Staying on top of your home loan repayments is easier when you have access to your loan statement. For IDBI Bank customers, downloading this document is straightforward and convenient.

All you need is an internet connection and a few minutes to follow the steps. Here’s everything you need to know about retrieving your IDBI Bank home loan statement hassle-free. Let’s get started!

IDBI home loan EMIs weighing you down?

Get a Home Loan Balance Transfer with Credit Dharma!

How to Download IDBI Home Loan Statement Online

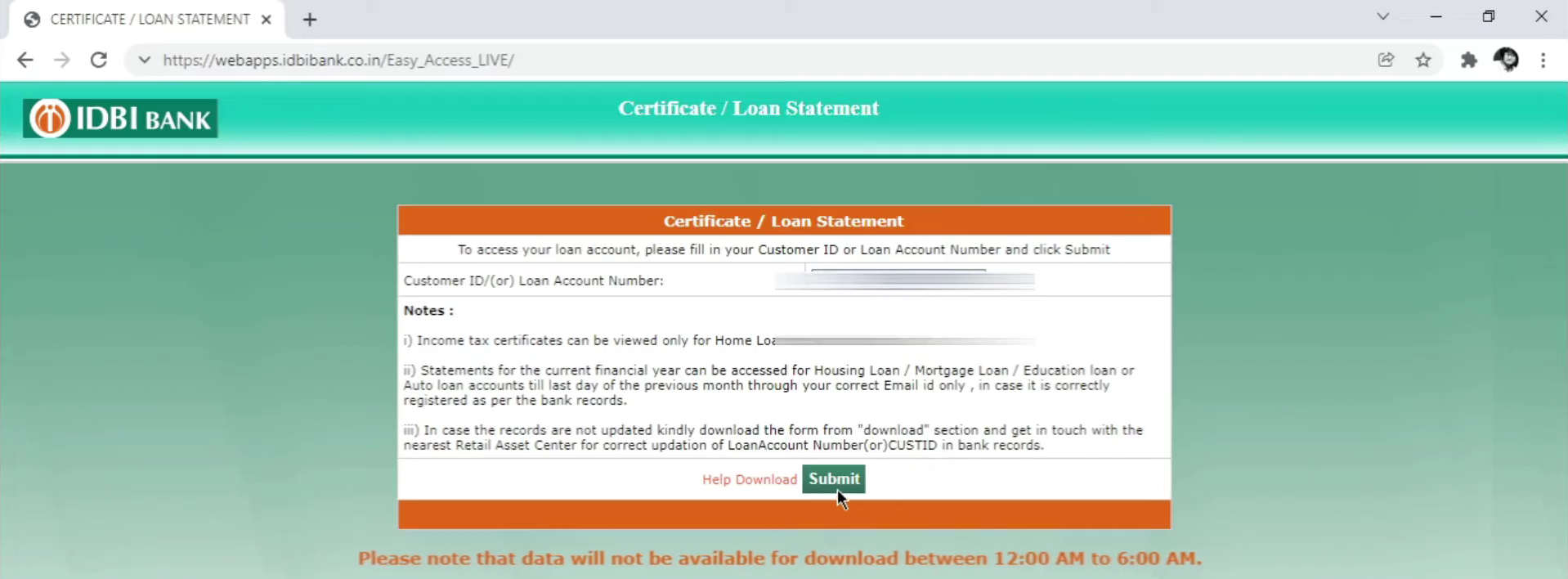

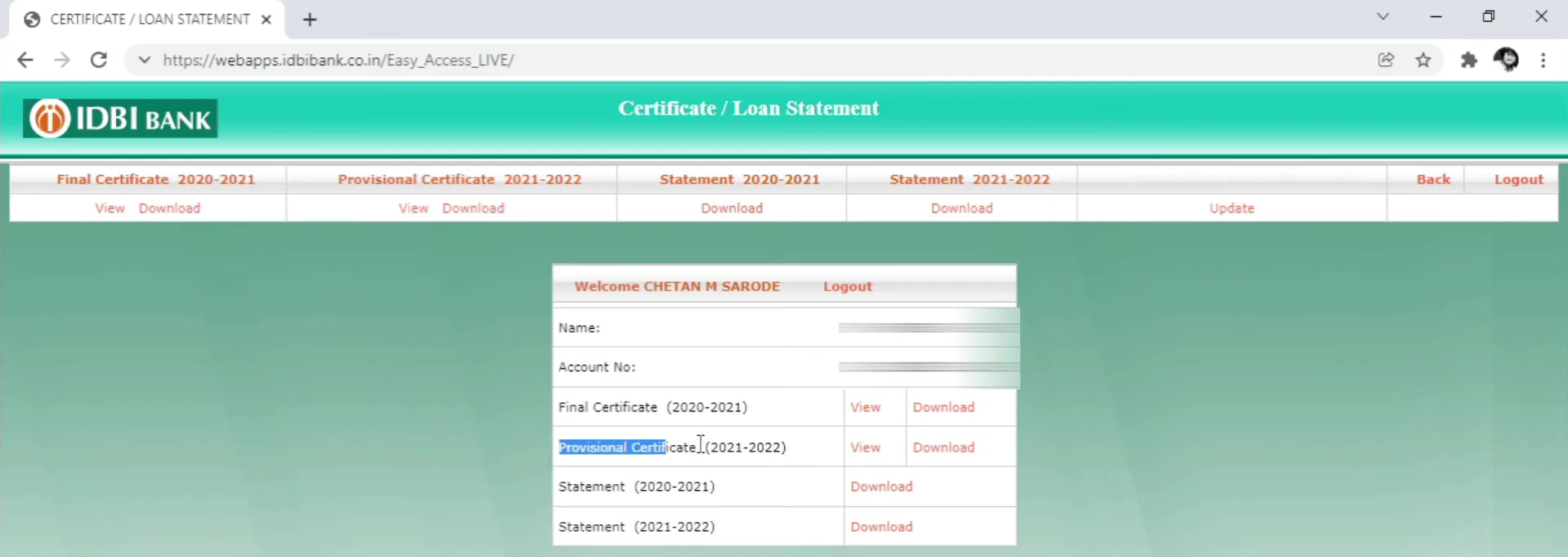

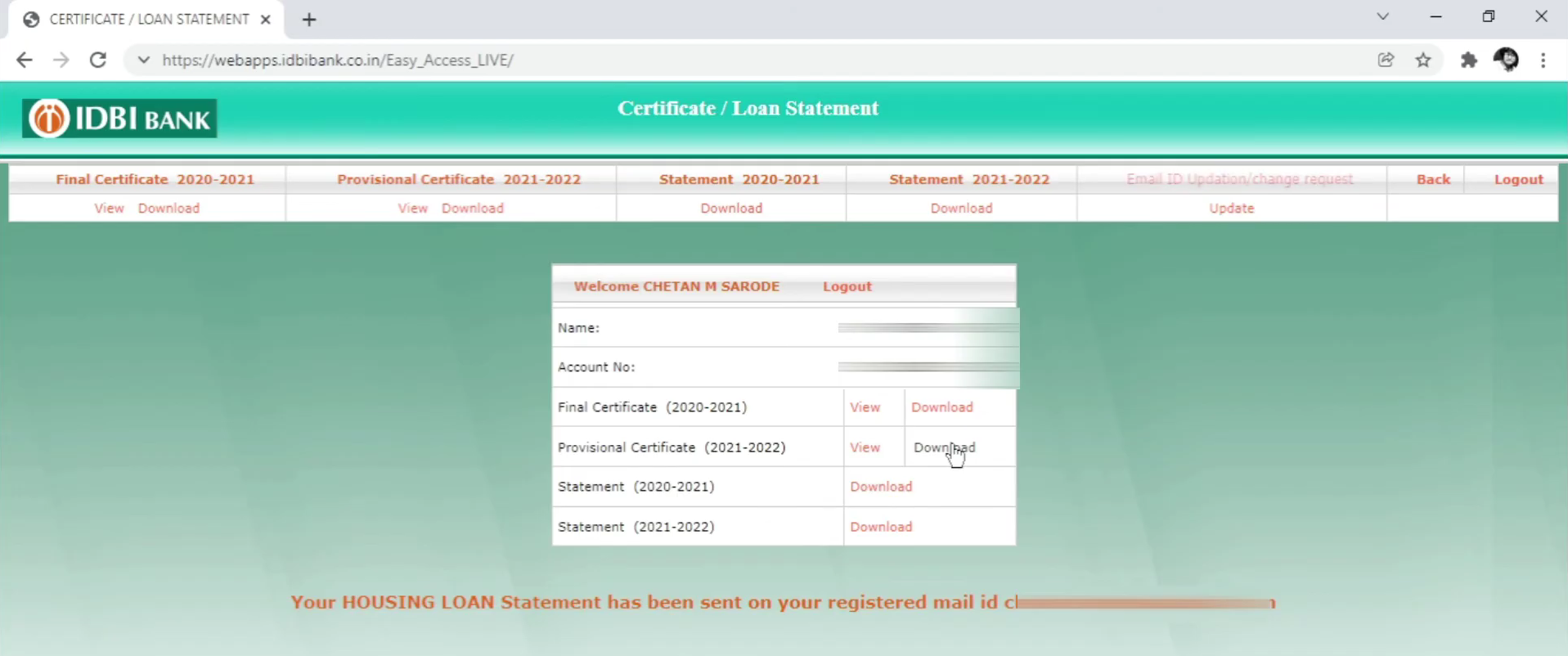

For smooth income tax filing, you can download your IDBI Bank home loan statement online with ease. Here’s how:

- Visit the official IDBI Bank website.

