The IDBI Bank Home Loan Provisional Certificate shows how much principal and interest you’ve paid on your home loan in a year. It is important for tax benefits and keeping track of your loan. You can get it online or collect it offline from the IDBI Bank branch.

This blog explains the IDBI Bank Home Loan Provisional Certificate, how to download it, its importance, and tax benefits.

How to Download IDBI Bank Home Loan Provisional Certificate Online?

Time needed: 3 minutes

You can easily download your IDBI Bank Home Loan Provisional Certificate online by following these steps:

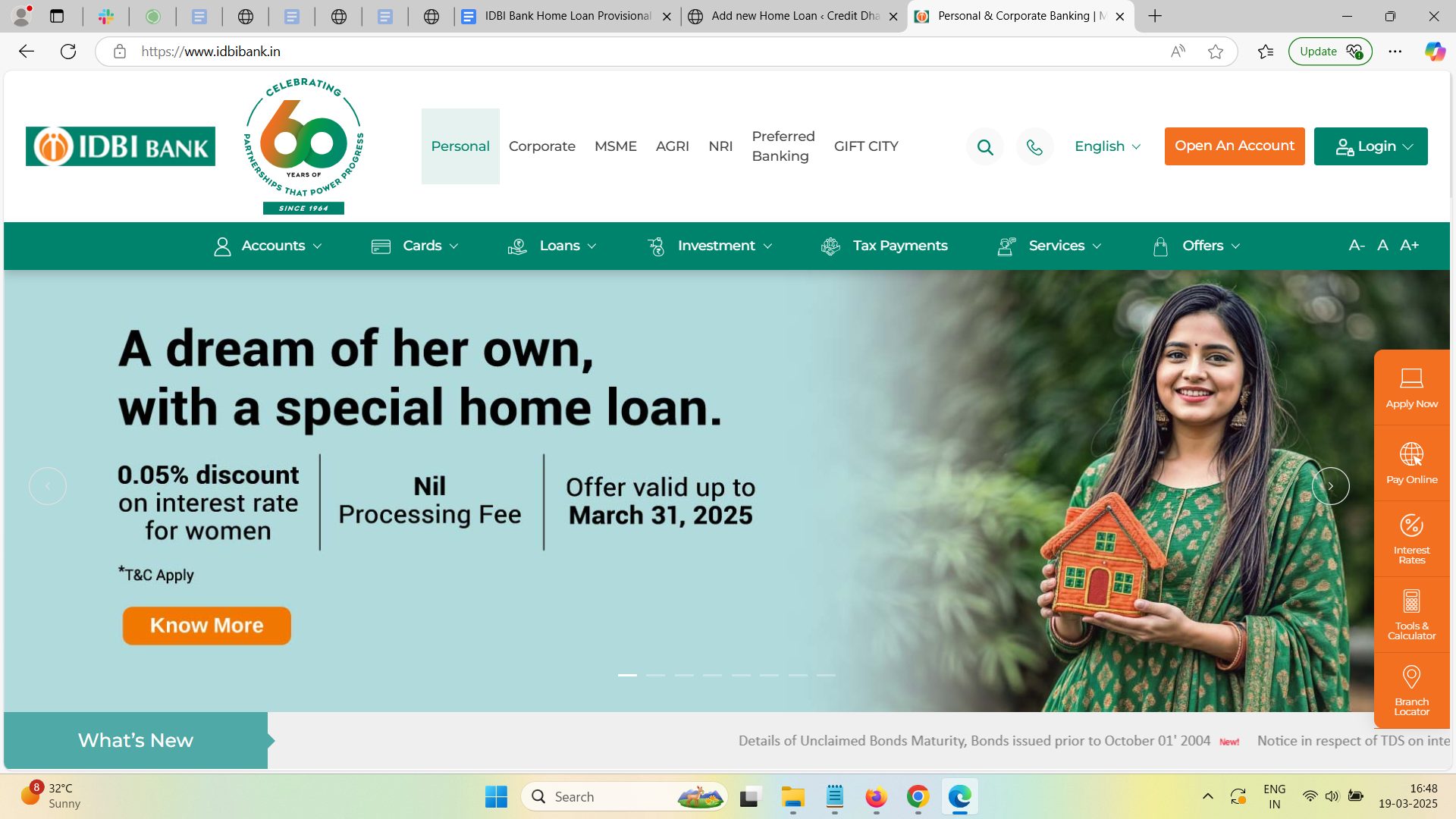

- Visit the IDBI Bank Website:

