When buying a property in Tamil Nadu, one of the most important documents you need is the Encumbrance Certificate (EC). It shows whether a property has any legal dues, loans, or liabilities attached to it.

Property buyers, sellers, lenders and real-estate professionals in Tamil Nadu can now verify, download and share a legally valid Encumbrance Certificate (EC) in under 10 minutes through the upgraded TNREGINET portal, avoiding queuing at Sub-Registrar Offices and cutting processing times from 15-30 days to 5-7 days.

Tamil Nadu will soon enable citizens to access about 50 government services via WhatsApp, officials said. The Tamil Nadu e-Governance Agency (TNeGA) plans a rollout within three months, powered by a bi-lingual (Tamil/English) chatbot using Generative AI and WhatsApp Business Flows to complete forms, upload documents, make payments, and track application status without external links.

Security will include OTP authentication, with an agreement finalised with Meta. Initial services span 13 departments and may use unique WhatsApp numbers. Utilities include applying for ration and income certificates, paying taxes and electricity bills, and viewing or downloading Encumbrance Certificates.

Source: The New Indian Express

What is TNREGINET?

TNREGINET is the Tamil Nadu state government’s one-stop digital interface for land, property and civil registrations, designed and maintained by Tata Consultancy Services under the Inspector General of Registration (IGR).

Launched to eliminate paper-heavy workflows, the portal today supports:

- Online property registration

- Stamp-duty payment

- Guideline-value search,

- Encumbrance Certificate issue

- Patta-Chitta extracts

- Marriage/birth/death registrations

- Appointment booking at 575 Sub-Registrar Offices statewide.

Suggested Read: Importance of EC in Property Transactions

How to Apply for an Encumbrance Certificate Online in Tamil Nadu?

Apply for a digitally signed EC on TNREGINET by logging in, entering property details, selecting search type, paying fees online, and downloading QR-coded certificate after registrar verification within two–five days.

- Log in to tnreginet.gov.in, go to E-Services → Encumbrance Certificate → Search and Apply EC.

- Select the search type: EC Search (survey/plot), Document-wise, or Form-wise.

- Enter property details: Zone, District, SRO, Village, Survey No, Subdivision, and date range.

- Click Search to view all registered transactions or get a Nil EC if none exist.

- Confirm details and click Apply Online; fill in applicant name, address, mobile, and email.

- Pay the fee online (₹1 application fee, ₹15 first year, ₹5 each extra year, ₹100 digital search).

- Sub-Registrar verifies records and digitally signs the EC (takes 2–5 working days).

- Log in again, go to Request List, and download your EC PDF with QR code.

Suggested Read: RERA Charges in Tamil Nadu 2025

How to View Encumbrance Certificate Online in Tamil Nadu via tnreginet.gov.in?

View EC on TNREGINET to quickly check transactions without logging in: choose search mode, enter zone, district, SRO, property identifiers, set date range, complete CAPTCHA, and view printable on-screen results.

