In today’s digital age, managing financial obligations has never been easier, and property tax payment is no exception. The Greater Visakhapatnam Municipal Corporation (GVMC) has embraced technological advancements to streamline the property tax payment process.

This article will walk you through GVMC property tax online payment process, highlighting the necessary steps, required documents, and common pitfalls to avoid, ensuring a seamless experience for all property owners.

How to Pay GVMC Property Tax Online?

Paying property taxes online is a quick and convenient process using GVMC’s official portal. Learn how to complete the payment step by step.

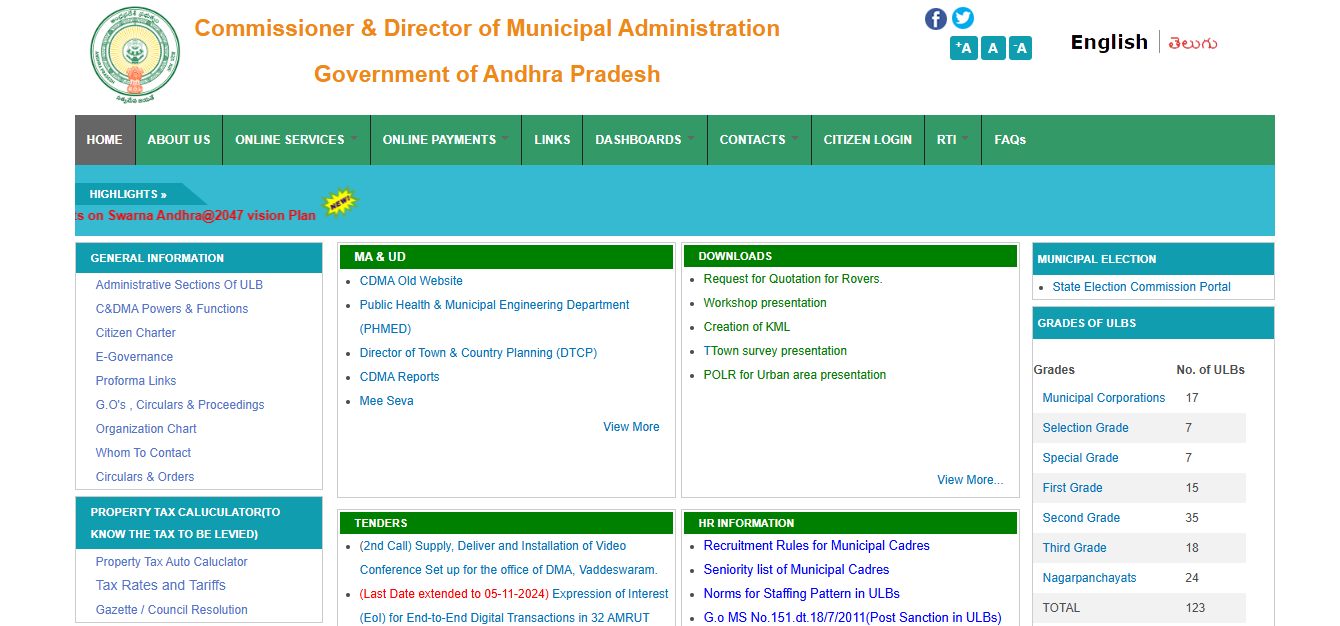

- Go to the official Government of Andhra Pradesh’s CDMA website.

