The ICICI Bank Home Loan Moratorium comes with specific rules that outline who can apply, how long the benefit lasts, and the steps involved in the application. From eligibility criteria to interest implications and the official process, understanding these guidelines is key for informed decision-making. In this guide, we break down the home loan moratorium rules you need to know.

How to Apply for ICICI Home Loan Moratorium Online

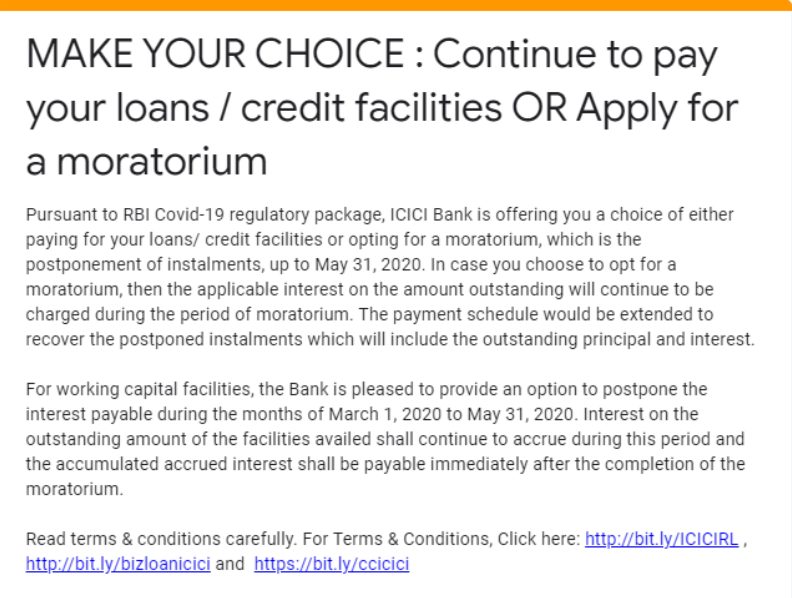

You can easily apply for the ICICI home loan moratorium through a fully digital process, without submitting any physical documents. The application must be submitted within the specified window to ensure timely approval.

- Visit the ICICI Bank Official Website

- Click on the “Choose Your Option” Link on the Homepage

- You’ll Be Redirected to the Moratorium Application Page

- Enter your Registered Mobile Number or Email ID

- Verify your Loan Details and Choose Whether to Continue EMI Payments or Opt for the Moratorium

- Confirm Your Selection and Submit—No Additional Paperwork is Needed

Alternatively, you can apply directly through the SMS or email link shared by ICICI Bank with eligible customers.

Source: Apply ICICI Bank EMI Moratorium Online

How to Calculate Home Loan Moratorium Using Calculator

You can quickly estimate the impact of a moratorium on your loan using an online home loan moratorium calculator.

Follow these steps to calculate:

1. Enter your original loan amount sanctioned at the start of your loan.

2. Input the current rate of interest applicable on your loan.

3. Fill in your total loan tenure as per the existing agreement.

4. Add the number of EMIs paid before March 2020.

5. Enter the moratorium months availed between March–May 2020.

6. Enter the moratorium months planned or taken between June–August 2020.

7. Choose from the dropdown whether you want to keep the EMI amount or loan tenure unchanged.

8. View the updated EMI, revised tenure, and total number of EMIs post-moratorium.

What is ICICI Bank Home Loan Moratorium?

The ICICI home loan moratorium was a temporary relief initiative introduced during the COVID-19 pandemic, allowing borrowers to postpone EMI payments due to financial uncertainty. While it offered short-term flexibility, interest continued to accrue during the deferred period, affecting the overall loan repayment structure. This measure was implemented following RBI’s directive to banks and financial institutions to support borrowers during the crisis. Borrowers can apply through official channels and follow specific bank guidelines to avail the benefit.

