Managing your home loan effectively requires easy access to important documents. One of these key documents is your HDFC home loan statement download.

Whether you need it for financial planning or tax purposes, the process is straightforward and essential for keeping your loan management on track.

How to Download HDFC Bank Home Loan Statement for Income Tax Online

Downloading your HDFC home loan statement is simple and quick. Follow these steps to get it done:

Step By Step Guide To Downloading Your Loan Statement From HDFC Online Portal:

- Visit the HDFC Bank Website

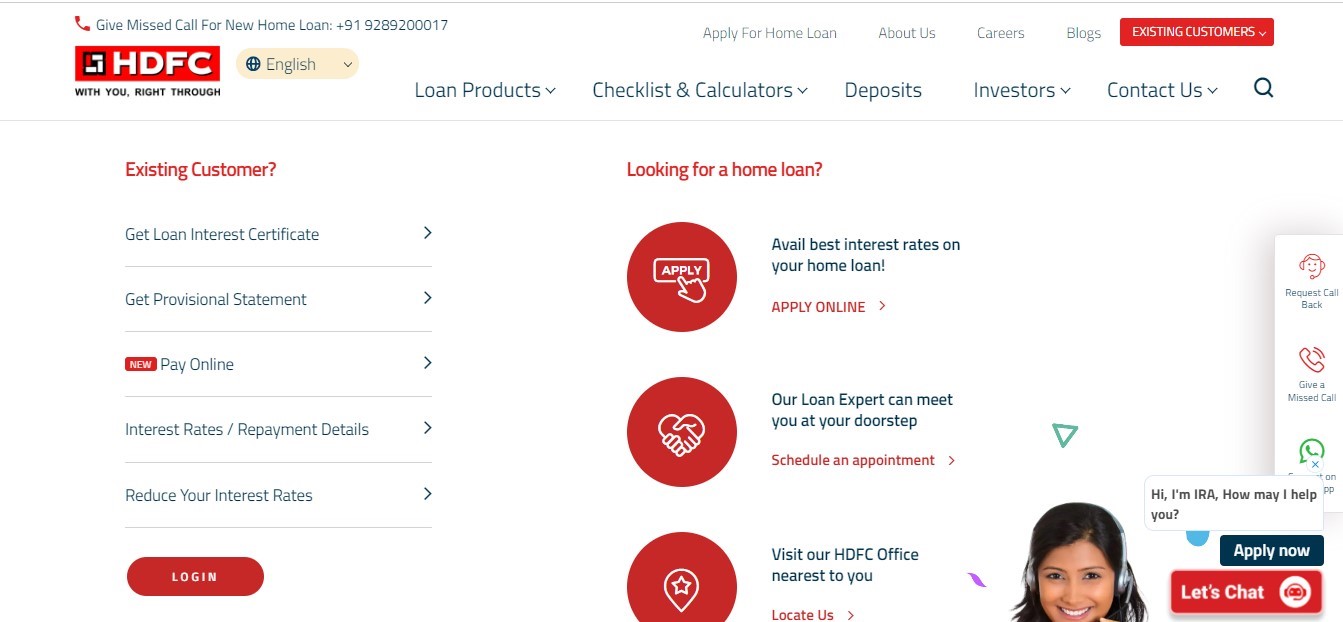

Start by going to the official HDFC Bank website.

- Access the Home Loan Section

Look for the “Existing Customers” tab at the top right corner. Hover over it, then select the “For Home Loans” option from the dropdown menu.

