A PNB Home Loan comes with a bunch of tax benefits, helping you save some money.

To claim these, it’s important to know how to download your Punjab National Bank (PNB) home loan tax certificate quickly and easily through net banking or the PNB One app.

How to Download the Home Loan Tax Certificate Online from Punjab National Bank?

Time needed: 2 minutes

Steps to Download PNB Home Loan Tax Certificate Online:

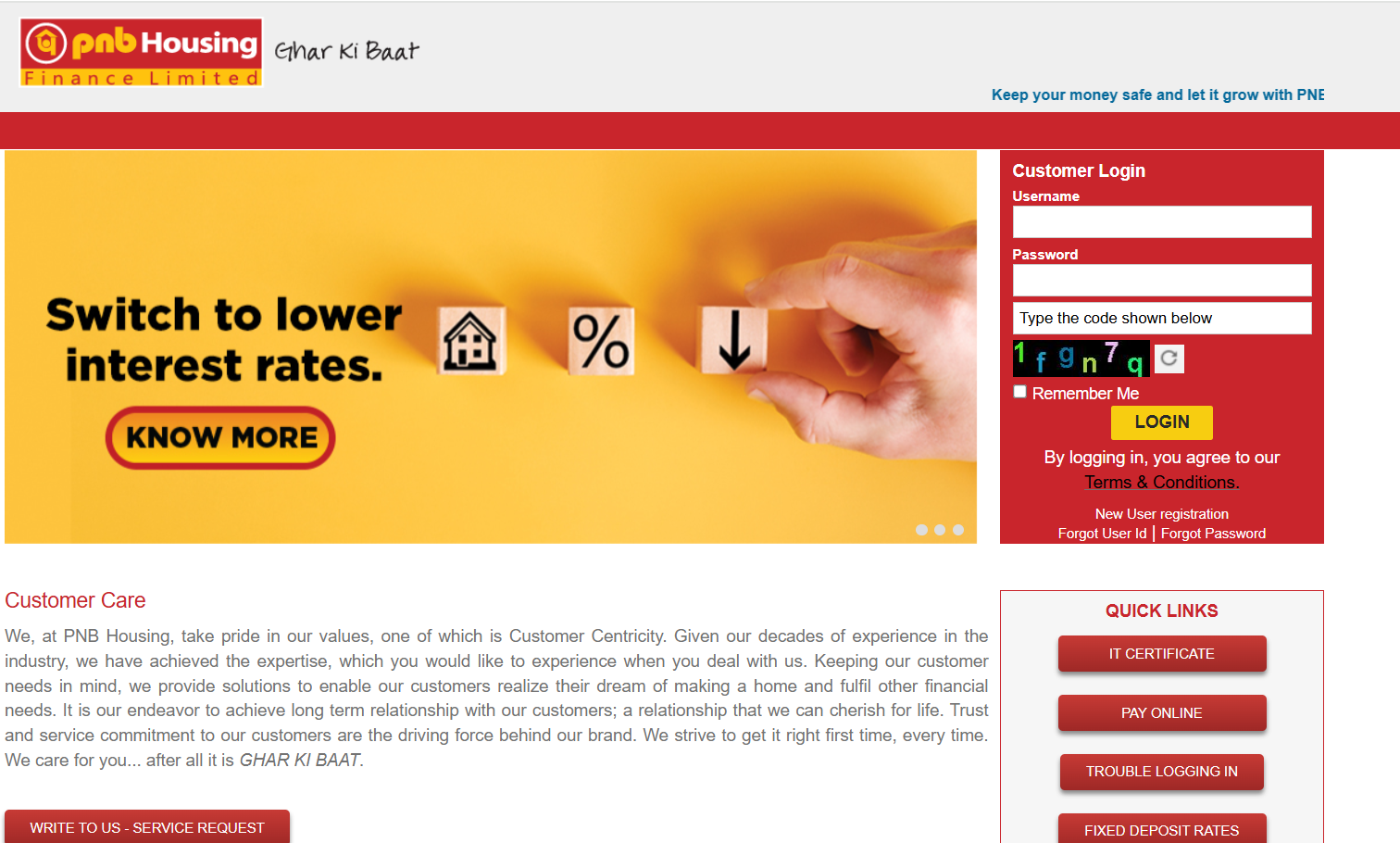

- Visit the PNB Housing Finance Official Website

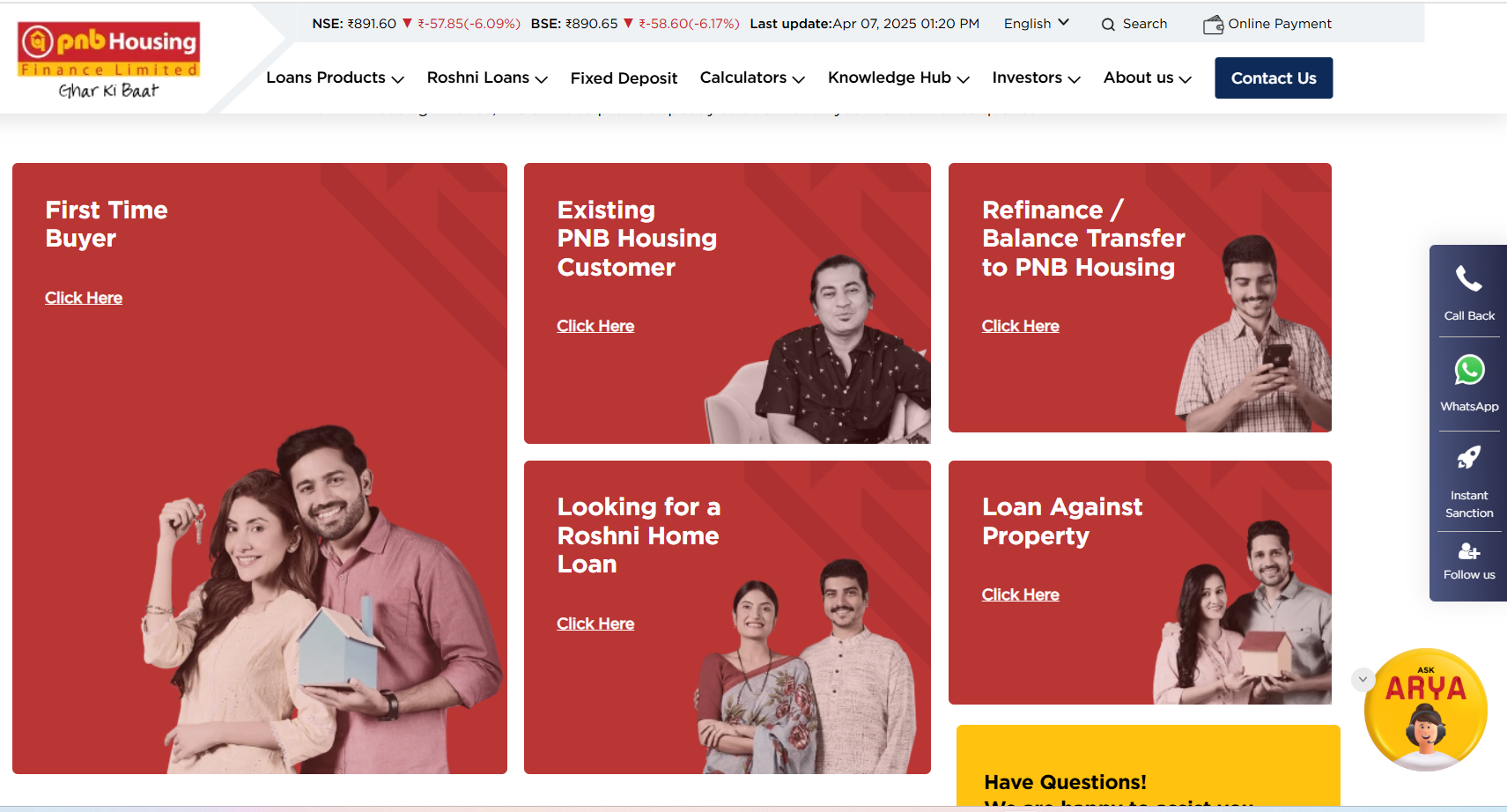

- Scroll down and click on “Existing PNB Housing Customer”

