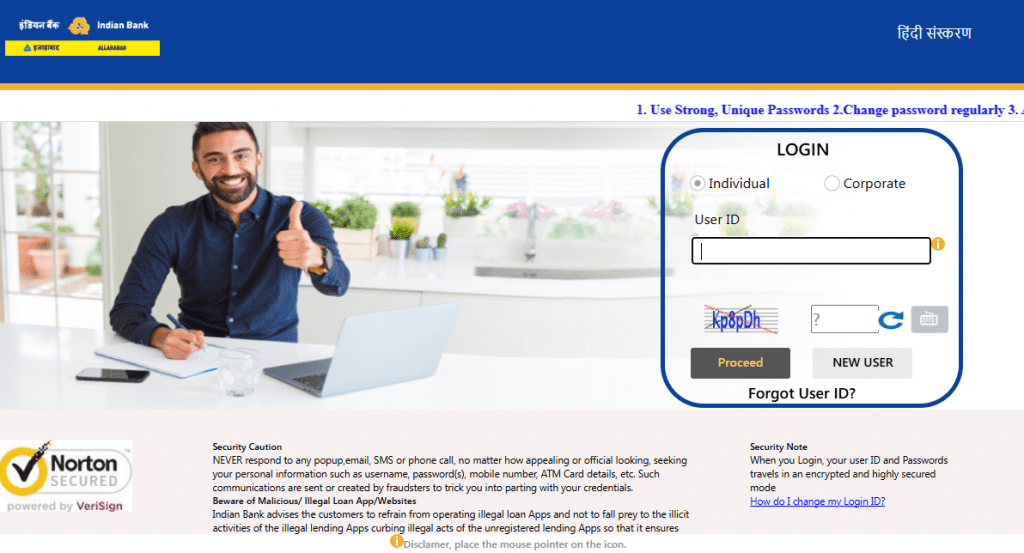

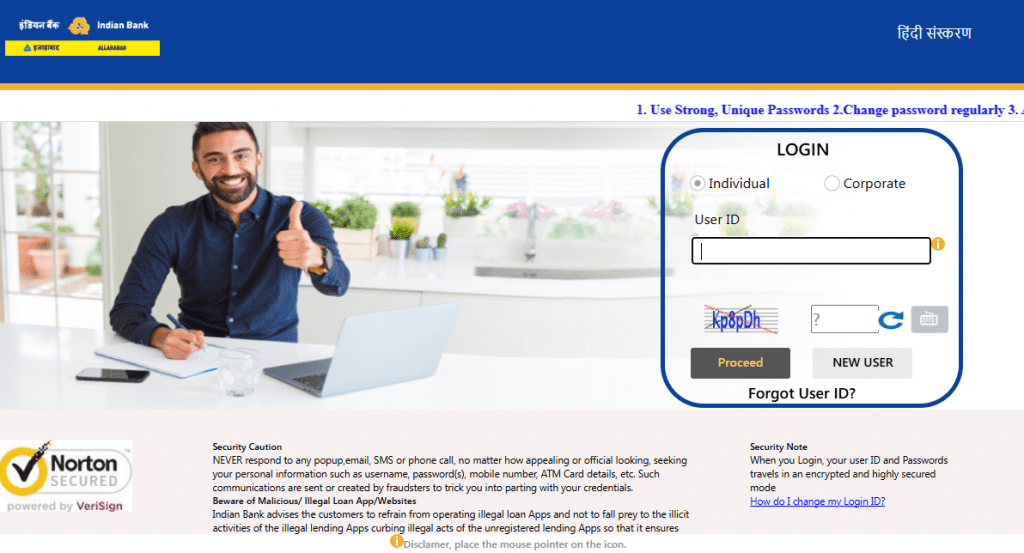

Step 2: Log in to your Indian Bank Net Banking account. If you haven’t registered yet, you will need to sign up for net banking first.

Step 3: Once you’re signed in, look for the specific option to view or download your home loan statement. You should be able to access a downloadable copy right after logging in.

Lower Rates, Bigger Savings with Indian Bank – Transfer Your Home Loan Balance Today!

How to Download Indian Bank Home Loan Interest Certificate Online?

Step 1: Go to the official Indian Bank home loan portal.

Step 2: Click on the “Login for Net Banking” option. If you already have Net Banking credentials, log in by providing your User ID and password. If not, complete the registration process.

Step 3: After successfully logging in, navigate to the “Enquiries” section. There, you will find the option to view and download your Home Loan Interest Certificate.