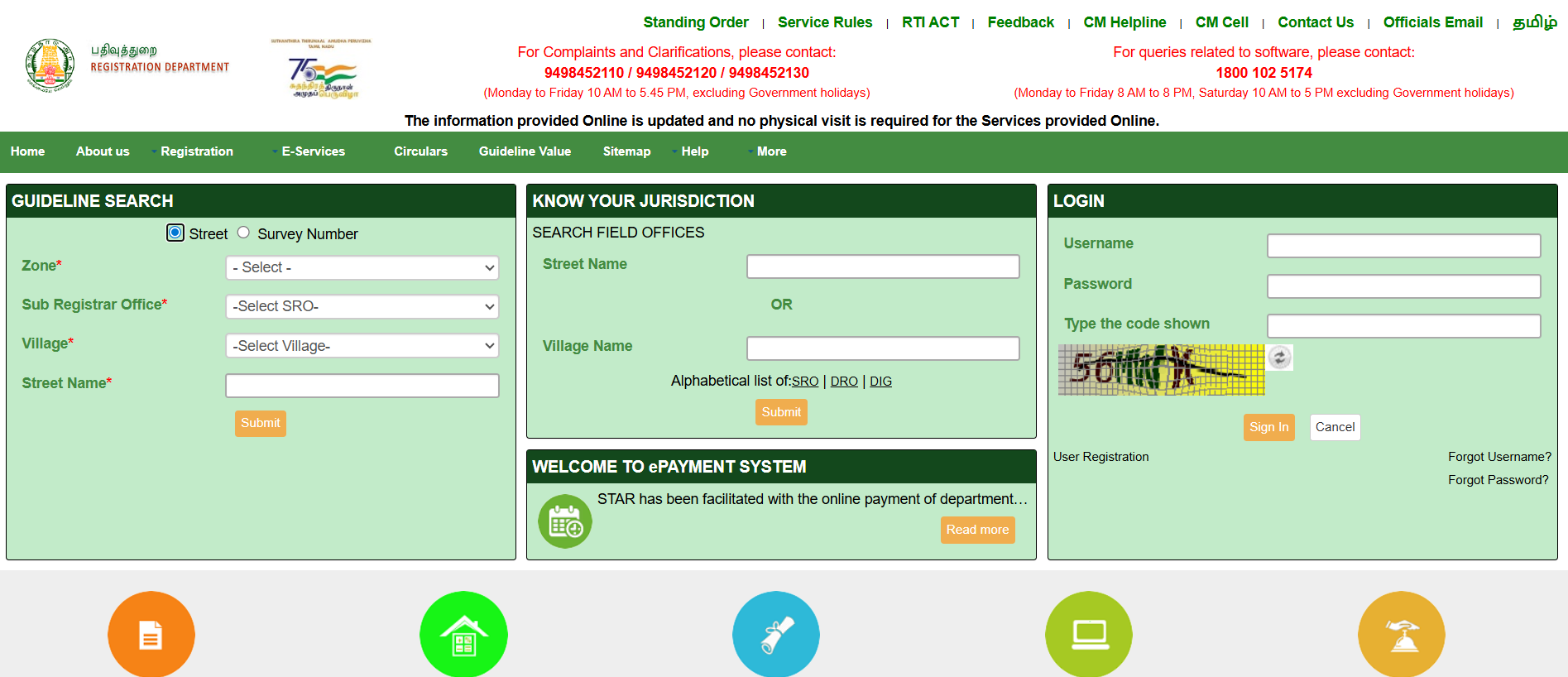

- Go to the official TNREGINET website.

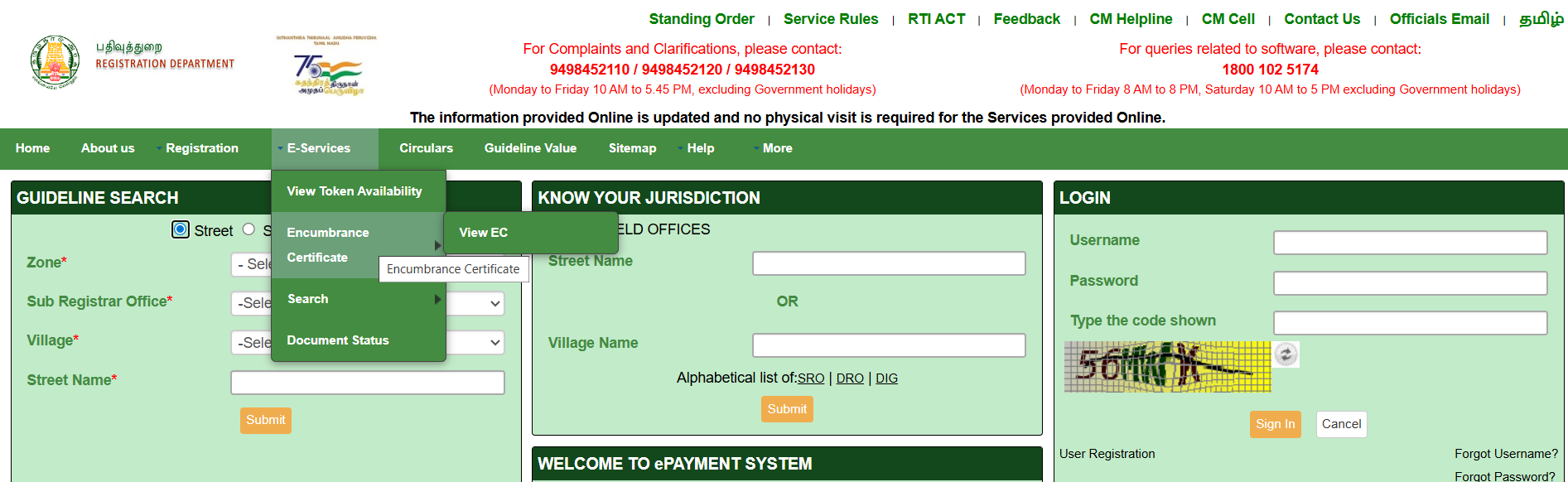

- Click on “E-Services” on the dashboard. A drop-down list will appear → Select “Encumbrance Certificate > View EC”.