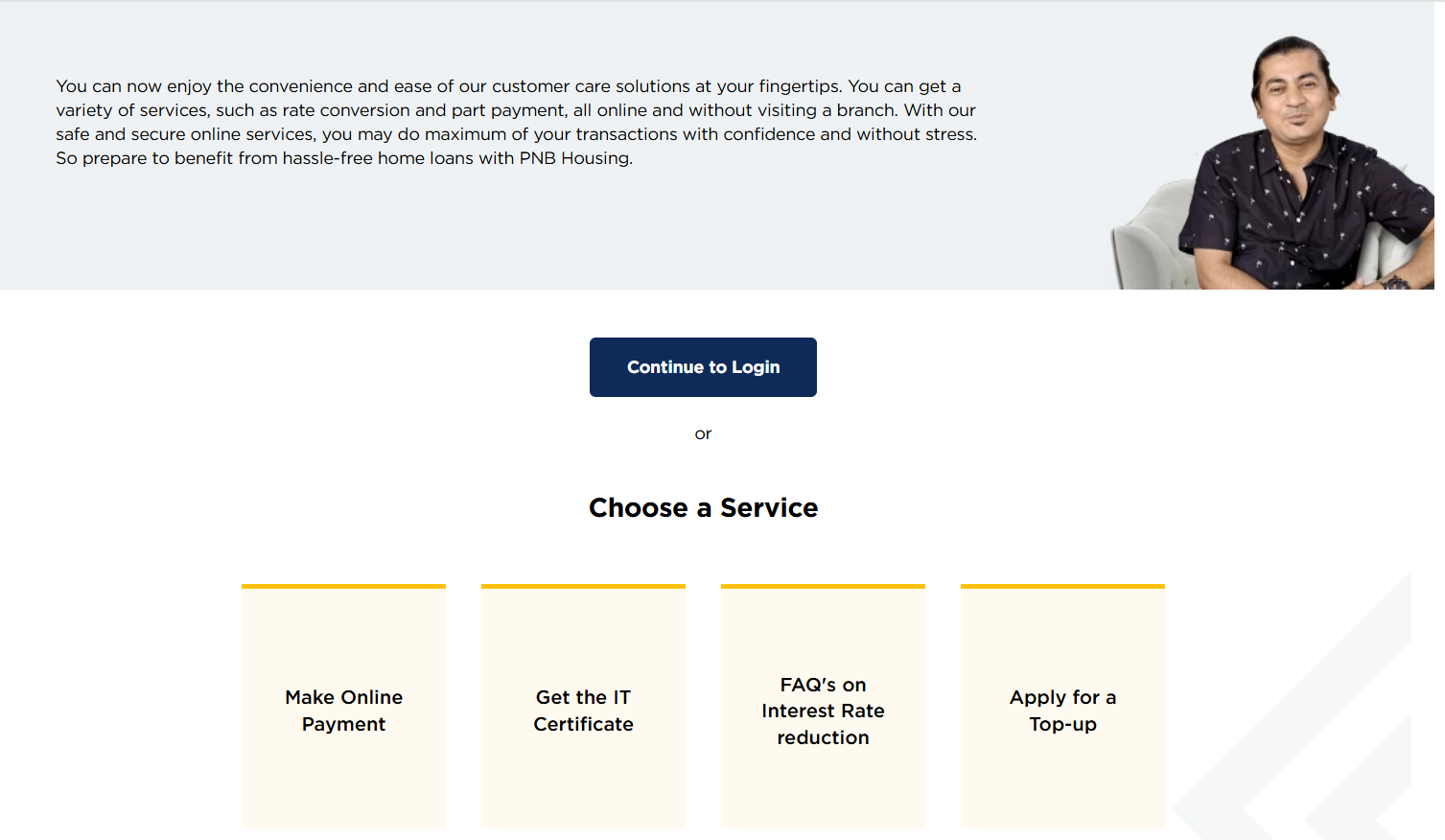

- Click on “Get the IT Certificate” in Choose a Service Option

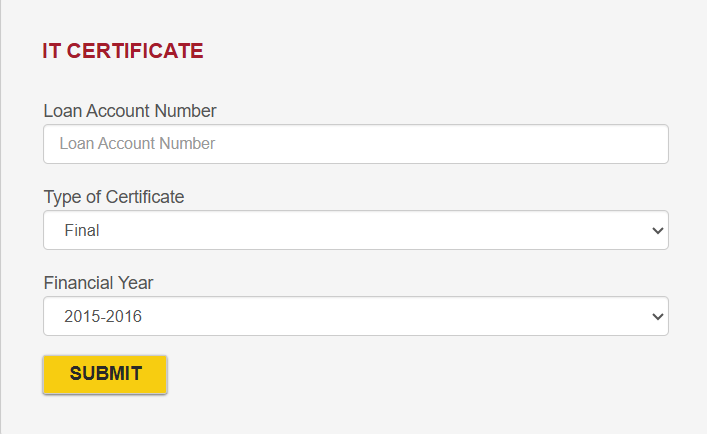

- Now in the IT Certificate Dialog Box, Type your “Loan Account Number” and Type of Certificate, and for which Financial Year You Want, and Click on Submit

- After logging in, access the Interest Certificate Section to Download

- You can also log in to Your Account Using Your Username and Password and Access Your Interest Certificate.

How to get the PNB Home Loan Tax Certificate Offline?

You can get your PNB home loan tax certificate offline by visiting a branch and submitting physical documents for a hard copy.

- Visit the nearest PNB Housing Finance branch in person.

- Fill out the physical request form for a home loan interest or provisional interest certificate.

- Provide necessary details like Loan Account Number, Date of Birth, Email ID, etc.

- Submit the form along with hard copies of ID proof (PAN, Aadhaar, Passport).

- Only the applicant or co-applicant should visit; others must carry a Letter of Authority with valid ID proofs.

Also Read: How to Download PNB Home Loan Statement

What are the Tax Benefits of a Home Loan with Punjab National Bank?

If you take a home loan from Punjab National Bank (PNB), you can claim tax benefits under two main sections. Under Section 80C, you can claim up to ₹1.5 lakhs per year on the principal repayment (as part of the EMI).

Under Section 24(b), you can claim up to ₹2 lakhs per year on the interest paid if the house is self-occupied.