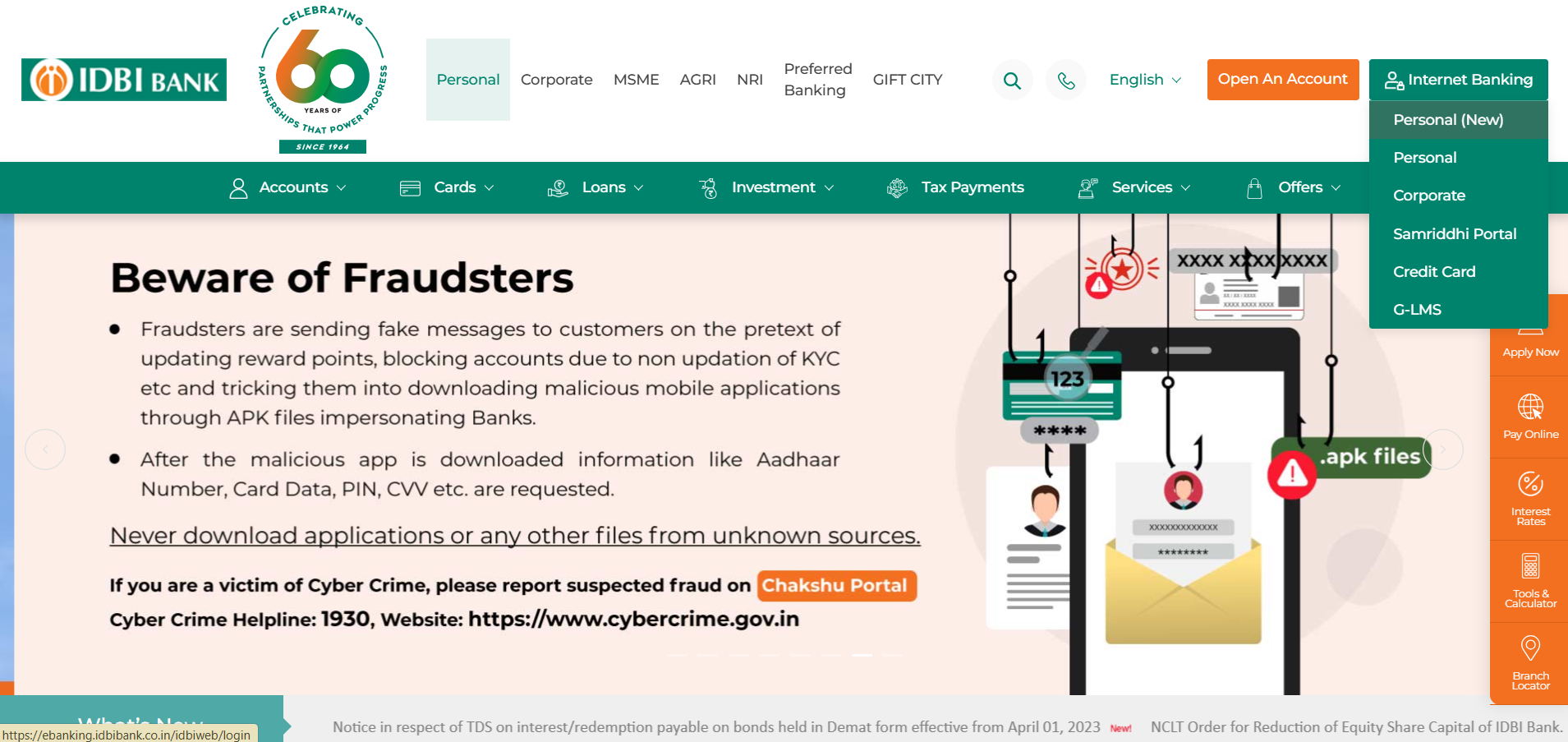

- Click on the “Internet Banking” tab.

- Log in to your net banking account by entering your User ID and Password.

- Click on the “Loans” section in the main menu.

- Select “Home Loan” from the dropdown menu.

- Click on “View Statement” or “Download Statement” option.

- Choose the desired date range for your statement.

- Select the format you prefer (PDF or Excel).

- Click “Download” to save the statement to your device.

Check Out: IDBI Home Loan Interest Rates 2025

How to Get IDBI Bank Home Loan Statement Offline?

- Visit the Nearest Branch: Go to your nearest IDBI Bank branch.

- Submit a Request: Fill out the physical request form for a home loan interest or provisional interest certificate.