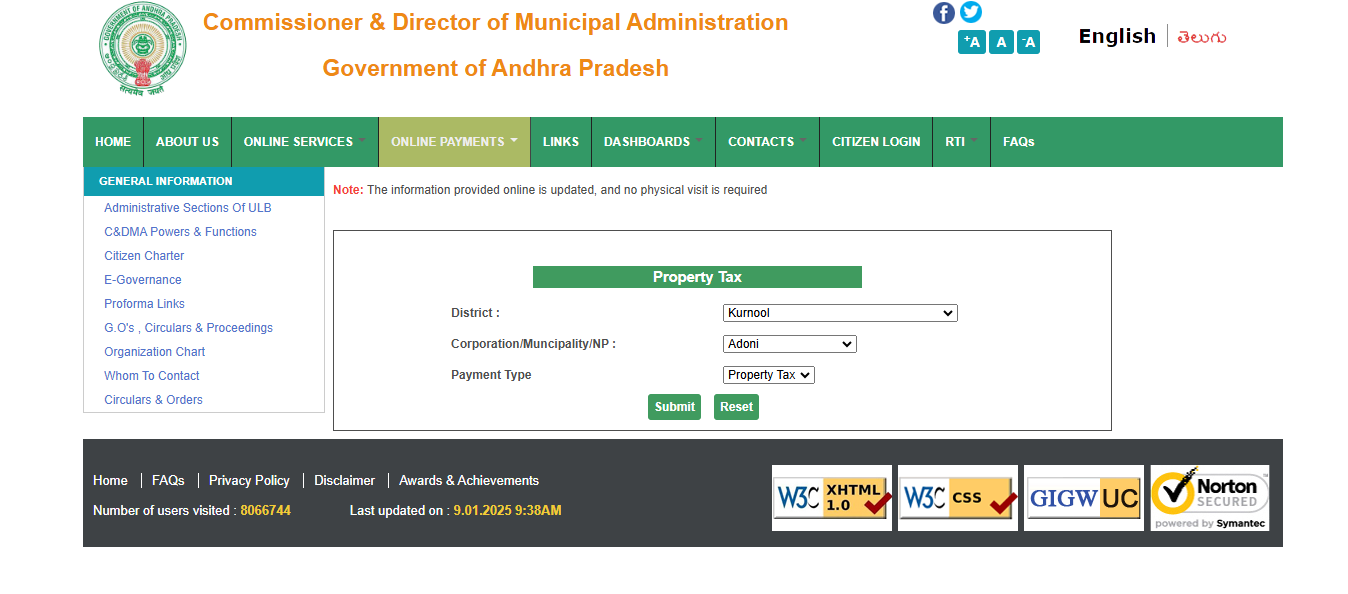

- On the dashboard, under “Online Payments” click on “Property Tax”

- Select the appropriate category for your property, such as district, corporation, and payment type. Click on Submit.

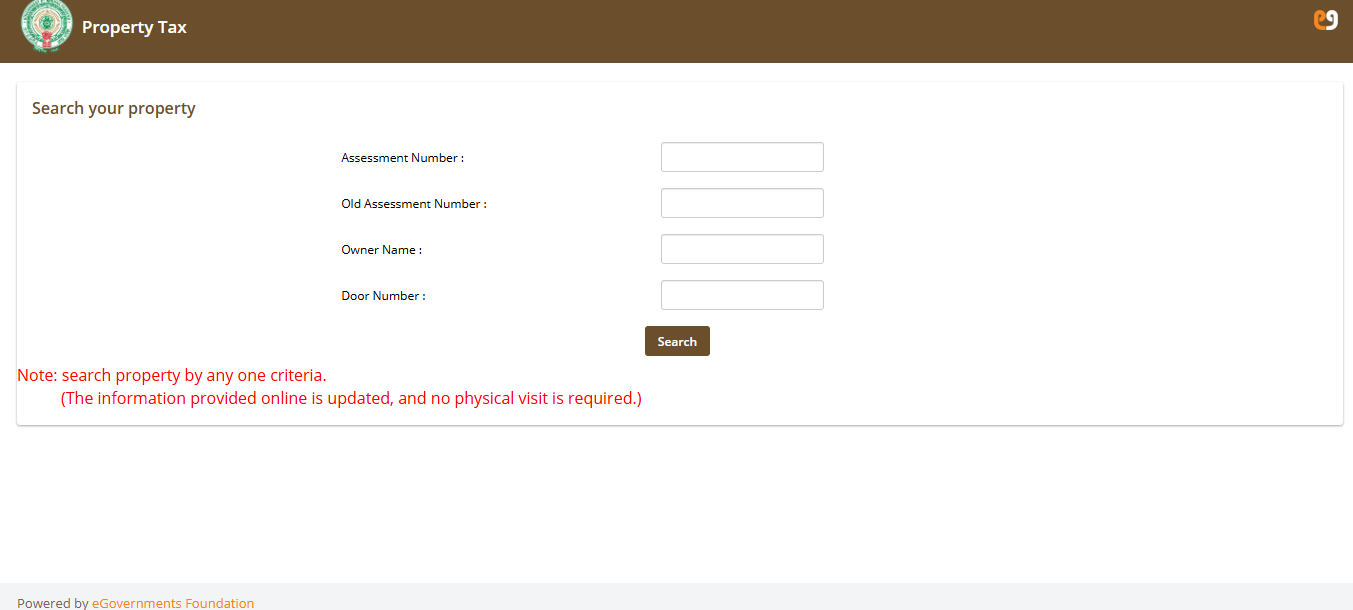

- On the redirected page, search your property by Assessment Number, Old Assessment Number, Owner Name, or Door Number.

- Review and Pay

Verify your property information, then choose a payment method (credit card, debit card, or net banking) and complete the payment.

- Download Receipt

After payment, receive a confirmation message and download the receipt for your records.

How to Pay Vishakapatnam Property Tax by Mobile App?

If you prefer using a mobile app, find out how to pay your property tax on the go through Visakhapatnam’s dedicated payment application.

- Install the Pura Seva app on your smartphone.

- Enter your mobile number, email, username, create a password, and verify via OTP.

- Access your account using your registered mobile number.

- Locate and select the GVMC property tax payment option.

- Provide details such as zone, district, and property information.

- Check all details and choose a payment method (credit/debit card or net banking).

- After completing the transaction, save the auto-generated receipt for reference.

Read More: How to Download Andhra Pradesh Land Records (Meebhoomi)

How to Pay Vishakapatnam Property Tax Offline?

For those who prefer in-person transactions, here’s how to visit designated municipal centers and settle your property tax payment.

- Go to your nearest Purva Seva Centre or citizen service centre.

- Inform the official that you want to pay GVMC property tax.

- Share the zone, district, and any required property information.

- Hand over necessary documents, such as the property assessment slip and holding number.