Go to IDBI Bank.

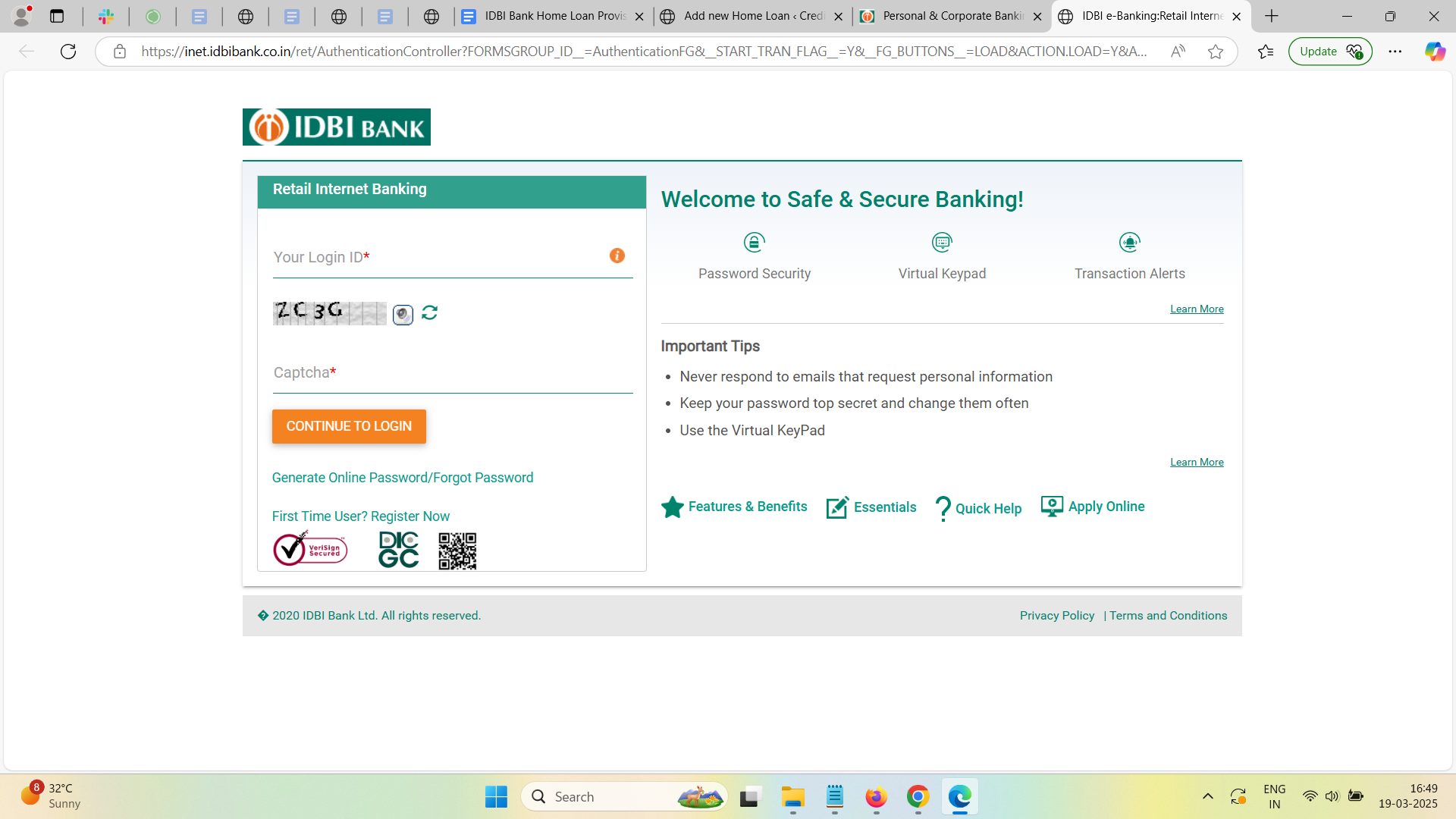

- Login to Net Banking:

– Click on ‘Login’ and select ‘Personal Banking’ or ‘Corporate Banking’ (as applicable).

– Enter your User ID and Password.

- Go to the Loan Section:

After logging in, navigate to the ‘Loans’ or ‘Services’ section.

- Select Your Home Loan Account:

Choose the home loan account for which you need the provisional certificate.

- Download the Certificate:

– Click on ‘Download Provisional Certificate’ or ‘Interest Certificate’.

– Select the financial year (e.g., 2024-2025).

– Click on ‘Download’ or ‘Save as PDF’.

Via IDBI Bank Mobile App

You can also download the certificate through the IDBI Bank Mobile App:

- Login with your credentials.

- Go to the ‘Loans’ section.

- Select your home loan account.

- Tap on ‘Download Provisional Certificate’.

- Save it or share it via email or messaging apps.

Note: If you face any issues, you can contact IDBI Bank’s customer care or visit your nearest branch for assistance.

Check Out: How to Download IDBI Home Loan Statement

Steps to Obtain IDBI Bank Home Loan Provisional Certificate Offline

If you prefer offline methods, you can obtain the provisional certificate by visiting your nearest IDBI Bank branch. Here’s how:

- Visit the Branch: Go to the IDBI Bank branch where your home loan account is maintained.

- Request the Certificate: Approach the customer service desk and request a provisional certificate for your home loan.

- Provide Required Details: You may need to provide your loan account number, identity proof, and other relevant details.

- Collect the Certificate: The bank will issue the provisional certificate, which you can collect in person.

What is a Home Loan Provisional Certificate?

A home loan provisional certificate is a statement from your bank showing the interest and principal you’ve paid on your home loan during the financial year. It helps you track your loan payments and claim tax benefits. For IDBI Bank borrowers, this certificate is important for filing ITR and following tax rules.