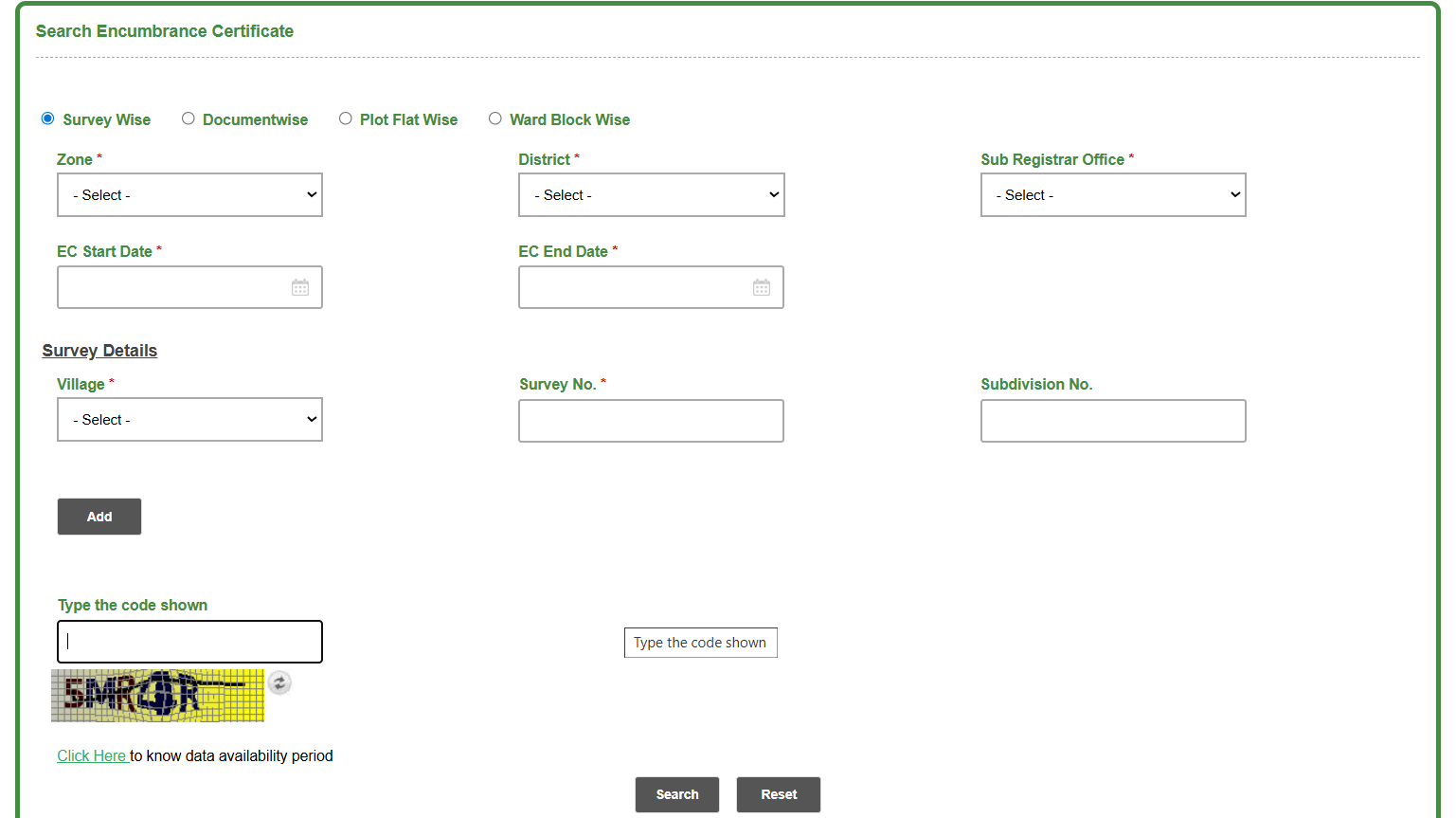

- You will be asked how you want to search for your EC. You can choose one of the following:

a. Survey Number – wise: Identifies land using village survey and subdivision numbers.

b. Document-wise: Finds property through its registered deed or document details.

c. Plot Number-wise: Used for properties in layouts or flats with plot/flat numbers.