So, for someone like Raj who pays ₹1.11 lakhs in principal and ₹3.90 lakhs in interest annually, the total deductible amount is ₹3.11 lakhs, resulting in a tax saving of up to ₹93,300 if in the 30% tax bracket.

Can I claim Tax Benefits on 2 Home Loans?

Yes, you can claim tax benefits on two home loans under Section 80C (up to ₹1.5 lakh on principal) and Section 24(b) (up to ₹2 lakh on interest). You’ll need your PNB Home Loan Tax Certificate to claim these. Do note that if one property is rented, rental income must be declared.

Can I claim both HRA and Home Loan Tax Benefits?

You can avail both HRA and home loan tax benefits, provided specific conditions are met. If you’re staying in a rented house and paying EMIs for another property, you’re eligible. HRA provides tax benefits under Section 80C and home loan interest under Section 24(b).

What is the Difference Between 80C and 24B Sections of Income Tax?

The following differences between Section 80C and 24B are as follows:

| Section | Deduction Limit (Per Annum) | Applies To | Purpose |

|---|---|---|---|

| Section 24(b) | Up to ₹2 lakh (self-occupied) No limit (rented/deemed rented) | Self-occupied or rented property | Interest payment |

| Section 80C | Up to ₹1.5 lakh | All properties (self-occupied/rented) | Principal repayment |

What is a PNB Home Loan Tax Certificate or Interest Certificate?

A PNB Home Loan Tax Certificate is an official document provided by Punjab National Bank that details the interest and principal repaid on your home loan during a financial year. It is essential for claiming tax deductions under applicable sections of the Income Tax Act.

Can I Download the Home Loan Tax Certificate Directly from the PNB Mobile Application?