Also Read: Role of the Provisional Certificate in Home Loans

Importance of IDBI Bank Home Loan Provisional Certificate

The IDBI Bank Home Loan Provisional Certificate holds significant importance for borrowers due to the following reasons:

- Tax Benefits: It helps borrowers claim deductions on the principal and interest components of their home loan.

- Loan Tracking: It provides a summary of the loan repayment status, including the principal and interest paid during the financial year.

- Proof of Payment: It serves as proof of the payments made towards the home loan, which may be required for legal or financial purposes.

- Financial Planning: Borrowers can use the certificate to plan their finances and track their loan repayment progress.

Suggested Read: Home Loan Tax Benefits

Can I get Tax Benefits for Extra Home Loan Principal Payments?

Yes, you can claim tax benefits for extra home loan principal payments under Section 80C of the Income Tax Act, subject to the overall limit of ₹1.5 lakh per financial year.

- Eligibility: Extra principal payments qualify for tax deductions under Section 80C.

- Limit: Total deductions (including other investments) cannot exceed ₹1.5 lakh annually.

- Documentation: Ensure extra payments are reflected in your Home Loan Provisional Certificate.

- Tax Filing: Include the principal repayment details in your Income Tax Return (ITR).

Check Out: ITR Filing Guide: Simple Steps & Complete Checklist

Different Ways to Download Home Loan Provisional Interest Certificate

Apart from downloading the provisional certificate online or obtaining it offline, you can also request it through the following methods:

- Email Request: Send an email to idbicards@idbi.co.in IDBI Bank’s customer care with your loan account details and request the provisional certificate.