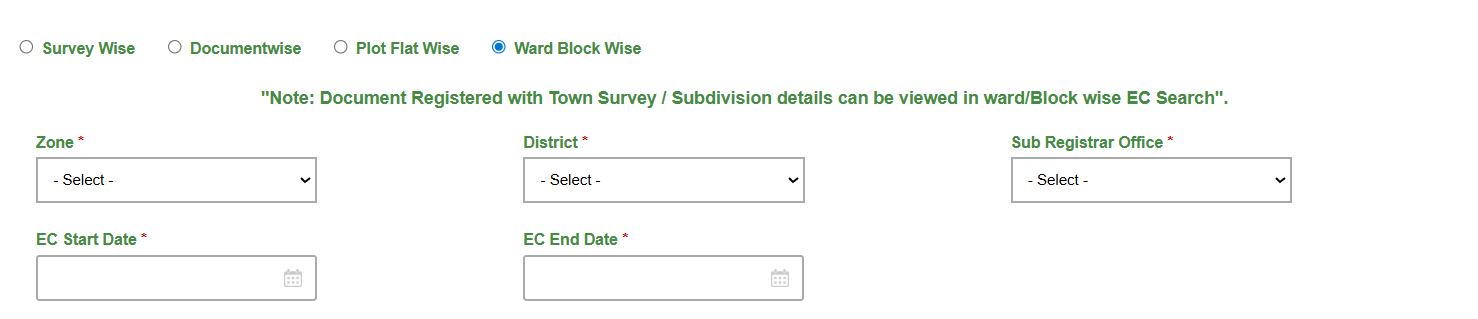

d. Ward & Block Number-wise: Refers to municipal property records in towns or cities.

- Fill in Location Details

No matter which method you choose, you must enter:

a. Zone: Select the registration zone (North, South, East, West, Central).

b. District: Choose the relevant district in Tamil Nadu.

c. Sub-Registrar Office (SRO): Pick the nearest SRO where the property is registered.

d. Date Range: Select the time period for which you want to view the EC (e.g., from 01-01-2015 to 31-12-2024).

- If you choose Survey Number. Enter Village Name, Survey Number, and Sub-division Number.