- Provide Required Details: Include necessary information such as your loan account number, date of birth, and email ID.

- Submit Identification Proof: Provide hard copies of ID proof (e.g., PAN, Aadhaar, Passport).

- Authorization: If someone else is submitting the request on your behalf, ensure they carry a Letter of Authority along with valid ID proofs.

- Processing Time: The bank will process your request and issue the certificate.

Suggested Read: Can Home Loan Balance Transfers Backfire?

Key Details Included in Your Home Loan Statement

Your home loan statement is a comprehensive record of your loan account, offering critical insights into your financial obligations and repayment progress:

1. Loan Account Details

- Loan Account Number : Unique identifier for your loan.

- Borrower Name : Primary applicant’s name.

- Loan Sanction Date : Date when the loan was approved.

- Loan Tenure : Original repayment period (e.g., 20 years).

2. Loan Specifications

- Sanctioned Loan Amount : Total amount approved by the lender.

- Interest Rate : Current rate (fixed/floating) applicable to your loan.

- Disbursed Amount : Funds transferred to your account (if disbursed in parts, details may be included).

3. Repayment Schedule

- EMI Amount : Monthly installment (principal + interest).

- Breakup of Principal and Interest : How much of each EMI goes toward reducing the principal vs. interest.

- Outstanding Balance : Remaining loan amount to be repaid.

4. Payment History

- Due Dates : Scheduled EMI payment dates.

- Paid EMIs : Record of payments made, including dates and amounts.

- Overdue Payments : Any missed EMIs or penalties (if applicable).

5. Additional Information

- Prepayments/Part-Payments : Details of any extra payments made to reduce the loan.

- Interest Certificate : Annual summary for tax-saving purposes (under Section 24b of the Income Tax Act).

- Charges : Processing fees, prepayment penalties, or late payment fees.

Suggested Read: Refianacing vs. Home Loan Balance Transfers

How to Use Your Home Loan Statement for Tax Benefit Claims?

| Key Detail | Tax Implication/Application |

|---|---|

| Total Interest Paid | Claim deduction underSection 24(b)(up to ₹2 lakh annually for self-occupied property). |

| Principal Repayment | Deduct underSection 80C(up to ₹1.5 lakh/year). |

| Annual Interest Certificate | Submit as proof for tax filings (available in your loan statement). |

| Prepayments | Reduces future interest, lowering taxable interest amounts over time. |

| Payment History | Cross-check EMI records to avoid discrepancies in tax claims. |

| Form 16/12BB | Share statement with employers to adjust TDS on salary (for salaried individuals). |

| Tax Declarations | Update tax-saving investments based on principal repayment deductions. |

| Consult Tax Expert | Seek advice for joint loans, let-out properties, or complex scenarios. |

| Retain Statements | Keep copies (digital/hard) for 6 years for audits or revisions. |

| File Before Deadlines | Submit claims by tax filing deadlines (July 31/November 30) to avoid penalties. |

Suggested Read: Role of Credit Score in Home Loan Balance Transfer

Common Problems When Downloading IDBI Bank Home Loan Statements

- Incorrect Login Credentials: Ensure you’re using the correct registered mobile number and CAPTCHA.

- Account Number Mismatch: Verify the loan account number entered is correct.

- Technical Glitches: Clear cache or try using a different browser if the page isn’t loading.

- Statement Not Available: Check if the statement is generated for the selected tenure.

What to Do If Your Tax Certificate Is Incorrect

- Check Details: Cross-check the information entered, such as the loan account number and tenure.

- Contact Support: Reach out to IDBI Bank customer service for corrections.

- Request Reissue: Submit a request for a new tax certificate with the correct details.

Suggested Read: Mutual Funds vs. Rental Income

Conclusion

Managing your IDBI Bank home loan statement online is simple and highly advantageous. By following the steps provided, you can easily access your financial information, empowering you to make well-informed decisions about your home loan.

Leverage the IDBI Bank online platform to efficiently manage your accounts. For further assistance with your IDBI Bank loan payments, loan details, or tracking your loan status, our team of experts is here to guide you every step of the way. Credit Dharma is your reliable partner in navigating loans, credit, and financial planning.

Frequently Asked Questions

Your statement is typically updated monthly, reflecting all transactions up to the last day of the previous month.

Yes, you can request your home loan statement by sending an email to IDBI Bank from your registered email address.

The statement includes your loan amount, outstanding balance, EMI details, repayment history, and significant dates related to your loan.

No, IDBI Bank does not charge for downloading your home loan statement through their online banking platform.

IDBI Bank typically maintains statement records for up to 7 years. However, it’s advisable to keep your own copies of important financial documents.

HDFC Home Loan

HDFC Home Loan SBI Home Loan

SBI Home Loan