An Encumbrance Certificate (EC) in Telangana is a crucial document that verifies a property’s legal status and ownership history. Whether you’re buying, selling, or applying for a home loan, obtaining an EC Telangana is essential to ensure the property is free from legal disputes or financial liabilities. The good news is that the Telangana government has made it easy to perform an EC Telangana online search through the Telangana Registration EC portal.

In this guide, we’ll walk you through everything you need to know about Telangana EC search, how to apply for an EC online Telangana, and step-by-step instructions to download your EC Telangana online search results effortlessly.

How to Apply for EC Telangana Online?

You can apply for an Encumbrance Certificate (EC) in Telangana online through the Meeseva portal. This method is quick and convenient. Alternatively, you can apply offline by visiting the Sub-Registrar’s office.

Time needed: 3 minutes

Here’s How To Apply For EC Telangana Online:

- Visit the Meeseva Portal:

Go to the official Telangana registration website.

- Select EC Services:

On the homepage, click on “Government Forms” and choose “Meeseva Services.” - Fill Out the Application Form:

Provide the required details such as property details, applicant’s name, and contact information. - Submit the Form:

Visit the nearest Meeseva center to submit the form. - Pay the Fee:

Pay the application fee as per the guidelines. - Receive Acknowledgment:

Collect the acknowledgment receipt for future reference. - Verification and Issuance:

The Sub-Registrar’s office will verify your application. Once approved, you will receive the EC.

Check Out: What is an Encumberance Certificate?

How To Get EC Offline on the IGRS Telangana Portal

- Visit Your Local Sub-Registrar Office. Find Your Local Subregistrar For The Jurisdiction of Your Property.

- Next, you will have to fill out Form 22. The required details include the names of the seller, the buyer, and other information.

- Then comes the nominal fees. You need to pay 200 rupees (if the search is up to 30 years) and 500 rupees (if the search is more than 30 years).

- Once you have paid the application fees, you are ready to submit the form!

- Once you make the payment, you will get the reference number against your application.

- You can use the reference number to track the current status of your application.

In the next section, we will guide you on how to check your application status online for EC Telangana.

How to Download EC Telangana?

You can easily download your Encumbrance Certificate (EC) online from the Telangana Registration Portal. This process is simple and saves time.

Follow these steps to download your EC:

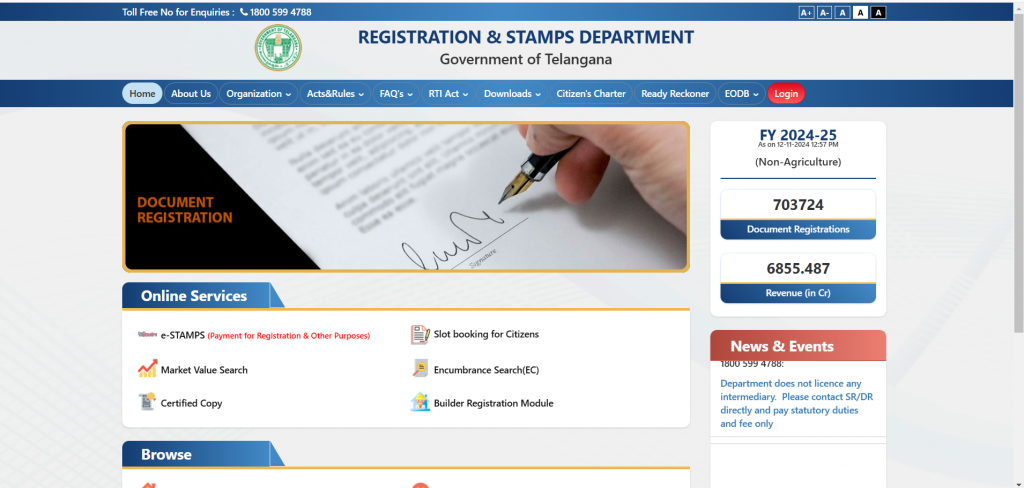

- Visit the Official Website:

Go to the Telangana Registration Portal at registration.telangana.gov.in.

- Select “Encumbrance Certificate”:

On the homepage, click on the “Encumbrance Certificate” option under the online services section.

- Enter Property Details:

Provide details such as the document number, year of registration, and property details.

- Submit the Information:

Review the entered details and click on the “Submit” button.

- View and Download EC:

Once the system retrieves your EC, you can view it on the screen. Click the “Download” button to save it to your device.

How to Search and Verify EC Telangana

You can search for and verify the status of your Encumbrance Certificate (EC) online through the Telangana Registration Portal. This helps you confirm the authenticity and current status of the property.

Here’s how to search and verify EC online:

- Visit the Telangana Registration Portal:

Go to registration.telangana.gov.in.

- Select “Encumbrance Search”:

On the homepage, find and click on the “Encumbrance Search” option.