Yes, you can directly download the home loan tax certificate from the PNB One mobile application. Simply log in using your registered credentials, navigate to your loan account, and download or email the provisional or final IT certificate for tax purposes.

How Long Does it Take to Receive the Home Loan Tax Certificate via Email?

The home loan tax certificate is usually emailed within 2 to 8 working days after placing the request, depending on the bank’s processing time. Some banks may also offer quicker turnaround through digital platforms or customer support channels.

Are There Any Fees Associated with Downloading the Home Loan Tax Certificate?

No, there are no charges for downloading the PNB Home Loan Tax Certificate through mobile banking, internet banking, or email. The service is provided free of cost for customer convenience.

Source of Information: Schedule of Applicable Charges on Retail Loans by the PNB Housing Company.

What are the Differences Between a Home Loan Tax Certificate and a Home Loan Interest Certificate?

Home Loan Tax Certificate and Home Loan Interest Certificate serve different purposes in tax planning, though both are crucial for claiming deductions.

| Aspect | Home Loan Tax Certificate | Home Loan Interest Certificate |

|---|---|---|

| Coverage | Includes both principal and interest components | Covers only the interest component |

| Purpose | Used for claiming deductions under Section 80C and 24(b) | Used for claiming deductions under Section 24(b) only |

| Information Provided | Gives a comprehensive view of repayment structure | Provides a focused summary of interest paid |

| Use Case | Suitable for overall tax planning and declaration | Used for interest-specific deduction claims |

How to Get a Punjab National Bank (PNB) Home Loan Provisional Interest Certificate?

To obtain a Punjab National Bank (PNB) home loan provisional interest certificate, you can follow these steps:

Using PNB One App

- Download and install the PNB One App: Get the app from the App Store (for iOS) or Google Play Store (for Android).

- Log in to the App: Use your username and password to log in.

- Navigate to Accounts or Statements: Find the section related to your accounts or statements.

- Select the Account: Choose the specific home loan account for which you want the certificate.

- Find the Interest Certificate Section: Look for a section labeled as “Interest Certificate” or something similar.

- Choose the Period: Select the financial year for which you need the provisional certificate.

- Download or Generate Certificate: Once you’ve selected the relevant options, download or generate the interest certificate.

- Verify and Save: Review the information to ensure it’s correct, then save the certificate to your device.

Visiting the Bank Branch

- Visit the Nearest PNB Branch: Go to your nearest PNB branch.

- Provide Details: Give your loan account number, PAN, and other required details to the bank officials.

- Request the Certificate: Ask them to provide you with the home loan provisional interest certificate.

Why do you need a Home Loan Tax Certificate from Punjab National Bank?

A PNB Home Loan Tax Certificate is a vital document that helps you manage your home loan efficiently. It provides a detailed breakup of your principal and interest repayments and is essential for tax filing, financial planning, and repayment tracking.

Tracking Your Loan Repayment

The certificate helps you keep track of how much you’ve paid toward the principal and interest components of your EMI. This ensures you stay aligned with your repayment schedule and manage your finances better.

Claiming Home Loan Income Tax Benefits

The following income tax benefits can be claimed by folks with home loans:

| Section | Covers | Purpose |

|---|---|---|

| Section 80C | Principal repayment | Claim deduction on the principal amount |

| Section 24(b) | Interest payment | Claim deduction on the interest paid |

Proof of Loan Repayment

In case of disputes or for future reference, the certificate serves as official proof that you have been consistently repaying your home loan.

It’s useful for both personal records and third-party verification.

Also Read: How to Apply for PNB Home Loan Online in Minutes?

Using PNB Home Loan Tax Certificates for Income Tax Filing

PNB Home Loan Tax Certificates provide a detailed breakup of principal and interest paid during the financial year. This information is essential for accurately filing income tax returns. It helps claim deductions under Section 80C and Section 24(b) of the Income Tax Act.

Locating Important Information for Tax Filing

While filing your income tax, it’s important to locate and use specific details from your PNB Home Loan Tax Certificate. This ensures accurate deductions and smooth processing.