Also Read: Home Loan Moratorium: Purpose and Benefits

Eligibility Criteria for ICICI Home Loan Moratorium

ICICI home loan moratorium eligibility varies by loan category, determining if it’s automatic or needs manual application; see the breakdown below.

| Criteria | Details |

|---|---|

| Loan Sanction Date | Credit facility must be availed before 1st March 2020 for a six-month moratorium |

| Borrower Type | Both Indian residents and NRI borrowers are eligible |

| Category A (Auto-Enrolled) | Includes vehicle, agri, gold, SHG, and small business loans |

| Category B (Manual Application) | Includes home loans, personal loans, credit cards, and education loans |

| Application Requirement | Category A: Opt-out if continuing payments Category B: Opt-in manually |

How Interest Accumulates During the Moratorium

During the moratorium period, borrowers are allowed to pause their EMIs, but interest continues to accrue on the outstanding principal. This accumulated interest is added back to the loan amount, leading to either an increase in EMI or an extension of the repayment tenure. The ICICI home loan moratorium follows this structure, making it crucial for borrowers to evaluate its long-term impact.

Case Study:

Ms. Mehra, a software engineer based in Pune, availed a home loan of ₹60 lakh on March 1, 2020, with an interest rate of 8.50% per annum and a tenure of 20 years. She opted for the moratorium starting with her April EMI of ₹53,000.

| Date | Month of Interest | Interest Amount (Approx.) (Interest = (Principal × Annual Interest Rate × 1 month) / 12) | Revised Principal (₹) |

|---|---|---|---|

| April 1, 2020 | March | ₹42,500 | ₹60,42,500 |

| May 1, 2020 | April | ₹42,803 | ₹60,85,303 |

Due to this accumulation, her loan tenure extended beyond the original 20 years, assuming the EMI and interest rate remained the same. This scenario shows how even a short break in payments under a moratorium can lead to a longer and costlier loan journey.

Does Moratorium Affect Your Credit Score?

- Moratoriums don’t affect your credit score per RBI guidelines.

- Missing payments or conditions outside moratorium terms can harm your credit.

- Adhering to agreed terms is crucial for protecting your score.

Read More: How to Increase CIBIL Score

Moratorium Duration as per ICICI Bank Rules

ICICI Bank’s two-phase moratorium, as per RBI COVID-19 guidelines, provided borrowers with up to six months of cash flow relief. Below are the mentioned ones:

| Phase | Period | Details |

|---|---|---|

| Initial Moratorium | March 1, 2020 – May 31, 2020 | A 3-month EMI pause for eligible borrowers; no penalty, but interest accrued |

| Extended Moratorium | June 1, 2020 – August 31, 2020 | Extended by 3 more months; required customers to opt in each month online |

The ICICI home loan moratorium period thus spanned from March to August 2020, based on borrower eligibility and application.

Impact of Moratorium on Your ICICI Home Loan Tenure

Opting for a moratorium doesn’t mean your loan burden disappears—it shifts the timeline. While EMIs are paused, interest continues to accrue, which affects your repayment structure. For ICICI home loan borrowers, this leads to either an extended tenure or a higher EMI once repayments resume.

Here’s how it impacts your loan:

- Loan Tenure Extension: In most cases, the unpaid EMIs during the moratorium are added at the end, increasing the total loan duration.

- Increased Interest Outgo: Since interest keeps adding up, the overall amount repaid by the end of the loan term becomes higher.

- EMI Hike (If Tenure Can’t Be Extended): If your loan structure doesn’t allow for tenure extension, your EMI may be increased to compensate.

- Compounding Effect: Interest gets added to the principal, and future interest is calculated on this revised amount, increasing the total cost.

ICICI Home Loan Moratorium: Eligible Loans & Application Requirement

Under the ICICI home loan moratorium, ICICI Bank divided its loan products into two groups—Category A (automatic relief) and Category B (manual application) where home loan-related products come under Category B, requiring customers to apply manually for EMI relief. Below is a quick summary of eligible loan types and their application requirement:

| ICICI Home Loan & Related Products | Moratorium Requirement |

|---|---|

| Home Loan / Land Loan | Manual application required |

| Loan Against Property / Lease Rental Discounting (LRD) | Manual application required |

| Top-up on Home Loan / Loan Against Property (LAP) | Manual application required |

| Non-Residential Premises / Office Premises Loan | Manual application required |

| Home Overdraft / Mortgage Overdraft | Manual application required |

RBI Guidelines and ICICI Bank’s Implementation

In response to the Reserve Bank of India’s (RBI) directives during the COVID-19 pandemic, ICICI Bank implemented the ICICI home loan moratorium to provide temporary relief to borrowers. This initiative allowed eligible customers to defer their Equated Monthly Installments (EMIs) without being classified as defaulters.