- Mobile App: Use the IDBI Bank mobile app to download the certificate directly to your smartphone.

- Customer Care: Call 1800 425 7600 IDBI Bank’s toll-free number and request the certificate to be sent to your registered email address.

Check Out: IDBI Home Loan Customer Care

Does the Provisional Certificate Reflect the Home Loan Moratorium?

Yes, the Home Loan Provisional Certificate reflects the home loan moratorium if you opted for it. During the moratorium period, EMIs are paused, but interest continues to accrue. The provisional certificate will show:

- Principal Repayment: If no EMIs were paid, the principal repayment will be zero for the moratorium period.

- Accrued Interest: The interest that accumulated during the moratorium will be included in the certificate.

- Under Section 80C: you cannot claim deductions for principal repayment during the moratorium since no payments were made.

- Under Section 24(b): you can claim deductions for the accrued interest during the moratorium, even if it wasn’t paid.

Can Joint Home Loan Holders Use the Same Provisional Certificate for Tax Benefits?

Yes, joint home loan holders can use the same provisional certificate to claim tax benefits. However, the tax deductions will be split between the co-borrowers based on their share of the loan. how it works:

- Principal Repayment (Section 80C): Each borrower can claim a deduction up to ₹1.5 lakh annually for their share of the principal repayment.

- Interest Payment (Section 24(b)): Each borrower can claim a deduction up to ₹2 lakh annually for their share of the interest paid (₹30 lakh limit for properties under construction).

The provisional certificate will include details like:

- Total principal and interest paid during the financial year.

- The share of each co-borrower (if specified in the loan agreement).

Key Points:

- Both borrowers must include their respective shares in their Income Tax Returns (ITR).

- Ensure the loan agreement specifies the share of each borrower to avoid discrepancies.

Also Read: Maximizing Tax Benefits on Home Loans In India

Provisional or Interest Certificate which one is valid for Home Loan Tax Deduction

Both the Provisional Certificate and the Interest Certificate are valid for claiming home loan tax deductions. However, there are key differences:

| Criteria | Provisional Certificate | Interest Certificate |

|---|---|---|

| When Issued | During the financial year | At the end of the financial year |

| Purpose | Shows estimated payments | Shows actual payments |

| Use Case | For tax planning or advance filing | For ITR filing and final tax claims |

| Accuracy | Gives an approximate amount | Shows the exact amount paid |

| Validity for Tax Deduction | Can be used for estimates | Preferred for claiming tax benefits |

Also Read: Exemptions and Tax Benefits on Housing Loans

Conclusion

The IDBI Bank Home Loan Provisional Certificate helps borrowers claim tax benefits and track their loan payments. You can get it online or offline. Make sure the details are correct to maximize tax savings and manage your loan better.

Track your home loan payments and tax benefits easily with Credit Dharma.

Frequently Asked Questions

A home loan provisional certificate is a document showing the estimated principal and interest paid during a financial year.

Yes, a provisional certificate can be used for preliminary tax filing, but the interest certificate is preferred for final ITR filing to claim tax benefits of up to ₹1.5 lakh under Section 80C and ₹2 lakh under Section 24(b).

You can instantly download a home loan provisional certificate online or get it from the branch within 1-2 working days.

You can get a provisional certificate by downloading it online through net banking or visiting your bank branch.

Yes, you can get the IDBI Home Loan Provisional Certificate offline by visiting your bank branch with the following documents:

– Loan account details (loan number or customer ID)

– ID proof (Aadhaar, PAN, or passport)

No, IDBI Bank does not charge any fee for downloading the provisional certificate online.

The provisional home loan interest certificate may not be available due to technical issues, a waiting period, or if it’s only issued at the end of the financial year.

HDFC Home Loan

HDFC Home Loan SBI Home Loan

SBI Home Loan