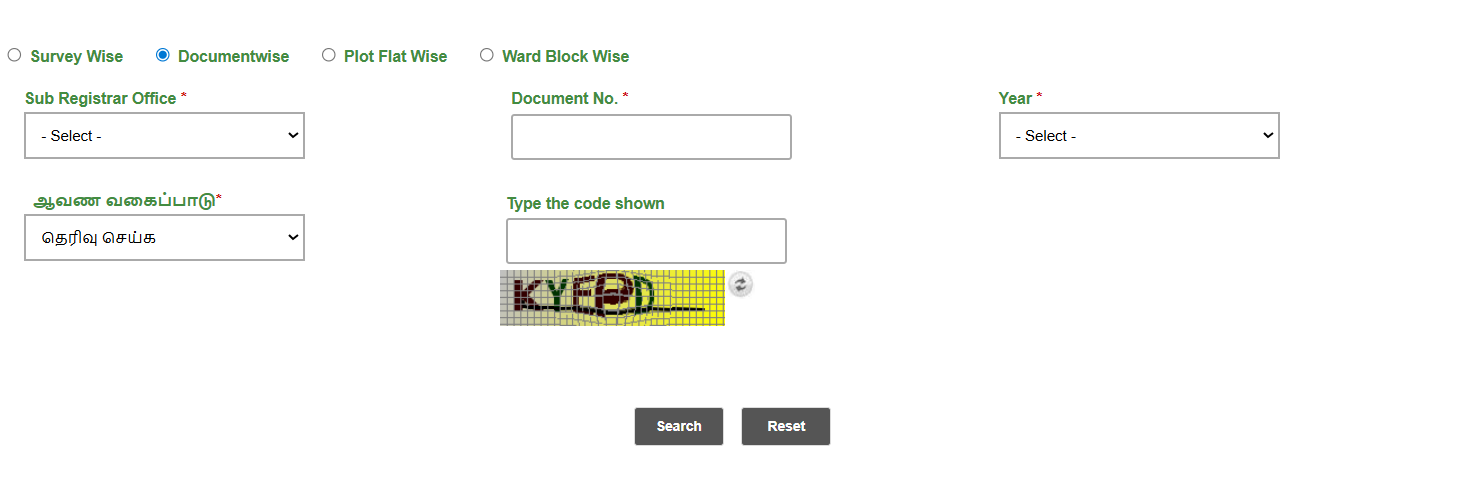

- If you choose Document-wise. Provide the sub-registrar office, select the document type (like a sale deed, loan order, or gift deed), and enter the document number along with the year of registration.

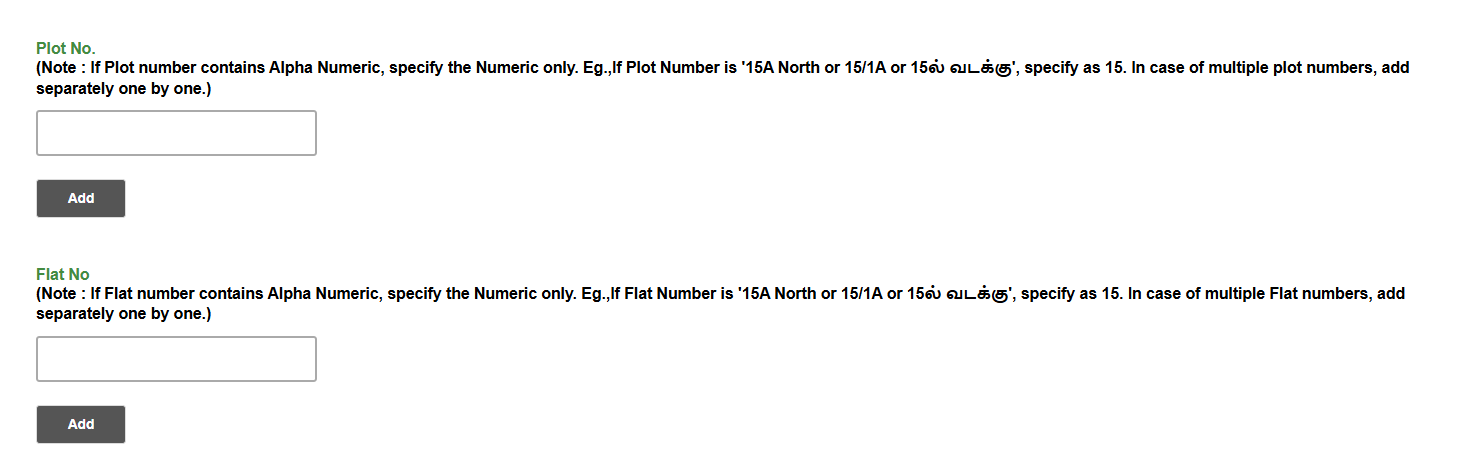

- If you choose Plot Number-wise. Fill in the survey number and subdivision number, and also enter the plot number and flat number (if it’s an apartment).