- Pay the tax amount in the accepted form (cash, cheque, etc., as directed).

- Obtain the receipt and keep it safe for future reference.

How to Download GVMC Property Tax Receipt?

Need proof of payment? Discover the simple steps to quickly download and save your GVMC property tax receipt online.

- Visit the official Greater Visakhapatnam Municipal Corporation portal.

- Choose the “Know Your Receipt” option on the homepage, select your zone, district, corporation, and so on.

- Click on “Submit.”

- Enter the necessary property details under “Search Your Property,”

- Verify the information displayed.

- Download the receipt to save or print for future reference.

Read More: Andhra Pradesh RERA Charges

Exemptions and Concessions for GVMC Property Tax

Check if you’re eligible for any rebates, deductions, or exemptions under GVMC’s property tax guidelines.

- State Mandates: Certain exemptions and concessions are provided under State Government guidelines.

- Early Payment Rebate: Pay property tax before April 30th to get a 5% rebate on the total tax amount.

- Age-Based Deductions (on Annual Rental Value):

- Up to 25 Years Old: 10% deduction

- 25 to 40 Years: 20% deduction

- Over 40 Years: 40% deduction

GVMC Property Tax Rate 2025

The Greater Visakhapatnam Municipal Corporation (GVMC) calculates property tax based on a property’s annual rental value (ARV). This ARV depends on several factors, including:

- Type of property

- Status of the property (occupied or vacant)

- Zone where the property is located

- Property dimensions

- Physical condition of the property

- Amenities provided

- Plinth area

- Age of the property

- Construction type

- Proximity to landmarks and public facilities

GVMC Tax Rates Based on ARV

| ARV Range | Residential Tax Rate | Non-Residential Tax Rate |

|---|---|---|

| More than ₹3,600 | 30% | 30% |

| ₹2,401 to ₹3,600 | 22% | 30% |

| ₹1,201 to ₹2,400 | 19% | 30% |

| ₹601 to ₹1,200 | 17% | 30% |

| Up to ₹600 | Exempt from payment | 30% |

- Residential properties with an ARV up to ₹600 are exempt from paying property tax.

- For non-residential properties, the tax rate remains 30% regardless of ARV.

Note:

- Section 85(2) of the Municipal Councils Act stipulates that property tax cannot exceed 25% for residential and 33% for non-residential properties.

- Despite the varying ARV ranges, non-residential properties are consistently taxed at 30%.

Read More: Stamp Duty and Registration Charges in Andhra Pradesh

How to File GVMC Property Tax Alteration?

Planning to modify property details or convert vacant land tax to house tax? Find out the straightforward process here.

- Go to the official Greater Visakhapatnam Municipal Corporation website.

- Select the “Online Services” section.

- Click on “Property Tax.”

- Select “File Your Addition/Alteration”, which covers converting Vacant Land Tax (VT) to House Tax (HT).

- On the new page, choose the correct zone, district, corporation, etc.

- Provide the property’s assessment number.

- Submit the alteration request.

How to File GVMC Property Tax Revision?

If you believe your tax assessment is inaccurate, learn how to submit a revision request within the specified timeframe.

You must file a general revision petition within 15 days of receiving the special notice.

- Visit the official Greater Visakhapatnam Municipal Corporation website.

- Click on “Property Tax.”

- Select “Submit Your General Revision Petition.”

- On the new page, pick the correct zone, district, corporation, etc.

- Provide the property’s assessment number.

- Complete any additional steps requested by the system to finalize your revision request.

Greater Visakhapatnam Municipal Corporation Zones

Identify the zone where your property falls to understand the specific tax rates, regulations, and municipal services.

| Zone | Location |

|---|---|

| Zone 1 | Bheemunipatnam |

| Zone 2 | Madhurawada |

| Zone 3 | Asilmetta |

| Zone 4 | Suryabagh |

| Zone 5 | Gnanapuram |

| Zone 6 | Gajuwaka |

| Zone 7 | Anakapalle |

| Zone 8 | Vepagunta |

Conclusion

Paying property taxes is not just a legal obligation but a civic responsibility that plays a pivotal role in the growth and sustainability of Visakhapatnam. The GVMC has made significant strides in simplifying the tax payment process through technological innovations, ensuring that residents can easily and securely fulfill their tax duties.

Frequently Asked Questions

GVMC calculates property tax based on the Annual Rental Value (ARV) of the property.

A penalty of 2% of the outstanding tax amount is charged each month for late payment until the payment is made.

The municipal authorities, like GVMC, estimate the Annual Rental Value (ARV) as the yearly rental income a property can generate if rented out. They use this value to assess property taxes for residential and non-residential properties.

The ARV takes into account factors like the property’s location, size, type, and condition to determine its potential rental income. The higher the ARV, the higher the property tax.

As the new owner, you become responsible for any outstanding property taxes. So, it’s advisable to clear all dues to avoid penalties.

Generally, GVMC expects full payment of the annual tax. However, in some cases, they may offer installment options. Check with the GVMC office for current policies.

HDFC Home Loan

HDFC Home Loan SBI Home Loan

SBI Home Loan