- Enter Your Details

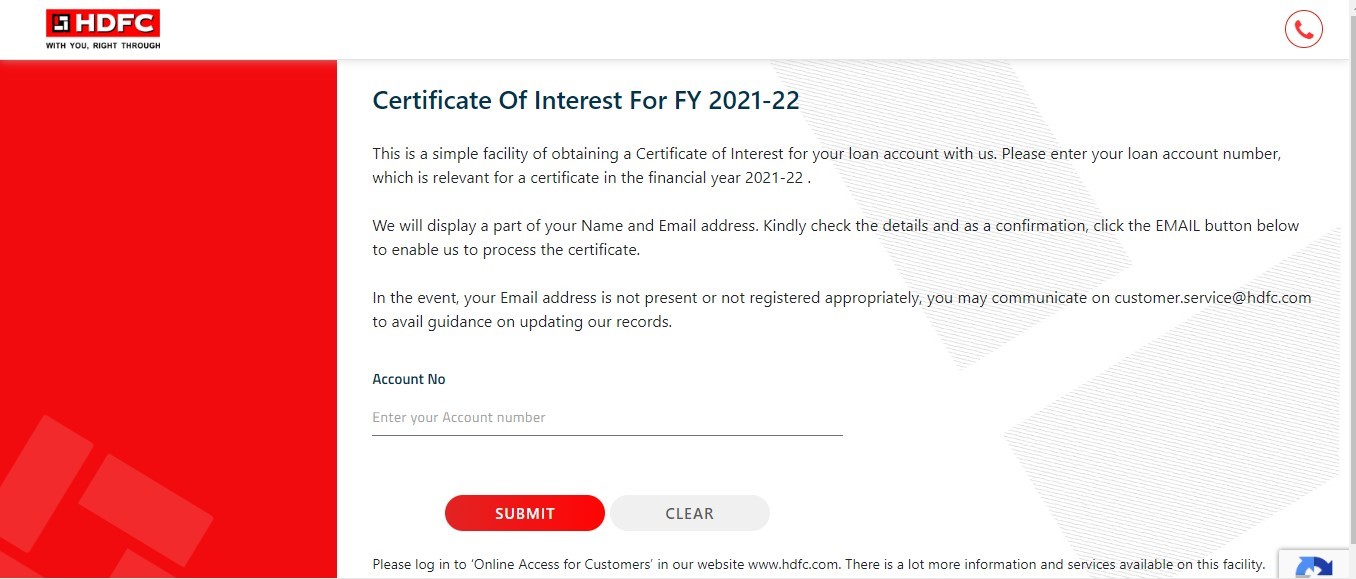

On the next screen, enter your home loan account number and other required details like your date of birth. Ensure the information is correct.

- Submit and Verify

After entering the details, click “Submit”. Verify your name and email ID on the next page. - Download or Receive by Email

View the statement online or email it to your registered email ID. The statement will be sent to your inbox if your email is registered.

- Check and Save

Once received, open the email, download the statement, and save it for your records.

Also Read: HDFC Home Loan Top-Up Interest Rates

How to Obtain HDFC Bank Home Loan Statement for Income Tax Offline

If you prefer getting your HDFC home loan statement in person, visit your nearest HDFC Bank branch. Here’s how to do it:

- Visit the Branch: Go to the nearest HDFC Bank branch during working hours.

- Ask for the Required Form: Once at the branch, request the home loan statement form from the bank staff.

- Fill Out the Form: Complete the form with your home loan account number, personal details, and any other required information.

- Submit the Form: Attach any necessary identification documents, such as your UID card or PAN card. Then, submit the form to the designated counter.

- Receive Your Statement: After verification, the bank will provide your home loan statement. This process is usually quick, and you can leave with your statement the same day.

These steps are straightforward and ensure you can get your statement directly from the branch with minimal hassle.

Also Read: HDFC’s Official Customer Care Contact Details

How to Download HDFC Bank Home Loan Statement for Income Tax via Mobile Application?

If you’re an HDFC Bank home loan customer, you can easily download your Home Loan Interest Certificate (Provisional Statement) for income tax purposes through the HDFC Bank mobile app. Here’s a step-by-step guide:

Install the HDFC Bank Home Loans App:

- For Android: Download from Google Play Store

- For iOS: Download from Apple App Store

Log In to the App:

- Open the app and log in using your credentials.

- If you’re a new user, register using your loan account details.

Navigate to Loan Account Details:

- From the dashboard, select your Home Loan account to view details.

Request the Income Tax Certificate:

- Within your loan account section, locate and select the option for “Income Tax Certificate” or “Provisional Interest Certificate.”

- Choose the relevant financial year for which you need the statement.

Download or Email the Statement:

- After selecting the desired certificate, you can either download it directly to your device or opt to have it emailed to your registered email address.

Suggested Read: HDFC Bank Home Loan Overdraft Facility

Key Details Included in Your HDFC Bank Home Loan Statement

- Loan Account Number:

This unique identifier for your loan account ensures that the statement is linked to your specific home loan. - Personal Information:

This section includes your name, address, and other personal details associated with the loan account. - Loan Disbursement Date and Amount:

The statement provides the date when the loan was disbursed and the total loan amount that was granted. - Interest Rate Details:

It outlines the interest rate applicable to your home loan, whether fixed or floating, and any changes to the rate over time. - Repayment Schedule:

The statement includes your repayment plan, detailing the number of EMIs, the EMI amount, and the due date for each payment. - Principal and Interest Breakdown:

A detailed breakdown showing how each EMI payment is divided between the principal amount and the interest. - Outstanding Loan Balance:

This section shows the remaining balance on your loan, which helps you understand how much you still owe. - Payments Made:

A record of all payments made towards the loan, including EMIs, prepayments, or any extra payments made towards principal reduction. - Late Fees and Penalties:

If any late fees or penalties have been incurred due to delayed payments, these will be clearly listed in the statement. - Tax Certificate:

Some statements may include a tax certificate or a summary of interest paid, which is useful for claiming deductions under Section 24(b) of the Income Tax Act.