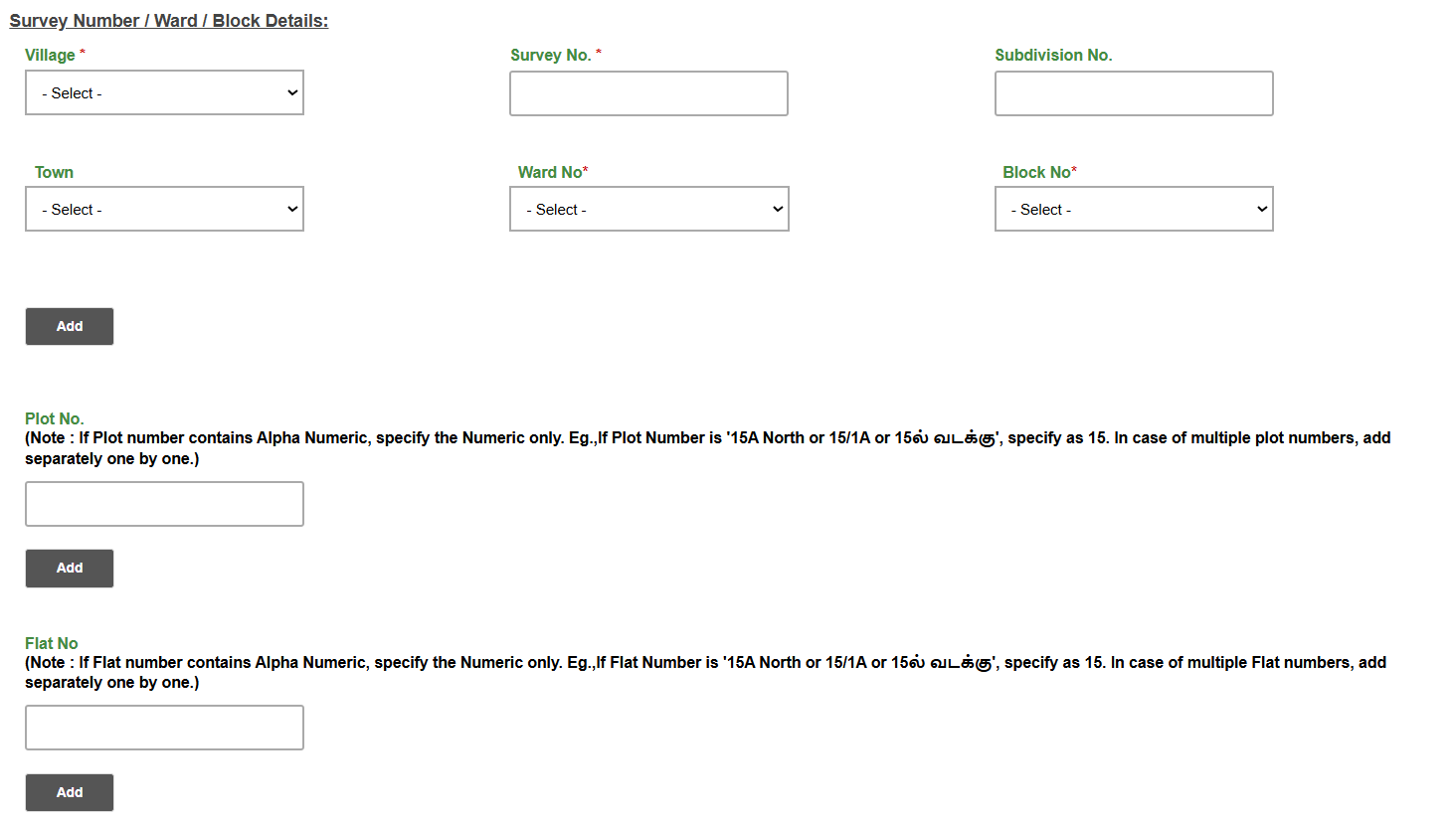

- If you choose Ward & Block Number-wise. Enter the village name, along with the ward number and block number.