Look for the following key information:

1. Loan account number and borrower’s name.

2. Financial year the certificate pertains to.

3. Breakup of principal and interest paid.

Use this data to claim:

1. Principal repayment under Section 80C.

2. Principal repayment under Section 80C.

Punjab National Bank Home Loan Address and Details for Income Tax Forms

To fill out income tax forms correctly, you may need Punjab National Bank’s address and other loan-related details. These are typically available in your PNB Home Loan Tax Certificate or through the loan sanction letter or online account portal.

Where to Find Key Details for Tax Filing:

| Detail Required | Where to Find It |

|---|---|

| Bank Name & Address | Home loan sanction letter or official PNB website |

| Loan Account Number | PNB Home Loan Tax Certificate or monthly EMI statement |

| Borrower’s Name & PAN | Tax certificate or original loan documents |

| Interest & Principal Breakup | Included in the PNB Home Loan Tax Certificate |

Where to Enter in Tax Forms:

- Interest Paid → Under Section 24(b) in the “Income from House Property” section of ITR.

- Principal Repaid → Under Section 80C in the “Deductions” section.

- Bank Name & Address → May be needed in detailed ITRs (e.g., ITR-2 or ITR-3) under lender details.

PNB Home Loan Tax Benefit Calculator

The PNB Home Loan Tax Benefit Calculator is an easy-to-use online tool that helps borrowers estimate their yearly tax savings based on their home loan details. It simplifies financial planning by showing how much you can save under Section 80C and Section 24(b).

How to Use PNB’s Tax Benefit Calculator

You can use the PNB’s tax benefit calculator by following the steps mentioned:

- Enter Basic Loan Details

1. Loan Amount

2. Interest Rate

3. Loan Tenure

4. Your Tax Bracket

5. Whether there’s a Co-applicant - Click to Calculate

The calculator instantly displays your estimated savings on:

1. Principal (Section 80C)

2. Interest (Section 24b)

3. Total Tax Benefits - Adjust and Recalculate

Modify loan parameters to see how changes affect your potential savings and choose the most tax-efficient loan setup.

Understanding and Applying the Results

- Principal Savings → Claim under Section 80C (up to ₹1.5 lakh/year)

- Interest Savings → Claim under Section 24(b) (up to ₹2 lakh/year)

- The calculator provides a year-wise breakdown of your expected tax benefits, which you can use for planning and during ITR filing.

Obtaining PNB Home Loan Tax Documents for Specific Years

You can obtain PNB home loan tax documents for specific years to track annual principal and interest payments for tax filing. These documents are available for each financial year and can be accessed through the PNB Housing portal or mobile app for easy download.

Getting Historical Punjab National Bank Tax Certificates

If you need PNB Home Loan Tax Certificates for previous financial years then you can obtain them through both online and offline methods, depending on availability.

How to Download Older Certificates Online:

- Log in to the PNB Housing Customer Portal or PNB One mobile app.

- Navigate to the Tax Certificate section.

- Select the desired financial year from the dropdown list.

- Download or email the certificate directly from the platform.

Note: Online access typically includes certificates for the most recent financial years. Earlier years may not be listed.

If Older Certificates Aren’t Available Online:

- Visit your nearest PNB Housing Finance branch.

- Carry a written request mentioning the required financial year(s).

- Submit valid ID proof (such as PAN, Aadhaar) along with your loan account number.

- The bank will process your request and issue a hard copy or email of the historical tax certificate.

PNB Home Loan Interest Certificate for Current Financial Year

The PNB Home Loan Interest Certificate for the current financial year outlines the total interest paid on your home loan, which is essential for claiming tax deductions under Section 24(b).

Special Considerations for the Current Financial Year:

- The certificate will include the exact interest paid for the financial year, helping you calculate tax deductions.

- If you have made prepayments or refinanced your loan during the year, ensure to check if these changes are reflected accurately in the certificate.

When Certificates Become Available for the Current Year:

- Typically, the PNB Home Loan Interest Certificate is made available after the end of the financial year (i.e., April or May).

- You can access the certificate via the PNB Housing customer portal or PNB One app, or request it through your nearest PNB branch.