Also Read: HDFC Bank Home Loan Insurance

How to Use Your Home Loan Statement for Tax Benefit Claims?

1. Interest Payment Deductions:

- Self-Occupied Property: Under Section 24(b) of the Income Tax Act, you can claim a deduction of up to ₹2 lakh on the interest paid for a self-occupied property.

- Let-Out Property: For properties that are rented out, there’s no upper limit on the interest deduction. The entire interest paid can be claimed, subject to certain conditions.

2. Principal Repayment Deductions:

- Under Section 80C, you can claim a deduction of up to ₹1.5 lakh for the principal repayment of your home loan. This benefit is available for both self-occupied and let-out properties.

3. Tax Benefits on Joint Home Loans:

- If the home loan is taken jointly, each borrower can independently claim deductions on interest (up to ₹2 lakh) and principal repayment (up to ₹1.5 lakh), provided both are co-owners and co-borrowers, and both are servicing the loan.

4. Home Loan Statement as Proof:

While earlier a Completion Certificate was required to claim tax benefits, recent rulings allow you to claim these benefits using the home loan statement from your bank, provided it contains necessary details like the housing society’s name.

Check Out: HDFC Bank Home Loan Prepayment Calculator

Get a Home Loan

with Highest Eligibility

& Best Rates

Troubleshooting HDFC Bank Home Loan Statement Issues

While downloading your HDFC Bank home loan statement, you might encounter a few issues. Here are some common problems and their solutions:

Common Problems When Downloading HDFC Bank Loan Statements

- Login Issues: Check credentials and reset password if necessary.

- Incomplete Statement Download: Refresh the page or clear cache to resolve the issue.

- Incorrect Statement Details: Cross-check payment records and contact customer support if needed.

- Date Range Selection Problems: Double-check the selected period to ensure accuracy.

What to Do If Your Tax Certificate Is Incorrect

Check for Pending Payments: Confirm all payments are processed correctly.

Verify the Details: Cross-check interest, principal, and balance information.

Contact Customer Support: Reach out for assistance with discrepancies.

Request a Re-issue: Ask for a corrected tax certificate if needed.

Conclusion

Accessing your HDFC home loan statement download is a straightforward process, whether you choose to do it online or at a bank branch. This document plays a crucial role in managing your loan, keeping track of payments, and claiming tax benefits.

Make sure to regularly download and review your statement to stay informed about your loan status and avoid any discrepancies. By following the outlined steps, you can easily obtain your HDFC home loan statement download and ensure your financial records are accurate and up to date.

Frequently Asked Questions

You can download it online from the HDFC website by entering your loan details.

Yes, visit your nearest HDFC branch, fill out a form, and they will provide it.

Yes, downloading your statement online is free of cost.

It’s good to download and review it every few months or before tax season.

Yes, you can request to receive it by email after downloading it online.

You can access your HDFC Home Loan statement through HDFC’s online customer portal. Log in with your credentials to view and download your statement.

A Home Loan provisional certificate is a summary of your loan repayment for a financial year, useful for tax exemptions. You can request it via HDFC’s online portal by entering your loan account number.

If you don’t have an HDFC savings or current account, you can register for the Loans Portal to access your loan details. Visit the registration page, create a User ID, and provide necessary details like your loan account number and date of birth.

Yes, you can obtain your Home Loan interest certificate, which details the interest paid during a financial year, through HDFC’s online portal.

The statement includes details such as the total loan amount, repayment start and end dates, interest rate, type of interest rate (fixed or floating), EMIs paid, outstanding loan amount, and more.

To update your email address, log in to the online customer portal and navigate to the account details section to make the necessary changes.

Yes, upon request, HDFC can send physical copies of your Home Loan statements to your registered mailing address.

The statement provides a breakdown of the principal and interest components of each EMI, outstanding balance, and any charges applied. For detailed explanations, refer to HDFC’s official resources or contact customer support.

HDFC Home Loan

HDFC Home Loan SBI Home Loan

SBI Home Loan