Read More: What is Home Loan Moratorium?

How to Get the Indian Bank Home Loan Statement and Interest Certificate Offline?

If you prefer traditional methods or find the online process inconvenient, you can also obtain your home loan statement and interest certificate by visiting your nearest Indian Bank branch. Here’s what you need to do:

- Visit the Indian Bank branch closest to you.

- Request the appropriate form for a Home Loan Statement or Interest Certificate at the helpdesk.

- Fill out the form with the required details—this typically includes your Home Loan Account Number, the applicant’s Date of Birth, Email ID, and other contact information as needed.

- Submit the completed form along with relevant identification documents such as your Aadhaar Card, PAN Card, Passport, or any other valid ID as required.

Note:

- Only the primary loan applicant or co-applicant is allowed to collect these documents.

- If neither the applicant nor the co-applicant is available, a representative can be sent on their behalf.

- In that case, the representative must carry a Letter of Authority signed by the applicant or co-applicant, along with valid ID proofs of both the applicant/co-applicant and the representative.

Read More: Home Loan Closure

What is Included in a Home Loan Statement?

A home loan statement offers a clear snapshot of your loan’s status and transactions. It typically includes:

- Loan Details: Account number, borrower’s name, interest rate, and loan tenure.

- Outstanding Principal: The remaining principal balance after recent payments.

- EMI Breakdown: How each monthly installment is split between principal and interest.

- Payment History: A list of all payments made, along with their dates and amounts.

- Fees & Charges: Any additional charges, penalties, or adjustments applied.

- Rate Changes (if any): Notations of interest rate revisions and their impact on your repayment.

Benefits of a Home Loan Statement

- Track Your Progress: Know how much you’ve paid and what’s left to repay.

- Plan Your Budget: Align your expenses and savings with upcoming EMIs.

- Maintain Transparency: Stay aware of rate changes, fees, and charges.

- Simplify Tax Filing: Easily extract interest amounts for tax deductions.

- Make Informed Decisions: Assess loan terms and explore refinancing options.

What is Included in a Home Loan Interest Certificate?

A home loan interest certificate provides a concise summary of the interest and principal amounts you’ve paid toward your home loan during a specific financial year. It generally includes:

- Borrower’s Information: Your basic details like name and mobile number.

- Home Loan Account Number: A unique reference number for any loan-related communication.

- Total Repayable Amount: The sum of the principal and the interest accrued.

- EMI Schedule: Start and end dates of your repayment cycle.

- Interest Rate Applied: The specific interest rate governing your repayments.

- Interest Rate Type: Confirmation of whether your rate is fixed or floating.

- Amount Repaid to Date: A running total of what you have already paid back.

- Missed Payment Records: Any past instances of skipped or delayed repayments.

- Principal Amount Adjustments: Details of any revisions to the principal balance.

- Part-Prepayment Details: Notes on any partial prepayments made before their due date

Read More: Home Loan Repayment Strategies

Benefits of a Provisional Home Loan Certificate

A provisional home loan certificate simplifies financial planning, especially when applying for tax deductions. It provides a clear breakdown of principal and interest components, helping you claim tax benefits under Section 80C for the principal and Sections 24, 80EE, or 80EEA for the interest.

Additionally, it can support deductions for related expenses, such as registration fees and stamp duty. By submitting this certificate with your tax returns, you ensure that you make the most of your eligible tax exemptions.

Conclusion

Indian Bank provides multiple options—both online and offline—to ensure you have easy access to your home loan statements and interest certificates. By following the steps outlined above, you can quickly retrieve the information you need.

This simple process not only helps you stay informed about your loan’s status and repayment details, but also makes it easier to manage your financial planning, tax filing, and general record-keeping.

Frequently Asked Questions

A home loan statement is an official document from your lender detailing your outstanding principal, interest accrued, and repayment schedule for a given period. It helps you track loan progress, manage finances, and stay aware of any changes in your repayment terms.

Most lenders allow you to access and download these documents anytime through their online banking platforms. You can also request an updated statement or interest certificate from your lender as often as needed.

Generally, online access to these documents is free of charge. However, if you request printed copies at the branch, some banks may charge a nominal fee. Check with your lender for specific details.

Generally, the bank requires the home loan applicant or co-applicant to request and collect these documents. If that’s not possible, a representative can be sent with a valid Letter of Authority and appropriate ID proofs.

HDFC Home Loan

HDFC Home Loan SBI Home Loan

SBI Home Loan