Troubleshooting Common Issues with PNB Home Loan Certificate

If you’re facing issues with your PNB Home Loan Certificate, here are some common problems and solutions. Troubleshooting can help ensure you access the correct details for tax filing and other purposes.

Can’t Access Punjab National Bank Home Loan Online Portal

If you’re unable to access the PNB Home Loan Online Portal, there could be several reasons, such as login issues or forgotten credentials. Here’s how to resolve common problems:

Common Login Issues and Solutions:

- Incorrect Username/Password: Double-check your login credentials and ensure Caps Lock isn’t on.

- Locked Account: After multiple failed attempts, your account might be temporarily locked. Wait for some time or reset your password.

- Technical Glitch: Clear your browser cache or try accessing the portal from a different device.

Account Recovery Options:

- Forgot Password: Use the “Forgot Password” option on the login page to reset your credentials via registered email or mobile number.

- Account Unlock: If your account is locked, follow the instructions sent to your registered contact details to unlock it.

- Customer Support: If issues persist, contact PNB customer service for further assistance with your login.

Unable to Find or Download Tax Certificate

If you’re unable to find or download your PNB Home Loan Tax Certificate from your account, there are several steps you can take to resolve the issue.

Steps to Take if the Certificate Isn’t Visible in Your Account:

- Check the Financial Year: Ensure you are selecting the correct financial year for which the tax certificate is required.

- Clear Cache & Refresh: Clear your browser cache or refresh the page to ensure no outdated data is being displayed.

- Try a Different Device or Browser: Sometimes switching to another browser or device resolves loading issues.

Alternative Methods to Obtain Your Certificate:

- PNB Customer Support: Contact PNB customer service for assistance in locating or obtaining the tax certificate.

- Branch Visit: If the certificate is still not available online, visit the nearest PNB branch with your loan account details. The branch will help you retrieve the required certificate.

Issues with PNB Home Loan Statement for Income Tax

If your PNB Home Loan Statement shows incorrect information, such as inaccurate principal or interest figures, it could affect your tax filings. Here’s what you can do to resolve the issue.

What to Do if Your Statement Shows Incorrect Information:

- Double-Check the Details: Verify if the loan account number, financial year, and repayment details are correct.

- Check for Prepayments or Changes: If you’ve made prepayments or refinancing, confirm whether those are reflected in the statement.

- Ensure Correct Dates: Make sure the dates on the statement match the financial year you are concerned with.

How to Request a Corrected Statement:

- Contact PNB Customer Support: Reach out to PNB’s customer service via phone or email to report the discrepancies.

- Visit a Branch: If the issue persists, visit your nearest PNB branch with your loan details and request a corrected statement.

- Online Request: Alternatively, use the PNB Housing portal or PNB One app to request an updated or corrected statement.

PNB Home Improvement Loan Tax Benefits

PNB Home Improvement Loans provide financial support for property renovations, repairs, or improvements. Available to salaried individuals, professionals, and self-employed individuals, these loans offer flexible terms and competitive interest rates.

Key Features:

- Loan Amount: Based on project cost and repayment capacity.

- Eligibility: Available to property owners with a regular income source.

- Repayment: Maximum tenure of 15 years, with up to 6 months of moratorium.

Tax Benefits:

- Interest Deduction: Under Section 24(b), up to ₹2 lakh for self-occupied properties.

- Principal Deduction: Under Section 80C, up to ₹1.5 lakh.

Process:

- Check eligibility and prepare documents.

- Submit the application to the nearest PNB branch.

- Loan approval and disbursement follow after assessment.

Contacting Punjab National Bank for Tax Certificate Assistance

To facilitate effective communication with customers, Punjab National Bank offers various channels for support.

| Service | Details |

|---|---|

| Toll-Free Number of Punjab National Bank | 1800 120 8800 Monday to Saturday, 10 A.M. to 5 P.M. (excluding 1st & 2nd Saturdays and holidays). |

| Email ID | customercare@pnbhousing.com nricare@pnbhousing.com |

| 918448198457 | |

| Locate Your Branch | PNB Branch Locator |

| Write to PNB | Service request/ Inquiry |

Visiting PNB Bank Branches for Assistance

If you need assistance with your PNB Home Loan, whether it’s for obtaining documents or resolving issues, visiting a PNB branch is a straightforward option. Here’s what you need to know before you go.

| Document Type | Examples |

|---|---|

| Valid ID Proof | Aadhaar, PAN Card, Passport |

| Loan Account Details | Loan account number, Loan statement |

| Address Proof | Utility bills, Ration card |

| Income Proof | Salary slips, Bank statements |

The Process at the Branch:

- Visit the Branch: Go to the nearest PNB branch with the required documents.