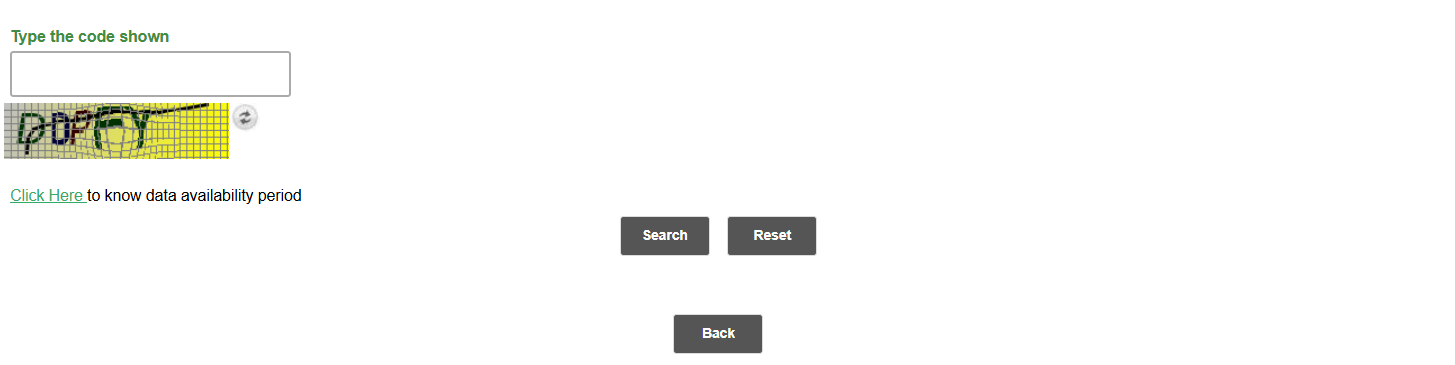

- Type the CAPTCHA Code displayed on the screen to verify. Click on Search to generate your Encumbrance Certificate (EC).

Source: https://tnreginet.gov.in/portal/

How to Apply for EC in Tamil Nadu Offline?

You can apply for EC in Tamil Nadu by visiting the Sub-Registrar Office. Here’s how:

- Visit the nearest Sub-Registrar’s Office (SRO) where the property is registered.

- Fill and submit Form-22 (EC application form).

- Attach supporting documents such as proof of address, sale deed, or title deed.

- Pay the applicable fees in cash at the SRO.

- Collect your Acknowledgement Number (ACK) for tracking.

- Wait 15–30 days for the Sub-Registrar to process and issue the Encumbrance Certificate.

Suggested Read: Stamp Duty and Registration Charges in Tamil Nadu 2025

How Much Does It Cost to Apply for an EC Online in Tamil Nadu?

| Fee Type | Amount | Details |

|---|---|---|

| Application Fee | ₹1 | Fixed fee for every EC application |

| First Year Fee | ₹15 | Charged for the initial year of records |

| Additional Year Fee | ₹5 | For every extra year beyond the first |

| Digital Search Fee | ₹100 | For records searched post-1987 |

Example

If you are applying for an Encumbrance Certificate from 2000 to 2015 (which is 16 years):

- Application Fee = ₹1

- First Year Fee = ₹15

- Additional Years (15 × ₹5) = ₹75

- Digital Search Fee (since after 1987) = ₹100

- Total = ₹191

Suggested Read: How to Download Patta Chitta Records in Tamil Nadu?

Who Can Apply for an EC in Tamil Nadu?

You can apply for an Encumbrance Certificate in Tamil Nadu if you are:

- The current owner of a piece of land or property.

- A prospective buyer planning to purchase land or property.

- An authorized representative holding Power of Attorney or acting as an official signatory.

Suggested Read: Land Registration Fees and Charges in Tamil Nadu

Documents Required for EC Application in Tamil Nadu

To obtain an Encumbrance Certificate in Tamil Nadu, Keep property identifiers ready.

| Category | Details Required |

|---|---|

| Property Location Details | • Village • Zone • District • Sub-Registrar Office • Survey Number • Subdivision Number • Plot Number |

| Property Physical Details | • Built-up Area • Complete Postal Address |

| Other Supporting Documents (if asked by authority) | • Sale Deed • Title Deed • Purpose of EC application • An attested copy of power of attorney (if applies) |

Suggested Read: Cost of Living in Coimbatore

How to Track the Status of an Encumbrance Certificate in Tamil Nadu?

Tracking your EC status online is simple and quick. Just follow these steps:

- Go to the official TNREGINET website.

- Scroll down to the bottom of the homepage, find the ‘Encumbrance Certificate’ section, and click on ‘Search/View EC’.

- A new page will open. Tick the checkbox for EC, enter the required property details along with the CAPTCHA code, and then hit ‘Search’.

- Your EC status will be displayed on the screen instantly.

Suggested Read: Top 5 Banks for Home Loans in Chennai

Common Issues on TNREGINET and How to Fix Them

| Issue | How to Fix It |

|---|---|

| ‘Record Not Found’ | • Double-check the survey number format. • For plots subdivided after 2017, use the updated sub-division codes. |

| Nil-EC Misinterpretation | • A Nil EC only means no transactions in the selected period. • It does not confirm a clear title since inception. • Extend the search up to 30 years for safer verification. |

| Captcha Loop / Session Timeout | • Clear your browser cache and cookies. • Try again during off-peak hours (before 9 AM or after 6 PM). |

| Account Deactivation | • User IDs deactivate if inactive for 90 days. • To reactivate, log in and view any guideline value to reset the account. |

Suggested Read: The Impact of Vandalur-Kelambakkam Road on Chennai’s Real Estate Market

Why is an Encumbrance Certificate Important in Tamil Nadu?