RBI Guidelines:

- Moratorium Period: Initially set for March 1 to May 31, 2020, and later extended until August 31, 2020.

- Scope: Applicable to all term loans, including home loans, outstanding as of March 1, 2020.

- Interest Accrual: Interest continued to accrue on the outstanding portion of the loans during the moratorium.

ICICI Bank’s Implementation:

- Automatic Enrollment: Certain loan categories were granted automatic relief, while others required customers to opt-in.

- Opt-In Process: Customers could apply for the moratorium via the bank’s website, SMS, or email links provided.

- Interest Capitalization: Accrued interest during the moratorium was added to the principal amount, potentially extending the loan tenure or increasing EMIs.

Read: Home Loan EMI Moratorium Period Extended

Home Loan Moratorium vs Grace Period

| Aspect | Grace Period | Home Loan Moratorium |

|---|---|---|

| Definition | Initial period where no payments are required. | Temporary pause or reduction in payments due to hardship. |

| Purpose | Allows time to start repayments without immediate pressure. | Provides relief during financial difficulties. |

| Duration | Short-term, usually a few months. | Varies, can be several months to a year. |

| Loan Tenure Impact | Typically doesn’t extend the loan tenure. | May extend the loan tenure due to deferred payments. |

| Interest Accrual | Interest may or may not accrue depending on lender terms. | Interest continues to accrue during the moratorium. |

Things to Consider Before Applying for a ICICI Home Loan Moratorium

- Interest continues to accrue during the moratorium period, increasing the overall loan cost.

- The loan tenure may be extended, meaning you’ll be paying off your loan for a longer period.

- Monthly installments (EMIs) could increase after the moratorium ends to make up for the paused payments.

Get the Best Home Loan Offers with Credit Dharma

Credit Dharma is your trusted partner for securing the best Home Loan offers, with over ₹500 Cr+ loans handled and partnerships with 20+ leading banks. We provide exclusive access to the lowest interest rates and a seamless, digital process with fast approvals in just 1-2 weeks, backed by lifetime support from our home loan experts.

Why choose Credit Dharma? We provide:

- Lowest Interest Rates: Save more with every EMI.

- Maximum Funding: Get up to 100% funding for your dream home.

- Simple & Digital Process: No tedious paperwork or branch visits.

- Expert Guidance: Lifetime support from our team of specialists.

Compare, choose, and secure the best Home Loan offer with Credit Dharma — your home loan journey starts here!

Conclusion

With RBI’s relief measures, ICICI Bank structured the moratorium to balance borrower support with financial responsibility. While the ICICI home loan moratorium offered much-needed short-term relief, borrowers should evaluate its long-term impact before opting in. Make informed decisions to stay financially secure. For more information and assistance, visit Credit Dharma and make informed decisions for your financial health.

Frequently Asked Questions

Customers could opt-in or opt-out of the moratorium through links provided via SMS, emails, or by visiting ICICI Bank’s official website during the offered period.

No, opting for the icici home loan moratorium does not affect your credit score, as it is considered a permitted relief under RBI guidelines. Just ensure timely compliance with the moratorium terms to avoid any negative impact.

For detailed information, visit ICICI Bank’s official website or contact their customer service directly.

The 3-month ICICI home loan moratorium was an EMI relief from March to May 2020, later extended by another 3 months till August 2020, allowing eligible borrowers to defer payments without penalties, while interest continued to accrue.

Eligibility criteria were defined by ICICI Bank based on guidelines from the Reserve Bank of India during the moratorium period.

HDFC Home Loan

HDFC Home Loan SBI Home Loan

SBI Home Loan