- Speak with a Loan Officer: Explain your query or request (e.g., tax certificate, loan details).

- Document Submission: Submit the necessary documents as per your request (e.g., for loan statement correction).

- Receive Assistance: The branch will guide you through the next steps, provide the required documents, or resolve any issues on-site.

- Follow-up: If needed, you may be asked to follow up on specific actions or additional documentation.

Conclusion

Understanding and utilizing the tax benefits associated with PNB home loans can significantly reduce your financial burden. The PNB home loan income tax certificate is a vital document that helps in claiming these deductions. By following the procedures outlined above, you can ensure that you maximize your tax benefits and manage your finances more effectively.

Get the Best Home Loan Offers with Credit Dharma

Credit Dharma is your trusted partner for securing the best Home Loan offers, with over ₹500 Cr+ loans handled and partnerships with 20+ leading banks. We provide exclusive access to the lowest interest rates and a seamless, digital process with fast approvals in just 1-2 weeks, backed by lifetime support from our home loan experts.

Why choose Credit Dharma? We provide:

- Lowest Interest Rates: Save more with every EMI.

- Maximum Funding: Get up to 100% funding for your dream home.

- Simple & Digital Process: No tedious paperwork or branch visits.

- Expert Guidance: Lifetime support from our team of specialists.

Compare, choose, and secure the best Home Loan offer with Credit Dharma — your home loan journey starts here!

Frequently Asked Questions

A Home Loan Provisional Interest Certificate is a statement provided by the lender that details the projected principal and interest amounts payable on your home loan for the upcoming financial year. It aids in tax planning and helps in claiming deductions under relevant sections of the Income Tax Act.

No, obtaining the Interest Certificate through the PNB Housing Customer Portal or Mobile App is free of charge. However, if you request the certificate through other channels, a nominal service fee may apply.

Yes, even without Internet Banking access, you can obtain the Interest Certificate by visiting your nearest PNB branch and requesting it in person.

The Final Interest Certificate is typically available shortly after the end of the financial year. It’s advisable to check with PNB Housing Finance Limited for the exact availability date.

Yes, co-applicants can download the Interest Certificate provided they have the necessary login credentials for the PNB Housing Customer Portal or Mobile App.

If you forget your login credentials, you can use the ‘Forgot User ID’ or ‘Forgot Password’ options on the PNB Housing Customer Login page to retrieve or reset your credentials.

Yes, the Interest Certificate serves as an official document for claiming tax deductions on the principal and interest components of your home loan under relevant sections of the Income Tax Act.

You can download your home loan interest certificate through PNB’s online banking portal or the PNB Housing Customer Portal. Log in with your credentials, navigate to the relevant section, and download the certificate.

Yes, by logging into the PNB One app, you can access and download your home loan interest certificate. Navigate to the ‘Accounts’ or ‘Statements’ section, select your loan account, choose the desired time frame, and download the certificate.

Yes, you can visit your nearest PNB branch and request the home loan interest certificate in person. Ensure you carry valid identification and loan account details for verification.

A provisional interest certificate provides an estimate of the interest and principal amounts payable for the upcoming financial year, aiding in tax planning. In contrast, a final interest certificate details the actual amounts paid during the concluded financial year, used for filing income tax returns.

To register your email for e-statements, log in to PNB Internet Banking, navigate to ‘Other Services’ > ‘Service Requests’ > ‘New Requests’ > ‘Email Statement Registration.’ Alternatively, you can contact your branch or call PNB’s customer service.

HDFC Home Loan

HDFC Home Loan SBI Home Loan

SBI Home Loan