- Transparency: Gives you real-time access to land records, helping prevent fraud and undervaluation.

- Saves Time & Money: Cuts down registrar office visits from three to just one and avoids unnecessary travel or middlemen costs.

- Protects State Revenue: Stamp duty is auto-calculated on the higher of guideline value or market price, stopping revenue leaks.

What Can You Use an Encumbrance Certificate For?

- To prove property ownership.

- To apply for a home loan from banks or financial institutions.

- To help village officers update land records.

- For land mutation during transfers.

- To buy or sell property without legal hurdles.

- To ensure legal recognition of ownership and avoid disputes in the future.

Suggested Read: Cost of Living in Chennai

How to Contact TNREGINET Customer Care?

| Mode of Contact | Details |

|---|---|

| Helpline Number | 044-24640160 |

| Email Support | helpdesk@tnreginet.net |

| Working Hours (Mon–Fri) | 8:00 AM – 8:00 PM |

| Working Hours (Saturday) | 10:00 AM – 5:00 PM |

In today’s property market, due diligence is non-negotiable. An Encumbrance Certificate is the backbone of property verification. It exposes unresolved debts or claims that could weaken loan security.

A clean record accelerates loan approvals, while inconsistencies demand exhaustive checks. Neglecting this step risks loan rejection and exposes buyers to hidden disputes that can derail their path to homeownership.

– Sanjay Bharti, Home Loan Expert

Conclusion

Buying a home is one of the most important financial decisions you will make, and having the right guidance can make all the difference. From identifying the right property to securing the best home loan, Credit Dharma provides complete support at every stage.

Our team ensures you get fair pricing, access to preferred units, and expert advice tailored to your needs. With transparent comparisons of home loan offers, lowest interest rates, and continuous post-purchase assistance, we make your home-buying journey smooth, informed, and stress-free.

Frequently Asked Questions

No, the TNREGINET portal exclusively processes Encumbrance Certificate applications for properties located within Tamil Nadu state boundaries. For properties in other states, you must use the respective state’s registration portal.

Yes, anyone can apply for an Encumbrance Certificate for any property in Tamil Nadu. The EC is a public document that provides transparency about a property’s transaction history and legal status, making it accessible to potential buyers, legal professionals, or anyone conducting due diligence.

If encumbrances exist, they will be clearly listed in the EC, showing details of mortgages, loans, legal disputes, or other charges against the property. This information is crucial for buyers and lenders as it indicates potential legal or financial complications that must be resolved before completing any property transaction.

When no transactions are recorded, you’ll receive a “Nil Encumbrance Certificate” (Form 16), which confirms that no registered transactions, mortgages, or legal charges were found during the specified search period. However, this doesn’t guarantee clear title from the property’s inception – it’s recommended to search for a 30-year period for comprehensive verification.

Online applications through TNREGINET typically take 2-7 working days for processing and delivery of a digitally signed EC. Offline applications at Sub-Registrar Offices take 15-30 days due to manual verification processes.

Yes, a registered TNREGINET user account is mandatory for applying for a digitally signed Encumbrance Certificate. However, you can view EC information for free without registration by using the “View EC” option under the Encumbrance Certificate section. For downloading an official, legally valid EC with digital signature and QR code, user registration is required.

Yes. The fees are ₹1 as an application fee, ₹15 for the first year, ₹5 for each additional year, and ₹100 for computerized records (1987 onwards). Viewing EC online is free, but downloading a legally valid certificate requires payment.

Go to tnreginet.gov.in → “E-Services” → “Encumbrance Certificate” → “View EC.” Select Zone, District, Sub-Registrar Office, and enter property details like survey number and period. Complete captcha and click “Search.” The EC will be displayed on screen for viewing or printing.

Yes. An EC is mandatory for home loans to prove clear property title and absence of mortgages or disputes. Lenders usually require a 13–30 year EC, not older than six months.

Two types:

a. Regular EC (Form 15): shows property transactions

b. Nil EC (Form 16): issued when no transactions are found.

Computerized ECs are available post-1987, and manual ECs are used for earlier records.

HDFC Home Loan

HDFC Home Loan SBI Home Loan

SBI Home Loan