- Accept Terms and Conditions:

Read and accept the terms and conditions, then click “Submit.”

- Enter Required Details:

Provide details like document number, year of registration, and property details.

- View EC Details:

After submitting the information, the system will display the EC.

- Verify EC Status:

Check the status of the EC to ensure it is accurate and up-to-date.

Documents Required for EC Telangana

To apply for an Encumbrance Certificate (EC) in Telangana, you need to submit specific documents. These documents help verify the details of the property and the applicant.

Here is the list of required documents:

- Property Details: Property and its possession deed details, this includes the complete address and survey number.

- Title Deed Copy: Submit a copy of the property’s title deed.

- Previous Transaction Records: Provide sale, gift, or partition deed details if available.

- Applicant’s ID Proof: Submit a valid government-issued ID like Aadhaar or PAN card.

- Applicant’s Address Proof: Include utility bills or any other official document as proof of address.

- Encumbrance Application Form: Fill out the form accurately with all necessary details.

- Letter of Authority: A copy of the reference letter of authority.

- Form 22: A duly filled Form 22.

What is EC Telangana?

An Encumbrance Certificate (EC) is a document that confirms a property is free from financial or legal obligations. It lists all registered transactions related to the property, such as sales, mortgages, or loans.

In Telangana, an EC is essential for property dealings. It helps buyers ensure there are no pending claims or disputes. Without this certificate, property transactions may carry hidden risks.

One major use of an EC is for home loan approvals. Banks require it to verify that the property is not under any debt. It also acts as legal proof of ownership, showing the property’s history of transactions. Additionally, it is crucial when transferring property ownership or selling it.

Financial Implications of Not Having an EC:

- Loan rejection (92% of banks mandate EC)

- Property dispute complications

- Transaction delays

- Additional legal expenses

By obtaining an EC, you can make informed decisions and avoid future complications. It provides transparency and protects your investment.

Who Needs an EC in Telangana and Why?

The Telangana Registration Department reports that multiple stakeholders require an EC for different purposes:

Primary EC Users:

- Property Buyers:

- For title verification

- To check property disputes

- For loan applications

- Property Sellers:

- To prove clear ownership

- For transparent transactions

- To facilitate quick sales

- Financial Institutions:

- For risk assessment

- To verify the property status

- For loan processing

Get the Best Home Loan Offers with Credit Dharma

Credit Dharma is your trusted partner for securing the best Home Loan offers, with over ₹500 Cr+ loans handled and partnerships with 20+ leading banks. We provide exclusive access to the lowest interest rates and a seamless, digital process with fast approvals in just 1-2 weeks, backed by lifetime support from our home loan experts.

Why choose Credit Dharma? We provide:

- Lowest Interest Rates: Save more with every EMI.

- Maximum Funding: Get up to 100% funding for your dream home.

- Simple & Digital Process: No tedious paperwork or branch visits.

- Expert Guidance: Lifetime support from our team of specialists.

Compare, choose, and secure the best Home Loan offer with Credit Dharma — your home loan journey starts here!

Conclusion

Obtaining an Encumbrance Certificate (EC) is a critical step in securing your property transactions. It provides assurance that the property is free from any legal or financial burdens. Ensuring transparency in property dealings helps you avoid future complications. With EC Telangana, you can easily access and verify your property’s history online.

Credit Dharma’s home loan experts with decades of experience can help you shape the plan for your home loan. Connect with Credit Dharma today for a free consultation call.

Frequently Asked Questions

An Encumbrance Certificate (EC) is an official document that certifies whether a property is free from any legal or financial liabilities, such as loans, mortgages, or disputes. It provides a record of all registered transactions related to the property, ensuring a clear title for buyers and financial institutions.

Obtaining an EC is crucial when purchasing or selling property, applying for home loans, or withdrawing from provident funds for property purchases. It ensures the property has a clear title and is free from any encumbrances, protecting the interests of buyers and lenders.

To obtain an EC online in Telangana, visit the official Registration & Stamps Department portal at https://registration.telangana.gov.in/. Navigate to the ‘Encumbrance Search (EC)’ section and enter the required property details to generate the certificate.

To search for an EC online, you need details such as the document number and year of registration, or property specifics like house number, apartment name, survey number, village, and district. Accurate information ensures a successful search.

Online EC records in Telangana are available for transactions registered post-January 1, 1983. For records prior to this date, individuals must visit the concerned Sub-Registrar Office (SRO) to obtain the necessary information.

Yes, there is a nominal fee to obtain an EC in Telangana. The exact amount may vary based on the duration and specifics of the search. It’s advisable to check the latest fee structure on the official portal or contact the nearest MeeSeva center for accurate information.

HDFC Home Loan

HDFC Home Loan SBI Home Loan

SBI Home Loan